Look beyond the majors for flexible cash flow funding to grow your clients' businesses

About a year ago, Greg Malone, director of G&H Financial in Sydney, was working with a well-known recruitment company that was looking to expand. The firm had reached its limit on the facility it held with a major bank and had exhausted its working capital.

Malone turned to Scottish Pacific Business Finance, a specialist provider of working capital solutions for SMEs, to see what the non-bank lender could offer. Not only was Scottish Pacific able to increase the limit but it also made more working capital available to the client at a better price.

“Going up against the bank and then beating them on the pricing and managing to give the customer the additional working capital was just a dream. It was a great result,” Malone tells MPA.

G&H Financial found a solution for the client and got to retain them, opening up many other opportunities to finance the company’s future facilities.

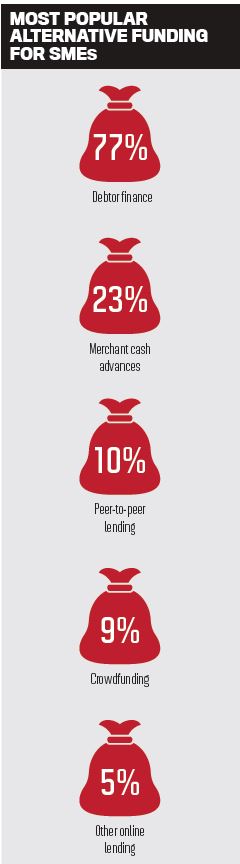

According to Scottish Pacific’s 2018 SME Growth Index, the gap between banks and alternative lenders is closing, with more than one in five SMEs planning to use alternatives to fund future growth. Of the SMEs that used alternative working capital in 2017, 77% used debtor finance.

One of the difficulties with debtor finance, however, is that brokers don’t always understand how it works, Malone says. “It doesn’t require a specialist, but you do need to have a commercial position on it … you need to understand that businesses need it regardless of how you feel about the product,” he says.

“Offering debtor finance can help deepen a broker’s relationship with existing clients and help to attract new clients” - Wayne Smith, Scottish Pacific

Smith explains that debtor finance is a line of credit linked to and secured by outstanding accounts receivable. There are variations in how the service is delivered, ranging from confidential invoice discounting for larger and more sophisticated businesses with dedicated finance departments, to full management of accounts receivables. This allows smaller clients to focus on growing their businesses rather than chasing outstanding invoices.

It works at any stage of a business’s life cycle, whether they’re a start-up with no trading history or are considering a merger, acquisition or succession plan.

“It’s quite straightforward for brokers to introduce debtor finance products to their clients. We work with the broker, explain the process and answer their questions, and the broker can be as involved or as hands-off in the process as they like,” Smith says.

The Invoice Market (tim.) is another lender that’s operating outside of the traditional funding model to provide more flexibility and options to brokers’ small business clients.

The company specialises in business cash flow funding to Australian businesses and has three product lines: invoice finance, trade finance and supply chain funding. Since launching four years ago, tim. has provided $320m in funding on 18,500 invoices.

“I

With cash flow funding, tim. will advance funds within 24 hours of approval against the money owed to a broker’s client on their invoices. It typically advances 80% on day one. Once those invoices are paid out, tim. will advance the remaining 20%. It takes a fee out of the back end, but there’s no repayment plan like there would be with an online unsecured lender.

It’s all about converting the client’s accounts receivables into cash now so they can use it in their business immediately.

“By accelerating their cash flow they have cash in the bank to negotiate better terms for themselves when they buy materials,” Sedgwick says.

Conrad Wilson, partner at Fnx Finance in Queensland, is one broker who used tim. to accommodate a fast-growing business client that needed prompt cash flow delivery.

He says he’s encountered more and more SMEs coming to him with troubles accessing finance as a result of the spotlight on the majors by the royal commission and other inquiries.

“The banks’ appetites for funding are becoming increasingly reliant on well-articulated and presented credit papers with a full ratio analysis, comprehensive risk analysis and detailed management representation, for any chance of a successful outcome. And even then they must fit within a small appetite window to be accessible,” he says.

Alternative lenders are therefore becoming increasingly important. “Debtor finance provides an alternative solution that can grow with the client, and also assists in creating a strong corporate governance structure for managing debtor collections,” Wilson says.

Not only are non-bank lenders continuing to expand their debtor finance proposition for SMEs, but brokers are also starting to notice the need, and a growing number of them are adding it to their suite of solutions or are becoming debtor finance specialists. Aggregators are also responding by promoting debtor finance on their online origination platforms.

“Given [brokers’] crucial role in the SME sector, it’s very encouraging to see this greater acceptance of debtor finance in the broker community, which we believe will lead to more take-up of the product,” Smith says.

From left to right: Wayne Smith, Angus Sedgwick

The right fit for debtor finance

According to Small Business Ombudsman Kate Carnell, 80% of small business owners have loans secured against their homes, using their homes as ‘piggy banks’ to sustain cash flow and pay wages.

“This is quite shocking, given that for many of these SMEs a debtor finance facility would remove this limitation by using trade receivables as security rather than putting the family home at risk,” Smith says.

“Debtor funding for Australian businesses is in my opinion one of the best forms of accessing cash flow that a business can use” - Angus Sedgwick, The Invoice Market

Despite this huge incentive and improved awareness of non-traditional finance offerings, many thousands of SMEs are still not looking beyond the banks at other credible options. This is where brokers come in.

“Those who look beyond ‘how things have always been done’, and grasp the advantages debtor finance and other alternative funding options can offer, are able to provide more holistic support to their clients and create deeper, longer lasting relationships,” Smith says.

Debtor finance is for clients who need working capital to fund their growth or to keep their business cash flow functioning smoothly. It’s tailored for businesses that sell to other businesses or to government bodies on standard trade credit terms. Debtor finance works well for a range of industries but is particularly popular in the transport and logistics, labour hire, recruitment, wholesaling, manufacturing, printing and import/export sectors.

Sedwick says that in order to determine if this is right for their clients, brokers need to start by conducting a thorough fact-find.

That means sitting down and asking: What are your circumstances? What is your cash flow looking like? What is the value of your accounts receivables? “That’s one of their biggest assets,” he adds.

Scottish Pacific advises brokers to look at a combination of business sectors and situations to find suitable clients. Ask whether your existing clients have unusual or rapid levels of growth, or seasonal issues to deal with. Ask if they’re trying to expand, if they have any new contracts coming up, if their bank overdraft has hit its limit and is stifling growth, or if they need help meeting wage commitments.

“With debtor finance, clients can improve their working capital position by accessing up to 80% of the value of invoices raised, usually within 24 hours, and the balance (less fees) when the invoice is paid,” Smith says.

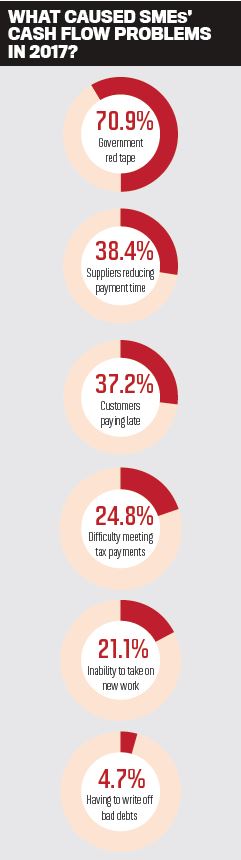

All infographics were sourced from the Scottish Pacific 2018 SME Growth Index