The results of MPA's 2016 Brokers on non-banks survey are out and we reveal which lender is Non-bank of the Year.

This is not just a survey of lenders; it’s a survey of an entire sector of lending. Non-bank lenders are incredibly diverse, both in terms of their funding and the products they offer, and MPA’s Brokers on Non-Banks survey asks brokers which of these approaches works for them. However, this survey also asks brokers about non-banks as part of a wider lending landscape: why they’d use them instead of a bank, what stops brokers from using nonbanks, and how consumers use non-banks.

These questions have certainly been asked many times before, but changes in lending over the past 12 months suggest they should be asked again. Banks have pulled back from lending to property investors, giving non-banks an incredible opportunity, albeit one that not all have been able to exploit. With the raising of capital requirements for banks, increased interest rates for existing owner-occupier customers mean the price advantage banks once enjoyed has been narrowed considerably, giving non-banks a route to prime customers.

What all this means is that non-banks need to do more than ever before: appeal to a wider range of customers, and add sharp rates to a long history of excellent service which brokers again applauded this year. It’s no coincidence that this year’s rankings were topped by a non-bank with several funding lines and multiple products covering everything from non-conforming to vanilla owner-occupier, while having a traditional high-touch support model.

This survey is relatively similar to our recent Brokers on Banks survey, ranking non-banks in a number of categories and taking the winner from an average, as well as highlighting a product of the year. We’ve also asked brokers a number of questions about the non-bank sector as a whole, and collected their comments on how it can improve. Finally, we’ve also included a lender-by-lender analysis and interviewed the boss of 2016’s Non-bank of the Year, which you can read at the end of this report.

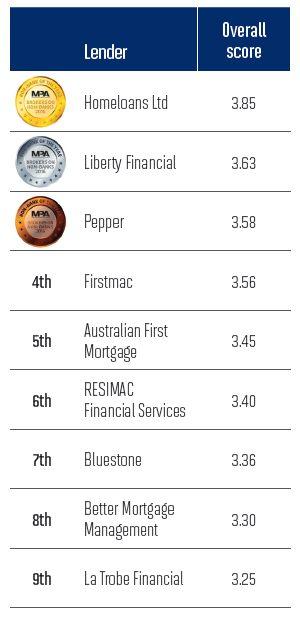

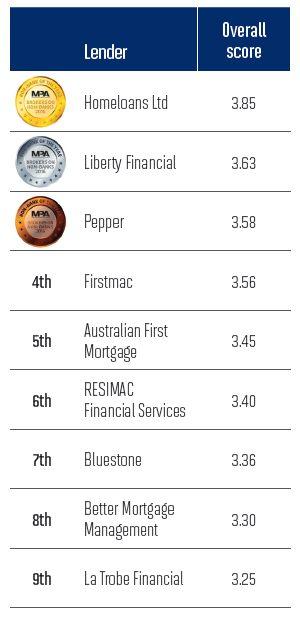

FINAL RESULTS

To come up with the overall results, we took an average of individual category scores for each lender. This means every category had an equal impact on the results. We would advise you to look at the importance ranking at the start of this report to see which categories matter most to brokers.

2016’s Non-Bank of the Year

.PNG)

HOMELOANS LTD

Position in 2015: 2nd

What’s immediately apparent is that Homeloans’ success is broad-based: it won eight out of 10 categories; its popularity is not based upon a single stunning interest rate or a temporary hike in commission, and in fact commission was the only category in which Homeloans didn’t make the top three.

As much as you can infer a lender’s proposition from a set of numbers, Homeloans’ proposition rests on excellent BDM support and a wide product range. BDM support was voted by brokers as their number one priority, and links to credit policy, another category that Homeloans won. When it came to product range and the related category of product diversification opportunities, Homeloans outperformed its competitors by a considerable margin, with new and existing funders aiding the creation of new products over the past 12 months.

excellent BDM support and a wide product range. BDM support was voted by brokers as their number one priority, and links to credit policy, another category that Homeloans won. When it came to product range and the related category of product diversification opportunities, Homeloans outperformed its competitors by a considerable margin, with new and existing funders aiding the creation of new products over the past 12 months.

However, a tough economic climate for mortgage managers, and immediate competitors which can raise their own funds through securitisation, means Homeloans will have to work just as hard to retain the number one spot come 2017’s Brokers on Non-Banks survey.

.PNG)

LIBERTY FINANCIAL

Position in 2015: 1st

When APRA and the banks announced sweeping restrictions to investor lending, Liberty stepped into the breach, continuing to lend at 95%. This appeared to pay off , with national sales manager John Mohnacheff reporting a “significant increase in applications from brokers who value sharp pricing, innovative products and superior service”.

In fact the number of applications doubled – but this “unprecedented influx” clearly affected turnaround times, as Liberty admitted at the time.

.PNG)

PEPPER

Position in 2015: 3rd

Pepper continued to impress brokers this year with its cascading product form, which can be used for prime, near prime and specialist loans, contributing to top three finishes in credit policy and turnaround times.

What’s keeping Pepper from the top spot is disappointing results in BDM support, interest rates and product range. That said, brokers voted Pepper as among the best lenders for product diversification opportunities, so it may be that Pepper needs to tackle broker and consumer confusion about its product suite.

.PNG)

FIRSTMAC

Position in 2015: Not listed

The last 12 months have seen Firstmac on a mission to get brokers’ attention, and it appears to be working. Its decision to pass on RBA rate cuts immediately and its Broker+ digital training scheme got Firstmac into the top three for interest rates as well as communications, training and development. Firstmac’s sponsorship of the Broncos also drove it to second place for marketing and brand awareness.

Brokers weren’t impressed by Firstmac’s product range, diversification opportunities or credit policies, however, so these should be first choice for future marketing drives.

.PNG)

AUSTRALIAN FIRST MORTGAGE

Position in 2015: 5th

With Iain Forbes’ retirement and a takeover by National Mortgage Company, AFM could be forgiven for having a quiet year of consolidation, yet it evidently continues to impress brokers.

NMC has kept the AFM brand and introduced a new logo; what’s needed now is a focus on particular areas of strength. AFM’s survey results were solid across all categories, but with the exception of product range it is not yet challenging at the top level.

These questions have certainly been asked many times before, but changes in lending over the past 12 months suggest they should be asked again. Banks have pulled back from lending to property investors, giving non-banks an incredible opportunity, albeit one that not all have been able to exploit. With the raising of capital requirements for banks, increased interest rates for existing owner-occupier customers mean the price advantage banks once enjoyed has been narrowed considerably, giving non-banks a route to prime customers.

What all this means is that non-banks need to do more than ever before: appeal to a wider range of customers, and add sharp rates to a long history of excellent service which brokers again applauded this year. It’s no coincidence that this year’s rankings were topped by a non-bank with several funding lines and multiple products covering everything from non-conforming to vanilla owner-occupier, while having a traditional high-touch support model.

This survey is relatively similar to our recent Brokers on Banks survey, ranking non-banks in a number of categories and taking the winner from an average, as well as highlighting a product of the year. We’ve also asked brokers a number of questions about the non-bank sector as a whole, and collected their comments on how it can improve. Finally, we’ve also included a lender-by-lender analysis and interviewed the boss of 2016’s Non-bank of the Year, which you can read at the end of this report.

FINAL RESULTS

To come up with the overall results, we took an average of individual category scores for each lender. This means every category had an equal impact on the results. We would advise you to look at the importance ranking at the start of this report to see which categories matter most to brokers.

2016’s Non-Bank of the Year

.PNG)

HOMELOANS LTD

Position in 2015: 2nd

What’s immediately apparent is that Homeloans’ success is broad-based: it won eight out of 10 categories; its popularity is not based upon a single stunning interest rate or a temporary hike in commission, and in fact commission was the only category in which Homeloans didn’t make the top three.

As much as you can infer a lender’s proposition from a set of numbers, Homeloans’ proposition rests on

excellent BDM support and a wide product range. BDM support was voted by brokers as their number one priority, and links to credit policy, another category that Homeloans won. When it came to product range and the related category of product diversification opportunities, Homeloans outperformed its competitors by a considerable margin, with new and existing funders aiding the creation of new products over the past 12 months.

excellent BDM support and a wide product range. BDM support was voted by brokers as their number one priority, and links to credit policy, another category that Homeloans won. When it came to product range and the related category of product diversification opportunities, Homeloans outperformed its competitors by a considerable margin, with new and existing funders aiding the creation of new products over the past 12 months.However, a tough economic climate for mortgage managers, and immediate competitors which can raise their own funds through securitisation, means Homeloans will have to work just as hard to retain the number one spot come 2017’s Brokers on Non-Banks survey.

.PNG)

LIBERTY FINANCIAL

Position in 2015: 1st

When APRA and the banks announced sweeping restrictions to investor lending, Liberty stepped into the breach, continuing to lend at 95%. This appeared to pay off , with national sales manager John Mohnacheff reporting a “significant increase in applications from brokers who value sharp pricing, innovative products and superior service”.

In fact the number of applications doubled – but this “unprecedented influx” clearly affected turnaround times, as Liberty admitted at the time.

.PNG)

PEPPER

Position in 2015: 3rd

Pepper continued to impress brokers this year with its cascading product form, which can be used for prime, near prime and specialist loans, contributing to top three finishes in credit policy and turnaround times.

What’s keeping Pepper from the top spot is disappointing results in BDM support, interest rates and product range. That said, brokers voted Pepper as among the best lenders for product diversification opportunities, so it may be that Pepper needs to tackle broker and consumer confusion about its product suite.

.PNG)

FIRSTMAC

Position in 2015: Not listed

The last 12 months have seen Firstmac on a mission to get brokers’ attention, and it appears to be working. Its decision to pass on RBA rate cuts immediately and its Broker+ digital training scheme got Firstmac into the top three for interest rates as well as communications, training and development. Firstmac’s sponsorship of the Broncos also drove it to second place for marketing and brand awareness.

Brokers weren’t impressed by Firstmac’s product range, diversification opportunities or credit policies, however, so these should be first choice for future marketing drives.

.PNG)

AUSTRALIAN FIRST MORTGAGE

Position in 2015: 5th

With Iain Forbes’ retirement and a takeover by National Mortgage Company, AFM could be forgiven for having a quiet year of consolidation, yet it evidently continues to impress brokers.

NMC has kept the AFM brand and introduced a new logo; what’s needed now is a focus on particular areas of strength. AFM’s survey results were solid across all categories, but with the exception of product range it is not yet challenging at the top level.