MPA's back-to-basics guide with Australia’s top low-doc lenders.

‘Low-doc’ is one of the most disputed terms in the industry – a term that for some emphasises convenience and flexibility and for others is a toxic label ensuring vilification in the mainstream press. Indeed, many lenders in this survey prefer the terms ‘alt-doc’, ‘lite-doc’, ‘flex’, and more.

Yet the problem actually lies in how low-doc is generally described: as a niche. To describe Australia’s many self-employed borrowers as a niche would be like describing first home buyers as a niche; you’re ignoring a huge number of potentially lifelong clients. Of course that doesn’t mean low-doc lending is the same as prime lending, which is exactly why we’ve put this guide together, using the expertise of the top lenders in this space.

If you know how to write a prime loan, you’re well on your way to writing a low-doc loan. This guide is intended as a practical look at how to move your business in that direction – it certainly isn’t an alternative to reading NCCP requirements, and it’s always worth going to lenders directly for further advice.

Finding low-doc clients: An A-Z

A Accountants

“There are also those borrowers who have less than two years trading in their business, a requirement for full-doc selfemployed borrowers. And who better to comment on the current trading performance of these businesses than the accountant, who in most cases is preparing the quarterly BAS returns and monthly management accounts?” (Allan Savins)

D Database

“The best place for brokers to find low-doc clients is often their existing client database. Brokers should fi lter for self-employed clients and consider if they may be:

- approaching the house limits of mainstream banks;

- behind on the preparation of their financial reports/taxation statements;

- tired of having to prepare annual review documents for the bank;

- looking to purchase additional property and require a higher LVR than the banks can offer, or wish to do so without incurring an LMI expense;

- looking to access equity in their property for personal, investment or business use; or looking to purchase commercial property.” (Cory Bannister)

“Another option is for brokers to talk to their network of accountants or financial planners, identifying clients who are not up to date with their tax lodgements but are self-employed and looking to borrow money prior to having their returns completed.” (Cory Bannister)

M Magazines

“Brokers could source low-doc clients from accountant referrals, or by accessing trade or business associations and advertising in their publications.” (Murray Cowan)

L Local businesses

“To state the obvious, it starts with customers that are self-employed; from tradies to affluent small business owners, this product does not discriminate … Other great prospecting opportunities are local businesses and your own network (printers, IT specialists, courier drivers, hairdressers, mechanics, restaurant owners, and the list goes on).” (Mario Rehayem)

R Referrals

“Any broker that creates a strong referral source will come across selfemployed borrowers, and some of these will [need] to apply on a low-doc basis.” (Murray Cowan)

S Self-employed

“Customers are often self-employed borrowers who are yet to complete their most recent financial statements; borrowers who have only recently become selfemployed; and/or borrowers with complex financial structures involving multiple entities and parties.” (Ray Hair)

INNOVATION AND EDUCATION AT BETTER MORTGAGE MANAGEMENT

“Continue to offer new innovations in this space and support these products with education to the broker community regarding the suitability of low-doc lending for certain clients. This education will show brokers that low-doc loan products do not need to be harder assessment or more complex when they understand the process. Low-doc loans can be another source of business-income generation from either their referral partners (if accountants) or existing self-employed applicants. With 30 June 2015 fast approaching, we have solutions to help them now, rather than waiting to get their financials completed, which may not be due until March 2016.”

Murray Cowan, Owner

“Continue to offer new innovations in this space and support these products with education to the broker community regarding the suitability of low-doc lending for certain clients. This education will show brokers that low-doc loan products do not need to be harder assessment or more complex when they understand the process. Low-doc loans can be another source of business-income generation from either their referral partners (if accountants) or existing self-employed applicants. With 30 June 2015 fast approaching, we have solutions to help them now, rather than waiting to get their financials completed, which may not be due until March 2016.”

Murray Cowan, Owner

Selling low-doc products

Telling your clients that they need a low-doc loan is very different to introducing prime products. And that’s for one main reason, RESIMAC’s Allan Savins explains. “Specialist loans are sold, not bought. No borrower will ever come in and say they want that loan through an unknown lender brand, with a higher interest rate,” he says.

Not all the lenders featured here characterise the initial broker-client conversation as selling, but they acknowledge the initial need to counter client ignorance. For Ray Hair of Homeloans it’s about explaining to the client the realities of their financial situation.

“In educating the client on what is required to verify income and expenditure, the broker assists the client to acknowledge whether they can meet the verification requirements of a full-doc loan,” Hair says. “Acknowledging the need for alternative verification is not an admission of poor credit risk.”

What brokers should be presenting is a solution, rather than simply a loan, our lenders insist. Part of that process is acknowledging to the client that this may be a solution for the short term, according to Better Mortgage Management’s Murray Cowan. He says “brokers need to make clear the parameters for full-doc loans and emphasise that low-doc loans are a solution for now, and their circumstances can be reviewed when circumstances change”.

Finally, and on a common-sense note, it should be pointed out that low-doc loans are subject to the same basic restraints as normal loans, as Mario Rehayem of Pepper explains. “Brokers should never engage in discussions where they are encouraging borrowers to apply for an alt-doc loan because their financials do not allow them to service the proposed debt.”

BLUESTONE: THE FUTURE IS BRIGHT

“More than half (55%) of loans written by us are in this space, and we see that continuing over the next 12 months. We want to be known as a lender that services the self-employed market. The self-employed sector is huge, and there’s no reason why these people shouldn’t have a lending solution available to them; likewise, borrowers who may have had a few hiccups in the past. Our current offering, coupled with what we have on our radar, will certainly attest to our appetite to help these borrowers.”

Royden D’Vaz, National Manager Sales, Marketing and Distribution

Assessing the client

By nature, low-doc lenders pride themselves on flexibility when it comes to client documents; in many cases they will accept just one of the three document types listed below.

However, as the broker, you should try to obtain all of these documents, in order to protect yourself if anything goes wrong further down the track, our lender panel strongly advises. You also need to take a specific approach to documents: the object is not to meet the minimum requirements but to have enough information to check what the client has told you about their situation, and document all the steps of the preliminary assessment process.

Be aware that lenders will do their own checks of all the documents you provide, potentially including talking to the client and the client’s accountant.

Accountant’s letters

Many low-doc lenders will accept a letter from the client’s accountant setting out their financial position, in place of financial statements. However, it’s vital that you check the accountant’s accreditation for yourself. There are three main accountants associations in Australia: the Institute of Public Accountants, CPA Australia, and the Institute of Chartered Accountants of Australia.

Business Activity Statements

These can be a good chance to check the client’s claims about the nature of their business, in terms of the type, frequency and consistency of revenue. Different low-doc lenders ask for different timespans for BAS statements, usually at least six months. Income tax returns can fulfil a similar role.

Bank statements

Like BAS statements, these are useful for assessing the performance of your clients’ businesses. Look for debts the clients may not have disclosed. Remember that not all mainstream lenders will pay attention to the client’s most recent financials – which could show business improvement – preferring to take a wider view across two to three years.

LA TROBE FINANCIAL: STEADY AS SHE GOES

“We will continue to offer low-doc loans to Australia’s underserviced self-employed sector as we have done for over 25 years since pioneering the product back in 1990, and do not anticipate any significant changes to be made to this product during the next 12 months.

“We already make our Lite-Doc™ option available across our entire product range, and have been consistently writing solid volumes in this space and will continue to do so as the level of actively trading SMEs in Australia continues to increase, now totalling more than 2.1 million businesses and growing – a sizeable market.”

Cory Bannister, Vice President and Head of Distribution

“We will continue to offer low-doc loans to Australia’s underserviced self-employed sector as we have done for over 25 years since pioneering the product back in 1990, and do not anticipate any significant changes to be made to this product during the next 12 months.

“We already make our Lite-Doc™ option available across our entire product range, and have been consistently writing solid volumes in this space and will continue to do so as the level of actively trading SMEs in Australia continues to increase, now totalling more than 2.1 million businesses and growing – a sizeable market.”

Cory Bannister, Vice President and Head of Distribution

Avoiding delays post-application

Allan Savins, RESIMAC:

“Brokers also need to take a common-sense approach and be mindful to check the supporting documentation. With mortgage loans being refinanced, have all monthly repayments been made? If not, why not, and does the reason given make sense and support the facts? If business bank statements are provided, do they support the income declared? Does the income declared make sense to the nature of business? Look for undisclosed debts.”

Paul Grant, Australian First Mortgage:

“Generally, low-doc loans are simple to process. The only thing they and their customers need to be mindful of is that lenders do tend to call accountants and borrowers to verify the details of the declarations held.”

Cory Bannister, La Trobe Financial:

“There shouldn’t be any hurdles late in the process that are specific to a loan being a low-doc loan. For us, the only difference between our Lite-Doc™ loans and our full-doc loans is the income verification method; once this has been established, which generally happens very early in the approval process, there is no difference in a file’s path to settlement, which is why there shouldn’t be any last-minute surprises.”

Murray Cowan, Better Mortgage Management:

“If the broker understands the funder’s assessment process, there shouldn’t be any surprises. As part of our/funders’ compliance we will check that the accountant is a registered tax agent and contact the accountant to confirm information provided on the accountant’s declaration and/or confirmation of BAS statements, if used as the income verification. The broker should ensure the applicants and accountants are aware that they may receive a call from the funder to confirm details provided.”

Ray Hair, Homeloans:

“Both the broker and the lender need to meet their responsible lending obligations (refer to ASIC Regulatory Guide, RG209) … A conditional low-doc approval from a lender will still require verification prior to a formal loan offer, and if the broker has not prepared and obtained such then broker and client are likely to be frustrated and disappointed.”

Mario Rehayem, Pepper:

“The key takeaway for brokers is validation. If they are comfortable with the stated income of the borrower and can validate it with the documentation available, then there should not be any significant hurdles in the application process.”

Royden D’Vaz, Bluestone:

“Not every application gets across the line, and deals do fall over for various reasons, the most common being ‘lower than expected valuations’ … real estate agents tend to be optimistic about price, yet values are, by their nature, conservative in order to protect the borrower and the lender over the long term. So, as you can imagine, sometimes the borrower’s expectations can’t be met. We suggest leaving a bit of ‘wiggle room’ in any serviceability and affordability calculations to accommodate this.”

PEPPER’S STRATEGY FOR 2015–16

“Since 2011, Pepper has seen resurgence in the alt-doc segment, with very strong performance, including low levels of arrears that even outperform its full-doc counterpart. Through specialist lending education campaigns we are starting to see more brokers understand and appreciate the important role that alternative documentation plays to serve the needs of the self-employed market.

“We will continue our focus on education as there are still a large number of brokers who are yet to realise the value of alternative-documentation lending. Over the next 12 months we will also look to identify and fill more gaps in the alt-doc market through product innovation so that we can cater to more of those unmet needs.”

Mario Rehayem, Director of Sales and Distribution

“Since 2011, Pepper has seen resurgence in the alt-doc segment, with very strong performance, including low levels of arrears that even outperform its full-doc counterpart. Through specialist lending education campaigns we are starting to see more brokers understand and appreciate the important role that alternative documentation plays to serve the needs of the self-employed market.

“We will continue our focus on education as there are still a large number of brokers who are yet to realise the value of alternative-documentation lending. Over the next 12 months we will also look to identify and fill more gaps in the alt-doc market through product innovation so that we can cater to more of those unmet needs.”

Mario Rehayem, Director of Sales and Distribution

Creating a client for life

1. Create a contact schedule

Low-doc clients are a valuable part of your database and should receive the same marketing and check-up contacts as other clients. It is particularly useful to get in contact 12–18 months following the application, as this period of time gives the client a chance to complete their full financials and possibly transfer to a full-doc loan and/or different rate.

2. Plan their road to recovery

The information you gathered about the client during your assessment isn’t just useful for the loan itself; you can plan the client’s road to financial normality and eligibility for prime products. This might just mean waiting for new financials to come through, or involve a fundamental restructuring of their debt. Either way it keeps you in the loop.

3. Auxiliary products

Given that self-employed and small business clients make up much of the market for low-doc products, it makes sense to offer them commercial and equipment finance if appropriate.

4. Debt consolidation

Even healthy small businesses often have a number of debts involved in running them, from loans to pay suppliers to more serious credit card debts. Combining and accounting for all these debts may be an important part of getting the clients back to full financial health.

5. SMSF lending

Self-employed clients may well also manage their own super funds, and so SMSF lending may be an option, particularly for small business clients looking to purchase commercial property.

6. Low-doc as an ongoing solution

Not all lenders agreed with this approach (see point 2) but some did suggest that low-doc loans might be an ongoing solution for some clients. With good self-employed clients, finding full documentation may be particularly difficult, making the cheaper low-doc products a potential time saving tool.

RESIMAC’S AMBITIONS FOR THE YEAR AHEAD

“We have just completed a major overhaul of our specialist product range, particularly in the alt-doc area. This has gone a long way to taking the complexity out of specialist lending and makes the process a lot more straightforward. The changes included a number of product and policy improvements, including an increase to the value of defaults that will be disregarded to $2,000 (up from $1,000) and introducing an interest-only option on all specialist products, including owner-occupiers.

“We have also added several new members to our sales team to ensure our new products are backed up with industry best service. This will form the overall basis of our 12-month plan to continue to strengthen relationships with our existing network and build new relationships with brokers who may not have used RESIMAC before.

Allan Savins, Chief Commercial Officer

“We have just completed a major overhaul of our specialist product range, particularly in the alt-doc area. This has gone a long way to taking the complexity out of specialist lending and makes the process a lot more straightforward. The changes included a number of product and policy improvements, including an increase to the value of defaults that will be disregarded to $2,000 (up from $1,000) and introducing an interest-only option on all specialist products, including owner-occupiers.

“We have also added several new members to our sales team to ensure our new products are backed up with industry best service. This will form the overall basis of our 12-month plan to continue to strengthen relationships with our existing network and build new relationships with brokers who may not have used RESIMAC before.

Allan Savins, Chief Commercial Officer

LOOKING TO THE FUTURE AT AUSTRALIAN FIRST MORTGAGE

“Here we will continue to create innovative product offerings to meet the needs of low-doc clients. This could be by sharpening interest rates, loan features, and ease of application, back to full-doc loans where applicable.”

Paul Grant, National Sales Manager

“Here we will continue to create innovative product offerings to meet the needs of low-doc clients. This could be by sharpening interest rates, loan features, and ease of application, back to full-doc loans where applicable.”

Paul Grant, National Sales Manager

HOMELOANS’ STRATEGY FOR THE LOW-DOC SPACE

“Homeloans has a diverse range of loan options (full-doc and low-doc), experienced BDMs and credit managers locally in the major capital cities. Low-doc loans provide an important alternative finance option for brokers and borrowers, and we are committed to maintaining a competitive range of solutions. We will continue to invest in broker training and workshops to build broker confidence and capabilities in low-doc lending and in homeloans as the business partner of choice.

Ray Hair, General Manager

“Homeloans has a diverse range of loan options (full-doc and low-doc), experienced BDMs and credit managers locally in the major capital cities. Low-doc loans provide an important alternative finance option for brokers and borrowers, and we are committed to maintaining a competitive range of solutions. We will continue to invest in broker training and workshops to build broker confidence and capabilities in low-doc lending and in homeloans as the business partner of choice.

Ray Hair, General Manager

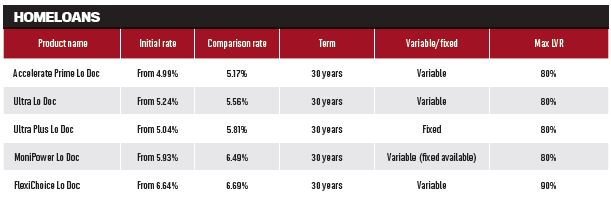

Featured products