Why the banking royal commission will find little time for brokers

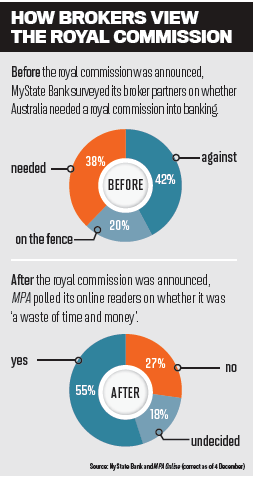

The government has given in, and Australia's banks will finally be subjected to a royal commission. With a sprawling mandate, it will find a little time for brokers, writes former MPA editor Sam Richardson

After a year dominated by political manoeuvring, it seems that the government couldn't resist one final backflip. When Prime Minister Malcolm Turnbull announced a royal commission into banking on the final day of November, his aim was to end speculation.

"It is now in the national interest for the political uncertainty to end," Turnbull said. Yet for those working in finance, the uncertainty has just begun.

There are some things we know about the royal commission. We know it'll be run by ex-High Court justice Kenneth Hayne, that it will commence in February and report to the government 12 months later, and that it will cost $75m - although some experts say more.

Beyond that, facts get hazy in the extreme. The terms of reference are broad, covering "any conduct, practices, behaviour or business activity by a financial services entity that falls below community standards and expectations". Hayne has pushed for brokers to be included in the terms of reference, but what does this mean in practice for brokers and their clients?

Rate rises

Within hours of the royal commission being announced, the Australian Bankers' Association was warning of rate rises. ABA CEO Anna Bligh said, “This runs the risk that Australia will be seen as a more risky investment by global investors that can go anywhere. The risk is that they don’t invest or suspend their investment in Australia, or they put a premium on the price of those funds.”

To complicate matters further, many, including Treasurer Scott Morrison, see rate hikes as part of the problem. Martin North, principal at Digital Finance Analytics, believes that rate hikes could be investigated under the commission’s above-mentioned terms of reference. “Community standards could include: ‘Why are you making out-of-cycle rate rises?’”

In an article on MPA’s website, FBAA executive director Peter White also called for scrutiny of bank interest rates and fees. Ironically, if the commission was to lead to tighter controls of pricing, this could force rates upwards. S&P warns that restrictions on banks’ pricing power could lead them to take on more risk to maintain returns, making them less attractive to foreign investors.

In mid-December, weeks after the commission was announced, brokers were added to its scope, following consultation with Hayne.

Neither the FBAA nor the MFAA have expressed concern at the announcement of the commission. White welcomed the royal commission, calling for: “No more limited inquiries, no more deceptive self-regulation, no more pretend commitments; it seems the people believe it’s time for a proper and widerreaching royal commission”.

Both associations have confirmed they will be cooperating with the commission.

“No more limited inquiries, no more deceptive self-regulation, no more pretend commitments” - Peter White, FBAA

AFG CEO David Bailey has claimed that the regulatory scrutiny already endured by brokers sets them up well for the commission. He said, “We are confident Justice Hayne will recognise the unprecedented data collection process conducted by ASIC in their review of mortgage broker remuneration has thoroughly examined our industry?"

Although the commission will be able to examine brokers, that does not mean brokers are high priority. The 12-month timespan for the commission is much shorter than that of more focused inquiries into youth detention and trade unions, making it likely that Hayne will need to focus on areas of obvious misconduct.

Crucially, according to MFAA CEO Mike Felton, the commission will not have an impact on the Combined Industry Forum. In November the CIF delivered its recommendations to the Treasury, so it is likely that action will be taken on broker commission months before the royal commission even delivers its report.

Productivity Commission

Just as important as what the royal commission is covering is what it isn’t. As North says, “the scope has been very carefully carved out to avoid landmines … [such as] the whole regulatory question, which is being carefully steered around”.

The terms of reference explicitly exclude macroprudential policy and regulation from scrutiny, so for example they do not include APRA’s limits on investment lending or ASIC’s surveillance of broking.

The commission’s terms of reference also prohibit it from duplicating another inquiry or investigation – a problematic move given that the banks have been subject to 17 inquiries since the GFC, with many ongoing.

One of these, an inquiry into competition in the Australian financial system by the Productivity Commission, may ultimately have far more relevance for brokers. It will also report earlier, in July, several months before the royal commission.

“Community standards could include: ‘Why are you making out-of-cycle rate rises?’ ” - Martin North, Digital Finance Analytics

Submissions by the RBA, APRA, several major banks and the MFAA explicitly discuss brokers and their beneficial impact on competition. The RBA has noted that “borrowers’ capacity to source the best deal and assess the benefits of switching providers has been assisted by the introduction of brokers and comparison websites”.

Conversely, this inquiry could result in changes for brokers, with CHOICE calling for the removal – or, failing that, scrutiny – of trail commission, and the Consumer Action Law Centre recommending that brokers be required to act in the best interests of their clients, rather than simply providing ‘not unsuitable’ loans. ASIC has also warned that white label products obscure the extent of real choice available to consumers, saying: “These arrangements can make the particular market appear more competitive than it is.”

Most importantly, by virtue of its more focused scope, the Productivity Commission’s inquiry could make more effective recommendations, North suggests. “I put out more hope on the Productivity Commission’s work, if they do their job properly and really look at vertical integration … and brokers are part of the problem there.