From CRMs to mobile phones, technology has come a long way and is now enabling rather than disrupting brokers

.jpg)

MPA editor Sam Richardson talks to industry leaders, software developers and start-ups to find out how today’s broker can do things only the biggest banks could do just 10 years ago.

Look out for articles coming up next week that will explore the technology companies and platforms are changing the way you write mortgages and what the future holds.

‘Digital Disruption’ is a term that sums up broking’s problem with technology. It’s a term that invokes helplessness, and a fear that barbarian hordes from Silicon Valley will tear down the industry, using systems and concepts we can’t even understand. Yet while it’s essential to keep an eye on the competition, it’s the fear of digital disruption that’s holding the industry back.

An iPhone 6 has more processing power than NASA used to send a man to the Moon; so does your WiFi router. Brokers now have access to technology that can do more, and is far easier to use, than many banks in the 1990s and even 2000s. In fact brokers can do much more with technology in 2017 than they could just five years ago, from automated customer relationship management to electronic signatures.

MPA takes a look at how technology is enabling, not just disrupting, broking. We’ve talked to the three biggest technology providers in the industry: NextGen.Net, Rubik and Sandstone, and the two biggest aggregators, AFG and Connective, to see how broking is changing and what’s coming next. We’ve also talked to a number of lesser-known companies and start-ups that are developing technology to enable you to do more.

MPA takes a look at how technology is enabling, not just disrupting, broking. We’ve talked to the three biggest technology providers in the industry: NextGen.Net, Rubik and Sandstone, and the two biggest aggregators, AFG and Connective, to see how broking is changing and what’s coming next. We’ve also talked to a number of lesser-known companies and start-ups that are developing technology to enable you to do more.

We explore how technology is adding to and not eliminating a broker’s value proposition. You can talk a borrower through their mortgage application at the park during their lunch break, or alternatively on video from the other side of the planet. Having uploaded electronic documents and signatures, your software can then split those documents up or group them together, while redacting tax numbers and other data, before submitting to a lender. We also look at the technology brokers are missing out on, and why we’re still waiting for the paperless mortgage in Australia. Whether you’re a single operator or a national franchise, technology is enabling you to do more. Read on for some ideas on how to get started.

To see how far broking has evolved over the last five years, you can’t just consider the technology itself – the actual hardware and software available to brokers – you also need to look at the utilisation of technology by brokers. Utilisation matters: Kodak infamously took too long to take digital cameras seriously, despite the technology being first invented in the 1970s.

According to Connective CEO Glenn Lees, brokers are utilising technology more than ever. “Everyone’s been talking about technology for years, but often people wouldn’t use it, or wouldn’t use it fully. What we’ve found in the last two years is a greater uptake of technology.”

Connective has been looking at how brokers use their Mercury platform, and Lees explains that the functions being used aren’t necessarily “the new and fantastic things in Mercury”. He says “quite often the things that add the most value are the simple things”. Change is being driven by both the younger, more technologically savvy brokers that are emerging and the regulatory challenges Lees says. “Interestingly, surprisingly – and quite boringly – the compliance tools we’re providing are being used more and more.”

Brokers are choosing to enter what Jaime Vogel, CIO at AFG, calls the “digital ecosystem”, particularly when it comes to dealing with customers. Digitised CRM systems can automate many tasks and track individual customers’ situations, “making the broker proposition more professional”, Vogel says. Contacting customers prior to the end of a fixed rate is a well-established practice; now technology can analyse changes in property values and a customer’s employment to prompt refinancing approaches, and AFG is introducing machine learning to further improve this technology.

The last few years have seen notable technological leaps forward in the area of uploading supporting documents, electronic signatures, and electronic applications for commercial loans. Less well known is the introduction, in late 2015, of APIs to allow broker groups to track lender requirements in real time. This is a huge improvement from the previous reliance on Microsoft Excel spreadsheets, says Tony Carn, sales director at NextGen.Net, and reduces mistakes and application rewording. It was a change driven by necessity, Carn says. “When real challenges emerge in the market people scramble to respond, and that was APRA making changes to investment lending, and it meant that a lot of changes were required of broker groups.” He predicts that half of broker groups will be using APIs to track lenders by the end of 2017.

Developing technology

The way that broking technology is developed is also changing. Over the last 12 months Rubik Group has been taking a “humancentred approach”, explains Emily Chen, head of product – financial services. Software was traditionally developed for the immediate user, such as brokerage support staff. Now the end customer experience is paramount, with Rubik’s considerations including “what the customer expects from the broker; what is the experience they’re looking for and, most importantly, what does the future look like so we create a future-proof solution and don’t design ourselves out.”

Developers are looking for end-to-end solutions across the lending process, explains Linda Stanojevic, global chief product officer at Sandstone Technology. “We look at building smart connections; we’re building smart connections between digital and physical flows [of information].” She says it’s “not just about working your end well, but really collaborating across the value chain”. That means, for example, that banks get the right pieces of information from brokers at the right stage of the application, reducing the time to approval.

“We’re seeing the emergence of really gamechanging technologies, but they do take longer than we’d like to see,” says Carn at NextGenNet. The challenge is not necessarily about the take-up of technology but comes from the regular updates required for modern software, he explains. That doesn’t mean technology isn’t moving forward in the meantime.

Beyond the traditional developers and large projects there are hundreds of bolt-on services for project management and document storage that brokers can use, explains Connective’s Lees. “The real power comes when the platform we provide has an open API,” he says. “You can find the bits you want and integrate them yourself, or with our help. There is a whole universe out there of really small, well-devised micro-services which you can put together.”

Look out for articles coming up next week that will explore the technology companies and platforms are changing the way you write mortgages and what the future holds.

‘Digital Disruption’ is a term that sums up broking’s problem with technology. It’s a term that invokes helplessness, and a fear that barbarian hordes from Silicon Valley will tear down the industry, using systems and concepts we can’t even understand. Yet while it’s essential to keep an eye on the competition, it’s the fear of digital disruption that’s holding the industry back.

An iPhone 6 has more processing power than NASA used to send a man to the Moon; so does your WiFi router. Brokers now have access to technology that can do more, and is far easier to use, than many banks in the 1990s and even 2000s. In fact brokers can do much more with technology in 2017 than they could just five years ago, from automated customer relationship management to electronic signatures.

MPA takes a look at how technology is enabling, not just disrupting, broking. We’ve talked to the three biggest technology providers in the industry: NextGen.Net, Rubik and Sandstone, and the two biggest aggregators, AFG and Connective, to see how broking is changing and what’s coming next. We’ve also talked to a number of lesser-known companies and start-ups that are developing technology to enable you to do more.

MPA takes a look at how technology is enabling, not just disrupting, broking. We’ve talked to the three biggest technology providers in the industry: NextGen.Net, Rubik and Sandstone, and the two biggest aggregators, AFG and Connective, to see how broking is changing and what’s coming next. We’ve also talked to a number of lesser-known companies and start-ups that are developing technology to enable you to do more.We explore how technology is adding to and not eliminating a broker’s value proposition. You can talk a borrower through their mortgage application at the park during their lunch break, or alternatively on video from the other side of the planet. Having uploaded electronic documents and signatures, your software can then split those documents up or group them together, while redacting tax numbers and other data, before submitting to a lender. We also look at the technology brokers are missing out on, and why we’re still waiting for the paperless mortgage in Australia. Whether you’re a single operator or a national franchise, technology is enabling you to do more. Read on for some ideas on how to get started.

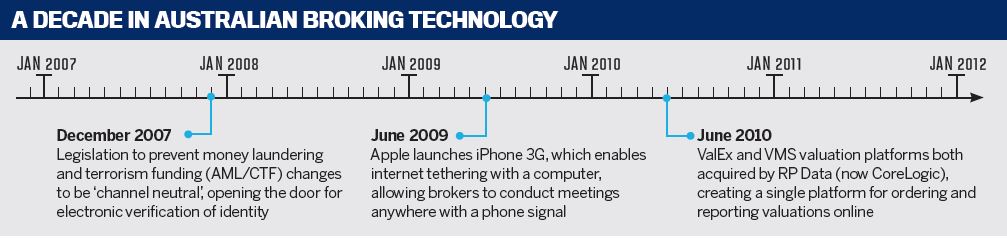

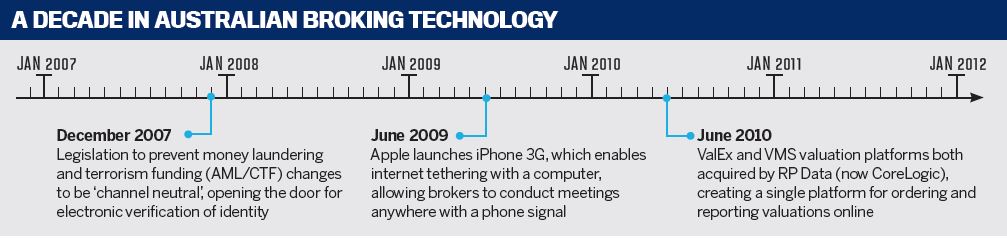

PAST

Technology is getting cheaper and more user-friendly, and is being used in a different way by brokers and aggregatorsTo see how far broking has evolved over the last five years, you can’t just consider the technology itself – the actual hardware and software available to brokers – you also need to look at the utilisation of technology by brokers. Utilisation matters: Kodak infamously took too long to take digital cameras seriously, despite the technology being first invented in the 1970s.

According to Connective CEO Glenn Lees, brokers are utilising technology more than ever. “Everyone’s been talking about technology for years, but often people wouldn’t use it, or wouldn’t use it fully. What we’ve found in the last two years is a greater uptake of technology.”

Connective has been looking at how brokers use their Mercury platform, and Lees explains that the functions being used aren’t necessarily “the new and fantastic things in Mercury”. He says “quite often the things that add the most value are the simple things”. Change is being driven by both the younger, more technologically savvy brokers that are emerging and the regulatory challenges Lees says. “Interestingly, surprisingly – and quite boringly – the compliance tools we’re providing are being used more and more.”

Brokers are choosing to enter what Jaime Vogel, CIO at AFG, calls the “digital ecosystem”, particularly when it comes to dealing with customers. Digitised CRM systems can automate many tasks and track individual customers’ situations, “making the broker proposition more professional”, Vogel says. Contacting customers prior to the end of a fixed rate is a well-established practice; now technology can analyse changes in property values and a customer’s employment to prompt refinancing approaches, and AFG is introducing machine learning to further improve this technology.

The last few years have seen notable technological leaps forward in the area of uploading supporting documents, electronic signatures, and electronic applications for commercial loans. Less well known is the introduction, in late 2015, of APIs to allow broker groups to track lender requirements in real time. This is a huge improvement from the previous reliance on Microsoft Excel spreadsheets, says Tony Carn, sales director at NextGen.Net, and reduces mistakes and application rewording. It was a change driven by necessity, Carn says. “When real challenges emerge in the market people scramble to respond, and that was APRA making changes to investment lending, and it meant that a lot of changes were required of broker groups.” He predicts that half of broker groups will be using APIs to track lenders by the end of 2017.

Developing technology

The way that broking technology is developed is also changing. Over the last 12 months Rubik Group has been taking a “humancentred approach”, explains Emily Chen, head of product – financial services. Software was traditionally developed for the immediate user, such as brokerage support staff. Now the end customer experience is paramount, with Rubik’s considerations including “what the customer expects from the broker; what is the experience they’re looking for and, most importantly, what does the future look like so we create a future-proof solution and don’t design ourselves out.”

Developers are looking for end-to-end solutions across the lending process, explains Linda Stanojevic, global chief product officer at Sandstone Technology. “We look at building smart connections; we’re building smart connections between digital and physical flows [of information].” She says it’s “not just about working your end well, but really collaborating across the value chain”. That means, for example, that banks get the right pieces of information from brokers at the right stage of the application, reducing the time to approval.

“We’re seeing the emergence of really gamechanging technologies, but they do take longer than we’d like to see,” says Carn at NextGenNet. The challenge is not necessarily about the take-up of technology but comes from the regular updates required for modern software, he explains. That doesn’t mean technology isn’t moving forward in the meantime.

Beyond the traditional developers and large projects there are hundreds of bolt-on services for project management and document storage that brokers can use, explains Connective’s Lees. “The real power comes when the platform we provide has an open API,” he says. “You can find the bits you want and integrate them yourself, or with our help. There is a whole universe out there of really small, well-devised micro-services which you can put together.”