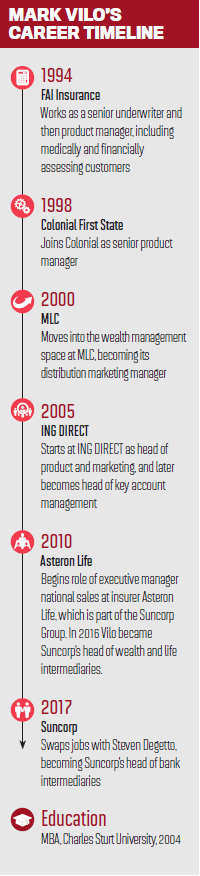

Mark Vilo, Suncorp's new head of bank intermediaries, tells MPA how he’s bringing his experience with wealth management to the broker channel

MPA: You’ve previously dealt with intermediaries, but not mortgage brokers. How has your experience prepared you for this role?

MARK VILO: I truly believe the synergies between financial advice and mortgage broking are significant. In the last 12 months I’ve worked closely with my colleagues across banking, general insurance and motor dealers and I’m constantly amazed at how similar we all are. Yes, the products are different; however, most of our intermediary partners generally work in small business, and in my opinion they all experience similar, if not the same, challenges. These include how to find new customers; how to manage existing client relationships and expectations and minimise lost business; how to grow a profitable business and diversify their portfolios; how to attract and manage their talent; and finally, how to exit when the time is right with a great succession plan.

This is something my team and I work with intermediaries on every day. To me, product is often the end game, and what we’ve got to do is ensure we are relevant and adding value where we can in our chosen markets.

Equally, if I compare the relationships aggregators have with their brokers versus licensees with their advisers, there too are similarities. Licensees are constantly working with their advisers to add value to their practices. They do this by identifying ways to help them build and grow a better business, facilitate quality professional development, assist them to manage their compliance and help influence relevant industry and government bodies. Advisers are definitely putting on the pressure and voting with their feet if they’re not satisfied. Sound familiar? I’m sure as the banking industry starts to work through new regulations brokers will increasingly look to the aggregator as a means to help influence the agenda as well as build even greater partnerships.

“To me, product is often the end game, and what we’ve got to do is ensure we are relevant and adding value where we can in our chosen markets”

MPA: What lessons can brokers learn from recent regulatory changes for intermediaries in the wealth and life channel?

MV: Mark Twain once said history never repeats, but it rhymes. If you’ve kept an eye on the changes currently happening in financial advice, firstly with FOFA [Future of Financial Advice] and now the Life Insurance Framework, you’ll recognise that change (like it or not) has been a constant. With the explosion of technology, along with the demand for greater transparency, the customer really does now drive the agenda. As an industry, financial services in general has a bit of work to do to manage this change. There are similar headwinds in the banking space, particularly around remuneration structures and professional standards. If there were a couple of lessons to be learned from those who have experienced change in the life and wealth space, they include the following.

Firstly, if you have a view, then don’t be afraid to share it. Sometimes there’s a sense of apathy when change is on the horizon. Brokers should absolutely have a say in their industry’s future, and the associations are a great platform to help influence the best outcomes for all parties. Brokers need to get their views heard.

Secondly, start future-proofing your business. Anticipate the change and strategise ways you can take advantage, even if it’s baby steps. This might mean investigating the options for additional study, diversifying your business, or taking a hard look at your bottom line right now and building a war chest for the future.

Thirdly, be optimistic; it’s never as bad as you first think. The market will always adapt, and those that choose to stay and take advantage of the change will always come out better than before.

“If you’ve kept an eye on the changes currently happening in financial advice … you’ll recognise that change (like it or not) has been a constant”

MPA: Suncorp has recently moved to better integrate different financial services. How will you make it easier for brokers to practically cross-sell services such as insurance?MV: It would be foolish for us to believe that all we need to do is provide products to brokers like insurance (and vice versa) and they will use them. The goal for changing our business model and strategy is to put our customers and partners at the centre of what we do. I know that sounds clichéd, but by structuring ourselves in a way that is not business-line focused, it forces us to work on a common goal in a better and more efficient way.

Suncorp’s strategy isn’t about cross-selling; it’s about getting closer to our partners and understanding where they’re at, what their appetite is for other sources of revenue, and building the platform to provide it … if that’s what they want. So in our view it’s absolutely conceivable that a broker may choose to want to use life or general insurance with their clients … or not. They may choose to use a referral partner like a general insurance broker … or not. In fact, we already know that many brokers are already qualified financial planners, and we also know that many financial planners are already involved in mortgage broking. There’s no ‘one size fits all’ here, so what we’d like to build is a marketplace that enables intermediaries to engage in other business lines or work with like-minded business people if they choose to refer. The only way we can do that is to ask brokers what they’d like to see, and this is the work we’re embarking on right now, so watch this space.

Mark Vilo has swapped jobs with previous head of intermediaries Steven Degetto. However, the swap was just the latest move in a year of major restructuring for the Suncorp Group, much of which is relevant to brokers. This began in February 2016, when chief executive Michael Cameron responded to falling profits by reorganising the business into three units: Banking & Wealth, Insurance Australia and Insurance New Zealand. Replacing a previous structure of multiple businesses and brands was intended to simplify the company, while getting related divisions – such as Banking & Wealth – to work closer together and make cross-selling simpler. Vilo’s arrival in the broker space and Degetto’s move into wealth management typifies the new approach.

“It would be foolish for us to believe that all we need to do is provide products to brokers like insurance (and vice versa) and they will use them”

MPA: Steven Degetto defined Suncorp’s target clients as “aspiring Australians”. How do you define Suncorp’s target clients?

MV: With leading brands across insurance, banking and superannuation, Suncorp is in a unique position to truly provide value by offering tailored financial solutions for a variety of stages of the customer journey. We have approximately nine million customers across Suncorp, and our aim is to provide financial solutions to meet the needs of customers at every stage of their life, whether they’re saving for their first home, buying an investment property, operating a business or embarking on retirement.

From a bank perspective, we provide a great deal for customers, no matter their lending needs.

In August, we introduced our popular Better Together Back to Basics special offer for customers seeking a no-frills loan, featuring a low rate and no ongoing fees, with extras including a fee-free transaction account and discounted insurance. This complements our Home Package Plus special offer for customers seeking all the features, benefits and savings of a package, including our unique 100% offset account with up to nine sub-accounts.

In 2015 we also strengthened our commitment to small and commercial business lending by introducing a dedicated Small Business team within the intermediaries channel, with highly competitive offers and ongoing education and tools to support diversification into this space. Many brokers are already taking advantage of our Masterclasses and love the support for getting into this profitable space.

MPA: Will Suncorp be offering preferential rates to owner-occupiers compared to investors over the coming year?

MV: Our rates are set based on a number of factors to balance the needs of borrowers, savers, shareholders and regulators, and we continually monitor this. We’ve always been a strong supporter of competition, and naturally we’ll continue to offer competitive deals in the market.

MPA: Does Suncorp need more products to attract brokers who’ve never used Suncorp before, better rates, or is it about more promotion?

MV: I think rate definitely plays a part, and that can be seen by volumes across any bank that runs a campaign. The bottom line is we’re not always going to be the sharpest, so we need to make sure we’re delivering in other ways all the time. This includes making sure our products are flexible and competitive, and our processes are simple, transparent and reliable for brokers to use with their customers.

Throughout 2017, we’ll continue to offer and promote great products and competitive pricing. We’re also going to work closer with our broker partners and ensure that we’re providing the best servicing proposition possible to deepen relationships and earn our position as the best non-major.

MPA: Will Suncorp be making any changes to its process over the coming year which could reduce turnaround times or make a broker’s job easier?

MV: This year we’re going to focus on utilising technology in a way that helps deliver a smarter way of doing business. This includes enhancing and expanding our upfront valuation process and utilising dynamic processes to validate information prior to assessment.

Service is also key, so providing consistent turnaround times our broker partners can rely on will remain a key priority. Up to now we’ve been able to deliver an answer on complete files within 48 hours 95% of the time. However, during busy campaign periods, turnaround times for our Bronze brokers have extended. We’re absolutely focused on improving our back-office scalability to delivery consistency 100% of the time.

MPA: How would you like brokers to view Suncorp 12 months from now?

MV: Steve has led the team to some big wins in 2016, including being recognised by brokers as the MFAA’s Non-Major Lender and the leading non-major in MPA’s Brokers on Banks survey, so he’s left some big shoes to fill.

Personally, I’d love brokers to be saying “Suncorp is approachable, professional; they listen and understand our needs, are easy to do business with and help me with mine”.

As a business we want to be known for providing exceptional service to brokers and customers and delivering as the industry’s leading non-major – one brokers are proud and confident to partner with and recommend to their customers.

2017 is going to be a great year and I’m excited to be working in a dynamic and exciting industry. I’m focused on building on our strong proposition and delivering tangible improvements to make us easier to do business with.