Low-doc clients are being offered a bigger range of products, giving brokers more choice and more ways to engage these clients

Everyone talks about the current instability of the mortgage space – the aggressive regulators, rate hikes and bank scandals. In doing so, they overlook one sector of the market which is stable, and growing steadily.

That’s the low-doc sector, often referred to as alt-doc space. Here, relative regulatory stability has allowed the non-banks to introduce new products, particularly in the prime and near-prime space. MPA has talked to the key lenders in this area to understand the new options available.

To understand the sector you need to understand ASIC Report 410, published in 2014, from which low-doc lenders emerged relatively well. ASIC deputy chairman Peter Kell commented that “our review shows lenders have lifted their game since the introduction of responsible lending laws.” The report, recalls La Trobe Financial vice president Cory Bannister, put “many minds at rest that the operators in this space have appropriately prudent policies in place around the assessment of low-doc loan applications”.

In some cases, developments in regulation since then have made brokers’ and lenders’ jobs simpler. Australian First Mortgage boss David White has been seeing “simple changes, like not having to provide a declaration of income plus two other forms to support the declaration, being bank statements, accountant’s letter and BAS. Now only one of these is required and not two.”

That’s not to say all restrictions have been loosened. Murray Cowan, managing director of Better Mortgage Management, has seen a tightening of serviceability requirements regarding an applicant’s total expenses. Furthermore, the low-doc sector has not escaped the furore over interest-only lending, he explains. “It [is] more difficult to obtain an interest-only loan without having a reasonable explanation/acceptable loan purpose.”

Prime loans in the low-doc space

The new generation of low-doc products has been guided by lenders’ target clients. As RESIMAC Financial Services’ Daniel Carde puts it: “Alt doc lending by its very nature is for the self-employed market.” Due to their business requirements, self-employed borrowers are more likely to borrow money on a regular basis, to finance equipment, vehicles, business expansion and the purchase of business premises.

Self-employed borrowers may lack payslips, but lenders increasingly refer to ‘prime alt-doc borrowers’ – those with limited documentation but a clear credit history. RESIMAC has been looking to expand their presence in this space by removing LMI and increasing the maximum loan amount on their Prime Alt Doc loan. This article’s product guide – which you can find at the end of the article – features prime alt doc products from almost all lenders: Pepper Prime Alt Doc, Bluestone’s Crystal Blue and Homeloans Ltd’s new near-prime construction loan, to name just a few.

With complicated tax arrangements, and given the risks associated with starting new businesses, many self-employed borrowers don’t have clear credit histories, which is why the products for both low-doc and non-conforming clients continue to be offered by lenders. Indeed, some have expanded their offering in this space. Early in 2016, Homeloans introduced their Envizion product range, which is for “business owners looking for a loan to be considered on its merits rather than a credit score”, according to Ray Hair, Homeloans’ general manager of sales.

As lenders introduce increasingly specialised new products dependent on credit histories, brokers do have to take care they don’t treat the self-employed as a homogenous group, nor assume that low-doc, alt-doc and self-employed borrowers are easily interchangeable terms. Pepper’s Mario Rehayem advises brokers to “be careful marketing directly for alt-doc clients as this is targeting a specific assessment criteria/product feature as opposed to targeting the self-employed market as a whole.”

LOW DOC OR ALT DOC?

In this article you’ll find lenders refer to both low-doc and alt-doc loans, and indeed some lenders, such as Pepper, argue they only use the term alt doc, because “both the lender and the borrower have an obligation to ensure they carry out the same level of income/capacity to repay assessment as they would for

a full-doc loan.”

At MPA, we use the term low doc. We do this for two reasons: brokers’ familiarity with the term and because ASIC – and thus consumers and the mainstream press – use it (ie Report 410 ‘Review of low-doc lending’). Alt doc may be a more useful term, however, in that it reflects the actual process of getting a loan.

We’ll keep our eyes and ears open to what brokers and regulators say about low-doc and alt-doc loans in the year ahead and, if necessary, change our wording.

BROKER VIEW: KERRY KALENDRA, OPTIM FINANCIAL

As director of Optim Financial, Kerry Kalendra has been dealing with low-doc clients for over 10 years. He first encountered these clients through working with accounting firms and these referral relationships continue to make a difference, although Kalendra’s client base is still broad.

Many clients don’t initially realise they are low-doc clients, Kalendra notes, and so this discussion must

be carefully structured. To reduce turnaround times, he insists clients provide all documentation – covering all the lenders’ verification requirements – before starting on their file. He also recommends using lenders that can switch loans during the application process, rather than going back to square one.

Rather than avoiding low-doc clients, Kalendra believes that brokers should see them as “just another client”.

Marketing to low-doc clients

A lot of the rhetoric surrounding low-doc lending talks about missed opportunities for brokers who turn down low-doc clients. There’s some truth in this. Many brokers are approached by low-doc clients after being rejected by banks. Yet, as in any area of broking, most brokers will want to take proactive action to improve their lead flow. Furthermore, the right marketing can not only bring more clients through the door, but improve the quality of leads, our panel of lenders explained.

“There are two levels of marketing that brokers should consider with respect to low-doc borrowers,” observes Homeloans’ Ray Hair. The first level is external marketing, which should be “targeted and relevant”. Hair suggests looking at prospective referrers and actively participating in business owners’ and self-employed networking groups, with the objective being to promote the broker’s experience and expertise in this field.

The second level of marketing involves understanding the low-doc clients currently on your database. By looking for ways to move these clients onto potentially cheaper full-doc solutions, explains Hair, “the broker can obtain repeat business and perhaps identify other opportunities such as plant and equipment, debt consolidation, etc.”

The low-doc space is one area where marketing through advertising still makes an impact, lenders told us. “For brokers, targeted marketing within a trade magazine or other publication is a great way to reach the right low-doc audience,” notes BMM’s Cowan. Brokers may want to target tax and accounting trade publications in order to reach referral partners, according to AFM boss White, whilst letterbox drops and an operating website continue to provide leads. Additionally, Bluestone points to industry bodies as a good place for brokers to market their services.

If you can afford it, a broad-based marketing strategy will be most effective, insists Liberty Financial’s national sales manager John Monacheff. “The key to any successful marketing campaign is to reach out to the customer in as many different ways as possible. Some low-doc borrowers will respond to local area campaigns, others to more targeted marketing, and then, finally, some will require a direct touch… The key is not to put all of your eggs in one basket.”

Pay particular attention to the language you use in your marketing. “Borrowers quite often feel ostracised when it comes to borrowing money,” says RESIMAC’s Carde. “Self-employed borrowers need to be made aware that there are other lending options available.” Also note Pepper’s abovementioned warning regarding the use of the name ‘alt doc’.

Referral partners naturally play a huge role in this type of lending. “Any referral partner that has exposure to self-employed clients is a valuable referral partner,” observes Pepper’s Rehayem. “Experience has shown that accountants are one of the best sources of alt-doc referrals.” Bluestone’s D’Vaz points to accountants, as well as solicitors and financial planners, and recommends brokers maintain at least two to three good referral relationships, whilst asserting that “the best referrers in this segment are satisfied customers themselves.”

Both La Trobe and Homeloans commented on the ability for accountants and financial planners to provide better qualified leads. However, Homeloans boss Hair warns that “referrers without a credit licence need to be aware of the importance of recommending a broker, not a product or specific solution. A referrer who understands the borrower’s financial, business and/or investment objectives can be expected to deliver better quality leads, but unless the referrer holds an ACL or is an authorised representative of a licensee, they cannot provide credit assistance or advice.”

BROKER VIEW: LARRY STRANGE, FINANCE COMPANY AUSTRALIA

Larry Strange encounters a large number of self-employed clients because he specialises in the commercial lending space, and finds himself arranging low-doc loans for business clients, backed by residential security.

When it comes to applications, Strange observes that lender requirements have changed hugely since the GFC. “Those days are well and truly gone.” He finds that accountants’ declarations are the most popular method of verification, providing the client has a good relationship with their accountant. He advises brokers to take particular care to verify that the income the client is declaring is their actual current income, not projected income.

Strange sees low-doc loans as “just another avenue of lending, which makes sense for a self-employed person if they don’t have the required documentation.”

Adapting your application process

One major concern for brokers looking at non-vanilla clients is whether it’ll require changes to their application process, especially given brokerages are being pushed to document and standardise their processes to aid efficiency. It’s therefore encouraging that low-doc, alt-doc and full-doc application procedures are becoming increasingly similar.

Indeed, several lenders told us the application processes for their low-doc and full-doc loans were almost identical. “There shouldn’t be any need for a broker to change their assessment process for low-doc loans,” says La Trobe’s Bannister. “The only difference between our Lite-Doc loans and our Full-Doc loans is income verification.” This happens very early in the process, so the rest of the process and subsequent turnaround times remain similar to full-doc loans.

The converging processes are a result of the lending environment, explains Pepper boss Rehayem. “Both the lender and the borrower have an obligation to ensure they carry out the ‘same’ level of income/capacity to repay assessment as they would for a full-doc loan... In today’s environment, we do not have policies that are of lower quality or standard when it comes to assessing a borrower’s income.”

Reducing back-and-forth between broker and lender is paramount in reducing turnaround times, argues Liberty’s Monacheff. Whilst understanding the client and their goals might seem obvious, “by taking the time to understand what the client wants and how Liberty can tailor a solution, brokers can massively reduce the turnaround time.”

A well-executed screening of the client can also help brokers be seen to add value, notes Royden D’Vaz, director of sales, marketing and distribution at Bluestone. “It is often the detail that provides the opportunity to match the client with a lower interest rate or more feature-rich product, or in some cases finding a solution for them.”

Thorough reviewing of the client’s documentation is obviously important for a number of reasons, but it can also aid turnaround times. RESIMAC’s Carde outlines an example when confirming income. “For an alt doc, it is no different, but instead of looking at a payslip you are looking at an accountant’s letter, BAS or bank statements. If any doubt or confusion exists, the broker should seek permission from the borrower to speak with their accountant directly to gain a better understanding of the borrower’s business operations and financial performance. Once completed, those conversations should be relayed to the lender in the form of file notes.”

Homeloans boss Hair put forward a number of additional tips, including checking the borrower’s ABN and GST registration on the ABN register, being aware that trading statements can involve a longer turnaround time due to complexity, and taking the time to make sure an accountant’s declaration is completed correctly, if necessary for an application.

Combating fraud

Fraud remains a serious concern throughout all areas of lending, and has been particularly associated with the low-doc space. However, low- and alt-doc lenders are determined to challenge this assertion, and put forward a number of reasons. “It is easy to pigeonhole the low-doc segment as being more prone to fraud,” comments Bluestone’s D’Vaz. “But in reality – and from our experience – this is not the case.”

Pepper’s Rehayem believes traditional assumptions should be reversed. “In my opinion, the full-doc loans process is more likely to be targeted by fraudsters. The assessment process tends to be more commoditised as opposed to the alt-doc process.” Lenders pointed out how they go to extra lengths compared to a full-doc process. La Trobe, for example, seeks assistance from independent accountants to confirm borrowers’ stated incomes. “We find that by involving another independent professional the incidence of fraud is greatly reduced,” Bannister explains.

Improvements in software are also helping lenders combat fraud in the low-doc space. “Technology these days allows brokers to undertake more checks than ever before to verify the information being provided,” notes RESIMAC’s Carde. “From simple Google searches, to ABN searches, and even full ASIC company extracts where possible.”

Nevertheless, brokers do have a role to play, as in full-doc lending. La Trobe’s Bannister urges brokers to “apply the reasonableness test” on all occasions, “such as considering the stated income against the industry the applicant operates in and the length of time in the role.” AFM boss White also notes the importance of a “common sense approach” in addition to the two forms of verification AFM require, whilst Liberty’s Monacheff explains that brokers making reasonable enquiries “can go a long way to circumventing activity of any fraudsters.”

Beyond common sense, the lenders raised a number of concerns and corresponding solutions. “Brokers need to be very careful to follow the strict guidelines attached to their own compliance policy,” warns Pepper boss Rehayem. “Brokers should never rely solely on a lender’s income verification.” Brokers should carefully record all discussions throughout the application process, taking care to document why the application was offered an alt-doc rather than full-doc loan.

Furthermore, Murray from Better Mortgage Management advises brokers to make extra copies of trading statements for their own records. Additionally, brokers should “be diligent to make sure it is a real business and the loan purpose is correctly disclosed. BMM conduct a phone interview with the applicant as part of the process. Where applicable, we also may contact the accountant as a part of the process.”

Why low-doc clients matter

Whilst the low-doc and alt-doc space is relatively stable, this shouldn’t distract brokers from the innovation occurring in this area. Just as brokers have traditionally been reminded by lenders to not miss out on opportunities by turning away clients, brokers should be aware that new products, particularly in the prime alt-doc space, allow them to add more value to these clients than before.

That’s just one of a vast array of reasons for brokers to deal with low-doc and alt-doc clients, according to lenders. At the marketing stage, brokers can gain a reputation as an expert in self-employed and accountant circles, claims BMM. Furthermore, the self-employed space is large and continuing to grow, notes La Trobe, as people start online businesses outside their normal day job.

Integrating low-doc products into your offering is part of a diversification strategy, according to AFM, because it is not limited to residential loans – the commercial low-doc sector is also expanding. Both RESIMAC and Liberty urge brokers to consider associated opportunities in asset and equipment finance to self-employed clients, particularly for vehicles, on which many self-employed people are dependent.

Finally, Bluestone, Pepper and Homeloans point to benefits for brokers over the long term. Clients may not remain alt doc for life, observes Pepper, but will look to that same broker in the future, whilst Bluestone observes that low-doc clients are particularly loyal referrers. Homeloans boss Hair concludes by returning to the theme of missed opportunity. “It is not just the lost revenue of the one customer you do not assist who does get assistance elsewhere. It is the lifetime value of that client directly, and the potential referrals that he or she could have delivered, that is missed.”

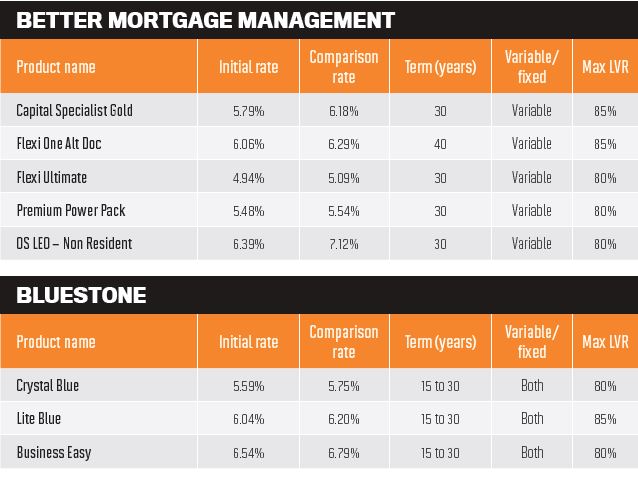

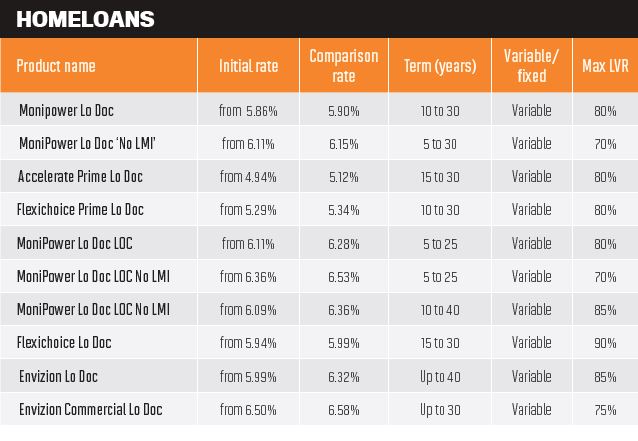

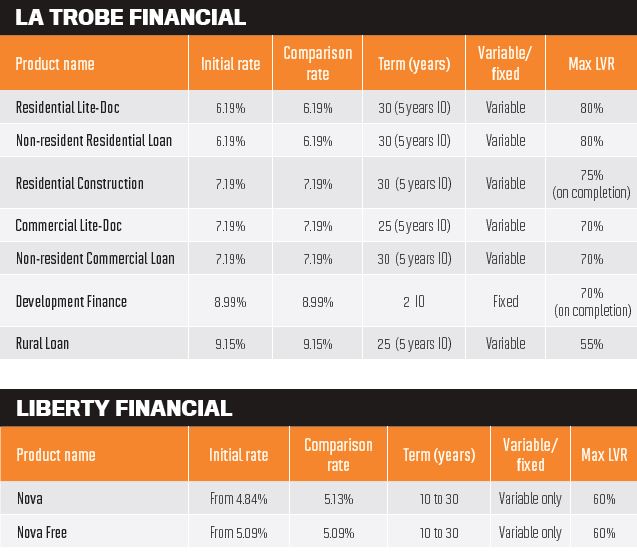

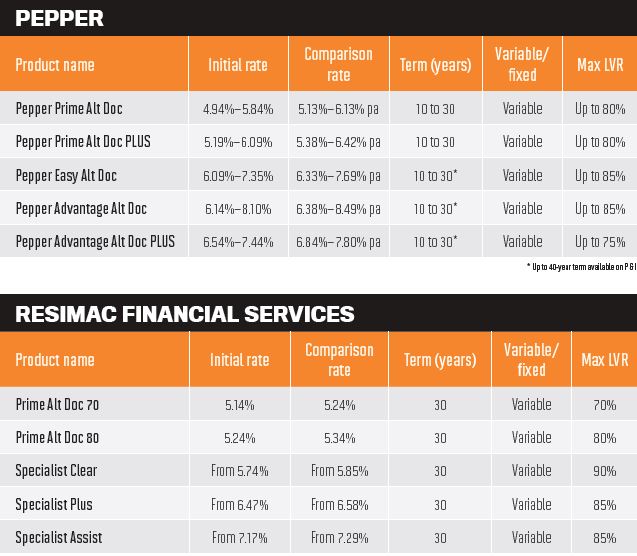

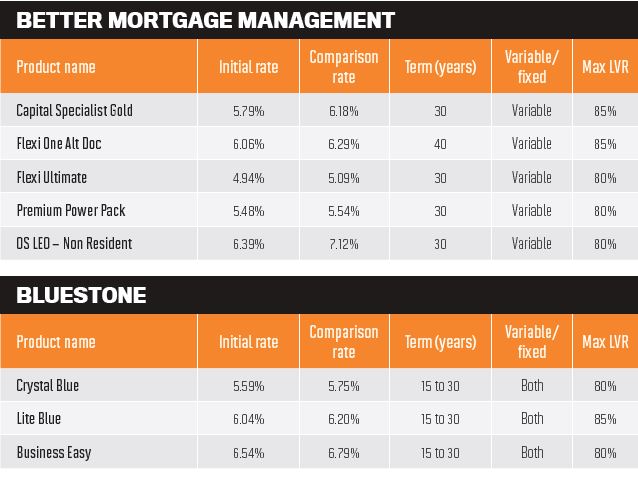

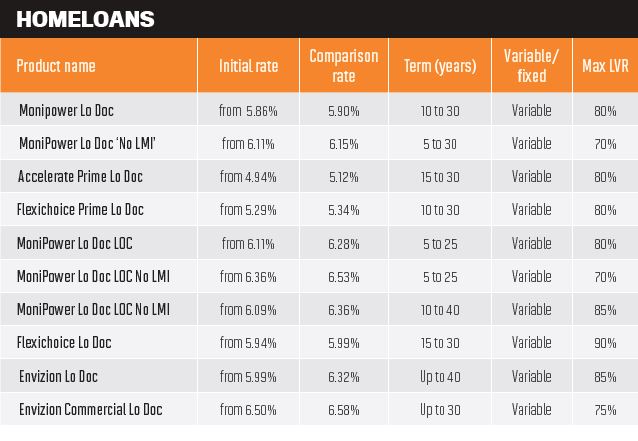

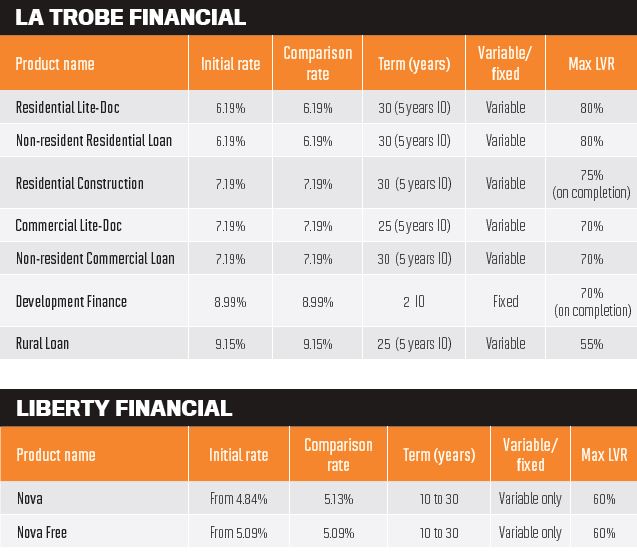

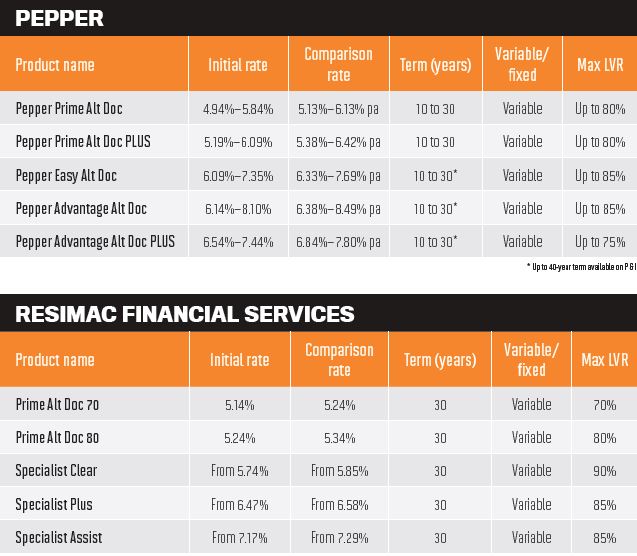

LOW- AND ALT-DOC PRODUCT GUIDE

We asked all the lenders featured in this article to provide details of their low- and alt-doc lending products. Please note that whilst these details are correct to our knowledge at the time of writing (April) you should always check directly with the lender.

LENDER DOCUMENTATION REQUIREMENTS

LENDER DOCUMENTATION REQUIREMENTS

PART 1

Please note this list is an introduction only – it is not exhaustive. Conversely, lenders could be more flexible in certain situations, meaning you should always check with the lender directly.

Australian First Mortgage

Can lend up to $2m with

1. AFM low-doc declaration

2. Accountant’s confirmation

Better Mortgage Management Verification required using one or two of the following:

1. Accountant’s letter

2. BAS statements

3. Trading statements

Bluestone

Bluestone

Will accept

1. Business bank trading statements

2. Personal bank statements

3. BAS statements

4. Accountant’s letter

Homeloans

As a minimum will require one of the following:

1. An accountant’s declaration

2. Six months of business trading statements

3. Two most recent BAS statements

La Trobe Financial

At a minimum you need:

1. Borrower repayment declaration

2. Accountant’s certification OR BAS statements OR business trading statements

LENDER DOCUMENTATION REQUIREMENTS

LENDER DOCUMENTATION REQUIREMENTS

PART 2

Please note this list is an introduction only – it is not exhaustive. Conversely, lenders could be more flexible in certain situations, meaning you should always check with the lender directly.

Liberty Financial

For a self-employed loan secured

by residential property:

1. Six month’s business or personal bank statements

2. Two quarters worth of BAS statements OR accountant’s declaration

3. For a loan secured by commercial property

4. Income/financial position statement completed by the applicant’s independent accountant

Pepper

You’ll need the following:

1. Income declaration

2. Two of the following documents:

a. Last two quarters’ BAS statements

b. Last six months of business trading statements

b. Last six months of business trading statements

c. Accountant’s declaration form

RESIMAC Financial Services You’ll need the following:

1. Income declaration

2. One of the following documents

a. Accountant’s letter

b. Six months of BAS

c. Three months of business bank statements.

That’s the low-doc sector, often referred to as alt-doc space. Here, relative regulatory stability has allowed the non-banks to introduce new products, particularly in the prime and near-prime space. MPA has talked to the key lenders in this area to understand the new options available.

To understand the sector you need to understand ASIC Report 410, published in 2014, from which low-doc lenders emerged relatively well. ASIC deputy chairman Peter Kell commented that “our review shows lenders have lifted their game since the introduction of responsible lending laws.” The report, recalls La Trobe Financial vice president Cory Bannister, put “many minds at rest that the operators in this space have appropriately prudent policies in place around the assessment of low-doc loan applications”.

In some cases, developments in regulation since then have made brokers’ and lenders’ jobs simpler. Australian First Mortgage boss David White has been seeing “simple changes, like not having to provide a declaration of income plus two other forms to support the declaration, being bank statements, accountant’s letter and BAS. Now only one of these is required and not two.”

That’s not to say all restrictions have been loosened. Murray Cowan, managing director of Better Mortgage Management, has seen a tightening of serviceability requirements regarding an applicant’s total expenses. Furthermore, the low-doc sector has not escaped the furore over interest-only lending, he explains. “It [is] more difficult to obtain an interest-only loan without having a reasonable explanation/acceptable loan purpose.”

Prime loans in the low-doc space

The new generation of low-doc products has been guided by lenders’ target clients. As RESIMAC Financial Services’ Daniel Carde puts it: “Alt doc lending by its very nature is for the self-employed market.” Due to their business requirements, self-employed borrowers are more likely to borrow money on a regular basis, to finance equipment, vehicles, business expansion and the purchase of business premises.

Self-employed borrowers may lack payslips, but lenders increasingly refer to ‘prime alt-doc borrowers’ – those with limited documentation but a clear credit history. RESIMAC has been looking to expand their presence in this space by removing LMI and increasing the maximum loan amount on their Prime Alt Doc loan. This article’s product guide – which you can find at the end of the article – features prime alt doc products from almost all lenders: Pepper Prime Alt Doc, Bluestone’s Crystal Blue and Homeloans Ltd’s new near-prime construction loan, to name just a few.

With complicated tax arrangements, and given the risks associated with starting new businesses, many self-employed borrowers don’t have clear credit histories, which is why the products for both low-doc and non-conforming clients continue to be offered by lenders. Indeed, some have expanded their offering in this space. Early in 2016, Homeloans introduced their Envizion product range, which is for “business owners looking for a loan to be considered on its merits rather than a credit score”, according to Ray Hair, Homeloans’ general manager of sales.

As lenders introduce increasingly specialised new products dependent on credit histories, brokers do have to take care they don’t treat the self-employed as a homogenous group, nor assume that low-doc, alt-doc and self-employed borrowers are easily interchangeable terms. Pepper’s Mario Rehayem advises brokers to “be careful marketing directly for alt-doc clients as this is targeting a specific assessment criteria/product feature as opposed to targeting the self-employed market as a whole.”

LOW DOC OR ALT DOC?

In this article you’ll find lenders refer to both low-doc and alt-doc loans, and indeed some lenders, such as Pepper, argue they only use the term alt doc, because “both the lender and the borrower have an obligation to ensure they carry out the same level of income/capacity to repay assessment as they would for

a full-doc loan.”

At MPA, we use the term low doc. We do this for two reasons: brokers’ familiarity with the term and because ASIC – and thus consumers and the mainstream press – use it (ie Report 410 ‘Review of low-doc lending’). Alt doc may be a more useful term, however, in that it reflects the actual process of getting a loan.

We’ll keep our eyes and ears open to what brokers and regulators say about low-doc and alt-doc loans in the year ahead and, if necessary, change our wording.

BROKER VIEW: KERRY KALENDRA, OPTIM FINANCIAL

As director of Optim Financial, Kerry Kalendra has been dealing with low-doc clients for over 10 years. He first encountered these clients through working with accounting firms and these referral relationships continue to make a difference, although Kalendra’s client base is still broad.

Many clients don’t initially realise they are low-doc clients, Kalendra notes, and so this discussion must

be carefully structured. To reduce turnaround times, he insists clients provide all documentation – covering all the lenders’ verification requirements – before starting on their file. He also recommends using lenders that can switch loans during the application process, rather than going back to square one.

Rather than avoiding low-doc clients, Kalendra believes that brokers should see them as “just another client”.

Marketing to low-doc clients

A lot of the rhetoric surrounding low-doc lending talks about missed opportunities for brokers who turn down low-doc clients. There’s some truth in this. Many brokers are approached by low-doc clients after being rejected by banks. Yet, as in any area of broking, most brokers will want to take proactive action to improve their lead flow. Furthermore, the right marketing can not only bring more clients through the door, but improve the quality of leads, our panel of lenders explained.

“There are two levels of marketing that brokers should consider with respect to low-doc borrowers,” observes Homeloans’ Ray Hair. The first level is external marketing, which should be “targeted and relevant”. Hair suggests looking at prospective referrers and actively participating in business owners’ and self-employed networking groups, with the objective being to promote the broker’s experience and expertise in this field.

The second level of marketing involves understanding the low-doc clients currently on your database. By looking for ways to move these clients onto potentially cheaper full-doc solutions, explains Hair, “the broker can obtain repeat business and perhaps identify other opportunities such as plant and equipment, debt consolidation, etc.”

The low-doc space is one area where marketing through advertising still makes an impact, lenders told us. “For brokers, targeted marketing within a trade magazine or other publication is a great way to reach the right low-doc audience,” notes BMM’s Cowan. Brokers may want to target tax and accounting trade publications in order to reach referral partners, according to AFM boss White, whilst letterbox drops and an operating website continue to provide leads. Additionally, Bluestone points to industry bodies as a good place for brokers to market their services.

If you can afford it, a broad-based marketing strategy will be most effective, insists Liberty Financial’s national sales manager John Monacheff. “The key to any successful marketing campaign is to reach out to the customer in as many different ways as possible. Some low-doc borrowers will respond to local area campaigns, others to more targeted marketing, and then, finally, some will require a direct touch… The key is not to put all of your eggs in one basket.”

Pay particular attention to the language you use in your marketing. “Borrowers quite often feel ostracised when it comes to borrowing money,” says RESIMAC’s Carde. “Self-employed borrowers need to be made aware that there are other lending options available.” Also note Pepper’s abovementioned warning regarding the use of the name ‘alt doc’.

Referral partners naturally play a huge role in this type of lending. “Any referral partner that has exposure to self-employed clients is a valuable referral partner,” observes Pepper’s Rehayem. “Experience has shown that accountants are one of the best sources of alt-doc referrals.” Bluestone’s D’Vaz points to accountants, as well as solicitors and financial planners, and recommends brokers maintain at least two to three good referral relationships, whilst asserting that “the best referrers in this segment are satisfied customers themselves.”

Both La Trobe and Homeloans commented on the ability for accountants and financial planners to provide better qualified leads. However, Homeloans boss Hair warns that “referrers without a credit licence need to be aware of the importance of recommending a broker, not a product or specific solution. A referrer who understands the borrower’s financial, business and/or investment objectives can be expected to deliver better quality leads, but unless the referrer holds an ACL or is an authorised representative of a licensee, they cannot provide credit assistance or advice.”

BROKER VIEW: LARRY STRANGE, FINANCE COMPANY AUSTRALIA

Larry Strange encounters a large number of self-employed clients because he specialises in the commercial lending space, and finds himself arranging low-doc loans for business clients, backed by residential security.

When it comes to applications, Strange observes that lender requirements have changed hugely since the GFC. “Those days are well and truly gone.” He finds that accountants’ declarations are the most popular method of verification, providing the client has a good relationship with their accountant. He advises brokers to take particular care to verify that the income the client is declaring is their actual current income, not projected income.

Strange sees low-doc loans as “just another avenue of lending, which makes sense for a self-employed person if they don’t have the required documentation.”

Adapting your application process

One major concern for brokers looking at non-vanilla clients is whether it’ll require changes to their application process, especially given brokerages are being pushed to document and standardise their processes to aid efficiency. It’s therefore encouraging that low-doc, alt-doc and full-doc application procedures are becoming increasingly similar.

Indeed, several lenders told us the application processes for their low-doc and full-doc loans were almost identical. “There shouldn’t be any need for a broker to change their assessment process for low-doc loans,” says La Trobe’s Bannister. “The only difference between our Lite-Doc loans and our Full-Doc loans is income verification.” This happens very early in the process, so the rest of the process and subsequent turnaround times remain similar to full-doc loans.

The converging processes are a result of the lending environment, explains Pepper boss Rehayem. “Both the lender and the borrower have an obligation to ensure they carry out the ‘same’ level of income/capacity to repay assessment as they would for a full-doc loan... In today’s environment, we do not have policies that are of lower quality or standard when it comes to assessing a borrower’s income.”

Reducing back-and-forth between broker and lender is paramount in reducing turnaround times, argues Liberty’s Monacheff. Whilst understanding the client and their goals might seem obvious, “by taking the time to understand what the client wants and how Liberty can tailor a solution, brokers can massively reduce the turnaround time.”

A well-executed screening of the client can also help brokers be seen to add value, notes Royden D’Vaz, director of sales, marketing and distribution at Bluestone. “It is often the detail that provides the opportunity to match the client with a lower interest rate or more feature-rich product, or in some cases finding a solution for them.”

Thorough reviewing of the client’s documentation is obviously important for a number of reasons, but it can also aid turnaround times. RESIMAC’s Carde outlines an example when confirming income. “For an alt doc, it is no different, but instead of looking at a payslip you are looking at an accountant’s letter, BAS or bank statements. If any doubt or confusion exists, the broker should seek permission from the borrower to speak with their accountant directly to gain a better understanding of the borrower’s business operations and financial performance. Once completed, those conversations should be relayed to the lender in the form of file notes.”

Homeloans boss Hair put forward a number of additional tips, including checking the borrower’s ABN and GST registration on the ABN register, being aware that trading statements can involve a longer turnaround time due to complexity, and taking the time to make sure an accountant’s declaration is completed correctly, if necessary for an application.

Combating fraud

Fraud remains a serious concern throughout all areas of lending, and has been particularly associated with the low-doc space. However, low- and alt-doc lenders are determined to challenge this assertion, and put forward a number of reasons. “It is easy to pigeonhole the low-doc segment as being more prone to fraud,” comments Bluestone’s D’Vaz. “But in reality – and from our experience – this is not the case.”

Pepper’s Rehayem believes traditional assumptions should be reversed. “In my opinion, the full-doc loans process is more likely to be targeted by fraudsters. The assessment process tends to be more commoditised as opposed to the alt-doc process.” Lenders pointed out how they go to extra lengths compared to a full-doc process. La Trobe, for example, seeks assistance from independent accountants to confirm borrowers’ stated incomes. “We find that by involving another independent professional the incidence of fraud is greatly reduced,” Bannister explains.

Improvements in software are also helping lenders combat fraud in the low-doc space. “Technology these days allows brokers to undertake more checks than ever before to verify the information being provided,” notes RESIMAC’s Carde. “From simple Google searches, to ABN searches, and even full ASIC company extracts where possible.”

Nevertheless, brokers do have a role to play, as in full-doc lending. La Trobe’s Bannister urges brokers to “apply the reasonableness test” on all occasions, “such as considering the stated income against the industry the applicant operates in and the length of time in the role.” AFM boss White also notes the importance of a “common sense approach” in addition to the two forms of verification AFM require, whilst Liberty’s Monacheff explains that brokers making reasonable enquiries “can go a long way to circumventing activity of any fraudsters.”

Beyond common sense, the lenders raised a number of concerns and corresponding solutions. “Brokers need to be very careful to follow the strict guidelines attached to their own compliance policy,” warns Pepper boss Rehayem. “Brokers should never rely solely on a lender’s income verification.” Brokers should carefully record all discussions throughout the application process, taking care to document why the application was offered an alt-doc rather than full-doc loan.

Furthermore, Murray from Better Mortgage Management advises brokers to make extra copies of trading statements for their own records. Additionally, brokers should “be diligent to make sure it is a real business and the loan purpose is correctly disclosed. BMM conduct a phone interview with the applicant as part of the process. Where applicable, we also may contact the accountant as a part of the process.”

Why low-doc clients matter

Whilst the low-doc and alt-doc space is relatively stable, this shouldn’t distract brokers from the innovation occurring in this area. Just as brokers have traditionally been reminded by lenders to not miss out on opportunities by turning away clients, brokers should be aware that new products, particularly in the prime alt-doc space, allow them to add more value to these clients than before.

That’s just one of a vast array of reasons for brokers to deal with low-doc and alt-doc clients, according to lenders. At the marketing stage, brokers can gain a reputation as an expert in self-employed and accountant circles, claims BMM. Furthermore, the self-employed space is large and continuing to grow, notes La Trobe, as people start online businesses outside their normal day job.

Integrating low-doc products into your offering is part of a diversification strategy, according to AFM, because it is not limited to residential loans – the commercial low-doc sector is also expanding. Both RESIMAC and Liberty urge brokers to consider associated opportunities in asset and equipment finance to self-employed clients, particularly for vehicles, on which many self-employed people are dependent.

Finally, Bluestone, Pepper and Homeloans point to benefits for brokers over the long term. Clients may not remain alt doc for life, observes Pepper, but will look to that same broker in the future, whilst Bluestone observes that low-doc clients are particularly loyal referrers. Homeloans boss Hair concludes by returning to the theme of missed opportunity. “It is not just the lost revenue of the one customer you do not assist who does get assistance elsewhere. It is the lifetime value of that client directly, and the potential referrals that he or she could have delivered, that is missed.”

LOW- AND ALT-DOC PRODUCT GUIDE

We asked all the lenders featured in this article to provide details of their low- and alt-doc lending products. Please note that whilst these details are correct to our knowledge at the time of writing (April) you should always check directly with the lender.

LENDER DOCUMENTATION REQUIREMENTS

LENDER DOCUMENTATION REQUIREMENTSPART 1

Please note this list is an introduction only – it is not exhaustive. Conversely, lenders could be more flexible in certain situations, meaning you should always check with the lender directly.

Australian First Mortgage

Can lend up to $2m with

1. AFM low-doc declaration

2. Accountant’s confirmation

Better Mortgage Management Verification required using one or two of the following:

1. Accountant’s letter

2. BAS statements

3. Trading statements

Bluestone

BluestoneWill accept

1. Business bank trading statements

2. Personal bank statements

3. BAS statements

4. Accountant’s letter

Homeloans

As a minimum will require one of the following:

1. An accountant’s declaration

2. Six months of business trading statements

3. Two most recent BAS statements

La Trobe Financial

At a minimum you need:

1. Borrower repayment declaration

2. Accountant’s certification OR BAS statements OR business trading statements

LENDER DOCUMENTATION REQUIREMENTS

LENDER DOCUMENTATION REQUIREMENTSPART 2

Please note this list is an introduction only – it is not exhaustive. Conversely, lenders could be more flexible in certain situations, meaning you should always check with the lender directly.

Liberty Financial

For a self-employed loan secured

by residential property:

1. Six month’s business or personal bank statements

2. Two quarters worth of BAS statements OR accountant’s declaration

3. For a loan secured by commercial property

4. Income/financial position statement completed by the applicant’s independent accountant

Pepper

You’ll need the following:

1. Income declaration

2. Two of the following documents:

a. Last two quarters’ BAS statements

b. Last six months of business trading statements

b. Last six months of business trading statementsc. Accountant’s declaration form

RESIMAC Financial Services You’ll need the following:

1. Income declaration

2. One of the following documents

a. Accountant’s letter

b. Six months of BAS

c. Three months of business bank statements.