The bank has lowered its one-year fixed rate home loan for owner-occupiers paying P+I to 1.75%

Digital bank UBank has unveiled its lowest fixed-rate offering as part of its end-of-financial-year-home-loan sale.

The bank has lowered its one-year fixed home-loan rate for owner-occupiers paying principal and interest to 1.75%. This discounted rate, which is UBank's lowest ever one-year fixed rate, will be available applications submitted until 30 June.

"While rates are at records lows, it’s important customers can still find the right home loan for their needs today and tomorrow. We believe a really sharp one-year fixed rate provides the right mix of certainty and flexibility that people are looking for," said Philippa Watson, UBank CEO.

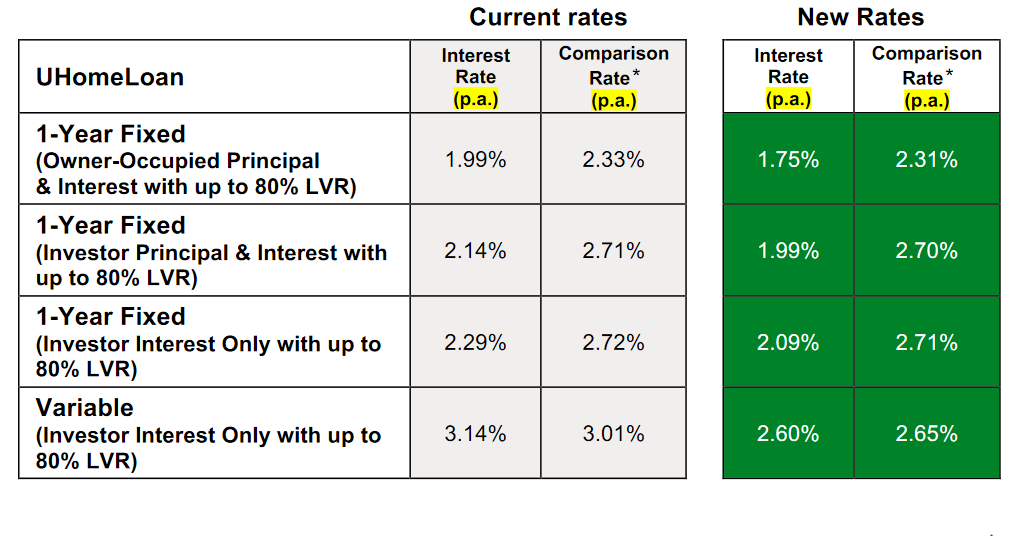

UBank has also reduced its one-year fixed rates and variable rates for investors paying interest-only. The table below show the changes to UBank's fixed-rate offerings:

UBank has more than halved its one-year fixed interest rate for owner-occupiers, from 3.59% in 2019 to 1.75%. This drop in fixed rate has the potential to save customers $731 per month in interest payments or $8,781 over the one-year fixed term, on a 30-year $480,000 loan.

“There’s currently a lot of discussion around fixed versus variable rates and which one is best. This very low offer gives customers one of the lowest rates in market, giving them more money back in their pocket and stability after a period of uncertainty,” Watson said.

Kate McIntyre is an online writer for Mortgage Professional Australia. She has a wealth of experience as a storyteller and journalist for a range of leading media outlets, particularly in real estate, property investing and finance. She loves uncovering the heart behind every story and aims to inspire others through the artful simplicity of well-written words.

Kate McIntyre is an online writer for Mortgage Professional Australia. She has a wealth of experience as a storyteller and journalist for a range of leading media outlets, particularly in real estate, property investing and finance. She loves uncovering the heart behind every story and aims to inspire others through the artful simplicity of well-written words.Email | LinkedIn