The founder and managing director of boutique aggregator Specialist Finance Group explains why it’s important aggregators make noise on industry change

The founder and managing director of boutique aggregator Specialist Finance Group tells MPA his thoughts on the Sedgwick report and why it’s important for aggregators to make noise on industry change

MPA: What are your main concerns for brokers regarding the Sedgwick review’s recommendation that banks take an ‘end to end’ approach to governing brokers, similar to that of retail bank staff?

William Lockett: This we believe clearly does not recognise the substantial difference between retail bank staff and mortgage brokers. Retail bank staff are generally employees of the bank and can only recommend and sell their own finance products for their employer, being a nominated bank.

A retail bank staff member will not advise a consumer of better and more suitable finance products available for a consumer that are on offer or available from an alternative lender other than themselves.

The core value proposition of a mortgage broker is that they are able to provide a significantly broader level of finance products to the consumer, as they assess their client’s requirements across a range of financial institutions and not solely one lender.

Brokers also have a higher level of one-on-one customer service with their clients, and in most cases the client deals exclusively with their mortgage broker throughout their engagement.

This is not the same when a consumer deals directly with a retail bank staff member as the consumer is also dealing with the bank, and on many occasions when dealing directly with the bank they will deal with a number of staff within the bank.

This more direct relationship between a mortgage broker and their client is one of the largest reasons why consumers are accessing their loan products through brokers.

Brokers are also independently licensed by the governing body ASIC, and in addition brokers are also held accountable by other industry bodies, including aggregators, lenders and associations such as the MFAA and the FBAA. Those who hold an Australian Credit Licence with ASIC are required to complete the process for an Annual Compliance Certificate (CL50).

Brokers must go through a detailed NCCP process, which includes a privacy statement, credit guide, fact find (client needs analysis), quote if applicable, preliminary assessment, and credit proposal disclosure, all before the finance application is signed by the consumer.

Retail bank staff do not follow the same extensive process, as most lenders when dealing with their customers proceed straight to a finance application form.

MPA: What are your main concerns for brokers regarding the Sedgwick review’s recommendation that banks alter remuneration to aggregators and brokers so there is no direct link with payments and loan size?

WL: Specialist Finance Group does not agree with linking mortgage brokers’ remuneration to either loan size or LVR. Brokers, in providing their services and making their finance recommendation to the consumer, do not have any decision-making authority or discretion regarding any loan approvals, as it is the sole decision of the lender as to whether or not the lender will accept and/or approve the finance application submitted.

With loans that have a higher LVR, the broker, in most cases, is required to carry out additional work and research on behalf of their client, being the consumer, and the broker should not be penalised in a reduction of their remuneration as it is the lender’s sole choice to accept and approve the loan as presented.

It is also noted that ultimately it is the lenders who approve all finance applications, and any loan amounts in any application need to be substantiated and agreed to by the lender when obtaining the loan approval.

It is unfair to brokers and to the third party channel that the inference that broker loans are larger than those of retail bank staff is a negative one, while it is in fact the lenders themselves that vet the broker’s application to them and approve it on its merits.

MPA: As a long-time aggregator, why do you think it is vital that aggregators make their voices heard on industry change?

MPA: As a long-time aggregator, why do you think it is vital that aggregators make their voices heard on industry change?

WL: Aggregators play a vital role in the third party industry, being the major conduit between the lenders and finance brokers.

Aggregators have a great duty of care to the lenders, whilst ensuring that all finance brokers are conducting their business in a lawful manner; that the best business and industry practices are maintained; and that brokers’ responsibilities to their customers are to ensure they are provided with the best finance options available to them and the best outcome for their situation.

An aggregator’s voice is purely within the third party channel, as the general public have little or no idea that aggregators exist and, if they do, what role they play.

Aggregators also have a clear understanding of the requirements of the lenders, along with a clear understanding of the general requirements of finance brokers. This intimate knowledge allows the aggregator to be a measured voice on industry change to all industry partners.

It is also the aggregator’s role to ensure that finance brokers are fully compliant with their duties and obligations, therefore it is an absolute requirement that they be involved with any proposed changes to our industry.

MPA: What are the advantages of independent ownership for aggregators, given that brokers and banks have different interests going into the commission debate?

WL: The advantage of being independent in ownership is exactly that: being independent. As a solely independent aggregator, Specialist Finance Group is not governed or influenced by any other party, such as being part-owned by a bank or industry partner.

A clear advantage of being independent is that you can, within reason, have a very clear voice in any debate without being influenced on any level.

An independent aggregator also provides for that very crucial independent third party between the finance institutions and the finance brokers.

MPA: In what ways is being a boutique aggregator an advantage for your broker members?

WL: One of the great advantages of being a boutique aggregator is being able to have a business relationship from one business owner to another. As the sole owner and managing director of Specialist Finance Group, all of our members have access directly to me, which they greatly appreciate.

Even allowing for the great benefits larger aggregators provide their members, they are unable call a Mr PLAN or a Mr AFG, therefore they are not dealing with the direct person or party that owns an important business that they have a relationship with.

A boutique aggregator can not only have a more personalised business relationship with all of their finance brokers but in most cases is able to provide a much better service model given the boutique size of the company and not being too large.

As a boutique aggregator we can also make business decisions efficiently, as our members are able to deal directly with the owner of the business and decisions do not have to go to a management team or a board for further review and recommendations.

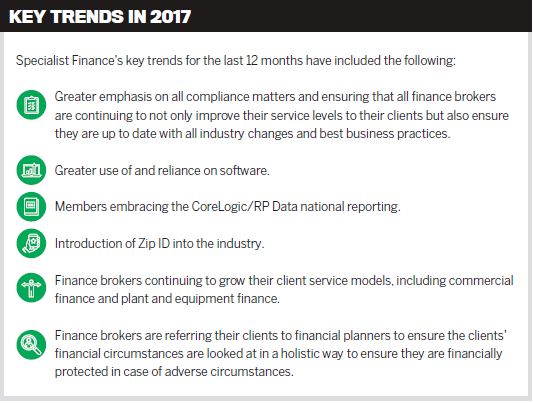

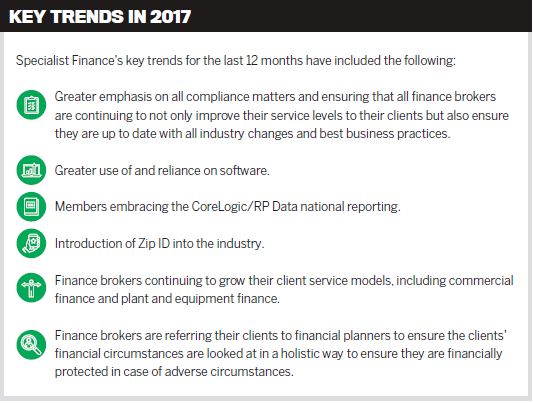

WL: Over the course of the next 12 months Specialist Finance Group looks to continue to improve its aggregation service models that it provides its current members today. Finance brokers within our industry have clearly voiced their opinion that compliance is the number one issue within our industry, and given this, over a large part of the next 12 months we will be refining and improving our compliance services to our members.

This will include a review of all of our business relationships with our members, and including a three-tiered approach on the auditing process of our members in every 12-month period.

This will include a remote electronic audit, a physical audit conducted internally by Specialist Finance Group, and then the third process will be via an independent third party which will then provide a comprehensive review on the audit process and audit reviews on all of our members.

We will also be mandating new initiatives such as Zip ID as further business practice to our members.

Specialist Finance Group also looks forward to continuing to grow its business through continued recruitment, along with further business acquisitions.

We will also be launching our Loyalty Program, which will provide a benefit and an additional income stream to our members who refer a new finance broker to the Specialist Finance Group.

MPA: What are your main concerns for brokers regarding the Sedgwick review’s recommendation that banks take an ‘end to end’ approach to governing brokers, similar to that of retail bank staff?

William Lockett: This we believe clearly does not recognise the substantial difference between retail bank staff and mortgage brokers. Retail bank staff are generally employees of the bank and can only recommend and sell their own finance products for their employer, being a nominated bank.

A retail bank staff member will not advise a consumer of better and more suitable finance products available for a consumer that are on offer or available from an alternative lender other than themselves.

The core value proposition of a mortgage broker is that they are able to provide a significantly broader level of finance products to the consumer, as they assess their client’s requirements across a range of financial institutions and not solely one lender.

Brokers also have a higher level of one-on-one customer service with their clients, and in most cases the client deals exclusively with their mortgage broker throughout their engagement.

This is not the same when a consumer deals directly with a retail bank staff member as the consumer is also dealing with the bank, and on many occasions when dealing directly with the bank they will deal with a number of staff within the bank.

This more direct relationship between a mortgage broker and their client is one of the largest reasons why consumers are accessing their loan products through brokers.

Brokers are also independently licensed by the governing body ASIC, and in addition brokers are also held accountable by other industry bodies, including aggregators, lenders and associations such as the MFAA and the FBAA. Those who hold an Australian Credit Licence with ASIC are required to complete the process for an Annual Compliance Certificate (CL50).

Brokers must go through a detailed NCCP process, which includes a privacy statement, credit guide, fact find (client needs analysis), quote if applicable, preliminary assessment, and credit proposal disclosure, all before the finance application is signed by the consumer.

Retail bank staff do not follow the same extensive process, as most lenders when dealing with their customers proceed straight to a finance application form.

WL: Specialist Finance Group does not agree with linking mortgage brokers’ remuneration to either loan size or LVR. Brokers, in providing their services and making their finance recommendation to the consumer, do not have any decision-making authority or discretion regarding any loan approvals, as it is the sole decision of the lender as to whether or not the lender will accept and/or approve the finance application submitted.

With loans that have a higher LVR, the broker, in most cases, is required to carry out additional work and research on behalf of their client, being the consumer, and the broker should not be penalised in a reduction of their remuneration as it is the lender’s sole choice to accept and approve the loan as presented.

It is also noted that ultimately it is the lenders who approve all finance applications, and any loan amounts in any application need to be substantiated and agreed to by the lender when obtaining the loan approval.

It is unfair to brokers and to the third party channel that the inference that broker loans are larger than those of retail bank staff is a negative one, while it is in fact the lenders themselves that vet the broker’s application to them and approve it on its merits.

MPA: As a long-time aggregator, why do you think it is vital that aggregators make their voices heard on industry change?

MPA: As a long-time aggregator, why do you think it is vital that aggregators make their voices heard on industry change?WL: Aggregators play a vital role in the third party industry, being the major conduit between the lenders and finance brokers.

Aggregators have a great duty of care to the lenders, whilst ensuring that all finance brokers are conducting their business in a lawful manner; that the best business and industry practices are maintained; and that brokers’ responsibilities to their customers are to ensure they are provided with the best finance options available to them and the best outcome for their situation.

An aggregator’s voice is purely within the third party channel, as the general public have little or no idea that aggregators exist and, if they do, what role they play.

Aggregators also have a clear understanding of the requirements of the lenders, along with a clear understanding of the general requirements of finance brokers. This intimate knowledge allows the aggregator to be a measured voice on industry change to all industry partners.

It is also the aggregator’s role to ensure that finance brokers are fully compliant with their duties and obligations, therefore it is an absolute requirement that they be involved with any proposed changes to our industry.

MPA: What are the advantages of independent ownership for aggregators, given that brokers and banks have different interests going into the commission debate?

WL: The advantage of being independent in ownership is exactly that: being independent. As a solely independent aggregator, Specialist Finance Group is not governed or influenced by any other party, such as being part-owned by a bank or industry partner.

A clear advantage of being independent is that you can, within reason, have a very clear voice in any debate without being influenced on any level.

An independent aggregator also provides for that very crucial independent third party between the finance institutions and the finance brokers.

MPA: In what ways is being a boutique aggregator an advantage for your broker members?

WL: One of the great advantages of being a boutique aggregator is being able to have a business relationship from one business owner to another. As the sole owner and managing director of Specialist Finance Group, all of our members have access directly to me, which they greatly appreciate.

Even allowing for the great benefits larger aggregators provide their members, they are unable call a Mr PLAN or a Mr AFG, therefore they are not dealing with the direct person or party that owns an important business that they have a relationship with.

A boutique aggregator can not only have a more personalised business relationship with all of their finance brokers but in most cases is able to provide a much better service model given the boutique size of the company and not being too large.

As a boutique aggregator we can also make business decisions efficiently, as our members are able to deal directly with the owner of the business and decisions do not have to go to a management team or a board for further review and recommendations.

“It is unfair to brokers and the third party channel that the inference that broker loans are larger than those of retail bank staff is a negative one”

MPA: What can we expect from Specialist Finance Group in the next 12 months?WL: Over the course of the next 12 months Specialist Finance Group looks to continue to improve its aggregation service models that it provides its current members today. Finance brokers within our industry have clearly voiced their opinion that compliance is the number one issue within our industry, and given this, over a large part of the next 12 months we will be refining and improving our compliance services to our members.

This will include a review of all of our business relationships with our members, and including a three-tiered approach on the auditing process of our members in every 12-month period.

This will include a remote electronic audit, a physical audit conducted internally by Specialist Finance Group, and then the third process will be via an independent third party which will then provide a comprehensive review on the audit process and audit reviews on all of our members.

We will also be mandating new initiatives such as Zip ID as further business practice to our members.

Specialist Finance Group also looks forward to continuing to grow its business through continued recruitment, along with further business acquisitions.

We will also be launching our Loyalty Program, which will provide a benefit and an additional income stream to our members who refer a new finance broker to the Specialist Finance Group.