Australia’s booming agribusiness sector is driving some of the nation’s top brokers, with significant opportunities for new entrants

It goes deeper than that, however: from the archetypical ‘conversation around the BBQ’ to the BDM networks of the banks and house price data, it all revolves around the capital cities. CoreLogic’s monthly Home Value Index, for instance, has figures for each capital city, but only a single ‘rest of state’ option for the rest of the nation. And what was the ‘rest of state’ house price growth year-on-year to May 2016? Just 1.9%.

In a sense this data is failing: failing to explain why a handful of rural brokers are winning awards and gaining national recognition, and failing to alert other brokers to the opportunities out there. While there have been specific rural broker awards for several years, rural brokerages have begun to pick up generalist top brokerage and even top broker awards at recent ceremonies held by the MFAA and others.

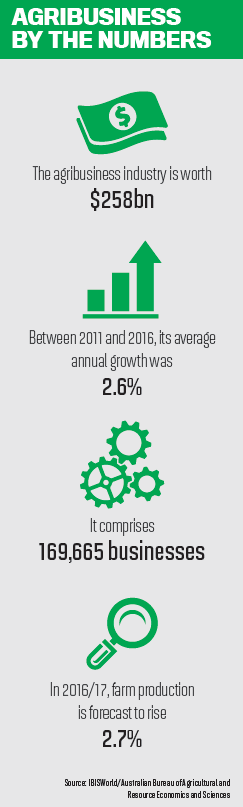

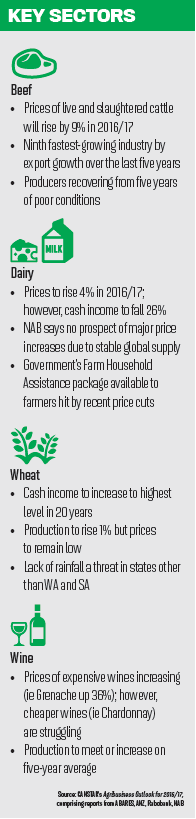

What’s driving these brokerages is not a new industry but one in rapid evolution. That industry – or rather group of industries - is agribusiness. In 2015 Deloitte nominated agribusiness as one of the five industry sectors that could drive growth in the post-mining era; nine of Australia’s top 20 growth areas by exports are in agribusiness, including rice growing, beef farming and dairy processing.

Whatever the trajectory of the market, agriculture is an industry with an integral need for finance and, increasingly, brokers. Here, leading brokers, lenders and aggregators tell MPA what’s happening to the industry, and why now is the time for brokers to make themselves indispensable.

Whatever the trajectory of the market, agriculture is an industry with an integral need for finance and, increasingly, brokers. Here, leading brokers, lenders and aggregators tell MPA what’s happening to the industry, and why now is the time for brokers to make themselves indispensable.Although these brokers have years of experience in agribusiness banking, their brokerages are relatively young. Dunartin Finance was established in 2007 and Robinson Sewell Partners in 2010. That’s no coincidence; agricultural businesses are struggling to get finance from banks at just the moment they need capital to expand and capture booming opportunities in Asia.

“We’re seeing that agribusiness is going through a cyclical boom at the moment, both from a domestic point of view and from a global commodities perspective,” says Robinson. Yet at the same time “banking is getting more complicated and bank policy is getting fine-tuned on the margins. That means it’s a lot more difficult for farm managers seeking to borrow a lot more money to negotiate with their banks”. That’s not to say banks aren’t interested in this space; quite the opposite. Cosi De Angelis, general manager of commercial origination at ANZ, tells MPA why he’s interested in agribusiness. “From a sector perspective, the opportunities for Australian agriculture are evident as we can take advantage of our proximity to Asia.” And ANZ sees its role as alerting agribusiness to those opportunities. “ANZ’s insights on Australian agriculture and trade with Asia help our broker partners and customers see agribusiness as part of the broader economic picture and help identify their key strengths and opportunities, even at a single business level,” De Angelis says.

As these businesses grow, the time they can devote to these increasingly complicated negotiations with the banks is decreasing, says Robinson. “We’re seeing a lot more sophistication with business owners outsourcing their financial needs to third parties like ourselves. It’s very much an exciting phase we’re going through.”

“We’re seeing a lot more sophistication with business owners outsourcing their financial needs to third parties like ourselves. It’s very much an exciting phase we’re going through” Ian Robinson, Robinson Sewell Partners

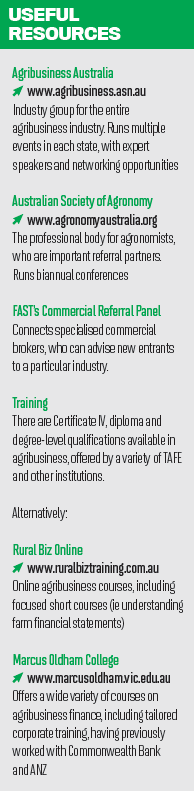

At the macro level, Brendan Wright, CEO of FAST, believes the growth of the third party channel is now being recognised in agribusiness. “As brokers’ market share and presence grows, they are increasingly being seen as experts in this space,” he says.

At the macro level, Brendan Wright, CEO of FAST, believes the growth of the third party channel is now being recognised in agribusiness. “As brokers’ market share and presence grows, they are increasingly being seen as experts in this space,” he says.Clients and lenders in the agribusiness space

Although the mainstream media tends to focus on huge agricultural operations, such as the politicised S. Kidman & Co sale, both Duncan and Robinson tell us the vast majority of the businesses they deal with are family-owned; Robinson believes that to be around 95% of farms. These businesses can nevertheless be quite large, says Robinson, and worth between $3m and $50m. “The average loan that we do is approaching $4m,” he says, “but there’s quite a number of cases where we go a lot larger than that, up to $50m in borrowing on a per-transaction basis.”

The lenders in the agribusiness space include all of the majors, with the nonmajors becoming a growing presence, including Suncorp, St.George, Rural Bank (a division of Adelaide and Bendigo Bank) and Bank of Queensland. Rabobank is a dedicated agribusiness bank; however, it doesn’t usually work with brokers. Beyond that, options are scarce, observes Duncan. “I don’t think solutions for funding have really diversified deep enough,” he says. In response, he’s recently begun working with a specialised non-bank lender based in Sydney.

Bankers have long been working in the agribusiness space, and all banks have divisions dedicated to agribusiness, explains Robinson. “Most of the banks have broken off agribusiness as a separate almost quasiindependent part of the banks, with their own credit policy, underwriting standards and dedicated resources in terms of the bank managers and various internal support key stakeholders. So it’s very much a key strategic part of the banks’ overall lending.”

Unusually, bankers in this space tend to stick around, with many having more than 15 years’ experience, according to Duncan.

De Angelis says ANZ’s agribusiness support team includes specialists in business risk, financial planners, interest rate management advisers and asset finance managers. “Our expertise extends throughout the supply chain, including processors, suppliers, wholesale and retail.” He explains that “we provide working capital solutions, core debt, transactional, equipment finance, interest rate risk management, business planning and wealth creation”.

“[Agribusinesses] are looking for stable funding solutions going forward; someone to manage it for them, not just now but timelining it into the future”

John Duncan, Dunartin Finance

The many faces of agribusiness finance

In agribusiness, a broker’s biggest role is providing working capital and debt consolidation. According to Duncan, debt is in the top five expense items for 80% of his clients requiring less than $10m in funding. Managing debt is an ongoing requirement for these businesses. “They’re looking for stable funding solutions going forward; someone to manage it for them, not just now but timelining it into the future,” he says.

Working capital is vital because of the challenge volatility poses for agribusiness, as Christine Linden, general manager of regional business banking at ANZ, told CANSTAR. “We see the biggest challenge as managing volatility in the form of commodity prices, seasonality and input costs,” Linden said.

As Robinson puts it, “getting the client is just the start of the journey – the client’s business is never static; it’s always evolving with the variabilities of agribusiness and where the client is in their business cycle. In addition to that, the banking environment is continually shifting as well”.

Secondary funding needs include equipment finance, trade finance and expansion finance. The latter two play an important role in making farms more profitable, notes Duncan – “improving farming practice or better returns or yield. So it might be a higher crop yield from increased fertiliser application; it might be new technologies which need to be purchased which give the client better control over the end product”.

ANZ’s De Angelis is seeing a similar picture. “Many farmers are considering expansion, not just land acquisition but land development (eg irrigation) and equipment purchases,” he says.

“Given there are varied levels of business acumen across the industry, there is opportunity for brokers to assist clients prepare for finance and credit discussions.”

Finance also plays an integral role in farm expansion. “Probably close to 100% of expansions in farming is financed by debt products,” says Robinson. “They actually use our services for expansion capital. Primary production is very capital-intensive as you’d imagine, and roughly 80% of all funding requirements is underpinned by the acquisition of land, which is the core asset, and the residual 20% would be the working capital.”

You may have noticed a focus on ‘ongoing’ and ‘evolving’ by Duncan and Robinson. Broking in agribusiness is by necessity a partnership, not a transactional relationship. Consolidating debt and financing acquisitions only works if a broker is brought in at the planning stage, Duncan argues. “It needs to be long-term; we have a very large market gardener and we had difficulty providing the services we felt we could give at the level we wanted to provide them, because they were only bringing us in on a need-by-need basis, and at the last minute. We sat down with them and said, ‘We want to be part of your business and your planning’.”

Fee-for-service plays an important role in Duncan’s business for the same reason, although banks do pay upfront and trailing commissions in the agribusiness space.

Building a reputation in agribusiness finance

All these types of finance could of course be obtained directly through a bank. Even if a broker makes financial sense, the third-party channel still needs to build trust within the agribusiness community.

While some operations are increasingly corporatised, brokers need to be attuned to local culture, says Robinson. “In the bush, culturally, a good reputation and credibility is everything, so having that embedded reputation within the marketplace is paramount to be able to engage on an ongoing basis within the market.”

“As brokers’ market share and presence grows, they are increasingly being seen as experts in this space” Brendan Wright, FAST

That means face-to-face contact and going to clients – hence the time spent driving – and “the experience and pedigree who’s very sympathetic and has a strong understanding of agribusiness. It’s obviously a very specialised area within commercial lending and so a very strong track record [helps],” Robinson says. Consequently, Robinson Sewell Partners’ website is packed with case studies, including video content, in addition to information on their brokers’ career credentials.

That means face-to-face contact and going to clients – hence the time spent driving – and “the experience and pedigree who’s very sympathetic and has a strong understanding of agribusiness. It’s obviously a very specialised area within commercial lending and so a very strong track record [helps],” Robinson says. Consequently, Robinson Sewell Partners’ website is packed with case studies, including video content, in addition to information on their brokers’ career credentials.It’s debatable exactly how essential experience is for new entrants to agribusiness finance. For Duncan, “today’s farmer is looking for someone that can deliver on the expertise they say they have: there’s credit advice and broking; there’s agronomy, which is advice for spraying of crops and growing; and there’s consultancy and small business convenances coming in, so you don’t have to have necessarily a strong background in farming, but it helps”.

ANZ’s De Angelis agrees that brokers should be aware of the issues. “Agribusiness customers want to be well connected with a broker and lender with good industry knowledge and insights and across the major issues and challenges impacting their business,” he says. Specific knowledge of these issues isn’t essential, however. “Brokers don’t need to know them inside out as the ANZ team are ready to work right alongside the broker to finalise the right customer solution.”

At FAST, CEO Wright finds that brokers focusing on agribusiness aren’t necessarily from rural areas, although experience is nevertheless important. “They tend to be well established in the industry and have been operating in the trade in one way or another for some time ... agribusiness brokers generally have a strong background in the specialist industries they fund, with a strong credit background. Often they come from a background working with an agribusiness lender or a specialist agribusiness consulting firm.”

Training is also available, both from aggregators and organisations within agribusiness. “It would certainly help if you did a short course in agriculture,” says Duncan. “There are certainly a lot of those available to young up-and-coming brokers if they were keen to better understand the people they want to provide services to.”

What is undoubtedly vital when entering the agribusiness space is contacts. Duncan advises brokers to “pick a niche market and get to know it, and perhaps enter into that through a consultant or adviser in that area, very similar to what they’d be doing now by chasing a real estate agent”.

In particular, get to know an agronomist, urges Duncan, as “that’ll bring trust and endorsement into the industry if that agronomist is prepared to endorse you”.

Brokers must be prepared to work with others, observes De Angelis. “The broker (and subsequent banker) should be an extension of their professional advisory team, including their accountant, solicitor, agronomist and farm consultants. The broker needs to be reliable, with good communication and customer service skills, along with being consistent and transparent.”

“The broker (and subsequent banker) should be an extension of their professional advisory team” Cosi De Angelis, ANZ

More than just farming

More than just farming Agribusiness is a niche area, and pretending otherwise ignores one of the reasons why brokers are doing so well in this space. At its core, however, are the key relationship-building and commercial lending skills that brokers are already using in other industries, and demonstrating these skills can negate the need for specialised agribusiness experience in the eyes of clients.

There’s another reason for building a reputation in a rural area, Duncan concludes. “For some people, regional is just farming. It’s a lot more than that. There’s your rent roll and real estate agency businesses, there’s your larger intermediary accounting firms that are usually positioned where your business banking centres are, and there’s small banking and car dealerships and pharmacies, doctors and hospitals.” “It’s a good, fun space to operate in; the entry barriers are in my view quite low. You just need to talk to people who are in the agricultural industry; that’ll take you a long way to achieving your goals.”