Advantedge's general manager says not only is white label here to stay, but it’s challenging Australia’s majors and non-majors.

Not only is white label here to stay, but it’s challenging Australia’s majors and non-majors, the general manager of Advantedge tells MPA.

MPA: Many brokers know about Advantedge’s white label products, but why should non-PLAN/Choice/FAST brokers care?

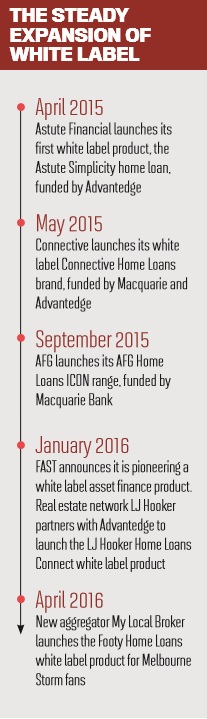

BRETT HALLIWELL: 2015 was really a watershed year for Advantedge. We launched our partner private label products outside of PLAN, Choice and FAST, taking the proportion of brokers who could access our products from 35% to 85%.

It’s been, to my mind, nothing short of phenomenal. There’s been really good take in brands such as AFG, Loan Market, Astute and LJ Hooker, and we’re finding that within a very short space of time we’ve managed to win a fairly substantial market share. How we do that is important: we recognise that Australia is blessed with a competitive home lending market, with lots of lenders that are very good at what they do. Our philosophy with PLAN, Choice and FAST and also partner private label is to recognise we have to win the business based on the right products for our customers, based on prices, but probably most importantly it’s about delivering great service to brokers and our customers, but also relationships.

Putting that all together, I think it’s been one of the greatest stories in the industry in recent times that a lender can step into the market and win substantial market share by delivering what brokers are wanting and asking for.

MPA: What types of clients is Advantedge targeting? Is this all about the ‘mum and dad’ clients?

MPA: What types of clients is Advantedge targeting? Is this all about the ‘mum and dad’ clients?

BH: Certainly what we aim to be is [serving] core mum-and-dad investors and owneroccupiers, so absolutely heartland Australia. We tend to be very strong in that and meet the vast majority of needs. At the same time, though, we do have a strong track record of more complex lending: we’ve settled loans well in excess of $5m and we cater for large loan sizes and complex structures – trust structures, corporate borrowers and that type of thing.

We try to be reasonably clear in the market about the niches we don’t play in. We don’t play in foreign borrowers, NRAS and self-managed superannuation funds. The benefit of us being very clear and very targeted in what we do enables us to offer very good rates and very good services. It’s not trying to be all things to all people; it’s about being targeted and being very good at what we do.

MPA: Many brokers still see Advantedge as a non-bank, but who are Advantedge’s main competitors in the market?

BH: The Australian banking market has really evolved over the last decade or so. There’s certainly been a concentration of lending on the four majors, so we absolutely see them as major competitors, but sitting below that there’s been the emergence of a group of non-major bank lenders. While we are very eager and compete aggressively across the big four, we also compete across the non-majors as well, and typically we do find ourselves coming up against the nonmajors. That’s in terms of prices, in terms of product and also, very importantly, the service offerings in the market. So our natural competitor base tends to be the nonmajors, but also the big four as well.

MPA: Does putting more focus into white label lending mean your mortgage manager partners will lose out?

BH: The heritage of Advantedge’s business is mortgage managers, and it continues to be a very important customer base and channel for us, but the mortgage manager industry has morphed and changed over time, and there’s been a number of consolidations within that sector, both with the mortgage managers and their wholesale funders as well. We don’t see the two [white label and mortgage management] as being mutually exclusive at all; we see them as being complementary. We continue to be committed to the mortgage manager channel, but we see the greater growth opportunities for our business have been very much within the white label space.

If you think about it, it’s like our pie has been growing very rapidly, and the majority of that growth has come from white label; we’ll continue to pursue that aggressively, whilst still being committed to mortgage managers and the wholesale funding model.

MPA: Is Advantedge looking for more awareness of what you do among brokers, and also among consumers?

BH: The interesting thing about white label is that consumers are increasingly familiar with white label through interactions in other areas, and the most commonly quoted example on that front is supermarkets, where typically white label products might occupy up to 30% of supermarket space. What consumers have learnt from that is that these products are high quality, well priced, and certainly meet their needs.

most commonly quoted example on that front is supermarkets, where typically white label products might occupy up to 30% of supermarket space. What consumers have learnt from that is that these products are high quality, well priced, and certainly meet their needs.

The consumer appetite and demand for white label is high; however, in the mortgage space it’s a new category for them. That’s where brokers come into play: brokers can get a great advantage in terms of offering white label to their customers. Their customers are aware of what white label is, but not necessarily from a mortgage perspective, so when their brokers explain to them that a mortgage white label is available, consumers tend to be very receptive of it, because they understand the benefits they’re going to receive.

From the broker’s perspective, there are great advantages in offering a product that’s available exclusively and only from brokers. What does that mean? Customers can by and large choose to source their mortgages from other channels from other lenders; direct through bank branches, online or over the phone. The advantage of Advantedge’s white label products is that they are only available through brokers, so I think that sets up a fantastic conversation through brokers that validates their value proposition to customers; that ‘I can give you a fantastic product that meets your needs and is good value, and it’s only available through me, the broker, and it’s not available for you to source from other channels directly’.

All of that stacks up to be a great proposition for both the customer and the broker.

MPA: Do you think Advantedge and white label more generally are particularly at risk from ASIC and other regulators, given the ownership structure of Advantedge?

BH: From an NAB perspective we have been working really closely with the ASIC review, both in terms of ongoing conversations and providing information as it’s requested. We certainly understand that vertical integration is something that is on the mind of the regulator.

Our position in relation to white label is effectively that our aggregators operate as aggregators. They have a very large representation of different lenders: banks and nonbanks across the market.

How Advantedge competes with its white label products on all aggregation platforms comes down to the absolute basics of lending. What that means is the right products, the right price and the right relationships, and competing against all of the other lenders on the panel.

I have said very publicly many times, when we do product launches, etc, that Advantedge will respectfully try and win business from brokers by competing on that basis. There is absolutely no expectation that brokers must use white label products; our commissions are broadly comparable with those of other lenders within the market. So to my mind the vertical integration debate doesn’t play out in terms of expectations; it just plays out in terms of a highly competitive market and highly competitive landscape where white label needs to compete on the same basis as other lenders. And fundamentally this is what has driven our great success: the fact that we compete as a quality lender within the marketplace.

MPA: How would you like brokers to view Advantedge and white label lending 12 months from now?

BH: I see brokers continuing to adopt and use Advantedge white label as a primary tool in their arsenal. I believe white label will be an increasing share of the market, and it will be increasingly mainstream, and I think that’s driven largely by consumers who will understand it and enjoy the benefits. Brokers will feel increasingly comfortable with recommending the product, but more importantly enjoy the service and features that Advantedge offers to them. So broadly I think it’s around increased share of market, which is won and fought hard for, to deliver a much better product which is absolutely mainstream and embedded as one of the major parts of the Australian third-party channel.

MPA: Many brokers know about Advantedge’s white label products, but why should non-PLAN/Choice/FAST brokers care?

BRETT HALLIWELL: 2015 was really a watershed year for Advantedge. We launched our partner private label products outside of PLAN, Choice and FAST, taking the proportion of brokers who could access our products from 35% to 85%.

It’s been, to my mind, nothing short of phenomenal. There’s been really good take in brands such as AFG, Loan Market, Astute and LJ Hooker, and we’re finding that within a very short space of time we’ve managed to win a fairly substantial market share. How we do that is important: we recognise that Australia is blessed with a competitive home lending market, with lots of lenders that are very good at what they do. Our philosophy with PLAN, Choice and FAST and also partner private label is to recognise we have to win the business based on the right products for our customers, based on prices, but probably most importantly it’s about delivering great service to brokers and our customers, but also relationships.

Putting that all together, I think it’s been one of the greatest stories in the industry in recent times that a lender can step into the market and win substantial market share by delivering what brokers are wanting and asking for.

MPA: What types of clients is Advantedge targeting? Is this all about the ‘mum and dad’ clients?

MPA: What types of clients is Advantedge targeting? Is this all about the ‘mum and dad’ clients? BH: Certainly what we aim to be is [serving] core mum-and-dad investors and owneroccupiers, so absolutely heartland Australia. We tend to be very strong in that and meet the vast majority of needs. At the same time, though, we do have a strong track record of more complex lending: we’ve settled loans well in excess of $5m and we cater for large loan sizes and complex structures – trust structures, corporate borrowers and that type of thing.

We try to be reasonably clear in the market about the niches we don’t play in. We don’t play in foreign borrowers, NRAS and self-managed superannuation funds. The benefit of us being very clear and very targeted in what we do enables us to offer very good rates and very good services. It’s not trying to be all things to all people; it’s about being targeted and being very good at what we do.

MPA: Many brokers still see Advantedge as a non-bank, but who are Advantedge’s main competitors in the market?

BH: The Australian banking market has really evolved over the last decade or so. There’s certainly been a concentration of lending on the four majors, so we absolutely see them as major competitors, but sitting below that there’s been the emergence of a group of non-major bank lenders. While we are very eager and compete aggressively across the big four, we also compete across the non-majors as well, and typically we do find ourselves coming up against the nonmajors. That’s in terms of prices, in terms of product and also, very importantly, the service offerings in the market. So our natural competitor base tends to be the nonmajors, but also the big four as well.

MPA: Does putting more focus into white label lending mean your mortgage manager partners will lose out?

BH: The heritage of Advantedge’s business is mortgage managers, and it continues to be a very important customer base and channel for us, but the mortgage manager industry has morphed and changed over time, and there’s been a number of consolidations within that sector, both with the mortgage managers and their wholesale funders as well. We don’t see the two [white label and mortgage management] as being mutually exclusive at all; we see them as being complementary. We continue to be committed to the mortgage manager channel, but we see the greater growth opportunities for our business have been very much within the white label space.

If you think about it, it’s like our pie has been growing very rapidly, and the majority of that growth has come from white label; we’ll continue to pursue that aggressively, whilst still being committed to mortgage managers and the wholesale funding model.

MPA: Is Advantedge looking for more awareness of what you do among brokers, and also among consumers?

BH: The interesting thing about white label is that consumers are increasingly familiar with white label through interactions in other areas, and the

most commonly quoted example on that front is supermarkets, where typically white label products might occupy up to 30% of supermarket space. What consumers have learnt from that is that these products are high quality, well priced, and certainly meet their needs.

most commonly quoted example on that front is supermarkets, where typically white label products might occupy up to 30% of supermarket space. What consumers have learnt from that is that these products are high quality, well priced, and certainly meet their needs. The consumer appetite and demand for white label is high; however, in the mortgage space it’s a new category for them. That’s where brokers come into play: brokers can get a great advantage in terms of offering white label to their customers. Their customers are aware of what white label is, but not necessarily from a mortgage perspective, so when their brokers explain to them that a mortgage white label is available, consumers tend to be very receptive of it, because they understand the benefits they’re going to receive.

From the broker’s perspective, there are great advantages in offering a product that’s available exclusively and only from brokers. What does that mean? Customers can by and large choose to source their mortgages from other channels from other lenders; direct through bank branches, online or over the phone. The advantage of Advantedge’s white label products is that they are only available through brokers, so I think that sets up a fantastic conversation through brokers that validates their value proposition to customers; that ‘I can give you a fantastic product that meets your needs and is good value, and it’s only available through me, the broker, and it’s not available for you to source from other channels directly’.

All of that stacks up to be a great proposition for both the customer and the broker.

MPA: Do you think Advantedge and white label more generally are particularly at risk from ASIC and other regulators, given the ownership structure of Advantedge?

BH: From an NAB perspective we have been working really closely with the ASIC review, both in terms of ongoing conversations and providing information as it’s requested. We certainly understand that vertical integration is something that is on the mind of the regulator.

Our position in relation to white label is effectively that our aggregators operate as aggregators. They have a very large representation of different lenders: banks and nonbanks across the market.

How Advantedge competes with its white label products on all aggregation platforms comes down to the absolute basics of lending. What that means is the right products, the right price and the right relationships, and competing against all of the other lenders on the panel.

I have said very publicly many times, when we do product launches, etc, that Advantedge will respectfully try and win business from brokers by competing on that basis. There is absolutely no expectation that brokers must use white label products; our commissions are broadly comparable with those of other lenders within the market. So to my mind the vertical integration debate doesn’t play out in terms of expectations; it just plays out in terms of a highly competitive market and highly competitive landscape where white label needs to compete on the same basis as other lenders. And fundamentally this is what has driven our great success: the fact that we compete as a quality lender within the marketplace.

MPA: How would you like brokers to view Advantedge and white label lending 12 months from now?

BH: I see brokers continuing to adopt and use Advantedge white label as a primary tool in their arsenal. I believe white label will be an increasing share of the market, and it will be increasingly mainstream, and I think that’s driven largely by consumers who will understand it and enjoy the benefits. Brokers will feel increasingly comfortable with recommending the product, but more importantly enjoy the service and features that Advantedge offers to them. So broadly I think it’s around increased share of market, which is won and fought hard for, to deliver a much better product which is absolutely mainstream and embedded as one of the major parts of the Australian third-party channel.