Helping brokers find their edge in the $100bn asset and equipment finance market

Helping brokers find their edge in the $100bn asset and equipment finance market

Jet skis, cars, boats and heavy machinery are now not-uncommon purchases to secure through a broker. But while brokers’ share of the equipment and asset finance market is increasing, not all customers are aware of the lifestyle extras and business essentials they offer.

Connective is on a mission to change that, first by changing brokers’ perceptions of themselves, and second by making brokers’ transition into asset and equipment finance as seamless as possible.

It’s worth paying attention: the asset finance market in Australia is worth about $100bn in receivables, and about $40bn in new equipment loans are written each year, according to the Commercial & Asset Finance Brokers Association of Australia.

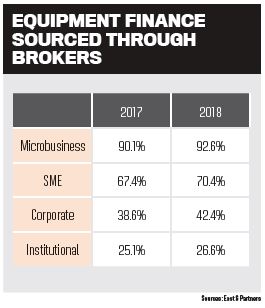

Businesses are starting to turn to brokers more frequently to secure this kind of finance, East & Partners shows in its 2018 asset and equipment finance report. The use of brokers by the total business market to source equipment finance solutions went up to 52.6% from 48.3% last year.

These numbers don’t surprise Brent Starrenburg, head of Connective Asset Finance.

“We’ve seen significant growth in the asset finance space, to the point where we’ve seen it grow roughly about 30% year-on-year for the past four years from [Connective brokers], and it continues to grow momentum; it’s quite strong,” he says.

While Connective started focusing on this area five years ago, last year was particularly significant. The company formally became a dedicated asset finance aggregator after partnering with Adelaide-based Positive Lending Group to launch BOLT, a singular asset finance quoting and lodgement platform.

The platform allows brokers to isolate and compare lenders based on what they offer and who they cater to. This lets brokers consider how to best structure a deal so it fits within those lenders’ loan and policy parameters.

“The broker can then push the application through our processing team, and they can ensure that the deal is consistent with lender expectations,” Starrenburg says.

If the broker is new to the industry or to the asset space, it can be tricky to understand the ins and outs of a deal, he says. But this guides them through the process and makes everything black and white.

“This means that, when the deal goes through, both the broker and the client have a positive experience because the client is getting the best possible service and the broker is getting a good experience because they’re having their hand held… and it’s going through to a processing team,” he says.

The gateway to asset finance

After a house, the second-biggest purchase that most consumers will make is their car. According to the ABS, new finance commitments for vehicles totaled around $2.8bn in the month of December. For all of 2017, they totaled around $35.7bn – or about 4.2% of total new finance commitments for the year.

The easiest entry point to asset and equipment finance for

“We use cars as an entry level and build brokers up from cars into equipment and other aspects of doing asset finance. The fundamentals are the same; it’s just the actual equipment style changes,” Starrenburg says.

This also goes hand in hand with additional referrals for brokers. “People who buy cars buy houses, and people who buy houses buy cars; it’s going to continue on that path, and cars are just the tip of the iceberg.”

Brokers can learn how to write those loans or brush up on their knowledge at one of Connective’s 90 workshops across Australia this year.

Starrenburg and his asset finance BDMs will talk to brokers about how to identify asset finance opportunities; why integrating asset finance is beneficial to their businesses both in the short and long term; how to present asset finance to a client; how car dealers operate, and what to look out for when competing in the asset finance space.

“It comes down to the whole education piece. It’s about opening your eyes to diversification, not pigeonholing yourself as a mortgage broker; think of yourself as a finance broker” - Brent Starrenburg, Connective Asset Finance

It was at some of those workshops that Starrenburg realised that brokers’ view of themselves might in fact be what was holding them back. When asked if they considered themselves mortgage brokers, about half of the people in the workshop raised their hands, he says.

“It comes down to the whole education piece. It’s about opening your eyes to diversification, not pigeonholing yourself as a mortgage broker; think of yourself as a finance broker,” Starrenburg says.

“It’s about helping brokers understand that there is more to the broking industry than just mortgages; it’s the whole gamut of products that’s available to them.”

Using BOLT makes that transition from ‘just mortgages’ to ‘all finance’ a lot easier, he adds.

“We have a dedicated team, a processing arm and a platform that integrates into our CRM; it really can’t get much easier.”