How Pepper's Product Selector tool is making it easier and faster for brokers to find solutions for underserved borrowers

How Pepper's Product Selector tool is making it easier and faster for brokers to find solutions for underserved borrowers

MPA: What sort of technological changes has Pepper made recently for the broker channel?

Aaron Milburn: At Pepper, we believe customers should never be in a position where they don’t understand their financing options, regardless of their circumstances. We know non-conforming borrowers are the largest underserved segment of the market. Our research has shown that six out of 10 eligible non-conforming customers go empty-handed when they could have been helped by a broker.

We wanted to make sure that those clients never leave a broker’s office with a “no” when it should have been a “yes” – that’s why we developed the Customer Conversion Toolkit, featuring the Pepper Product Selector.

MPA: The Pepper Product Selector was launched last year. For those brokers who haven’t used it yet or don’t know how, why should they and what should they know about it?

AM: Essentially, it’s a market-first conversion tool that allows brokers to identify a specific home loan product, interest rate and fees for any client in less than two minutes. The Pepper Product Selector takes the guesswork out of finding the most appropriate Pepper product for brokers’ customers, especially for difficult scenarios.

“Pepper Product Selector can be used for any customer situation. However, it can be particularly useful where their circumstances will not typically fit the banks’ criteria and you are searching for an alternative solution”

As part of the product matching process, Pepper Product Selector will ask if the customer’s credit score is known. If the score is not known, the tool will access the credit bureau to retrieve the credit score free of charge via an ‘Access Seeker’. This method does not impact the customer’s credit score and is visible to the customer only, not to lenders and other credit providers.

PPS can be used for any customer situation. However, it can be particularly useful where their circumstances will not typically fit the banks’ criteria and you are searching for an alternative solution.

MPA: How has the tool changed and evolved since 2017 to further assist brokers? Did you take on broker feedback?

AM: Following feedback from our early-adopter brokers, we released our first round of improvements in January, all aimed at optimising the user experience for brokers and their customers. We will continue to release further updates as more brokers use the tool.

MPA: How are you seeing brokers use the PPS tool? Any surprises there?

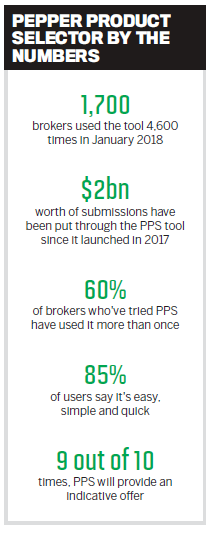

AM: We’ve really seen brokers embrace the extra information they are receiving upfront to help their customers make a decision. The uptake has been swift and overwhelming. In January alone, we had 1,700 brokers utilise it 4,600 times. We have had nearly $2bn in submissions put through the Pepper Product Selector tool since it launched last year. It’s brought a number of new brokers who are relatively new to writing nonconforming business, and it’s helping dispel the misconception that writing a nonconforming loan is too hard.

“[The PPS tool] has brought a number of new brokers who are relatively new to writing non-conforming business, and it’s helping dispel the misconception that writing a non-conforming loan is too hard”

What’s been most pleasing is the level of repeat use the tool is getting. Sixty percent of brokers who’ve tried PPS have used it more than once. Eighty-five percent of users have told us they like how easy it is to access the tool, they love its simplicity and how quick it is to use. These findings aren’t really a surprise to us, as we designed the tool with all this in mind.

- Improve customer service: Provide a timely, readily available and customised product offer

- Alternative to a decline: Pepper Money may provide a viable loan alternative in minutes

- Ease of use: Mobile-responsive application with one-time log-in to Pepper Product

Selector and the credit bureau

- No cost: Free for accredited brokers to use and submit Pepper Product Selector applications to the bureau

- It’s fast: Receive an indicative decision within minutes

MPA: Are there any features of the tool that perhaps brokers aren’t yet using to the full extent and that you think they should know more about?

AM: Not really. Once a broker tries the tool, they quickly realise how readily they can adopt it for all their customers who might not meet a bank’s criteria.

MPA: How is the tool speeding up the loan process for brokers’ customers?

AM: PPS was built around returning a quick decision so that brokers can provide a customer with an alternative solution in less than two minutes.

MPA: What about those tricky deals? Can the PPS still provide an indicative offer in those cases?

AM: Nine times out of 10, Pepper Product Selector will provide an indicative offer which includes the product, rate and applicable fees. For those extra-tricky deals, PPS will refer the broker to the Pepper Scenarios Team, who are trained to work with the broker to determine the best and most appropriate outcome for the customer.

MPA: After a broker uses the tool and receives an indicative offer, what do they do next?

AM: All the broker needs to do is submit a formal application as per the usual process, attaching a copy of the indicative offer letter to the application.

Pepper will honour the rate and fees documented in the indicative offer, subject to there being no material differences between the information entered into PPS and the formal application. If there is a material variance, Pepper will contact the broker to discuss the application.

MPA: If brokers want to start using this tool or they want to find out more, what steps should they take to do that?

AM: We have lots of information available on our broker portal. Alternatively, a broker can talk to a Pepper Money BDM to request a live demo.