Westpac’s head of commercial introducers tells MPA how her team works with brokers expanding into commercial lending

Westpac’s head of commercial introducers tells MPA how her team works with brokers expanding into commercial lending

MPA: Why are we hearing so much about brokers and commercial lending right now?

JANELLE PEARCE: If we look at brokers themselves, the majority of them are business owners, and to really have strong, sustainable businesses they shouldn’t be one-dimensional and solely reliant on mortgages. Business owners are looking for more from their broker and for brokers to be a thought leader and adviser, with the ability to talk to them about all of their needs and not just their mortgage. I think it’s particularly customer demand that’s driving this, but also if you look at aggregators they’re encouraging their members to spread their wings, through continuous improvement; expanding into commercial lending is a part of that growth.

We also in the last couple of months conducted a series of roadshows down the East Coast, and we invited a mix of our existing commercial brokers and also brokers who had the potential to become commercial brokers. That was based on the recommendations of some of our colleagues in the residential business, but also by the aggregators. Every single one of those events was full to capacity, which for me was evidence of residential mortgage brokers wanting to do more than just mortgages.

MPA: Are business customers becoming more and more prepared to work with a broker?

JP: We’re starting to see it more and more and there are things that are driving that. One is if there’s been a continuous change in [banking] manager, if the customer has been with a particular bank for some time. Banking is a career, so managers do move on, but in some cases customers had five or six managers in a two-year period – I’m not saying that doesn’t happen at Westpac – and I think customers are looking for another alternative to be able to facilitate their needs for their business.

“Most people are time-poor, and having to continually keep telling your story gets hard. For them the broker is the constant in the relationship”

Most people are time-poor, and having to continually keep telling your story gets hard. For them the broker is the constant in the relationship; the broker is running their business based on building sustainable relationships with customers. It makes it a lot easier for a customer then. They don’t have to continually provide the information to the bank or tell them about their business history over and over again; the broker does that on their behalf. We then continue to build that relationship with both the broker and the customer into the long term.MPA: With so many industries out there, are there any that brokers should take a particular interest in?

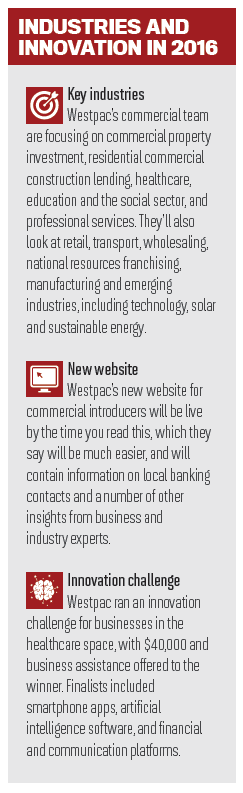

JP: I think a big opportunity for brokers could be to specialise in cash flow lending. That would go across many of those different industries … Having a strong understanding of the balance sheet and how we can lend against the balance sheet instead of having property-secured backing. In some of these newer businesses that we’re talking about, these guys starting out have brilliant minds but they may not have had the assets to back what they’re doing. In those cases we’re really backing innovation and looking at it in a different light. So if I was a broker I’d be looking at more cash flow type situations rather than any specific industry.

MPA: What can brokers expect from Westpac’s commercial partnership managers?

JP: They can expect a relationship which is a partnership, which is the reason why I chose the title of partnership manager for my team on the ground as opposed to the BDM title that most of the banks have. They can also expect that time spent with their partnership manager is time well worth spending. The PMs are not just there to be a conduit to introducing a client into Westpac; I see them there rather to

create value for their brokers through their knowledge across a broad range of industries and product offerings.

“We’ve actually got many of our commercial brokers who want to come into our offices and attend roundtable sessions with our bankers and credit managers”

Time is a precious commodity, and we get that, so the way we recognise that is we’re very mindful that if a broker gives us an hour or so of their time they can come away thinking that was an hour worth spending because my partnership manager has imparted industry insights or gifts of knowledge that increase the broker or their clients’ knowledge base. MPA: How can the commercial expertise your PMs have help brokers who may be new to a specific industry?

MPA: How can the commercial expertise your PMs have help brokers who may be new to a specific industry? JP: They know what it takes to be successful as a broker, because they’re working with so many of them, and the best in the industry … I think my guys get it; they’re all pretty much ex-commercial bankers, so they understand what is a deal and what isn’t a deal, so they can help a broker understand that as well.

The other thing is just to be really honest with the brokers: we’re looking for people that want to partner with us into the future. We want to have sustainable long-term relationships. We’re not interested in just doing a deal with someone; we want to be seen as a partner and a valued partner. If they think they don’t have the client base or the network to be able to introduce business clients regularly, then maybe that isn’t the solution for them. They might be better off working with their aggregator, who in most cases have an in-house specialist to help them with facilitating a commercial loan for a bank.

MPA: Commercial loans can be long and complicated – how does Westpac keep everyone involved?

JP: We take a flexible approach when it comes to how a broker introduces the customer. We provide them the option to be involved the whole way through, or just at the beginning and the end. We leave that entirely up to the broker – how they want to manage the process with us. We’ve actually got many of our commercial brokers who want to come into our offices and attend roundtable sessions with our bankers and credit managers, which helps speed up the decision-making process. For me it demonstrates the commercial acumen of the broker in the eyes of the banker and our credit team. We find that to be quite valuable and the brokers find that valuable as well.

MPA: What’s the advantage of your two-tier accreditation system, and how can a broker move from one to another?

JP: There are two programs that we offer: the first one is the full broker accreditation, and that means they would be remunerated by way of an upfront payment as well as an ongoing trail commission. To be accepted into that program we’re looking for people that have a previous commercial lending background or have been a chartered accountant or something of the like. They can put together a detailed credit paper so that we understand what the transaction is; they provide us with all of the security, etc.; they’ve got to be able to work their way around a balance sheet and profit-and-loss statement and provide an understanding of the industry that the customer is playing in.

The other offer we have is the commercial referrer program. That program is great for anyone who wants to start out in commercial; anyone who has no prior commercial experience and wants to learn; or anyone who wants to outsource their commercial lending to us, and we’ll pay an upfront fee for that. So we’ll do all of the work to get the deal assessed, and then if it’s successful, if it’s approved, they’ll be paid at the end of the period.

The other offer we have is the commercial referrer program. That program is great for anyone who wants to start out in commercial; anyone who has no prior commercial experience and wants to learn; or anyone who wants to outsource their commercial lending to us, and we’ll pay an upfront fee for that. So we’ll do all of the work to get the deal assessed, and then if it’s successful, if it’s approved, they’ll be paid at the end of the period.

“We want to have sustainable long-term relationships: we’re not interested in just doing a deal with someone: we want to be seen as a partner and a valued partner”

So again, even though it’s simply a spot-and-refer program, for us it’s about building a sustainable partnership with the brokers, so that we’re not just considering one deal. We don’t have the resources to bring on every single person that wants to be a commercial broker, but what we can do is for those that have the desire and have the right client base or network, we’re more than happy to work with them to help them grow their business.

If you’re on the referrer program initially and can demonstrate over time that they’ve learnt a lot, which may be learning from our partnership manager or coming to meetings with clients and the banker and credit teams, then if [the broker] believes they’ve done enough to warrant full accreditation as a commercial broker, we’d ask them to submit an application. If it meets all the criteria, then we’d be happy to upgrade them to full commercial accreditation at that time.

MPA: How does Westpac manage relationships between brokers and business bankers to avoid channel conflict?

JP: We’ve worked incredibly hard to amplify the commercial third-party story within the consumer’s choice to work with a broker. I think pretty much on every single occasion that has happened we just moved on and continued the deal with the broker. So I just think the work that we’ve done internally has helped to really alleviate channel conflict, and when it does we move swiftly. But I’d be lucky to see one or two in a year where it happens, which shows we have a strong message out there.

MPA: How would you like Westpac’s commercial operation to be viewed by brokers 12 months from now?

JP: I think the coming year is a really important one for brokers, because on the 18th April 2017 we’ll make history as Australia’s oldest bank and first company to enter its third century, and we’ll celebrate that incredible milestone in a big way and we’re currently working on plans to do that.

For me, I see in 12 months’ time we’ll have continued to deliver a strong proposition to our broker partners, with a continued focus on creating value for them and delivering best-in-class service.

My ambition is to remain strong and continue to build a sustainable business for the longer term. It’s always about quality over quantity and that continuous improvement; the CI business is better tomorrow than it is today.