Despite the challenges of the last year, these brokers have continued to grow

.jpg)

Despite the challenges of the last year, these brokers have continued to grow

In last year’s Top 10 Brokerages report MPA said the year prior had been one of the toughest in recent memory.

But then along came the next 12 months, when we saw continued scrutiny during the royal commission and came to a sudden realisation that Commissioner Hayne might actually recommend banning commissions.

Then of course the recommendation came in his final report in February, sparking deep fear within the industry among those who were worried about their livelihoods and the jobs they were passionate about.

But out of that grew a strong resilience, and the fight for mortgage brokers really kicked off.

Brokers did not have to be part of the big advertising campaigns or conversations with government; simply working in the best interests of their customers and having conversations with them was part of that fight.

The head of the number one brokerage in this year’s Top 10 told MPA that his customers had begun phoning him to voice concern for the industry because brokers had been there for them through some of their toughest times.

When we spoke to our Top 10 Brokerages this year, the biggest theme of our discussions was their passion for the customer.

For some, falling house prices and tightened credit had simply given them more time to educate themselves so they could better service their clients – and that was what was important to them.

Many brokerages hold frequent training sessions to keep their brokers on top of the changing credit policies.

Some also encourage group support sessions to workshop scenarios so that brokers who have experienced similar situations are able to guide the rest of the team.

Changing credit policies were the biggest challenge for these brokerages over the last year, but they explained how they had prepared for this. In some cases they diversified their product portfolios, and in others they had already introduced systems to start dealing with extra documentation.

Although it might be easy to say that the biggest challenge of the year was changing credit policies or the impact of the royal commission, it was interesting to hear from these brokerages about what really affected them.

There were two resounding answers. The first was the royal commission, but not because of the impact of changing regulations or anger about what was said in the hearings; these heads of brokerages were most affected by worry about their teams and their teams’ families.

They saw how di cult it was for their brokers to focus on their jobs and how disheartened they were.

The second was the challenge of recruiting new brokers.

All these brokerages want to continue to grow but have found it hard to recruit staff.

They faced difficulties either in assessing potential recruits for the right fit beyond what was written in their résumés, or because new brokers were too nervous to enter the industry at a time when no one really knew what was going to happen.

Read on to find out more about how these brokerages overcame the challenges of the last year.

Thank you to everyone who took part.

Featuring in this list at this time is a significant achievement and a credit to all your hard work.

MORTGAGE CHOICE MIAMI

For founder and director James Hasselle, getting the best outcome for the customer is non-negotiable.

“It’s never been as hard as it is now to get a loan or gain access to credit,” he says.

“But if you’re doing things properly, you should still be able to help. It’s our duty to help customers gain that competitive edge.”

Where brokers can really help, Hasselle believes, is with everyday borrowers: families and small businesses that are looking to negotiate their way through the often complex borrowing rules set out by the banks.

“The new credit rules can really cause them problems, particularly if they’ve had a few rejected applications already,” says Hasselle.

“The level of experience we possess is a crucial asset.”

With new offices opened in Burleigh Heads and Palm Beach in the last few years, business looks to be booming. “We’re not just a small business any more,” says Hasselle.

“We’re an employer, and that’s just one more way we [are] giving back to the local community.”

LOAN MARKET, ONE NETWORK BROKING

While most of the Top 10 Brokerages this year said recruitment was one of their biggest challenges, only Loan Market, One Network Broking said it was a challenge they were beginning to enjoy.

Like everyone else, Gurry has also faced the challenge of new lending policies, but the brokerage has been quick to learn how to get better and adapt.

It specialises in the residential mortgage space and has a strong focus on the customer experience.

“We like to call our relationship with our customers ‘professionally intimate’, with a focus on strong communication – with all brokers and support staff on the same page,” he says.

The brokerage has also taken its training and development “up a notch”.

On top of the training Loan Market provides, it runs its own training sessions.

“I am particularly proud of the learning and growth culture of the team,” Gurry says.

“We have traineeships and external training, but there’s also a heap of self-coaching, peer-to-peer sessions and constant support from the entire team.”

THE FINANCIERS GROUP

For many brokers one challenge of the last 18 months was the emotional stress of worrying about the future

“There was this thing called the royal commission. Emotionally, it was a bit of a scare,” says The Financiers Group director Chris Huynh.

But it did not stop the industry from doing its job, and in Huynh’s case it gave him the opportunity to reassess the business.

“It made us review and put a lot of things in perspective,” he says.

From day one after its launch in 2015, the brokerage focused on implementing solid processes.

With a great team of brokers and admin staff, it was prepared to withstand the obstacles the industry has faced.

Still focusing mainly on residential loans, The Financiers Group has not had to diversify too much into commercial; however, it has broadened its customer base.

While Huynh says the banks’ changing goalposts have been difficult, he and the team are prepared for the challenges.

“In terms of documents and managing clients’ expectations we've always been prepared for tightening of credit.”

EMPOWER WEALTH

Guiding customers through each stage of the journey to owning an investment property has been made much harder by the longer turnaround times and extra work.

“Getting appropriate funding for our clients’ planned journey meant we were challenged with excessive lending credit policy changes, long delays on the back of extra scrutiny and some unnecessary reworking,” says Ben Kingsley, founder and MD of Empower Wealth.

“Ultimately, a less productive and efficient lending environment leads to greater client expectation management and hand-holding, resulting in increased workloads for no client upside.”

Despite the challenges of the past year, the brokerage wrote some good figures and celebrates its success in “finding novel and advantageous ways” to help its customers.

The group has built a cloud-based Wealth Portal and Money SMARTS system to help customers better manage their money and trap more surplus.

It plans to continue investing in innovation with the aim of deepening its connection with customers.

MORTGAGE CHOICE BRISBANE

Being a group of young brokers, the team at Mortgage Choice Brisbane face slight skepticism from those outside looking in.

The biggest challenge for Cunliffe over the past year was in February when the royal commission’s final report was released.

“The unknown of what might be happening to our industry, how that might play out with an effect on my family and the family of my staff around me – I have felt the burden of the unknown.

It’s been a long waiting game,” he says.

With big plans to grow the business in the future and train his staff, Cunliffe was, like many brokers, waiting for the outcome of the federal election.

But while he waited, they took the chance to reassess the business. In September the team looked at its functions and processes and worked on building a new system to improve the client experience.

“Seeing the whole team work together to get the outcome, and the commitment that people have put forth, has made me really proud of the team.”

Cunliffe puts the brokerage’s success down to that same team, which has not seen a change in staff in two and a half years.

GREEN FINANCE GROUP

Client education has been an important part of the past year for Green Finance Group director Daniel Green.

“We’ve had to work harder to really educate clients about the change in lending landscape,” he says.

“Things like timing and preparation and the fact that just because their existing bank worked in the past doesn’t mean they’ll be receptive now.”

The Brisbane brokerage offers residential and commercial finance, and pub and hotel finance is Green’s personal specialty.

Word-of-mouth referrals are an important tool and make up a large percentage of the business.

Green prides himself on his relationship with his customers, many of which are repeat or long term clients; there are business owners he has been working with for nearly two decades.

“A large portion of my clients are family owned and run businesses and, in some cases, I’m now assisting the third generation of these families,” he says.

As well as those relationships, Green puts the brokerage's success down to consistency and understanding his own limits.

He has surrounded himself with a network of established professionals, including the finance specialists at Green Finance Group, lending colleagues, accountants, financial planners and real estate agents.

Over the year ahead, it’s these business partnerships he’ll continue to grow.

SHORE FINANCIAL

The best relationship with customers is one born out of interactions that educate them, says Shore Financial’s CEO Theo Chambers, and that is where he intends to continue his work over the next year.

Rather than having interactions in which they are just selling to customers, he says, “we want to create relationships from educating people”.

By improving the brokerage’s digital presence and offering tools like property seminars and online content, Chambers hopes to build customer trust by enabling them to have better conversations. Already, the relationship with the borrower is not just a transactional one.

The group has the biggest team out of all of our top 10 brokerages, and this includes financial planners, who work alongside the mortgage brokers to provide advice.

They work together not just to give the customer the most competitive rate but to provide a larger service, particularly with property investors.

“We really engage in the consumer’s journey of house-hunting, and by having highly educated individuals who understand tax strategies personally, they can relate to our clients’ goals and their motives when purchasing their second property or upsizing,” Chambers says.

One of the biggest challenges of the past year for Shore Financial was training and recruitment.

Holding interviews with a candidate who ticks all the boxes in terms of their résumé, training and education is fine, but it’s not as easy to assess their work ethic and attitude, which is crucial in this industry.

The other challenge was the market and having to manage client expectations.

Over the last two years, with changes from APRA, plus the royal commission and higher assessment rates, it’s harder for people to borrow money.

“The morale of our team got disheartened with the extra hoops we’re jumping through to get loans approved,” Chambers said.

“We’re the bearer of bad news, telling the consumer they can’t afford what they want to do.”

Despite the challenges, there were some great highlights for Shore Financial in the last year.

Individual team members have continued to develop in their roles, and the group’s property seminars have been very successful too.

The brokerage also offers exclusive rights to a number of real estate groups, allowing brokers to partner with agents and provide a more seamless transition for customers.

It’s these holistic offerings that Chambers really wants to focus on moving forward.

The brokerage is already offering a diversified product portfolio, ranging from residential to car finance and commercial loans, and is also working on the launch of a white label product.

Chambers remembers a line he learnt while working at a major bank 10 years ago: “If you sell a consumer 3.8 products or services, that consumer becomes a client for life. So, we want to try to make sure we’ve got 3.8 products or services in place with our clients.”

AQUA FINANCIAL SERVICES

Since 2011, Aqua Financial Services has marked itself out as a strong achiever within the broking field.

Headed up by principal Daniel Hustwaite – and a regular fixture in MPA’s Top 100 Brokers list – the company has carved out its own niche across a variety of different fields, including home loans, investment property loans, SMSF, commercial and equipment/vehicle finance.

It’s a broad spectrum, but Aqua’s placement in this year’s list is testament to the positive power of diverse brokerages.

As the lending market continues to shift, it’s essential for brokerages to stay ahead and secure their future.

In 2019, Aqua finds itself in the same position as many other Australian brokerages.

The industry is changing, with rapid technological shifts driving both innovation and procedural change; new loan requirements, and the royal commission into financial services pushing for legislative changes.

But for Hustwaite it’s all part of the business.

With almost two decades of experience in finance, he’s well aware of the cycles and challenges that come with the territory.

“I started working in finance and banking back in 2000,” Hustwaite says.

“So I saw quite a bit even before I moved into broking.”

That's not to say he’s downplaying the seriousness of some of the current challenges in the industry. He says brokers arguably have a more important role than ever before in helping clients secure loans and finance.

“The principles of responsible lending are currently in a bit of a flux, and accordingly we’ve seen borrowing capacities decrease significantly across the board,” says Hustwaite.

“This means it’s trickier to get a loan approved.”

Recent years have also seen almost all Australian banks move away from the generally accepted practice of adjusting their rate settings in line with movements in the RBA cash rate.

“Since this time, we’ve started to see significant out-of-cycle movements and adjustments to the rates on offer by the banks,” says Hustwaite.

“We’re expecting this volatility to continue for the foreseeable future, so it’s more important than ever to be vigilant in monitoring client portfolios to ensure they are receiving the best outcomes for their specific circumstances.”

As part of this process, over the next 12 to 18 months Aqua will have a continued focus on process management, with the aim of streamlining as much as possible, ensuring efficiency without sacrificing service.

“The most important thing is that we’ve got to be flexible and adept enough to adapt to the changing regulatory and lending landscape,” says Hustwaite.

But just as importantly, Hustwaite aims to continue growing Aqua organically by leveraging its existing customer base and building deeper relationships with its strategic partners.

“The place a lot of businesses fall down is in not treating their existing customers as well as their new ones,” says Hustwaite.

“But you need to make sure everyone is looked after properly; that’s why we are constantly in touch with customers, reassessing their current arrangements and looking at how we can help them get the best possible deal.”

MY HOME LOAN

The slowing market has allowed the team at My Home Loan to spend more time on education and training.

Everything at this brokerage is designed to improve the customer experience, from algorithms for finding the right broker fit to simply spending time learning about credit policies.

Managing partner Darren Liu entered the mortgage broking industry in 2012 and established My Home Loan in early 2014.

Contrary to its name, the group diversified in 2015 to offer a number of commercial finance products.

While the brokerage has not been long in the market, Liu says it has learnt to adapt and grow and develop t

Early on in the business My Home Loan realised that customers felt uncomfortable with multiple brokers or assistants following up on their loan enquiries.

The brokerage came up with a system and procedure to develop the best customer experience right from the start.

“When enquiries come into the system or into our office, we don’t randomly give them to one broker to follow up – we have an algorithm to match the customer,” he explains.

As Liu says, different customers want different experiences.

“Each one of our consultants is specialised in different products and demographical locations.

We will allocate customers accordingly to achieve a better customer experience.”

Once a home loan is settled, the brokerage goes the extra step by offering the borrower help with setting up their utilities. It's a small gesture but one that provides that extra value.

My Home Loan grew significantly in its first year, thanks to the property boom, but as expected has slowed down in the current climate.

While things are slow, Liu says they are using the time to concentrate on their education.

The team holds Mortgage Broker Academy sessions each week to talk about changing credit policies and make sure that everyone is on the front foot.

The program includes nine modules and is designed to help new-to-industry brokers understand the full picture in an efficient way, as well as enhance the sales and technical skills of experienced brokers.

It is not only offered to My Home Loan staff but used as an opportunity to share experiences with other brokers in the industry.

As with other brokerages, My Home Loan has found recruitment a challenge as people have started to question the industry.

To combat this, the group has been developing its training and education program to attract those candidates who are keen to learn.

ACCEPTANCE FINANCE

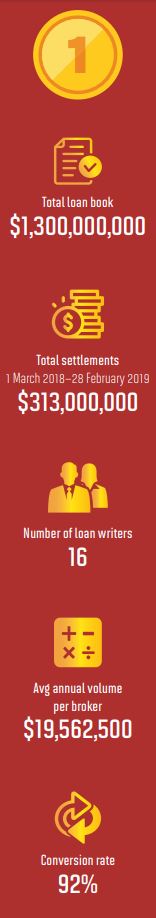

This year's number one brokerage has “bucked the trend” and written more loans in the last year than ever before.

Acceptance Finance CEO Daniel Di Conza says they have faced the same industry challenges as everyone else, but the group’s great teamwork and positive attitude have kept the business growing.

For Di Conza, one of the hardest parts of the last year was keeping a team of concerned brokers focused and enthusiastic in spite of the royal commission recommendations.

“It’s really easy to react negatively when you’re faced with these headwinds, but the most positive thing was seeing the team come together and support each other,” Di Conza says.

“When they thought the industry they were working in was going to evaporate, they worked harder together, supported each other with transactions, problem solved, and gave each other moral support.”

Di Conza says this attitude was reflected in the service the brokerage provided to clients. Operating since 2002, Acceptance Finance has built a strong customer base.

“If you always look after the client everything else will look after itself”

After the royal commission's final report, the brokerage sent out a brief video message to let its clients know the potential impact.

“That sparked a fair bit of conversation, and clients were genuinely concerned,” Di Conza says.

“They trust their brokers, and for them the relationship they have had with their brokers has helped navigate them through difficult times.”

With the royal commission enhancing customer support and forging strong bonds between brokers, Di Conza has a glass half full attitude.

“Sometimes these challenges we get can actually be really positive when you get through them,” he says.

“The royal commission and focus on brokers is going to provide some positives for the industry – as painful as it was at the time.”

The team at Acceptance Finance is made up of subject matter experts, Di Conza says, focusing on areas like SMSF lending, investment properties and commercial lending.

When one team member doesn’t understand an area quite so well, they workshop with others.

One of the biggest concerns for Di Conza moving forward is about clawback for a facility that has not been used within a certain period.

Working with a lot of property investors, his brokers are often asked to arrange a refinance and set up an investment facility for a future transaction.

Di Conza says the clawback policy gives brokers too much of a reason to change behaviours; for example, they might decide to do the refinance first and the investment facility as a separate transaction down the line when the borrower is ready for it, creating twice the paperwork for all involved while not providing any benefit for the client.

“Brokers are getting mixed messages,” he says.

“Are we looking after clients for a long period of time, or are we looking after them for a transaction? Current clawback policies will conflict with best interest duty; a bit of work will need to be done for our industry to have them both at the same time.”

The other thing to focus on going forward is the growing costs of doing business.

Di Conza is looking at where to place resources, and at boosting the relationships with referral partners.

Most importantly, he will stick to his simple but effective strategy: “Advise the client as if you’re advising yourself. If you always look after the client, everything else will look after itself.”