Data for March shows the figure dropping, but each state has a different story

Fixed rate demand has dropped according to new research from Mortgage Choice, but borrowers in different states are doing it differently.

The brokerage’s latest national home loan approval data showed fixed rate home loans accounted for 21% of all home loans written – a drop of 1.38% from the month before.

Mortgage Choice CEO Susan Mitchell said it was unsurprising to see borrowers taking a cautious approach towards fixing their interest rates.

“There is a great deal of uncertainty surrounding the housing market at present, which could be weighing against borrowers’ decisions to commit to a fixed term,” she said. “The outcome of the upcoming Federal election carries potential policy implications that could affect people’s willingness to buy. There is also increasing speculation that the RBA will cut the official cash rate in the short-term.

“That being said, lenders would be acutely aware of borrowers’ reluctance to fix and have in the last few weeks responded by cutting rates on some of their fixed rate products.

“Those looking to fix could enjoy great rates right now. Major lenders and smaller lenders alike are attempting to lure borrowers to their fixed rate products by announcing reductions of up to as much as 55 basis points.”

Where is fixed rate demand highest in Australia?

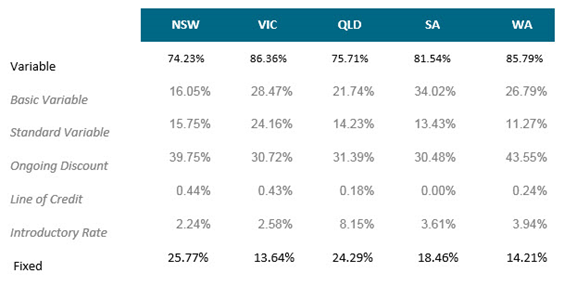

New South Wales

Fixed rate demand was highest in NSW, accounting for nearly 26% of all home loans written in March

Queensland

The second highest state, 24% of all home loans were fixed rate loans

South Australia

Dropping below average, 18% of South Australians fixed their home loans

Western Australia

Just over 14% of borrowers in WA went for a fixed home loan product

Victoria

Borrowers in Victoria were least likely to fix their interest loan, with just under 14% choosing the product