Non-conforming clients are a lost opportunity for many brokers, especially when the definition of such clients is in constant evolution. MPA asks top lenders in the sector how to spot a non-conforming client in 2015.

Would you know a non-conforming client the moment they walked through your door? Chances are you wouldn’t, because they look much like any other client – and like any other client, they want a loan.

Unfortunately, the moment many brokers realise a client is nonconforming is also the moment they turn them away, missing out on a valuable business opportunity. MPA has asked Australia’s top nonconforming lenders how brokers can identify, assist and make a long-term difference to nonconforming clients, whilst creating valuable referral networks.

An opportunity lost

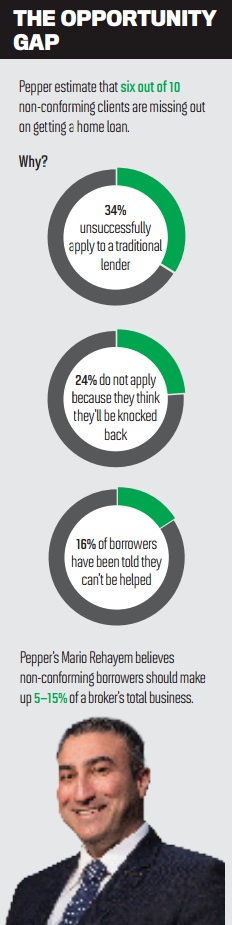

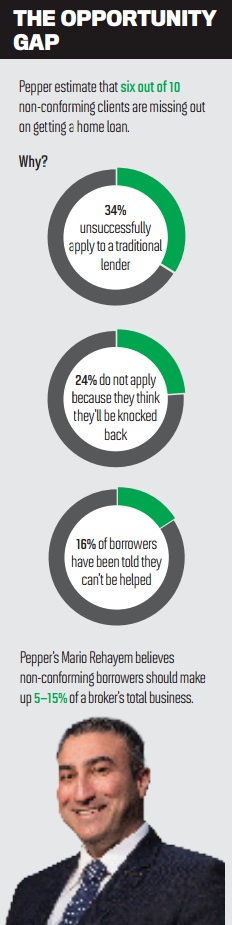

It’s likely you’re already missing out on nonconforming clients. Pepper’s director of sales and distribution, Mario Rehayem, certainly believes so: “Brokers will always come across nonconforming clients; it’s whether they’re aware of it, or want to acknowledge it, or want to partake in that transaction. The way we envisage nonconforming, it should be a percentage of a brokers’ business.”

It’s likely you’re already missing out on nonconforming clients. Pepper’s director of sales and distribution, Mario Rehayem, certainly believes so: “Brokers will always come across nonconforming clients; it’s whether they’re aware of it, or want to acknowledge it, or want to partake in that transaction. The way we envisage nonconforming, it should be a percentage of a brokers’ business.”

Pepper suggest that with the right procedures in place, 5–15% of a broker’s business should be non-conforming clients. Today, according to Pepper’s estimates, 24% of non-conforming clients don’t even apply for finance because they think they’ll be rejected, and 16% are told by brokers they can’t be helped. Non-conforming lenders believe that latter statistic should be far lower. As Liberty Financial national sales manager John Monachef puts it, “Australians from all walks of life deserve to be considered to own their own home, car or business”. So what’s stopping them getting finance?

What non-conforming means now

One reason many non-conforming clients get turned away is because non-conforming encompasses a vast array of situations, many of which do not make clients bad borrowers. What all lenders told MPA is that the traditional definition of non-conforming clients as credit-impaired – with all the negative connotations that carries – is no longer useful for brokers.

For a start, many non-conforming clients aren’t credit-impaired at all; they just lack the documents required by the banks. Bluestone Mortgages specialises in small-business borrowers whose tax returns just “don’t show what the business is actually earning”, according to Royden D’Vaz, national manager of sales and distribution. They also deal with new businesses whose owners don’t have the 24 months’ credit history required by some lenders, as well as entrepreneurs whose previous business didn’t succeed, Bluestone explains. “They have the business acumen, but the business didn’t work, and they have to start again.”

Similarly, self-employed people are “at the top of the list” for non-conforming business at Resimac, according to Allan Savins, Resimac’s chief commercial officer, who argues that “with over two million self-employed people in Australia, the opportunity for brokers to target these borrowers is evident”.

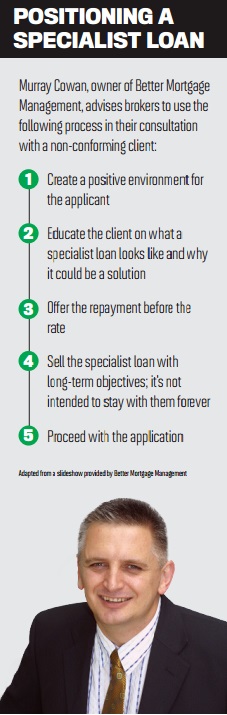

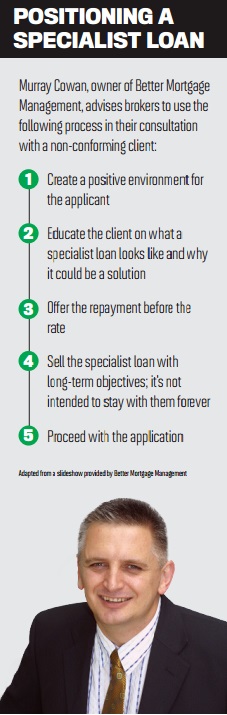

Small-business owners also make up a sizeable proportion of Better Mortgage Manager’s customers, and the reason is tax debts. “Paying tax debts is a good one for us,” says BMM owner Murray Cowan. “We pick up quite a lot of business. The book keeper’s falling ill, or they had to use the money in an emergency and have got in problems with the ATO … a lot of people that are PAYG can get themselves into similar situations.”

Unfortunately, the moment many brokers realise a client is nonconforming is also the moment they turn them away, missing out on a valuable business opportunity. MPA has asked Australia’s top nonconforming lenders how brokers can identify, assist and make a long-term difference to nonconforming clients, whilst creating valuable referral networks.

An opportunity lost

It’s likely you’re already missing out on nonconforming clients. Pepper’s director of sales and distribution, Mario Rehayem, certainly believes so: “Brokers will always come across nonconforming clients; it’s whether they’re aware of it, or want to acknowledge it, or want to partake in that transaction. The way we envisage nonconforming, it should be a percentage of a brokers’ business.”

It’s likely you’re already missing out on nonconforming clients. Pepper’s director of sales and distribution, Mario Rehayem, certainly believes so: “Brokers will always come across nonconforming clients; it’s whether they’re aware of it, or want to acknowledge it, or want to partake in that transaction. The way we envisage nonconforming, it should be a percentage of a brokers’ business.”Pepper suggest that with the right procedures in place, 5–15% of a broker’s business should be non-conforming clients. Today, according to Pepper’s estimates, 24% of non-conforming clients don’t even apply for finance because they think they’ll be rejected, and 16% are told by brokers they can’t be helped. Non-conforming lenders believe that latter statistic should be far lower. As Liberty Financial national sales manager John Monachef puts it, “Australians from all walks of life deserve to be considered to own their own home, car or business”. So what’s stopping them getting finance?

What non-conforming means now

One reason many non-conforming clients get turned away is because non-conforming encompasses a vast array of situations, many of which do not make clients bad borrowers. What all lenders told MPA is that the traditional definition of non-conforming clients as credit-impaired – with all the negative connotations that carries – is no longer useful for brokers.

For a start, many non-conforming clients aren’t credit-impaired at all; they just lack the documents required by the banks. Bluestone Mortgages specialises in small-business borrowers whose tax returns just “don’t show what the business is actually earning”, according to Royden D’Vaz, national manager of sales and distribution. They also deal with new businesses whose owners don’t have the 24 months’ credit history required by some lenders, as well as entrepreneurs whose previous business didn’t succeed, Bluestone explains. “They have the business acumen, but the business didn’t work, and they have to start again.”

Similarly, self-employed people are “at the top of the list” for non-conforming business at Resimac, according to Allan Savins, Resimac’s chief commercial officer, who argues that “with over two million self-employed people in Australia, the opportunity for brokers to target these borrowers is evident”.

Small-business owners also make up a sizeable proportion of Better Mortgage Manager’s customers, and the reason is tax debts. “Paying tax debts is a good one for us,” says BMM owner Murray Cowan. “We pick up quite a lot of business. The book keeper’s falling ill, or they had to use the money in an emergency and have got in problems with the ATO … a lot of people that are PAYG can get themselves into similar situations.”

It’s vital to separate clients from individual life events to appreciate the diversity in the space, as Pepper’s Rehayem notes. “From our perspective, a non-conforming client has the same characteristics as a conforming client. That can range from blue collar to an affluent investor looking to purchase a refi home or property.”

Collecting such information isn’t much different to the process for a prime loan, says Hair; the key step is identifying

the singular life event that has made the client nonconforming. Accuracy here helps prevent further delays down the track, when credit reports and investigation by the lender can uncover details that

the singular life event that has made the client nonconforming. Accuracy here helps prevent further delays down the track, when credit reports and investigation by the lender can uncover details that

Improving the client’s financial future

and ultimately make the move to prime products, which lowers their repayments and gives the broker additional business through refinancing.

and ultimately make the move to prime products, which lowers their repayments and gives the broker additional business through refinancing.

The timeframe for this rehabilitation can be shorter than you might think – Hair suggests that six to 12 months of on-time repayments on a specialist product can move the client to prime or near prime-territory. In time, the customer’s defaults also will be removed from their record, adds BMM’s Cowan. “In two or three years’ time, the defaults won’t be there any more on the report, and they’ll be able to qualify for a prime loan. The broker can get upfront commission for writing that loan, and we offer discounts to customers for moving from a specialist loan to a prime loan.”

As Cowan implies, in order to keep their clients, non-conforming lenders are placing an increased emphasis on their prime products. Pepper are working with brokers to make the transition from non-conforming to prime as easy as possible, Rehayem says. “The only reason our customer would leave is if we cannot accommodate them with a conforming loan with a corresponding lower interest rates, hence the reason we created Pepper Prime.”

Lenders differ on how much the broker needs to be involved in clients’ financial rehabilitation. Bluestone’s D’Vaz suggests it’s important to keep all parties in the loop, and to tell clients “[to] make sure you look after the loan, make sure your payments are paid on time, and when the time is right, they can refinance to a typical home loan with a much better rate”. Modern CRM software can make the job of reminding clients about loan repayment dates easier than ever, as well as alert the broker when the client may be eligible for prime products.

Acting sooner rather than later could make the most difference, concludes Resimac’s Savins: “You only need to look at the Sydney market, where property prices have increased 18.4% over the previous 12 months. Had a client who considered a purchase 12 months ago delayed that decision [because they couldn’t get finance], they would now require a substantially higher deposit and require a much larger loan. And all this after paying an additional 12 months’ rent.”

Uncover the opportunities

Savins’ point works both ways – nonconforming loans that don’t get written are a missed opportunity for brokers and clients. What’s needed is an understanding of nonconforming clients as a product of changing market conditions, rather than one underlying reason, as Pepper’s Rehayem argues. “The borrower profile has not changed for many years. What has changed is the lenders’ appetites, regulatory changes, and we’ve got to be mindful that ‘prime is a moment in time’.”

By optimising their processes – from lead generation to pre-assessment and beyond – brokers can uncover the business opportunities in a changing landscape and provide clients they solution they’ve been looking for.

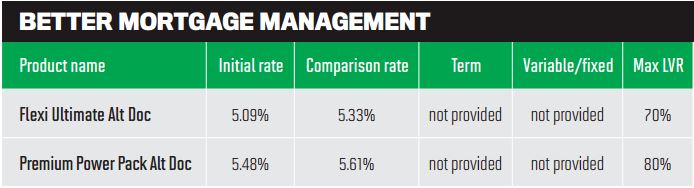

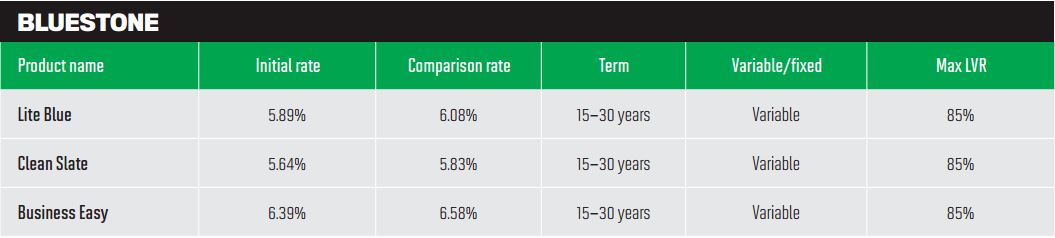

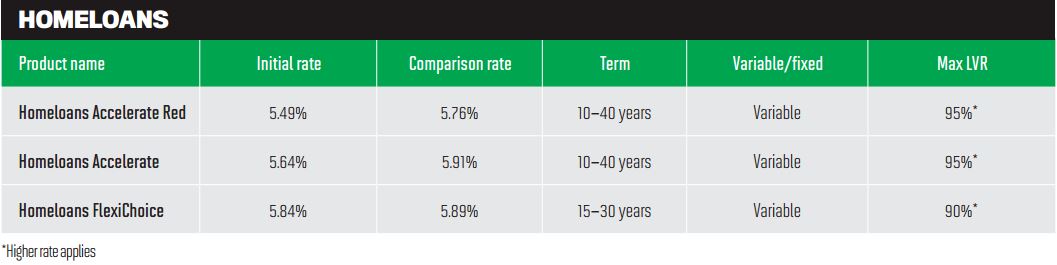

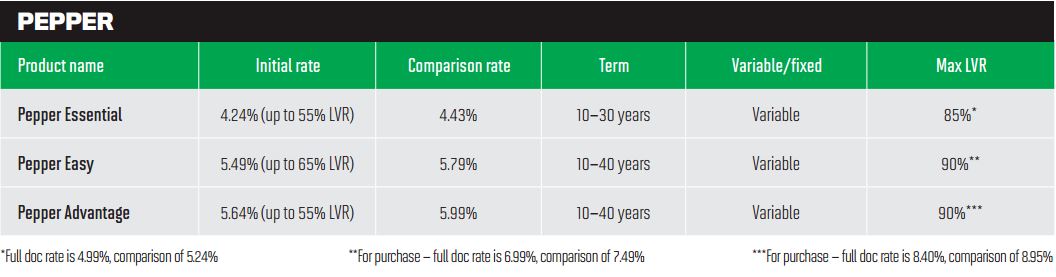

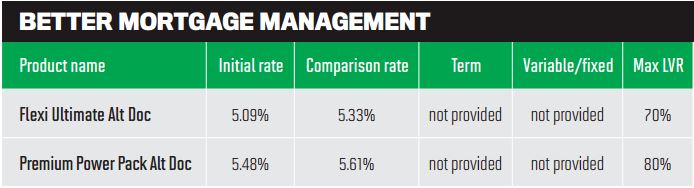

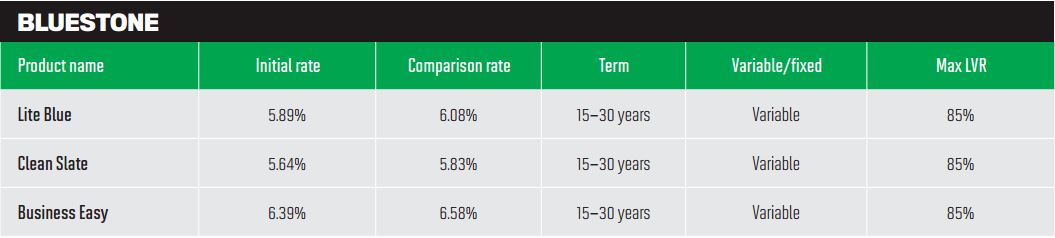

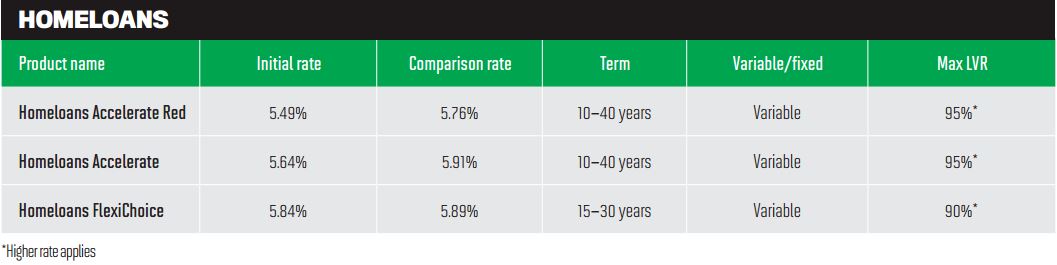

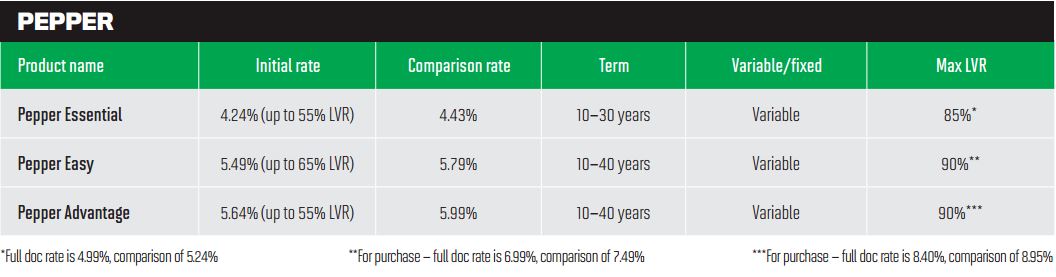

Featured Non-Comforming Products

We asked non-conforming lenders to provide details of their non-conforming products. This list should be viewed in the context of nonconforming lending – rates and LVRs are tied to the clients’ individual situations and can therefore vary; these details are for guidance only. Note that all details are correct to the best of our knowledge at the time of writing.

Ray Hair, general manager of sales at Homeloans, says common situations include “marital breakup, long-term illness, loss of employment, and a failed business or investment, all of which can contribute to payment arrears, defaults, tax debts and insolvency or bankruptcy”.

“marital breakup, long-term illness, loss of employment, and a failed business or investment, all of which can contribute to payment arrears, defaults, tax debts and insolvency or bankruptcy”.

Prime is a moment in time

It’s not only personal crises that turn prime clients into non-conforming clients. Recent shifts in regulatory policy – reflected in banks’ LVR and serviceability requirements and assessments – have left many borrowers on the wrong side of lenders’ policies, providing opportunities for brokers.

Just as this article was being compiled, regulator ASIC published a number of recommendations on interest-only loans, such as requiring banks to utilise borrower-specific living expenses. BMM’s Cowan believes that measure will help his business. “We and our funders already required more investigation; I think the ASIC release means banks will have to change their customers. At times we would have a customer [who would] ask for an increase, and we’d say they don’t qualify, and they would go to a bank and they would qualify, and we wouldn’t understand how.”

Moreover, the year’s biggest development in the mortgage industry – APRA’s crackdown on investor lending – has changed the status of many investors. Pushing banks to keep investor lending growth to 10% resulted in many banks both raising rates for investor borrowers and lowering maximum LVRs. Many would-be or current investors can no long qualify for such loans, particularly younger investors who lack the deposit. However non-bank lenders, who aren’t tied to APRA’s 10% limit, can still offer the higher range LVRs.

Looking to the future, the prospected increase in banks’ capital requirements may lead to more borrowers being pushed over the line, says Bluestone’s D’Vaz. “As banks and mortgage insurers get tighter in their lending, with the capital requirements coming up, this part of the market is becoming bigger.”

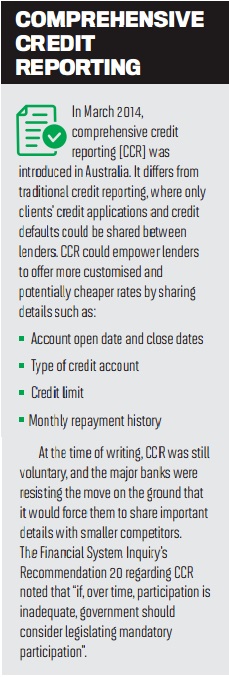

The 2014 Financial System Enquiry recommended increasing capital ratios for major banks, which could both level the playing field and make lending more expensive for the majors. The incoming Basel III and proposed Basel IV regulations would set international standards with similar effects.

Managing referral partners

Once you’re aware of the diversity of nonconforming clients, you can adjust your

processes to increase non-conforming leads. As with prime lending, referrals are

a crucial conduit of business, particularly as satisfied non-conforming clients are more active referrers. However, in some situations, referral partners can become a hindrance to non-conforming loan-writing if not properly managed.

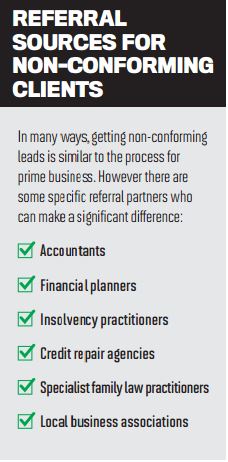

According to D’Vaz, referral partners can make the same mistake as brokers by turning away clients who could be helped. The solution, he argues, is to encourage them to refer on more clients. “It’s a matter of letting referral partners – people who give or refer business to them – be aware of stuf they can do. Say, ‘Don’t become my gatekeeper; tell me everything.’ [Brokers should] train referral partners first.”

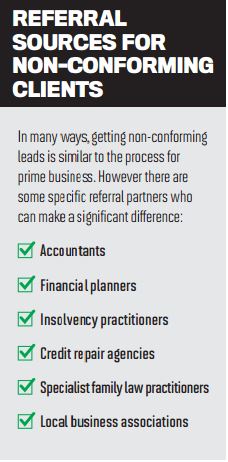

When it comes to finding referral partners, Resimac’s Savins advises brokers to target accountants and solicitors. “Accountants will often have clients who are seeking finance to help fund growth or pay taxation liabilities arising from recent growth, and solicitors may have clients who are going through a relationship breakdown where a property transfer and debt consolidation is required.”

Savins believes brokers can get more nonconforming business through

expanding their relationships with referral partners. “For example, most brokers will call on the local solicitors and conveyancers, asking for purchase contract referrals. If you want to take this business relationship a step further, you could ask for a referral for anyone going through a divorce who needs to refinance the family home or consolidate some debt.” For divorcee clients, Savins notes, brokers may also wish to ally with specialist family law practitioners.

In fact, there are as many referral sources as there are non-conforming

scenarios, says Homeloans boss Hair. “Brokers [should] align themselves with the professionals who provide assistance to clients experiencing marital breakups, long-term illnesses, involuntary unemployment, financial hardship/counselling, business failures and restructures, tax debt negotiations

or similar services [so] the broker can build effective referral relationships.”

Getting pre-assessments right

Getting non-conforming leads is one thing; turning them into satisfied customers is quite another. One area where you can lose many non-conforming clients is their very first encounter with your brokerage: the preassessment stage, which a number of busy brokers now assign to their personal assistants.

For Pepper’s Rehayem, this stage is more important than marketing. “The first area I would concentrate on – before I go and advertise for non-conforming – is

to concentrate on our preliminary assessment.” The danger is delegating decisions to PAs who are merely following a spreadsheet, he says. “Where a lot of brokers fall short is getting a PA to tick boxes to pre-qualify a client before they sit in front of a broker. Effectively that’s like a credit scoring model; they are looking to knock out clients so they don’t waste an experienced person’s time.”

What’s required is a change of attitude; PAs need to delve a little deeper into the client’s story and reason for being creditimpaired, and also consider the requirements of all lenders, rather than just those of the major banks. This does need to be done with care, of course, because of regulatory requirements around providing borrowers the right product. BMM owner Cowan urges brokers to be cautious. “Leaving a PA to do the fact-find part might be a bit risky, considering ASIC [are] encouraging lenders and brokers to thoroughly investigate a client’s situation.”

Meeting the client

By the time you actually sit down with a nonconforming client, much of the work is already done; you’ll have some understanding of their particular situation and what stops your client being prime. However, the assessment is still important – first, for finding documentation when standard documentation isn’t available, and second, for customising the product to the client.

Above all, you need to document the client’s scenario, Savins says. “The complexity of the scenario will determine the level of background information and documentation required in support of the application. There really is no substitute for good-quality submission notes.”

“marital breakup, long-term illness, loss of employment, and a failed business or investment, all of which can contribute to payment arrears, defaults, tax debts and insolvency or bankruptcy”.

“marital breakup, long-term illness, loss of employment, and a failed business or investment, all of which can contribute to payment arrears, defaults, tax debts and insolvency or bankruptcy”. Prime is a moment in time

It’s not only personal crises that turn prime clients into non-conforming clients. Recent shifts in regulatory policy – reflected in banks’ LVR and serviceability requirements and assessments – have left many borrowers on the wrong side of lenders’ policies, providing opportunities for brokers.

Just as this article was being compiled, regulator ASIC published a number of recommendations on interest-only loans, such as requiring banks to utilise borrower-specific living expenses. BMM’s Cowan believes that measure will help his business. “We and our funders already required more investigation; I think the ASIC release means banks will have to change their customers. At times we would have a customer [who would] ask for an increase, and we’d say they don’t qualify, and they would go to a bank and they would qualify, and we wouldn’t understand how.”

Moreover, the year’s biggest development in the mortgage industry – APRA’s crackdown on investor lending – has changed the status of many investors. Pushing banks to keep investor lending growth to 10% resulted in many banks both raising rates for investor borrowers and lowering maximum LVRs. Many would-be or current investors can no long qualify for such loans, particularly younger investors who lack the deposit. However non-bank lenders, who aren’t tied to APRA’s 10% limit, can still offer the higher range LVRs.

Looking to the future, the prospected increase in banks’ capital requirements may lead to more borrowers being pushed over the line, says Bluestone’s D’Vaz. “As banks and mortgage insurers get tighter in their lending, with the capital requirements coming up, this part of the market is becoming bigger.”

The 2014 Financial System Enquiry recommended increasing capital ratios for major banks, which could both level the playing field and make lending more expensive for the majors. The incoming Basel III and proposed Basel IV regulations would set international standards with similar effects.

Managing referral partners

Once you’re aware of the diversity of nonconforming clients, you can adjust your

processes to increase non-conforming leads. As with prime lending, referrals are

a crucial conduit of business, particularly as satisfied non-conforming clients are more active referrers. However, in some situations, referral partners can become a hindrance to non-conforming loan-writing if not properly managed.

According to D’Vaz, referral partners can make the same mistake as brokers by turning away clients who could be helped. The solution, he argues, is to encourage them to refer on more clients. “It’s a matter of letting referral partners – people who give or refer business to them – be aware of stuf they can do. Say, ‘Don’t become my gatekeeper; tell me everything.’ [Brokers should] train referral partners first.”

When it comes to finding referral partners, Resimac’s Savins advises brokers to target accountants and solicitors. “Accountants will often have clients who are seeking finance to help fund growth or pay taxation liabilities arising from recent growth, and solicitors may have clients who are going through a relationship breakdown where a property transfer and debt consolidation is required.”

Savins believes brokers can get more nonconforming business through

expanding their relationships with referral partners. “For example, most brokers will call on the local solicitors and conveyancers, asking for purchase contract referrals. If you want to take this business relationship a step further, you could ask for a referral for anyone going through a divorce who needs to refinance the family home or consolidate some debt.” For divorcee clients, Savins notes, brokers may also wish to ally with specialist family law practitioners.

In fact, there are as many referral sources as there are non-conforming

scenarios, says Homeloans boss Hair. “Brokers [should] align themselves with the professionals who provide assistance to clients experiencing marital breakups, long-term illnesses, involuntary unemployment, financial hardship/counselling, business failures and restructures, tax debt negotiations

or similar services [so] the broker can build effective referral relationships.”

Getting pre-assessments right

Getting non-conforming leads is one thing; turning them into satisfied customers is quite another. One area where you can lose many non-conforming clients is their very first encounter with your brokerage: the preassessment stage, which a number of busy brokers now assign to their personal assistants.

For Pepper’s Rehayem, this stage is more important than marketing. “The first area I would concentrate on – before I go and advertise for non-conforming – is

to concentrate on our preliminary assessment.” The danger is delegating decisions to PAs who are merely following a spreadsheet, he says. “Where a lot of brokers fall short is getting a PA to tick boxes to pre-qualify a client before they sit in front of a broker. Effectively that’s like a credit scoring model; they are looking to knock out clients so they don’t waste an experienced person’s time.”

What’s required is a change of attitude; PAs need to delve a little deeper into the client’s story and reason for being creditimpaired, and also consider the requirements of all lenders, rather than just those of the major banks. This does need to be done with care, of course, because of regulatory requirements around providing borrowers the right product. BMM owner Cowan urges brokers to be cautious. “Leaving a PA to do the fact-find part might be a bit risky, considering ASIC [are] encouraging lenders and brokers to thoroughly investigate a client’s situation.”

Meeting the client

By the time you actually sit down with a nonconforming client, much of the work is already done; you’ll have some understanding of their particular situation and what stops your client being prime. However, the assessment is still important – first, for finding documentation when standard documentation isn’t available, and second, for customising the product to the client.

Above all, you need to document the client’s scenario, Savins says. “The complexity of the scenario will determine the level of background information and documentation required in support of the application. There really is no substitute for good-quality submission notes.”

Collecting such information isn’t much different to the process for a prime loan, says Hair; the key step is identifying

the singular life event that has made the client nonconforming. Accuracy here helps prevent further delays down the track, when credit reports and investigation by the lender can uncover details that

the singular life event that has made the client nonconforming. Accuracy here helps prevent further delays down the track, when credit reports and investigation by the lender can uncover details that

could affect the success of the application.

In terms of financial documents, Rehayem points out lenders have a “multitude of ways” in which they can assess clients. Given that the financials required by banks can be up to 18 months old, BAS statements and evidence of outgoing expenses can fill gaps and provide an alternative. Lenders can be flxible, says Liberty boss Monacheff “We employ a considered and subjective underwriting process so we can ensure that we always offer a product ‘fit’ for each client, and also so we do not exclude many great customers simply because they did not fit a rigid set of criteria.”

The assessment helps brokers match clients to products, which is important because nonconforming products are generally specific to the customer – “risk for rate”, as Bluestone’s D’Vaz puts it. You can find basic details of lenders’ products on the final page of this feature, but note that the rate and LVR often will depend on the client’s specific circumstance. Some lenders now offer a range of nonconforming, prime and near-prime products and use the information from the assessment to suggest a suitable product.

According to Homeloans’ Ray Hair, having a single application form allows the process to work the other way. “Should a broker submit an application to Homeloans for a prime loan and the credit report reveals an event that would impact on their ability to qualify, with the same application form, we are able to match the client to an appropriate product from our specialty range.”

In terms of financial documents, Rehayem points out lenders have a “multitude of ways” in which they can assess clients. Given that the financials required by banks can be up to 18 months old, BAS statements and evidence of outgoing expenses can fill gaps and provide an alternative. Lenders can be flxible, says Liberty boss Monacheff “We employ a considered and subjective underwriting process so we can ensure that we always offer a product ‘fit’ for each client, and also so we do not exclude many great customers simply because they did not fit a rigid set of criteria.”

The assessment helps brokers match clients to products, which is important because nonconforming products are generally specific to the customer – “risk for rate”, as Bluestone’s D’Vaz puts it. You can find basic details of lenders’ products on the final page of this feature, but note that the rate and LVR often will depend on the client’s specific circumstance. Some lenders now offer a range of nonconforming, prime and near-prime products and use the information from the assessment to suggest a suitable product.

According to Homeloans’ Ray Hair, having a single application form allows the process to work the other way. “Should a broker submit an application to Homeloans for a prime loan and the credit report reveals an event that would impact on their ability to qualify, with the same application form, we are able to match the client to an appropriate product from our specialty range.”

Improving the client’s financial future

The payof for non-conforming clients goes far beyond the upfront commission. With the broker’s help, clients can improve their credit rating

and ultimately make the move to prime products, which lowers their repayments and gives the broker additional business through refinancing.

and ultimately make the move to prime products, which lowers their repayments and gives the broker additional business through refinancing.

The timeframe for this rehabilitation can be shorter than you might think – Hair suggests that six to 12 months of on-time repayments on a specialist product can move the client to prime or near prime-territory. In time, the customer’s defaults also will be removed from their record, adds BMM’s Cowan. “In two or three years’ time, the defaults won’t be there any more on the report, and they’ll be able to qualify for a prime loan. The broker can get upfront commission for writing that loan, and we offer discounts to customers for moving from a specialist loan to a prime loan.”

As Cowan implies, in order to keep their clients, non-conforming lenders are placing an increased emphasis on their prime products. Pepper are working with brokers to make the transition from non-conforming to prime as easy as possible, Rehayem says. “The only reason our customer would leave is if we cannot accommodate them with a conforming loan with a corresponding lower interest rates, hence the reason we created Pepper Prime.”

Lenders differ on how much the broker needs to be involved in clients’ financial rehabilitation. Bluestone’s D’Vaz suggests it’s important to keep all parties in the loop, and to tell clients “[to] make sure you look after the loan, make sure your payments are paid on time, and when the time is right, they can refinance to a typical home loan with a much better rate”. Modern CRM software can make the job of reminding clients about loan repayment dates easier than ever, as well as alert the broker when the client may be eligible for prime products.

Acting sooner rather than later could make the most difference, concludes Resimac’s Savins: “You only need to look at the Sydney market, where property prices have increased 18.4% over the previous 12 months. Had a client who considered a purchase 12 months ago delayed that decision [because they couldn’t get finance], they would now require a substantially higher deposit and require a much larger loan. And all this after paying an additional 12 months’ rent.”

Uncover the opportunities

Savins’ point works both ways – nonconforming loans that don’t get written are a missed opportunity for brokers and clients. What’s needed is an understanding of nonconforming clients as a product of changing market conditions, rather than one underlying reason, as Pepper’s Rehayem argues. “The borrower profile has not changed for many years. What has changed is the lenders’ appetites, regulatory changes, and we’ve got to be mindful that ‘prime is a moment in time’.”

By optimising their processes – from lead generation to pre-assessment and beyond – brokers can uncover the business opportunities in a changing landscape and provide clients they solution they’ve been looking for.

Featured Non-Comforming Products

We asked non-conforming lenders to provide details of their non-conforming products. This list should be viewed in the context of nonconforming lending – rates and LVRs are tied to the clients’ individual situations and can therefore vary; these details are for guidance only. Note that all details are correct to the best of our knowledge at the time of writing.