Become a bigger asset to your clients with commercial property finance

.jpg)

Become a bigger asset to your clients with commercial property finance

When it comes to commercial finance, the numbers speak for themselves. The total volume of commercial loans in Australia is some $658bn. Commercial loans range from under $100,000 all the way up to $300m. Last year’s MPA Top 10 Commercial Brokers were averaging loan volumes of $169m, with the top broker, George Giovas, settling $520m in 2016/17.

The asset and equipment finance market is estimated to be valued at about $100bn in receivables. Businesses are turning to brokers about half the time when they’re sourcing equipment finance solutions, so there’s still plenty of room for further growth in this sector.

Then there are the potential customers in the SME space: more than two million small businesses that at some point during their life cycle will likely be looking for credit, whether that’s to fi t out new premises, buy an upgraded espresso machine, or invest in a truck.

From the stripped-down facts, it’s easy to see the opportunities that abound for brokers, who are increasingly being told that they need to do more than just residential mortgages to safeguard and future-proof their businesses.

The commercial market does not come without its challenges, however. First of all, it’s always di‑ cult to launch into and learn something new. Is it worth the time and effort? Do you want to choose one area to specialise in or try it all? Our feature on commercial property finance looks at how the royal commission may influence the commercial market, and our SME lending feature (page 24) delves into some of the reforms that are taking place in that sector.

Despite the changes taking place in this market, the lenders, aggregators and fintechs featured in this report are adamant about wanting to support and train brokers through their diversification journeys so they can provide a broader range of solutions to meet the increasingly diverse and complex needs of their clients. And brokers already know how crucial it is to keep clients in the business – or risk them going elsewhere.

With those lender resources and partnerships in place, experienced residential brokers should have no trouble upskilling into a new field of commercial finance, breaking new ground and uncovering the vast opportunities that exist for their businesses.

COMMERCIAL PROPERTY

With the home loan sector undergoing intense examination, there’s no better time than the present to seriously consider the benefits of diversification into commercial property finance.

While the banking industry and the home loan market as a whole have been through significant changes in the last 12 months, the changes in the commercial lending space haven’t been as pronounced, says Liberty’s group sales manager, John Mohnacheff .

In fact, the outlook for commercial finance is “overwhelmingly positive”, he says, prompting more residential brokers to experience those “aha! moments” as they test the water and write their first commercial deals.

This is, after all, where the big numbers are. The total volume of commercial loans in Australia is some $658bn. Brokers can start with smaller commercial loans in the $5–10m range and work up to specialist loans above $25–$50m. At the other end of the spectrum are jumbo commercial loans from $50m all the way up to $300m.

And yet it’s generally accepted that brokers account for less than 20% of all commercial lending, as opposed to residential, which now sits at around 54%.

“We expect the commercial market to remain strong in the current low interest rate environment, with yields generally higher than that of residential investment” - Steve Lawrence, La Trobe Financial

Since economic conditions generally dictate the value of commercial property, one only needs to look at the Reserve Bank’s economic outlook from February 2018 to see positive signs of what’s to come.

According to the RBA’s forecast, GDP growth is expected to strengthen; public infrastructure spending continues unabated, suggesting positive spillovers for growth in machinery and equipment investment; and there will be some strength in non-residential construction. Employment growth is expected to remain steady, while unemployment will gradually decline.

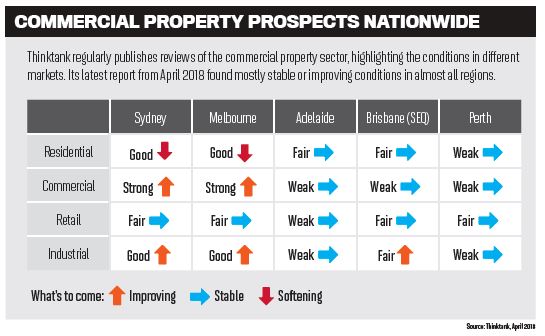

While construction activity has been moderating for some time, Peter Vala, Thinktank Commercial Property Finance’s head of sales and distribution, says standard commercial lending remains solid for typical purposes such as purchases, refinancing and equity release.

“Some regions are flat to a little soft, yet the main metro areas, particularly on the east coast, are looking to present good and consistent financing opportunities while interest rates and unemployment stay low and government spending on infrastructure and services remains high,” Vala says.

Steve Lawrence, La Trobe Financial’s vice president and head of credit, says that while some financiers seem to be pulling back and controlling their books more tightly, La Trobe has seen growth in the owner-occupier SME market.

“We expect the commercial market to remain strong in the current low interest rate environment, with yields generally higher than that of residential investment,” he says.

Thinktank has seen SMSF lending continue to represent 20% of enquiries and volume, while SMEs and self-employed applicants show very strong interest in buying property for their businesses rather than renting.

The royal commission effect

The royal commission might not have direct consequences for commercial lending, but it will still alter the environment in which all lenders operate.

According to Vala, there’s already been a “perceptible shift in the way the market is functioning, with the larger lenders tending to apply more focus to loan and client selection, as well as heavier scrutiny in the underwriting process”.

This is generally adding more to the approval process for applications. As the majors’ turnaround times lag behind, specialist lenders have been able to operate with superior speed and efficiency, Vala says.

But he says the larger themes that have come out of the royal commission, such as an increased focus on responsible lending, ethical behaviour and compliance, need to be taken on board by all lenders.

“[These themes will] progressively spread across the entire financial services industry to capture all of consumer, small business, commercial, unsecured and equipment finance in different ways, but in broadly equal measure. The brokers and lenders who are proactive and embrace this shift will contend with change the best and continue to do very well in their respective businesses.”

All market participants are required to take corporate governance from ASIC and APRA into account in forming their risk management and lending policies.

“But what the Hayne royal commission is devastatingly showing us is adherence to these polices and the regulatory standards is not uniformly actioned,” Lawrence says.

La Trobe Financial has not changed the way it approaches its loan business given this regulatory focus, he says. And it will continue to assist those who are underserved by traditional lenders.

“We treat the assessment of both residential and commercial loans in a very similar vein, whether they are National Credit Code-regulated residential loans or ‘non-coded’ commercial loans. Our loan assessment process is uniformly applied.”

Lawrence says the fact that La Trobe Financial’s commercial offerings, whether for investment purposes or construction, have remained almost unchanged for a decade or more highlights the stability of the non-bank lender’s products and credit policies.

From a broking point of view, Liberty’s Mohnacheff is resolute that the ongoing scrutiny of the residential sector won’t, nor should it, affect how brokers work in the commercial lending sector.

“We are confident that brokers writing residential loans will continue to meet the compliance requirements of commercial lending,” he says.

He doesn’t expect the current scrutiny of the finance industry to stymie the continued trend of brokers diversifying and offering commercial lending solutions to customers.

“Doing so is good for the customer, and in today’s world, being competitive in business demands customers are serviced in more ways than one,” Mohnacheff says.

John Kolyvas, ING’s national sales manager, commercial, also says the scrutiny has had no direct impact on the non-major bank. And, like Liberty, it has seen a lift in the number of residential brokers wanting to be trained in commercial lending – though this is likely to be more indicative of brokers looking to better service their existing clients, 30–40% of whom are said to be self-employed customers, than a reflection of the increased scrutiny of home loans.

“ING remains committed to commercial lending, and there have been no changes to our approach. Our commercial team continues to grow, and we remain prudent in our credit appetite,” Kolyvas says.

A boost in opportunities for smaller lenders

All of this is welcome news for smaller lenders, who have become increasingly viable competitors to the majors in the commercial property space. As the major banks rein in their lending appetites and focus on responding to the ongoing investigations and recommendations, the non-banks and second-tier banks will gladly fill the void.

Driving competition and providing more consumer choice has always been the role of non-banks, and that won’t change, Mohnacheff says.

“Liberty remains focused on supporting all brokers with the help and guidance they need to embrace commercial products. That means brokers can assist more customers and diversify their revenue streams,” he says.

“For experienced residential brokers, moving into commercial lending is not as di cult as you think. There are plenty of training courses out there” - John Kolyvas, ING

As market conditions prove ripe for smaller lenders, they’re now focusing on attracting brokers and their clients through improved training and support.

Liberty takes a very hands-on approach with its business partners, Mohnacheff says. As a result, brokers are using Liberty BDM and direct underwriter support to get their first commercial deals under their belts. “From there it’s just onwards and upwards,” he says.

Kolyvas says ING is expanding its sales team and is looking at building closer relationships with commercial specialist brokers and residential brokers who undertake the occasional commercial application.

“We take a different approach to each channel by offering residential brokers more advice and support when structuring their commercial applications,” he says.

ING also runs a one-day training workshop that teaches brokers about commercial lending, called Commercial State of Mind; it is now in its third year. Two thousand brokers have completed the program to date. Kolyvas says brokers should get in touch with their ING representative if they want to attend the next workshop.

“For experienced residential brokers, moving into commercial lending is not as di cult as you think. There are plenty of training courses out there – I’d start by attending as many as you can,” Kolyvas says.

Vala adds that it helps that there is a general perception that the non-banks are easier to do business with. “The greatest level of activity and innovation is also happening in this space as well,” he says.

A key focus for Thinktank in 2018 and beyond is on service that supports turnaround times. This means making the credit team just as important a part of the service as its relationship managers and assistant managers.

“We are a much bigger business now, with monthly loan volumes in the same bracket as many ADIs, and we want to make sure we don’t become ‘bank-like’. Technology enhancements will help, but for us it has always been about the personal relationship and value-add side,” Vala says.

Thinktank’s ongoing education and mentoring series has also helped brokers build their businesses by capturing more opportunities, while simultaneously making them more connected and valuable to their client network.

Lawrence says La Trobe emphasises the accessibility of its commercial loan products, which are constructed in an easy-to-use and familiar format so first-time users can write them confidently and competently. Its relationship managers engage brokers from the first point of contact, and then brokers are supported throughout the process with direct access to senior commercial credit analysts. The lender has a team of 86 underwriters who are well equipped to help new entrants.

“Our turnaround times are far superior to most, and we provide a personalised relationship service model to treat each application on its merits; we are not a ‘tick the box’ lender,” Lawrence says.

“We have enjoyed great success with our broker engagement strategy and plan to continue along the same path in 2018, increasing our footprint further each year.”

The non-banks and the non-majors are always ready to help guide and support brokers through commercial finance in any way they can. Now’s the time to start collaborating.

From left to right: John Kolyvas, Steve Lawrence, John Mohnacheff, Peter Vale

LENDERS TAKE

QUESTION: What makes a top commercial broker?

John Kolyvas: “They have a good understanding of credit and usually structure and condition their application appropriately before it gets to the bank – this makes the approval process much quicker. They also have a good understanding of the banks’ commercial appetites and readily use ‘discussion papers’ to gauge a bank’s appetite for a proposal before lodging a formal application.”

Steve Lawrence: "“A top commercial broker is one who understands the specific needs of the borrower both in the immediate and over the longer term, which is often solutions-based. Top commercial brokers know where to find the best commercial product that will meet the borrower’s needs and requirements, and can look outside mainstream traditional loan providers to do this.”

John Mohnacheff: “Simple – self-belief and a genuine interest in helping customers get finance."

Peter Vale: “The very good and effective commercial brokers have a number of traits in common. They all tend to be very client focused and maintain discipline around regular contact with clients to understand what their current and future business and finance needs are. These brokers always appear to have very good relationships with their aggregators and a range of commercial lenders, and have a core group of referral sources. They are effective in Peter Vala, Thinktank bringing deals together on their own or with the assistance of the lender.”

QEUSTION: What do you specialise in?

John Kolyvas: “We specialise in commercial property lending, with a preference for commercial investment property and owner-occupied business premises. We generally offer higher LVRs than the major banks for amounts below $3m, although larger loans can still be serviced by our commercial property team, who also look at construction for amounts over $5m. We have no ongoing fees and our upfront costs are competitive.”

Steve Lawrence: “We cater for a variety of commercial property finance needs, including the purchase, refinance or construction of either owner-occupied or investment property. We can also lend to individuals, companies, trusts and SMSFs, residents and non-residents, and can do so on a full-doc, Lite Doc® and lease-doc basis. Our sweet spot is the $5–10m loan range, with some smaller appetite up to $25m.”

John Mohnacheff: “Liberty’s SMSF SuperCredit product offers LVRs up to 75% and loan terms up to 30 years for any owner-occupier and investor loans. We are always looking to engage with new and existing commercial brokers, and to do this effectively we have built a large and experienced national sales team. We also offer additional support to brokers, such as giving them direct access to our underwriters so they understand how we came to a decision.”

Peter Vale: “Thinktank is well known for its set-and-forget commercial loan products, with no annual reviews, ongoing fees or mandatory property revaluations; loan terms of up to 30 years and upper-end LVRs to 75%. Our approach to workshopping deals with brokers assists transactions to progress faster and with greater certainty of result.”