Lenders and aggregators look for new ways of partnering with brokers and their SME clients

Lenders and aggregators look for new ways of partnering with brokers and their SME clients

The home loan market may be the one garnering much of the public’s attention at the moment, but in the meantime SME lending has not been exempt from reforms and changes either.

The Australian Small Business and Family Enterprise Ombudsman inquiry into small business loans released in February 2017 detailed the “almost complete asymmetry of power in the relationship between banks and small business borrowers” and provided 15 recommendations for how banks and the government could amend this.

In addition to that, the new Banking Code of Practice delves specifically into improving communication and transparency in the terms and conditions of small business loans. If approved, it will be the first time ASIC has approved a code related to the financial services industry. The legally binding document will require lenders to simplify loan contracts, ensure they’re written in plain English, and provide longer notice periods for changes to loan conditions.

SMEs will also benefit from the establishment of the Australian Financial Complaints Authority, which will commence operations later this year, as well as interest rates that remain at generational lows, says Robynne Frost, Suncorp’s national small business and commercial manager.

These changes are anticipated to shake up how banks lend and connect with small business customers, cutting red tape, lifting standards, and making access to loans easier for the more than two million small businesses out there.

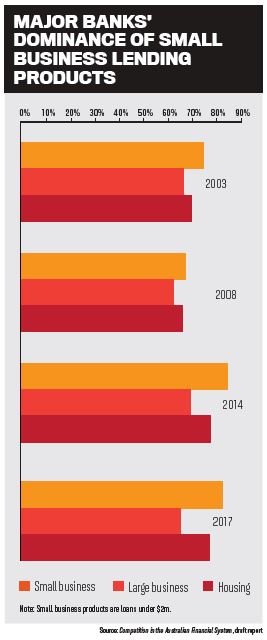

As it stands right now, more than 80% of commercial finance filters through the major banks and only 10% of small business loans are originated by brokers, says Keiran Evans, AFG’s general manager of commercial.

“We are firmly of the opinion that small business in Australia is underserviced and requires assistance. The lifeblood of SMEs is access to cash flow and access to capital, and AFG is bringing about a much larger panel of lenders across the entire product spectrum and risk appetite,” he says.

“NAB will be the first major to go head to head with [fintechs] on providing these smaller business loans … to address that concern around access to finance” - Chris Thomas, NAB

That’s why the aggregator launched AFG Business last October, an intuitive platform designed to help brokers conduct a thorough needs-based conversation about their clients’ business requirements. The platform currently hosts 12 lenders who provide the full spectrum of commercial products. It will soon expand to include an asset finance module and a further nine lenders, Evans says. So far, a third of AFG’s 3,000 brokers are trained and accredited to use the platform.

“Brokers have fantastic skill sets in conducting needs-based conversations and in their knowledge of lender pricing, products and policy, so we would like to see the percentage of customers accessing brokers for commercial finance grow dramatically,” Evans says.

“We believe that providing that choice and increasing the competition between lenders plays a positive role in the Australian economy.”

Despite some of the changes on the way, the SME market is flourishing, something Chris Thomas, general manager commercial broker at NAB, has seen in the major bank’s monthly surveys of its clientele, which look at business confidence and business conditions.

“Right now, for both those measures, our customers are telling us they’re feeling more confident and business conditions are better than at any other time in recent history,” Thomas says. “Business owners have a spring in their step.”

While there may be some areas of uncertainty for SMEs in regard to regulatory changes and slightly firmer wage pressures, Frost also says she is confident that the market outlook remains positive as business conditions track above average. “We expect the Australian economy to gain momentum. SMEs should benefit as the downturn in mining investment ends, non-mining investment picks up, and positive spillovers from infrastructure projects come through,” she says.

From left to right: Chris Thomas, Robynne Frost, Keiran Evans

Taking a page out of the fintech playbook

As unsecured online business lenders come into their own, the mainstream banks are looking at how they can innovate and apply the same level of speed and agility offered by those online lenders.

In May, NAB will unveil its QuickBiz $100,000 unsecured business loan to the broker channel, making it the first unsecured business loan of that amount available through a big four bank. An equivalent product for equipment finance will be released shortly after.

“We believe the launch of QuickBiz in May is a game changer. We’ll be the first major to go head to head with the fintech community on providing these smaller business loans … to address that concern around access to finance prohibiting businesses from participating in the economy,” Thomas says.

With access to capital being a key concern for new SMEs, Thomas says it was important for the bank to come up with a responsive solution that didn’t require property security as backing. The loan is approved on the strength of the business’s trading and cash flow. The main qualifying criteria are that the applicant needs to be in business for more than 12 months and have a minimum turnover of $100,000 per annum.

“The key to Suncorp’s overall proposition is education, and we are delivering and investing significantly in some exciting initiatives to assist our brokers to be as successful and confident as possible” - Robynne Frost, Suncorp

“The key to Suncorp’s overall proposition is education, and we are delivering and investing significantly in some exciting initiatives to assist our brokers to be as successful and confident as possible. Diversification is a key theme as we continue to offer dedicated SME BDM specialists as part of our unique offering,” Frost says.

For a non-major bank like Suncorp, which sees a significant portion of its home lending and SME business coming from brokers, committing and investing in the third party channel is a priority.

This year the bank implemented its Power of Partnership model, an aggregator-aligned service model that offers better and more consistent support to brokers. Through the dedicated support of a home loan BDM, SME BDM and phone-based BDM in each state, the teams are granted a holistic view and understanding of how the broker, aggregator and lender work together.

What AFG Business is taking from the fintechs is better use of digital and machine learning capabilities to facilitate a single origination process that leads to multiple lender choices. AFG is also moving towards full API integration with lenders, which means far quicker customer responses through the business platform, Evans says.

“We’re in uncharted waters; we’re the first aggregator to open up commercial finance to our full broker membership base,” he says.

“We’re leading the digital origination of commercial finance in Australia.”

Transitioning into SME finance

With brokers now writing nearly 55% of all residential mortgages, and with about 30% of brokers’ customers being small business owners, Thomas believes there’s increasing awareness among the public of the broad skills and services brokers offer. It’s just a matter of time before brokers increase their 10% market share of SME lending.

As awareness improves, brokers should focus on deeply understanding the nuances of their customers’ companies. Thomas suggests “walking in the shoes of your business customer” to engage them and understand what they’re trying to do with their business.

“Look at what they’re trying to achieve and the broader strategy, and then move into solution mode,” he says. This often involves coming up with a structure that combines different products and services.

Frost agrees that success in SME finance stems from having the right conversations with business customers, just as brokers are used to having with their regular home loan clients.

“It’s diffcult for brokers to satisfy [all of] a customer’s requirements ... when they’re not accredited or trained to provide commercial finance. AFG’s brokers are” Keiran Evans, AFG

“SMEs are busy, time-poor people. A successful commercial broker understands this and aims to make things simple and easy for their customers,” she says.

That also means it’s critical for brokers to develop their financial analysis skills so they understand cash flow management and what’s required to bring a business transaction together.

Frost suggests that brokers reach out and engage with their SME BDMs in order to surround themselves with knowledgeable and reliable lender partners.

It’s also a good idea for brokers to segment their customers to ensure they’re staying in tune with their SME customers’ needs, she says.

From Evans’ perspective, the most important thing for brokers to do is provide customers with choice, because if they don’t know what options exist, they won’t be able to expand their businesses.

“It’s difficult for brokers to satisfy a customer’s requirements in their entirety when they’re not accredited or trained to provide commercial finance. AFG’s brokers are.”