Borrowing through an SMSF is a complex option that suits the needs of many SMEs, and it will stand brokers in good stead

Borrowing through an SMSF is a complex option that suits the needs of many SMEs, and it will stand brokers in good stead to understand how it's done

It’s fair to say that the market for SMSF lending has become tougher in recent months, with several banks tightening their policies and others backing out of the space altogether.

However, the aversion of some of the major players doesn’t mean brokers should shy away from SMSF lending – in fact, one senior industry figure says the option is ideal for many SME clients.

According to Peter Vala, head of sales and distribution at non-bank lender Thinktank, owners of SMEs can mitigate a significant business risk if they leverage their SMSFs effectively.

“A major issue facing SMEs is trading from leased premises owned by an unrelated party, and on expiry having the concern as to whether the lease will be extended under terms and conditions acceptable to the business,” Vala tells MPA.

“The potential disruption and loss of goodwill through relocation can have a materially detrimental impact on a client’s net-worth position and future cash flow.”

“The SMSF structure provides SME business owners considerable protection in the event things go wrong” - Peter Vala, Thinktank

However, if an SME owner uses their SMSF to enter into a limited recourse borrowing arrangement (LRBA), they can purchase commercial property to operate their business from – a move that will not only give them greater security but also assist with long-term wealth creation.

The arrangement is possible because, unlike residential property purchased via an SMSF LRBA, trustees are permitted to occupy a commercial property, provided it meets certain requirements. These include the property being used primarily for business purposes, although some minor non-business use is permitted – for example, in the case of a large dairy farm with a small house on site.

An arm’s-length commercial lease must also be entered into, with a binding lease agreement and rent paid on a regular basis, at market rates.

Reducing the level of uncertainty for SMEs is just one advantage of an SMSF LRBA. Business owners can also rest assured that, should things turn sour and the loan default, the lender is limited to seeking compensation via the specific asset bought with the loan. Under no circumstances can the lender seek recourse from other assets held in the SMSF.

“The SMSF structure provides SME business owners considerable protection in the event things go wrong with their business, as the equity acquired in the now-owner- occupied premises is protected from creditors and external control,” Vala adds.

With such key benefits, it’s no surprise the option is proving popular. According to Vala, a fifth of new loan applications received by Thinktank are now for SMSF LRBAs.

Of these applications, approximately 80% are from owner-occupiers looking at longterm investment strategies and securing property tenure through indirect ownership.

Of course, as with any financial product there are some drawbacks, and Vala admits the borrowing structures are more complex and costly than a standard loan transaction in an individual, trust or company name – but not so much that it should put borrowers or brokers off.

“Borrowers also need to be mindful that the equity created through additional repayments or accelerated debt reduction cannot be redrawn; neither can the property be pledged as additional security for future advances,” Vala tells MPA.

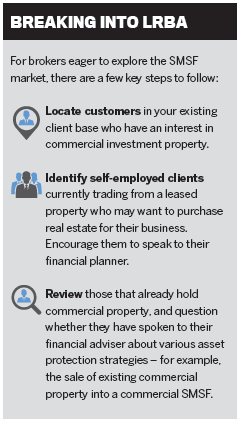

For brokers, there are elements to be wary of. Due to the more complicated nature of the product, a client’s decision to enter into an SMSF LRBA often follows consultation with their financial planner or accountant, but everyone involved must be careful not to overstep their mark.

“If the client decides to follow the SMSF path, then the broker will have assisted that client with a major acquisition” - Peter Vala, Thinktank

“All parties assisting the client need to take care that they do not provide financial advice unless they are suitably qualified to do so,” Vala says.

Maintaining an arm’s-length arrangement is also of utmost importance as failure to do so could put an SMSF in breach of super laws. If this happens, the ATO can render the SMSF non-compliant and the fund could face substantial penalties and additional tax.

While there are certainly hoops to jump through and obstacles to avoid, Vala says offering this finance option will help a broker increase their value proposition and grow their business.

“If the client decides to follow the SMSF path, then the broker will have assisted that client with a major acquisition,” he says.

“As a result, the broker will have secured the customer for the longer term so that they can then assist with additional services, create the possibility for future referral business, generate potential introductions to new referral partners in the form of the client’s financial planners and accountants, and be in receipt of trail income from a loan with an above-average life.”