Figures show the changing appetite of lenders

Figures show the changing appetite of lenders

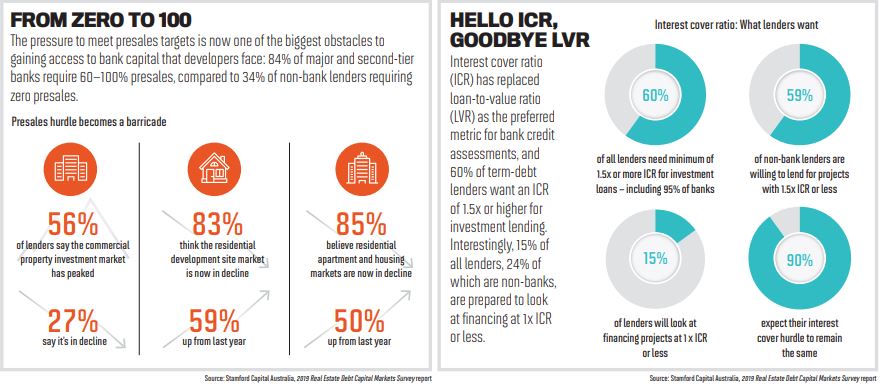

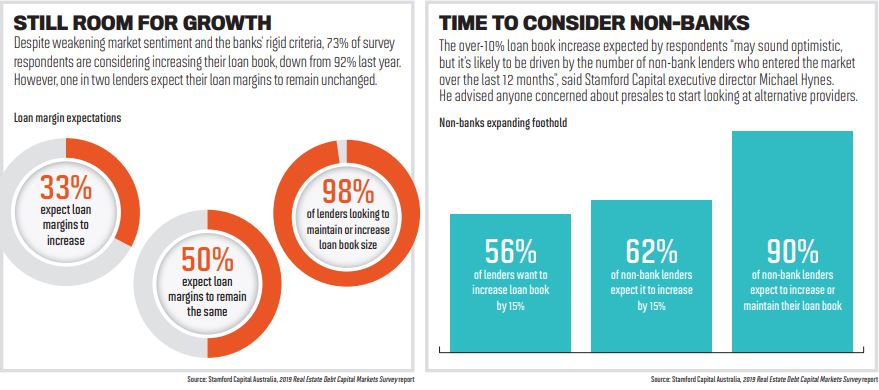

As the banking sector recovers from the perfect storm created by APRA restraints, the royal commission and the final Hayne report, lenders are looking to grow their loan books and develop new products for the changing market, according to Stamford Capital’s 2019 Real Estate Debt Capital Markets Survey.

Over 100 lenders participated in the survey described as “a barometer of lending sentiment and an early identifier of market trends”.

They included major and non-banks, private lenders and second-tier banks. The report found that lenders overwhelmingly believe the housing market is going down – a jump of 50% on last year.

They also foresee an interest rate decline in 2019 that could sustain the residential sector.

“The presales hurdle is now a barricade in the market, and this is where we are witnessing one of the biggest divides between bank and nonbank lenders. It is no surprise that non-bank lenders are continuing to gain momentum,” said Stamford’s executive director, Michael Hynes.

“Lenders are definitely looking to find their feet in this rapidly changing landscape, and typically the non-bank lenders are nimbler at this as they are not governed by APRA.”