MPA hears from you on how an aggregator can best support its brokers.

Being a small business person is about independence: having your success or failure entirely in your hands; building a business rather than waiting on a pay cheque – and for many brokers, these were the reasons they went into the industry.

Yet in 2016 brokers remain dependent upon aggregators. From training to IT support and commission payments, an aggregator can help brokers become brokerages, and brokerages become success stories, or stop a business in its tracks.

MPA’s Brokers on Aggregators survey is about determining how an aggregator can best support brokers. Unlike lenders, aggregators aren’t primarily selling a product, but that doesn’t mean they can’t be held to account. As part of the survey, we asked brokers what they want from their aggregator.

Surveying aggregators is different to a survey of lenders as most brokers will only use a couple of aggregators throughout their careers, whereas they have access to a large panel of lenders. Satisfied brokers are likely to highlight their aggregator’s best points; unsatisfied brokers will highlight where their aggregator has failed.

We’ve used a combination of numerical scores and comments to produce a balanced view of aggregators; if we haven’t found the evidence to substantiate a claim then we haven’t mentioned it.

What do brokers want?

Aggregators need to play many different roles, depending on the state of a broker’s business

Unlike lenders, aggregators can afford to appeal to just a small proportion of brokers – indeed some regard this as a prudent commercial strategy, given that different brokers prefer different fee models and prioritise different services. What our survey shows is there are quite a few areas that no aggregator can afford to overlook.

We asked brokers which services were most important to them, and it’s notable how many services received an average score of between 4 (important) and 5 (very important). By this logic, commission payments, lending panels, compliance support, IT support, communication, BDMs and training are non-negotiables – a very long list. Only additional income streams, marketing support, white label and lead generation can really be regarded as optional.

What these numbers can’t tell us is whether it’s important for aggregators to perform these services competently – such as providing a working IT system and an extensive panel of lenders – or to go beyond that and offer more support than their competitors (more training days, regular BDM visits). Comments suggest that brokers’ preferences are divided between new brokers wanting more support and their more experienced counterparts who feel they don’t need it.

One eChoice broker, who we can ascertain was new to the industry as she attended their academy and praised her BDM, Nick Dalamagas, as well as the aggregator’s support, from compliance to IT and beyond. “They are avant-garde in many parts of the business bringing partners in all the time – e.g ALI Allianz etc – giving my business other sources of revenue. I would recommend them as an aggregator to anyone,” this broker said.

On the other hand, the manager of a multi-award-winning brokerage, who was with Connective, told this survey that “Connective have been involved with our business as much as we need them to be. We have more of a consultative relationship and that works well for us. They do what we pay them to do well and we have a relationship that is based on mutual respect for what both parties bring to the table.”

Do beginner and high-performing brokers really have markedly different needs?

We broke down our ratings for importance by annual volume. We found that compliance support, for example, was most important at the lower end of the volume scale (up to $20m), while the importance of IT and CRM support rises with a broker’s annual volume – most likely because they have a larger customer base and more incoming deals to process. (For more on IT support turn to the final page of this survey.)

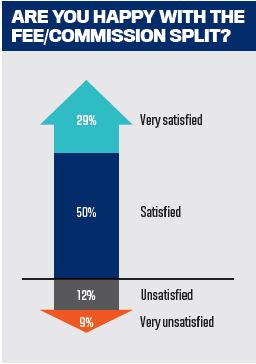

As expected, the need for lead generation, training and marketing support falls with volume, and as our chart shows, preferences when it comes to commission also change with volume. Based on our ‘typical respondent’ profile (see previous page), the overall preference for commission split structures makes sense: our typical respondent has an annual volume of $0–$10m, whereas flat-fee structures have more appeal for high-performing brokers (fi nancially speaking). Additionally, commission-split aggregators such as AFG, FAST and Outsource Financial were heavily represented in this survey. For a more accurate view of commission preferences, have a look at our graph of volumes versus fee models below.

Some needs are universal, including good BDMs, an excellent panel and on-time commission payments. Sadly, the comments suggest that not all aggregators can even offer these, with unmet needs tending to overlap: commission payment problems and poor IT, for example, came up in several comments.

Clearly, aggregators need to be highly confident that they understand their members’ needs – and indeed whether their members are a homogenous group – before envisioning any sort of cost-cutting when it comes to their core services.

Yet in 2016 brokers remain dependent upon aggregators. From training to IT support and commission payments, an aggregator can help brokers become brokerages, and brokerages become success stories, or stop a business in its tracks.

MPA’s Brokers on Aggregators survey is about determining how an aggregator can best support brokers. Unlike lenders, aggregators aren’t primarily selling a product, but that doesn’t mean they can’t be held to account. As part of the survey, we asked brokers what they want from their aggregator.

Surveying aggregators is different to a survey of lenders as most brokers will only use a couple of aggregators throughout their careers, whereas they have access to a large panel of lenders. Satisfied brokers are likely to highlight their aggregator’s best points; unsatisfied brokers will highlight where their aggregator has failed.

We’ve used a combination of numerical scores and comments to produce a balanced view of aggregators; if we haven’t found the evidence to substantiate a claim then we haven’t mentioned it.

What do brokers want?

Aggregators need to play many different roles, depending on the state of a broker’s business

Unlike lenders, aggregators can afford to appeal to just a small proportion of brokers – indeed some regard this as a prudent commercial strategy, given that different brokers prefer different fee models and prioritise different services. What our survey shows is there are quite a few areas that no aggregator can afford to overlook.

We asked brokers which services were most important to them, and it’s notable how many services received an average score of between 4 (important) and 5 (very important). By this logic, commission payments, lending panels, compliance support, IT support, communication, BDMs and training are non-negotiables – a very long list. Only additional income streams, marketing support, white label and lead generation can really be regarded as optional.

What these numbers can’t tell us is whether it’s important for aggregators to perform these services competently – such as providing a working IT system and an extensive panel of lenders – or to go beyond that and offer more support than their competitors (more training days, regular BDM visits). Comments suggest that brokers’ preferences are divided between new brokers wanting more support and their more experienced counterparts who feel they don’t need it.

One eChoice broker, who we can ascertain was new to the industry as she attended their academy and praised her BDM, Nick Dalamagas, as well as the aggregator’s support, from compliance to IT and beyond. “They are avant-garde in many parts of the business bringing partners in all the time – e.g ALI Allianz etc – giving my business other sources of revenue. I would recommend them as an aggregator to anyone,” this broker said.

On the other hand, the manager of a multi-award-winning brokerage, who was with Connective, told this survey that “Connective have been involved with our business as much as we need them to be. We have more of a consultative relationship and that works well for us. They do what we pay them to do well and we have a relationship that is based on mutual respect for what both parties bring to the table.”

Do beginner and high-performing brokers really have markedly different needs?

We broke down our ratings for importance by annual volume. We found that compliance support, for example, was most important at the lower end of the volume scale (up to $20m), while the importance of IT and CRM support rises with a broker’s annual volume – most likely because they have a larger customer base and more incoming deals to process. (For more on IT support turn to the final page of this survey.)

As expected, the need for lead generation, training and marketing support falls with volume, and as our chart shows, preferences when it comes to commission also change with volume. Based on our ‘typical respondent’ profile (see previous page), the overall preference for commission split structures makes sense: our typical respondent has an annual volume of $0–$10m, whereas flat-fee structures have more appeal for high-performing brokers (fi nancially speaking). Additionally, commission-split aggregators such as AFG, FAST and Outsource Financial were heavily represented in this survey. For a more accurate view of commission preferences, have a look at our graph of volumes versus fee models below.

Some needs are universal, including good BDMs, an excellent panel and on-time commission payments. Sadly, the comments suggest that not all aggregators can even offer these, with unmet needs tending to overlap: commission payment problems and poor IT, for example, came up in several comments.

Clearly, aggregators need to be highly confident that they understand their members’ needs – and indeed whether their members are a homogenous group – before envisioning any sort of cost-cutting when it comes to their core services.