Brokers are moving en masse into SME lending, and lenders are responding with products and training designed to take brokers well beyond the home loan

Suncorp’s national manager of SME and commercial, Robynne Frost, believes she’s lucky to be in a commercial lending role in the current market. “Even with some of the challenges we’re facing, I wouldn’t want to be anywhere else,” she says.

A new startup channel within Suncorp dedicated to SME lending through intermediaries, Frost’s business is only 18 months old, but already it’s fulfilling its promise to capitalise on the next big opportunity. “We saw the trends in the market that showed business lending is growing substantially in Australia,” she says, “and with other challenges to growth, like APRA’s restrictions on investment lending, we saw SMEs as a good opportunity.”

This opportunity applies as much to brokers as to the bank. “We’ve definitely identified an opportunity and trend toward diversification among brokers, who have been for some time facing a future in which customers will likely expect a lot more than just a traditional home loan,” Frost says.

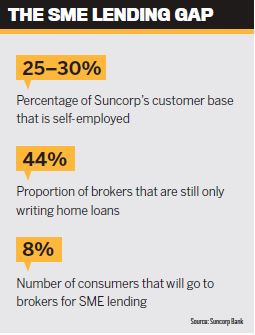

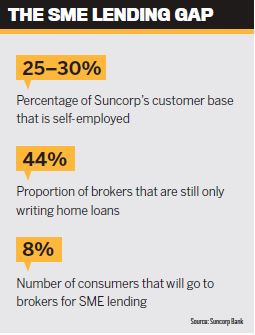

The statistics support Frost’s enthusiasm. The broking market as a whole is still transitioning towards a greater volume of business lending, so there is a gap waiting to be filled by entrepreneurial brokers. “We know 25% to 30% of our home loan customers are SME customers,” Frost says. “What we also know is that 44% of brokers Australia-wide are only writing home loans.”

However, it appears commercial lending’s time may have finally come. John Mohnacheff, who has spent years spreading the word as Liberty Financial’s national sales manager, has witnessed over the past year a significant shift in brokers and aggregators diversifying to offer asset finance and commercial, in addition to mortgages. He says a symbol of that is Aussie Home Loans’ embrace of commercial lending.

“Aggregators have realised that to maintain their relevance, brokers have got to be able to cater for the SME market,” Mohnacheff says. “The happy result of that scenario is that brokers are trying it, and after they’ve tried it, they are saying it was not as difficult as they thought it was.”

Remaining relevant

SME lending has always been the traditional domain of the banks, Mohnacheff says, but the market is shifting. “Business lending was theirs through and through, but brokers are now saying, ‘I’m going to be in the business market; I’ve got a lot of lenders on my panel outside the Big Four who can work with me and help me.’”

That may be because brokers are being flanked by competitors. Suncorp’s Frost says brokers have realised they may lose customers if they don’t upskill.

“If a home loan customer turns out to be self-employed, many brokers have often been too scared to ask deeper questions – they just move on and do the home loan transaction,” Frost says. “That approach risks a situation where, if a business has a need, they will go and see another broker or go directly to a bank. The broker not only loses the SME lending business, but the home loan customer as well.”

Mohnacheff says today’s entrepreneurs have a more intelligent approach to opening a small business. Thanks to the internet, they are better informed in all aspects of opening a new business. These educated entrepreneurs know what they want, but need someone to do it for them.

Mohnacheff says today’s entrepreneurs have a more intelligent approach to opening a small business. Thanks to the internet, they are better informed in all aspects of opening a new business. These educated entrepreneurs know what they want, but need someone to do it for them.

This is good for brokers. “They’re not going to go and beg a bank for the money,” Mohnacheff says. “They want to get on and build a business – they don’t want to sit around or go from one branch to another. They are embracing commercial brokers.”

However, brokers need to be ready for a different type of conversation to remain relevant. When customers already know what they want, brokers need to remain agile or risk being overtaken by the free knowledge that’s available, as well as the emerging direct peerto- peer channels that are being created by fintech disruptors.

Frost sees a big chance for brokers open to the SME market. “Our customers’ expectations of brokers are rapidly increasing as their appetite for advice on multiple product solutions, not just home loans, increases,” she says. “Today’s market provides a huge opportunity for brokers to diversify and offer SME lending to their customers. That represents a huge opportunity for the industry.”

Up to speed

After Suncorp began exploring SME lending through brokers, the bank found that it needed to adapt its approach. Although it had a team of existing BDMs for home lending, it needed a dedicated infrastructure for brokers, who were finding small business lending more complex than home lending.

“While growth was phenomenal, there were lots of challenges around brokers having the right skill base to be able to do these transactions,” Frost says.

The bank has responded by establishing a footprint across the Eastern seaboard, with six dedicated SME business development managers who provide tailored services to assist brokers solely with small business transactions. But the bank has also gone much further. Seeing a need for education, Suncorp committed to helping brokers understand SME lending in a deeper way.

“Our approach has been around education and giving back to the industry, which we achieve through our SME master class program,” Frost explains. “In the past 12 months, we have trained in excess of 900 brokers on how to improve their confidence around things like reading financials, trends and ratios so that they can provide more ‘whole of business’ advice to SME customers.”

Once brokers have attended the program, Frost says they are inducted into a Small Business Alumni program, allowing them to continue to build knowledge and skills in small business lending. “That comes in the form of monthly communications, access to tips and tools, and ongoing education and training,” she says.

Suncorp has been very happy with the early results of its education program. “The outcome is some of the quality transactions we are seeing coming through brokers,” Frost says. “It is a really high-touch model, building strong relationships with brokers and providing the hands-on support as they do the transaction.”

Technology and product

Technology and product

Technology is playing a big role in making the SME market easier for brokers to manage. For example, Suncorp’s investment in technology led it to become the first in the market to offer online lodgement capability through NextGen. “This simplifies and improves the process for our broker partners, especially when submitting a dual small business and home loan product,” Frost says.

But lenders like Suncorp know they have to do more. In 2017, Frost says she will be aiming to make it faster and easier for brokers to do business with the bank.

“In our first year we’ve experienced terrific growth, and we have been listening to what’s important to our broker partners,” she says. “We are looking to improve and deliver on these points, and we have process improvement initiatives underway.”

Liberty Financial’s John Mohnacheff says Liberty’s products “have always been squarely pitched to the SME market” – particularly its “superstar” SMSF commercial product. Going to 75% LVR, he says it is a great vehicle for SMEs, allowing them to own a commercial premise and rent it back from their super fund. “It’s a match made in heaven.”

However, Liberty has been focused on improving its service proposition. “We’ve been putting on more BDMs and have sharpened our turnaround times,” Mohnacheff says. “If brokers put a deal in this morning, nine times out of 10, they’ll get conditional approval tomorrow by lunchtime. We are focusing on speedy turnaround times and giving answers – we are focusing on speed and certainty.”

Capturing the SME

Frost says SME businesses are a priority segment for Suncorp as a whole, and the banking push through brokers is an important part. “We are looking at the market and seeing how we can be sharper and faster and better,” she says. “We are going to be continuing to build and improve our broker proposition as part of that.”

But there are still challenges, like convincing SMEs that brokers can help. “One of the challenges we have collectively as an industry is building consumer confidence in going to a broker for small business and commercial lending,” Frost says. “Only about 8% of consumers now consider going to a broker for those lending needs. While it’s changing, we need to build confidence in consumers going to their broker.”

Mohnacheff believes brokers themselves will be the catalyst. “The most pleasing thing is, we have all the leading aggregators saying, ‘We need to play here’, and that brokers need to be invested in learning about these invaluable classes of lending,” he says. “Because if we don’t, we will become less and less relevant.”

In Mohnacheff’s mind, this shift can’t come too soon. “It’s been too bloody long,” he says. “When Liberty embarked on this journey, we knew it would be a long one. It takes a long time to turn the Titanic. But we’ve persevered and persevered and persevered. Now it’s finally happening, and this is music to my ears.”

A new startup channel within Suncorp dedicated to SME lending through intermediaries, Frost’s business is only 18 months old, but already it’s fulfilling its promise to capitalise on the next big opportunity. “We saw the trends in the market that showed business lending is growing substantially in Australia,” she says, “and with other challenges to growth, like APRA’s restrictions on investment lending, we saw SMEs as a good opportunity.”

This opportunity applies as much to brokers as to the bank. “We’ve definitely identified an opportunity and trend toward diversification among brokers, who have been for some time facing a future in which customers will likely expect a lot more than just a traditional home loan,” Frost says.

The statistics support Frost’s enthusiasm. The broking market as a whole is still transitioning towards a greater volume of business lending, so there is a gap waiting to be filled by entrepreneurial brokers. “We know 25% to 30% of our home loan customers are SME customers,” Frost says. “What we also know is that 44% of brokers Australia-wide are only writing home loans.”

However, it appears commercial lending’s time may have finally come. John Mohnacheff, who has spent years spreading the word as Liberty Financial’s national sales manager, has witnessed over the past year a significant shift in brokers and aggregators diversifying to offer asset finance and commercial, in addition to mortgages. He says a symbol of that is Aussie Home Loans’ embrace of commercial lending.

“Aggregators have realised that to maintain their relevance, brokers have got to be able to cater for the SME market,” Mohnacheff says. “The happy result of that scenario is that brokers are trying it, and after they’ve tried it, they are saying it was not as difficult as they thought it was.”

Remaining relevant

SME lending has always been the traditional domain of the banks, Mohnacheff says, but the market is shifting. “Business lending was theirs through and through, but brokers are now saying, ‘I’m going to be in the business market; I’ve got a lot of lenders on my panel outside the Big Four who can work with me and help me.’”

That may be because brokers are being flanked by competitors. Suncorp’s Frost says brokers have realised they may lose customers if they don’t upskill.

“If a home loan customer turns out to be self-employed, many brokers have often been too scared to ask deeper questions – they just move on and do the home loan transaction,” Frost says. “That approach risks a situation where, if a business has a need, they will go and see another broker or go directly to a bank. The broker not only loses the SME lending business, but the home loan customer as well.”

Mohnacheff says today’s entrepreneurs have a more intelligent approach to opening a small business. Thanks to the internet, they are better informed in all aspects of opening a new business. These educated entrepreneurs know what they want, but need someone to do it for them.

Mohnacheff says today’s entrepreneurs have a more intelligent approach to opening a small business. Thanks to the internet, they are better informed in all aspects of opening a new business. These educated entrepreneurs know what they want, but need someone to do it for them.This is good for brokers. “They’re not going to go and beg a bank for the money,” Mohnacheff says. “They want to get on and build a business – they don’t want to sit around or go from one branch to another. They are embracing commercial brokers.”

However, brokers need to be ready for a different type of conversation to remain relevant. When customers already know what they want, brokers need to remain agile or risk being overtaken by the free knowledge that’s available, as well as the emerging direct peerto- peer channels that are being created by fintech disruptors.

Frost sees a big chance for brokers open to the SME market. “Our customers’ expectations of brokers are rapidly increasing as their appetite for advice on multiple product solutions, not just home loans, increases,” she says. “Today’s market provides a huge opportunity for brokers to diversify and offer SME lending to their customers. That represents a huge opportunity for the industry.”

Up to speed

After Suncorp began exploring SME lending through brokers, the bank found that it needed to adapt its approach. Although it had a team of existing BDMs for home lending, it needed a dedicated infrastructure for brokers, who were finding small business lending more complex than home lending.

“While growth was phenomenal, there were lots of challenges around brokers having the right skill base to be able to do these transactions,” Frost says.

The bank has responded by establishing a footprint across the Eastern seaboard, with six dedicated SME business development managers who provide tailored services to assist brokers solely with small business transactions. But the bank has also gone much further. Seeing a need for education, Suncorp committed to helping brokers understand SME lending in a deeper way.

“Our approach has been around education and giving back to the industry, which we achieve through our SME master class program,” Frost explains. “In the past 12 months, we have trained in excess of 900 brokers on how to improve their confidence around things like reading financials, trends and ratios so that they can provide more ‘whole of business’ advice to SME customers.”

Once brokers have attended the program, Frost says they are inducted into a Small Business Alumni program, allowing them to continue to build knowledge and skills in small business lending. “That comes in the form of monthly communications, access to tips and tools, and ongoing education and training,” she says.

Suncorp has been very happy with the early results of its education program. “The outcome is some of the quality transactions we are seeing coming through brokers,” Frost says. “It is a really high-touch model, building strong relationships with brokers and providing the hands-on support as they do the transaction.”

Technology and product

Technology and productTechnology is playing a big role in making the SME market easier for brokers to manage. For example, Suncorp’s investment in technology led it to become the first in the market to offer online lodgement capability through NextGen. “This simplifies and improves the process for our broker partners, especially when submitting a dual small business and home loan product,” Frost says.

But lenders like Suncorp know they have to do more. In 2017, Frost says she will be aiming to make it faster and easier for brokers to do business with the bank.

“In our first year we’ve experienced terrific growth, and we have been listening to what’s important to our broker partners,” she says. “We are looking to improve and deliver on these points, and we have process improvement initiatives underway.”

Liberty Financial’s John Mohnacheff says Liberty’s products “have always been squarely pitched to the SME market” – particularly its “superstar” SMSF commercial product. Going to 75% LVR, he says it is a great vehicle for SMEs, allowing them to own a commercial premise and rent it back from their super fund. “It’s a match made in heaven.”

However, Liberty has been focused on improving its service proposition. “We’ve been putting on more BDMs and have sharpened our turnaround times,” Mohnacheff says. “If brokers put a deal in this morning, nine times out of 10, they’ll get conditional approval tomorrow by lunchtime. We are focusing on speedy turnaround times and giving answers – we are focusing on speed and certainty.”

Capturing the SME

Frost says SME businesses are a priority segment for Suncorp as a whole, and the banking push through brokers is an important part. “We are looking at the market and seeing how we can be sharper and faster and better,” she says. “We are going to be continuing to build and improve our broker proposition as part of that.”

But there are still challenges, like convincing SMEs that brokers can help. “One of the challenges we have collectively as an industry is building consumer confidence in going to a broker for small business and commercial lending,” Frost says. “Only about 8% of consumers now consider going to a broker for those lending needs. While it’s changing, we need to build confidence in consumers going to their broker.”

Mohnacheff believes brokers themselves will be the catalyst. “The most pleasing thing is, we have all the leading aggregators saying, ‘We need to play here’, and that brokers need to be invested in learning about these invaluable classes of lending,” he says. “Because if we don’t, we will become less and less relevant.”

In Mohnacheff’s mind, this shift can’t come too soon. “It’s been too bloody long,” he says. “When Liberty embarked on this journey, we knew it would be a long one. It takes a long time to turn the Titanic. But we’ve persevered and persevered and persevered. Now it’s finally happening, and this is music to my ears.”