A major ACCC report reveals what's behind the major banks' mortgage pricing decisions-- and it's not what you'd expect

.jpg)

A major ACCC report reveals what's behind the major banks' mortgage pricing decisions-- and it's not what you'd expect

The ACCC's interim report into residential mortgage pricing found that the biggest banks in Australia have become more concerned with “maintaining orderly market conduct” – as one bank memo revealed – than with fuelling price competition. The ‘inquiry banks’ (CBA, Westpac, ANZ, NAB and Macquarie) therefore tend to employ pricing strategies that align with, rather than rival, one another.

“There are signs of accommodative oligopoly behaviour among the big four banks,” the report said.

In the past, the banks’ interest rates were more transparent because they were linked to the cash rate decisions of the Reserve Bank, says Steve Mickenbecker, group executive of financial services at Canstar, a leading comparison website of home loans and other products.

“Consumers used to watch the Reserve Bank’s every move in expectation that a 0.25% move in the cash rate would mean a 0.25% move in their home loan rate,” he says. “That’s no more. The gyrations of the last 12 months have dispelled the myth that the Reserve Bank is setting rates.”

What this means for borrowers – and for brokers – is that the pricing landscape has become even more complex, and as the ACCC report shows, neither party is always getting as good a deal as expected.

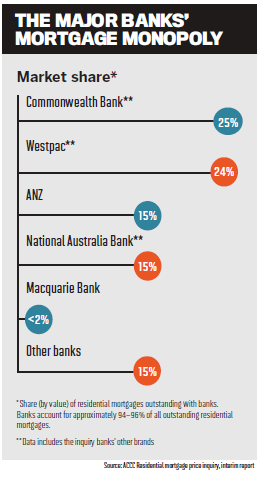

The ACCC’s report collated documents and data from the inquiry banks’ pricing decisions from 30 June 2015 to 30 June 2017. As of December 2017, these five banks held approximately $1.3trn in outstanding residential mortgages, representing 84% of all mortgages held by Australian banks.

Not the best deal

While consumers might think that basic or ‘no frills’ mortgages are the most affordable option, the ACCC found that that’s not always the case.

A price comparison found that borrowers on no-frills owner-occupier loans with ANZ and CBA actually paid higher average interest rates than borrowers with standard owner-occupier loans once discounts were factored in. This was not a one-off occurrence either, but was indicative of a broader trend where the discounts offered to standard loan borrowers actually amounted to a better deal and lower average interest rates than the no-frills option.

Banks offer borrowers various discounts, both advertised and discretionary, based on a range of factors, including the lender’s policies, the individual’s characteristics, their value or potential value to the bank, and their ability to negotiate.

“The discounting by big banks lacks transparency, and it’s almost impossible for customers to obtain accurate interest-rate comparisons” - Rod Sims, ACCC

These discounts can significantly impact what a customer pays. Across the five inquiry banks, the average discount on variable rate loans ranged from 78 and 139 basis points off the headline rate, the ACCC found. At each inquiry bank, 44% or more of borrowers were receiving a discount of more than 90 basis points in June 2017.

“The discounting by the big banks lacks transparency, and it’s almost impossible for customers to obtain accurate interest-rate comparisons without investing a great deal of time and effort. But the potential savings from these discounts are immense,” said ACCC chairman Rod Sims.

Lenders provide discounts to win or retain business, and may price more attractively in the broker channel, Mickenbecker says.

“The problem with discretionary discounts is that consumers have no idea how much is on the table,” he adds. “Is 20 basis points all that I could expect to negotiate, or are people like me getting a 40-basispoint discount?”

This is historically where brokers have added value: by being able to negotiate, navigate the complexities, weigh up the options and score a better deal for customers. But the Productivity Commission has seeded doubt about this in its draft report, claiming that “brokers do not consistently get lower home loan interest rates for consumers".

Shared interest in avoiding disruption

The ACCC stated that the inquiry banks – and the big four in particular – lacked the appetite for “vigorous price competition”, appearing to have a “shared interest in avoiding disruption of mutually beneficial pricing outcomes”.

Instead of trying to increase market share by offering the lowest rates possible, the banks were mainly preoccupied with each other, the report said. In late 2016 and early 2017, two of the big four banks each adopted pricing strategies aimed at reducing discounting in the market, even though this was potentially costly for them if the other majors didn’t follow suit, the ACCC found. Similar sentiments were expressed in bank executives’ internal communications, which made reference to “maintaining orderly market conduct” and “industry conduct”.

The banks were not only attentive to how their direct competitors were setting rates, but also to how they would be announced to the public. Fear of bad publicity and political scrutiny even prompted one inquiry bank to defer a rate rise due to the potential reputational damage.

Another bank’s internal document noted that changing the variable interest rate without an easily understood reason, or a trigger event, could have the “potential to attract a lot more attention and focus”.

Blame it on APRA

APRA’s prudential measures limiting lending to investors to 10%, and interest-only repayments to 30% of new lending, compelled the banks to employ a number of strategies to curb their appetites. Some reduced discounts to new investor borrowers and tightened loan approval criteria.

When those measures weren’t sufficient, the solution across the board was to increase rates. The opportunity to gain “substantial economic benefit” of hundreds of millions of dollars in additional revenue – as one internal document put it – and meet performance targets was not lost on the banks, the ACCC said.

Once some of the inquiry banks raised their rates, the others claimed a need to do the same or else be inundated with new loans and breach APRA’s cap, the report said.

In 2017, all the inquiry banks attributed an increase in variable interest rates for interest-only loans on both new and existing customers to APRA, a matter that will be investigated in further detail once the ACCC releases its final report after 30 June.