La Trobe Financial gives brokers a foundation in commercial financing

.JPG)

La Trobe Financial gives brokers a foundation in commercial financing

MPA: What are the first steps a broker should take if they’d like to write a construction loan?

Mark Hood: A broker should always understand the needs and requirements of the client by obtaining a detailed summary of the project, including the expected time frame to completion and intentions around holding or selling on completion, as these an often influence the finance required.

Once they have a full understanding of the transaction, the broker should contact the respective lenders' BDMs to ascertain each lender's appetite for the transaction.

Then we would encourage brokers to work with the lender that is most accessible and provides the most support – assistance and accessibility can be worth much more than a few basis point when dealing with construction finance.

MPA: What support or traning does La Trobe Financial offer brokers in this area?

MH: La Trobe Financial has dedicated senior manager client partnerships with credit skills in each state who are available to walk brokers through transactions as required. In addition, we give direct access to our commercial credit analysts, who understand the complexities of the construction process and who can workshop any scenario on the spot.

“We know of a number of cases where brokers have since become specialists in construction finance” Mark Hood, La Trobe Financial

Recently, La Trobe Financial's head of credit, Steve Lawrence, conducted a development finance webinar that covered the construction process from start to completion. The webinar can be viewed on La Trobe Financial's website.

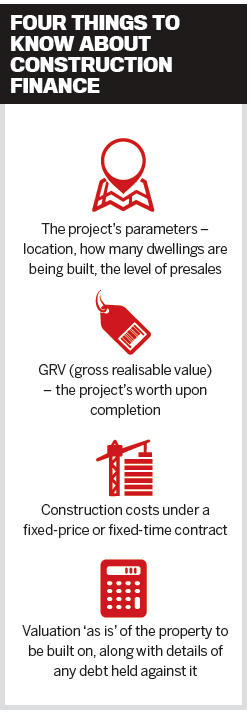

MPA: What are four key things a broker should know about construction finance, and who are these loans best suited for?

MH: If a broker can source the project's parameters, gross realisable value, construction costs under a fixed-price or fixed-time contract, and the valuation 'as is' of the property to be built, La Trobe Financial can provide an indicative funding table that determines the feasibility of the finance, along with proposed pricing for the transaction.

La Trobe Financial's construction loans are suited to those developers building a single dwelling, right through to those looking to complete small to medium-rise apartment projects.

MPA: How can brokers benefit from working in construction finance in addition to residential lending?

MH: We know a number of cases where brokers have since become specialists in construction finance following a high number of referrals received upon successfully completing transactions for their clients.

The short-term nature of construction finance lends itself to repeat transactions that can come on completion of a project. Not only are you likely to obtain the developer’s next transaction but you are also front and centre with the opportunity to obtain business from potential purchasers.

MH: The main difference between a construction loan and a residential loan is that you work off future value, or ‘on completion’ value.

With residential loans, you have a finished product to value and you can set your loan advance accordingly. With construction lending, you obtain a value ‘on completion’ that you set your loan amount to. However, we also need to have regard for the current, or ‘as is’, value, along with the cost to complete the build – which we must retain at all times. Construction loans are progressively drawn as the stages are completed, with the final payment made on handover of the Certificates of Occupancy.

MPA: Why should clients go to a non-bank lender for construction finance versus a major bank? What makes La Trobe Financial’s offer competitive?

MH: There are a number of product-specific reasons to choose La Trobe Financial, such as our flexible presales requirements that often allow builders to get to site quicker, reducing unnecessary holding costs; as well as the ability to market a completed product which can achieve a greater sale price.

Having direct access to key decision makers and speedy responses makes La Trobe Financial the first point of call for construction finance, evidenced by its many repeat clients.

MPA: What are some of the challenges or changes in the construction finance space that brokers should be aware of?

MH: There have been a number of changes to lenders' construction finance products in recent times, with many significantly curbing their appetite through the introduction of increased presale requirements, minimum and maximum loan sizes, limitations on new-to-bank customers and, in some cases, a complete withdrawal of the product altogether.

La Trobe Financial is proud of the reputation that we have built by maintaining a consistent product offering with very few changes made. We are committed to providing construction finance solutions for brokers which are based on an understanding of the transaction from the get-go; and providing quick, clear and concise directions to enable brokers to convert their opportunities.