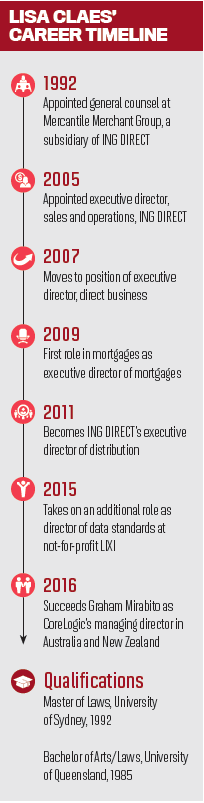

CoreLogic’s new managing director tells Sam Richardson how she’s connecting the company’s sprawling data sets to provide valuable insights for brokers

.jpg)

LISA CLAES: A lot! CoreLogic wasn’t a black box to me; I was a customer, so I knew what it did, its strategy and the segments it served. But when I came in I realised it does a lot more than you can see looking in from the pavement. It strives to serve the segments of banking, finance, insurance, real estate, brokers, valuers and government, so there’s a lot of segments it has and various solutions and products that those segments have an appetite for.

So the first thing I did is I restructured at the executive level, to align better to the segments that it serves. You want to reflect your customers, and want to restructure around your customers’ needs and appetite; well then your internal environment should reflect your external environment. Thinking about how our customers are configured and how they operate, they tend to be grouped together, such as banking, finance, wealth and government. Then property, real estate and data have a very close affinity, so I’ve brought those groups together. Call it housekeeping, but it just enables us to be more focused and more efficient in serving customers’ needs, if we restructure that way.

All that organisational, critical housekeeping is the plan for 2017. We are an organisation that’s had 14 acquisitions in the last eight years – acquisitions, integrations which are disruptive on the one hand, but we’ve added extensively to our suite of products and solutions. So the plan looks very different to what it did in the past, because we’ve got a lot more to offer … we’ve got a double-digit growth aspiration, we have ambitious efficiency targets … as you move into maturity as an organisation, the expectation of your owners definitely increases.

From CoreLogic’s own data and the data it uses from other sources, such as the ABS, Claes has identified three key trends brokers should look out for in 2017:

1. Refinancing stays strong

With not enough houses coming on to the market, people are not moving around as much as they did. Add to that very high competition and rate discounting by lenders and there will continue to be a lot of activity in discounting.

2. Increased capital charges

Claes believes there’s a “strong possibility of additional capital charges”. She believes interest rates are most likely to rise in the investment lending space, an area targeted by APRA and international capital requirements, and Claes suggests that brokers should warn clients who are looking into investing in property.

3. Off-the-plan risks

Brokers should look at the off-the-plan units their customers currently own, to see if there’s any potential settlement risk. That could mean the customer needs to top up their deposit, and if the loan is an investment loan, also anticipating higher capital charges and building in a buffer for potential changes to LVRs.

MPA: CoreLogic is heavily associated with home value indices and local property values. What other services do you offer that are most relevant to brokers?

MPA: CoreLogic is heavily associated with home value indices and local property values. What other services do you offer that are most relevant to brokers?LC: I’d call out the suite of solutions that came with the Cordell acquisition. Cordell is a data insights business, but their mainstream business offering is around the costing data of every physical component of construction; so for anything from a nail to a steel beam they have a current costing of what that is. On its own you’d think that would be useful for estimating costs for builders, but the expansion application of that is quite exciting.

That of course finds its way into insurance, in terms of replacement costs for breakages in commercial properties. That drives sum insured, which drives premiums, which drives reinsurance arrangements. We have a couple of banking customers who use those insights for their customers who don’t know whether to sell and buy, or renovate and upgrade; how much it’ll cost to do the latter, and what their property will be worth afterwards. That’s a nice marriage between the valuation ability and the costing data. Joining the dots is about how you cross-pollinate and integrate the data sets that you have and the insights you can create.

The other services they have are around the commercial property market: all the current data on the development pipeline across Australia; who’s building what, when. The catalyst is the building approval, the development applications. If I can tell a purveyor of commerce that a 20-storey office building is about to go up, with some residential component, mainly commercial, approval for coffee, supermarkets, whatever, then that gives you the landscape of the commercial enterprise, and that’s of enormous interest to anyone that serves that, from baristas to childcare centres … there’s a solution called lease expiry, which tells you within a building who’s leasing what, and when it expires. If you look at a building and there’s a lot of leases coming for up for expiration, and no one taking over, it shows there’s a shift of value happening within a community.

That commercial data is not something many would know CoreLogic for. We have a product called SkyMeasure, which will take a picture of a roof. Sounds rather mundane, but it’ll tell you the pitch, the gradient, the condition. You can imagine the leverage that would have into solar panel markets, construction and that property identity data: what does it look like, what is its access to the street? You can’t see from a binary address, 5 Smith Street, that’s it’s on top of a cliff, inaccessible by transport. And that sort of insight is really important to emergency services and people who want to build … the property ecosystem is expansive, immersive and touches everyone in a very significant way, and overall our strategy is to meaningfully optimise what we have to help those who play in that vast property ecosystem.

MPA: How is CoreLogic working with aggregators and broker associations to make your services more accessible, especially to new brokers?

LC: One of the main CoreLogic tools of trade for brokers, and particularly new brokers, is our flagship RP Professional platform, and it’s been undergoing a significant customisation and simplification process, aligned to the way we understand a broker works and thinks. It’ll be more intuitive for a broker, so if you like we’ve gone from a clever one-size-fits-all proposition for banks, brokers and valuers on a customisation journey … I want to make it feel like a tool for brokers to use, whilst increasing the data sets that sit within it and the functionality that we have.

For example, something we’re keen to increase our presence in is rural and commercial data. Our aim is to get 100% of residential data, but also to start to grow the less mature data sets. That may not be of interest to every broker, but we’ve got to have something that every broker can [use] … Brokers are very omnichannel themselves, and have to do a lot of work on the go, so we’re making sure we replicate the functionality of the desktop platform into the palm.

The third bit, and probably the most critical, is working closely with the major aggregators, who use a variety of CRM tools to ensure those solutions integrate neatly into their CRM platforms. What we don’t want is for someone to have to get out of their working platform, go to ours, and then have to cut and paste and that sort of clunky migration back into their day-to-day working systems. We want to make sure it’s very much a plug-and-play system.

“We’ve gone from a clever one-size-fits-all proposition for banks, brokers and valuers on a customisation journey”

MPA: Are there different versions of CoreLogic’s services available to brokers, with different levels of functionality and hence costs?

LC: The answer is we do currently, based upon number of users and geographical coverage. We want to move to a position where as we enhance the functionality with expanded solution and data sets we will explore price modularity between a classic and luxury offering. Certainly philosophically, I very much believe that you should have a great base offering and should be able to option up on that.

“Over the next couple of years we should be able to grow at 8–10%”

MPA: Like an Air New Zealand situation, with different packages available on top of the basic option?

LC: Yeah, but you’ve just got to make sure basic is great. What I’m not in favour of – and I said the same thing at ING DIRECT – is that I’m not a communist, but I want the base to be really good. Certainly pay more for luxury, but your basic proposition has to appeal to the lifeblood of the customer segment. Many options increase complexity; even having pricing options increases complexity, although I certainly like classic and luxury, and paying accordingly.

MPA: For high-performing brokers looking to get more out of CoreLogic’s offerings, are there services you believe are currently underutilised?

LC: The magic of data is when it’s a verb, not a noun; when it’s insight, not just data. Data is by itself quite unexciting; it’s how you use it. It’s about insight, and how does that translate for a broker? Propensity. Propensity to list, and Property Monitor. Property Monitor enables a broker to tag every property of every customer in their database and it will send them alerts as to when there’s activity in those properties. I’ve got one myself on this beautiful property, and it will alert me whenever something happens, so I’m not trawling the portals day by day.

If I was a broker and one of my customers was thinking about selling, I’d like to get in and have a conversation. For two reasons: not only to be the broker on the next transaction, but more importantly to be there as a thought leader for my customers’ P&L and balance sheet; to know the area and have deep market intelligence of suburbs, down to the street, down to the property … I really believe if you use these propensity tools to have a proactive discussion with your customers it secures the fact you’ll get the transactional opportunity that’ll inevitably follow.

The other one is a new solution and arises through our partnerships with Quantium and Experium; the consumer demographic data, on a de-identified basis. There’s a high predictability, if you know how long someone’s been in a home, with indicators such as spend, of when someone will be shifting residences. So even before Property Monitor sends you the alert from the listing, the propensity to list could be of insight … having a similar type of conversation with that customer as Property Monitor could trigger.

Another propensity solution is propensity to refinance. I think that in a market which is becoming increasingly commoditised in terms of product and price this is where the differentiation is: using predictive analytic tools to get in front of your customer – not waste their time – to help them get the best solution. That’s where I see elite brokers moving into.

“The magic of data is when it’s a verb, not a noun; when it’s insight … how does that translate for a broker? Propensity”

MPA: How would you like brokers to perceive CoreLogic 12 months from now?

LC: I would like to think that we have been an intelligent partner in providing them with efficient solutions to help them and their business harvest leads, convert leads into customers and retain their existing customers. It’s as simple as that. We’re not here to tell brokers we’re the experts at how they run their business, but that we’re here, I believe, to help them do something clever and meaningful for their customers.

Lisa Claes is currently writing a book about navigating through large corporate and global organisations. It will bring together some of the best feedback she’s received, insights and networking tips, and be directed at both men and women.