NAB Broker will finally become NAB, says its GM, bringing new products and a new approach to branch-broker relations

NAB Broker will finally become NAB, says its GM, with a new set of products and, more importantly, a whole new approach to branch-broker relations.

MPA: In brief, what changes are brokers about to see from NAB in the coming months?

Steve Kane: This is really the final change in a journey that started with the rebranding from Homeside to NAB Broker some two years ago. We recognised that we’d put a barrier in between brokers and their customers when they had to explain what the Homeside brand was; we weren’t taking account of the value of the iconic NAB brand … that was just the start of the journey.

Putting the customer at the centre of everything, we wanted to make sure that the customer had the full opportunity for services, products and interactions with NAB, whether it be through branches, through brokers, the internet, over the phone. No matter how they interacted with NAB they needed to be treated as a NAB customer, exactly the same as any other customer. So the second phase of making this happen was to take the NAB brand and remove the NAB Broker part, so it’s a relaunch of NAB into the broker market, to put the full weight of the NAB brand and the full weight of the organisation behind the broker market.

There will be all of the NAB products made available to brokers, and that will strengthen their position to their customers and give them much more choice. We’ll also see a drive to make sure broker customers are treated with and given the same high level of service that any NAB customer gets. That’s the methodology behind it and the reasoning behind it. We’re putting the customer at the centre of everything by recognising the value and the connection and the relationships that brokers have with their customers ... it’s like CBA, or ANZ or Westpac or whatever the brand is that they run on; we’ll be running on the NAB brand in the broker market.

SK: Not at all. Our business is going from strength to strength. What we’re saying is: the overall NAB organisation has put the customer at the centre of everything we do. We recognise that these customers are introduced to the bank by the broker channel, which is a very important channel for the bank, and we recognise that value that is being created by brokers in introducing customers.

To ensure customers get an even better service than what they do today, we’re making a change to the NAB brand to really reflect that when a broker sits down with their customer and says “we’re recommending NAB”, they don’t have to – as was the case two years ago – say Homeside or NAB Broker; they can say they’re recommending NAB. It makes the conversation much simpler and gives the customer the opportunity to understand what’s going on. It also gives the customer a much wider product set.

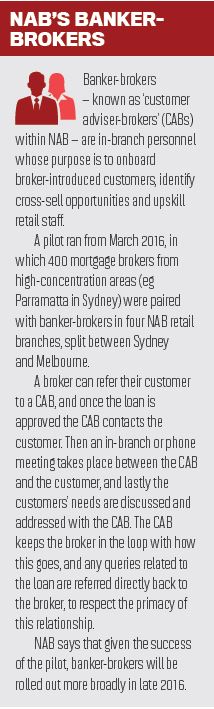

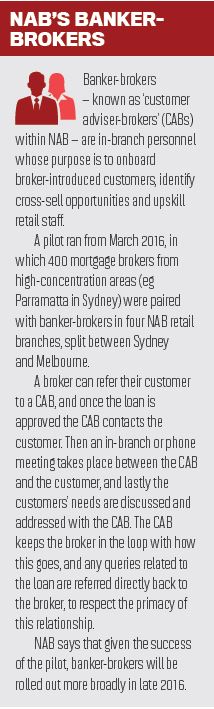

We’re doing a number of other things as well, simply focused around the customer and the broker. We’ve been piloting a number of officers in branches [banker-brokers, or as NAB refers to them, customer advisorbrokers] that deal specifically with brokerintroduced customers, to make sure, first and foremost, that their first interaction with the bank is a positive one, everything is set up, all of the accounts are set up, all of the facilities work from day one; and secondly that they create relationships with the broker and are really introducing other broader branch staff to ensure that everyone understands the value that the broker and customers introduced by the broker are providing.

So this is just saying we’ve not maximised the opportunity for brokers and their customers, and it was time we used the iconic NAB brand in all the services and facilities we offer, and [ensure that] the reputation of the broker is enhanced because they’ve recommended the customer come to us.

MPA: Among the new products, are there any that are significantly different from what was previously available?

MPA: Among the new products, are there any that are significantly different from what was previously available?

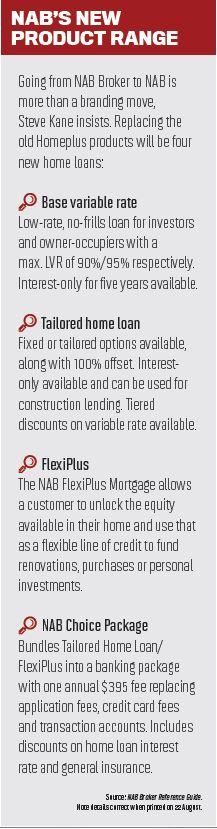

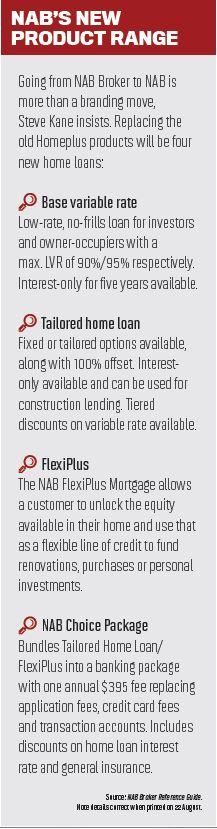

SK: We will be offering exactly the same suite of products that a customer coming through the proprietary channel would get; those products will be available to broker customers. In fact we’re piloting them through NABBroker.com at the moment … brokers will be competing on an absolutely level playing field with the proprietary channels of the bank. They’ll also get the benefit of the things we offer the broker channel, such as ramped trail, LVR pricing for risk-tiering; those things will still remain.

In terms of products, there’s still the basic product and the NAB Choice Package bundled facility, and then there will be a portfolio-style facility and we’ll release that in November. The full suite will be available in November; the first three go out right now.

There’s a broader range of products. They service customers right through from your first home buyer through the Choice package, through to portfolio-style facilities. So we’re covering all the bases in all markets, while we had a narrower product set in the NAB sphere.

SK: All of those styles of offers will still remain; in fact the Velocity [frequent flyer points] campaign will remain right through to December, and that’s across all channels of the bank, including the broker channel. We’re not necessarily saying this is a total rate/pricedriven thing; in fact what we’re saying is we are offering the full suite of product features that customers can choose from, from basic products right through to a very fully featured portfolio-style facility.

It’s around product features, and it’s around service as well; it’s around accessibility to all the channels of the bank through these products. So if the customer, having taken one of these products out, walks into a NAB branch, the branch staff will know exactly who that customer is, what that product is, how to service that customer, and in particular they’ll know who the broker was that introduced the loan; they’ll know that this was a broker-introduced customer.

MPA: So is this what customers now want from products: more features; more ways to connect?

SK: There are obviously markets that are totally price-driven. They’re your online-type situation where they’re purely price-driven; they’re not looking for features. Different customer segments look for different things; there’s no doubt about that. It’s really the choice we’re talking about. You’ve really got a wider choice of a range of products so we should be able to satisfy more broker customers’ needs. Each customer has their own individual set of needs … this is just making sure brokers can offer this to their customers.

MPA: You’ve hinted at coming service improvements – what exactly will brokers be seeing?

SK: The advocacy that customers have for their brokers is determined to a greater or lesser extent by the service they receive from the lending institution their broker puts them with … this is really where the people that we’ve been putting within the branch networks – and we’ve been piloting in Sydney and Melbourne – has really come to the fore. We’ve been able, after six months and a number of customers going through this process, to track what’s happening in terms of how the customers feel about it, and it’s been an overwhelming success. We measure on net promoter score, and the NPS for those customers that used that service is much greater than the standard mortgage NPS for all institutions. We know now that it absolutely works. It works for the broker; it works for the broker’s customer. It’s really changing the face of service to that customer.

Part of their role is understanding that any customer introduced to the bank through a broker is an NAB customer … it’s their role to educate other branch staff about this, setting up broker hubs to manage these customers that are already existing, but will be expanded as well.

MPA: Are there any changes to commission with these new products?

MPA: Are there any changes to commission with these new products?

SK: Same ramped trail, same commissions; absolutely no change at all.

MPA: Will NAB having an identical product range for brokers and branches do anything to reduce channel conflict?

SK: Yes, absolutely. Part of the benefit of having one product set means there is no real necessity and no drive, in terms of giving the customer the correct product and correct service at the right time, to look at channel conflict.

We think that the same product set will go a long way to doing that. We also know that having established these broker-banker associates to look after broker customers specifically, [that there’s an] education process which they provide. We’re already seeing, in the four pilot areas, that the opportunity to help and service that customer is far greater than trying to create any conflict between the broker, themselves, and the customer … we’ve also changed incentive schemes to ensure that there is no value in transferring a loan from NAB to NAB Broker or NAB Broker to NAB. The reality is they won’t need to do it.

MPA: How would you like brokers to view the ‘new NAB’ 12 months from now? Do you expect an instant response from brokers in taking up these products, or does NAB need to earn brokers’ trust?

SK: I think you’ve always got to be earning the trust of your customers – and that in this instance is the brokers who use NAB as a supplier to their customers. We think there will be a natural uplift because of the broader product spectrum and the fact we will be touching more markets within the brokers’ portfolio of customers. But we also recognise that as we build the trust through these relationships we’re setting up through the branch network … initially it’s “oh, we’re not too sure”, but after having one or two customers going through these branches, they think it’s the best service they’ve ever received … we’re really looking not so much to talk about the products – that’s the facilitator. This is about the full power of NAB standing behind the broker channel.

MPA: In brief, what changes are brokers about to see from NAB in the coming months?

Steve Kane: This is really the final change in a journey that started with the rebranding from Homeside to NAB Broker some two years ago. We recognised that we’d put a barrier in between brokers and their customers when they had to explain what the Homeside brand was; we weren’t taking account of the value of the iconic NAB brand … that was just the start of the journey.

Putting the customer at the centre of everything, we wanted to make sure that the customer had the full opportunity for services, products and interactions with NAB, whether it be through branches, through brokers, the internet, over the phone. No matter how they interacted with NAB they needed to be treated as a NAB customer, exactly the same as any other customer. So the second phase of making this happen was to take the NAB brand and remove the NAB Broker part, so it’s a relaunch of NAB into the broker market, to put the full weight of the NAB brand and the full weight of the organisation behind the broker market.

There will be all of the NAB products made available to brokers, and that will strengthen their position to their customers and give them much more choice. We’ll also see a drive to make sure broker customers are treated with and given the same high level of service that any NAB customer gets. That’s the methodology behind it and the reasoning behind it. We’re putting the customer at the centre of everything by recognising the value and the connection and the relationships that brokers have with their customers ... it’s like CBA, or ANZ or Westpac or whatever the brand is that they run on; we’ll be running on the NAB brand in the broker market.

“Brokers will be competing on an absolutely level playing field with the proprietary channels of the bank”

MPA: Is this move an admission that NAB Broker failed?SK: Not at all. Our business is going from strength to strength. What we’re saying is: the overall NAB organisation has put the customer at the centre of everything we do. We recognise that these customers are introduced to the bank by the broker channel, which is a very important channel for the bank, and we recognise that value that is being created by brokers in introducing customers.

To ensure customers get an even better service than what they do today, we’re making a change to the NAB brand to really reflect that when a broker sits down with their customer and says “we’re recommending NAB”, they don’t have to – as was the case two years ago – say Homeside or NAB Broker; they can say they’re recommending NAB. It makes the conversation much simpler and gives the customer the opportunity to understand what’s going on. It also gives the customer a much wider product set.

We’re doing a number of other things as well, simply focused around the customer and the broker. We’ve been piloting a number of officers in branches [banker-brokers, or as NAB refers to them, customer advisorbrokers] that deal specifically with brokerintroduced customers, to make sure, first and foremost, that their first interaction with the bank is a positive one, everything is set up, all of the accounts are set up, all of the facilities work from day one; and secondly that they create relationships with the broker and are really introducing other broader branch staff to ensure that everyone understands the value that the broker and customers introduced by the broker are providing.

So this is just saying we’ve not maximised the opportunity for brokers and their customers, and it was time we used the iconic NAB brand in all the services and facilities we offer, and [ensure that] the reputation of the broker is enhanced because they’ve recommended the customer come to us.

MPA: Among the new products, are there any that are significantly different from what was previously available?

MPA: Among the new products, are there any that are significantly different from what was previously available?SK: We will be offering exactly the same suite of products that a customer coming through the proprietary channel would get; those products will be available to broker customers. In fact we’re piloting them through NABBroker.com at the moment … brokers will be competing on an absolutely level playing field with the proprietary channels of the bank. They’ll also get the benefit of the things we offer the broker channel, such as ramped trail, LVR pricing for risk-tiering; those things will still remain.

In terms of products, there’s still the basic product and the NAB Choice Package bundled facility, and then there will be a portfolio-style facility and we’ll release that in November. The full suite will be available in November; the first three go out right now.

There’s a broader range of products. They service customers right through from your first home buyer through the Choice package, through to portfolio-style facilities. So we’re covering all the bases in all markets, while we had a narrower product set in the NAB sphere.

“We think there will be a natural uplift because of the broader product spectrum and the fact we will be touching more markets”

MPA: In a low interest rate environment, is competing with rate now a viable strategy in any area, and will your cashback and waived fee offers remain?SK: All of those styles of offers will still remain; in fact the Velocity [frequent flyer points] campaign will remain right through to December, and that’s across all channels of the bank, including the broker channel. We’re not necessarily saying this is a total rate/pricedriven thing; in fact what we’re saying is we are offering the full suite of product features that customers can choose from, from basic products right through to a very fully featured portfolio-style facility.

It’s around product features, and it’s around service as well; it’s around accessibility to all the channels of the bank through these products. So if the customer, having taken one of these products out, walks into a NAB branch, the branch staff will know exactly who that customer is, what that product is, how to service that customer, and in particular they’ll know who the broker was that introduced the loan; they’ll know that this was a broker-introduced customer.

MPA: So is this what customers now want from products: more features; more ways to connect?

SK: There are obviously markets that are totally price-driven. They’re your online-type situation where they’re purely price-driven; they’re not looking for features. Different customer segments look for different things; there’s no doubt about that. It’s really the choice we’re talking about. You’ve really got a wider choice of a range of products so we should be able to satisfy more broker customers’ needs. Each customer has their own individual set of needs … this is just making sure brokers can offer this to their customers.

MPA: You’ve hinted at coming service improvements – what exactly will brokers be seeing?

SK: The advocacy that customers have for their brokers is determined to a greater or lesser extent by the service they receive from the lending institution their broker puts them with … this is really where the people that we’ve been putting within the branch networks – and we’ve been piloting in Sydney and Melbourne – has really come to the fore. We’ve been able, after six months and a number of customers going through this process, to track what’s happening in terms of how the customers feel about it, and it’s been an overwhelming success. We measure on net promoter score, and the NPS for those customers that used that service is much greater than the standard mortgage NPS for all institutions. We know now that it absolutely works. It works for the broker; it works for the broker’s customer. It’s really changing the face of service to that customer.

Part of their role is understanding that any customer introduced to the bank through a broker is an NAB customer … it’s their role to educate other branch staff about this, setting up broker hubs to manage these customers that are already existing, but will be expanded as well.

MPA: Are there any changes to commission with these new products?

MPA: Are there any changes to commission with these new products?SK: Same ramped trail, same commissions; absolutely no change at all.

MPA: Will NAB having an identical product range for brokers and branches do anything to reduce channel conflict?

SK: Yes, absolutely. Part of the benefit of having one product set means there is no real necessity and no drive, in terms of giving the customer the correct product and correct service at the right time, to look at channel conflict.

We think that the same product set will go a long way to doing that. We also know that having established these broker-banker associates to look after broker customers specifically, [that there’s an] education process which they provide. We’re already seeing, in the four pilot areas, that the opportunity to help and service that customer is far greater than trying to create any conflict between the broker, themselves, and the customer … we’ve also changed incentive schemes to ensure that there is no value in transferring a loan from NAB to NAB Broker or NAB Broker to NAB. The reality is they won’t need to do it.

MPA: How would you like brokers to view the ‘new NAB’ 12 months from now? Do you expect an instant response from brokers in taking up these products, or does NAB need to earn brokers’ trust?

SK: I think you’ve always got to be earning the trust of your customers – and that in this instance is the brokers who use NAB as a supplier to their customers. We think there will be a natural uplift because of the broader product spectrum and the fact we will be touching more markets within the brokers’ portfolio of customers. But we also recognise that as we build the trust through these relationships we’re setting up through the branch network … initially it’s “oh, we’re not too sure”, but after having one or two customers going through these branches, they think it’s the best service they’ve ever received … we’re really looking not so much to talk about the products – that’s the facilitator. This is about the full power of NAB standing behind the broker channel.