Homeloans' recently topped MPA's Brokers on non-banks survey and its general manager explains why

Homeloans’ general manager of sales puts success of topping our Brokers on Non-banks survey down to the lender’s wide funding and product range, combined with its excellent team

MPA: What has Homeloans changed over the past year to go from runner-up to the number one spot?

Ray Hair: It’s been a two-year transition, and it’s been the fundamentals … Homeloans is a traditional mortgage manager; a hightouch, high-service proposition, not a pricing proposition, although price is very important. We’ve got good people in our business at BDM level: experienced lenders who know how to pull apart and construct a deal and know how things best stick with our six different funders so we’ve got that diversity of funding … everybody knows why they’re there and what their job is, and I think that’s reflected in broker feedback around turnaround, service, BDM availability and knowledge, and that transition from second to fi rst is about improving and developing on that service proposition.

MPA: Were there any particular products that you think drove broker interest?

RH: Because we have six different funders and diversity therefore available to us in terms of what we can offer and/or promote… we’ve introduced RedZed as a funder this year, which gives us an extended component of specialist lending and our fi rst opportunity to do commercial lending. With Pepper as a funder, we introduced the near-prime construction product, which was very much about listening to the market.

MPA: When you’re dealing with a range of prime and specialist products, how do you maintain a fast turnaround time?

RH: There’s a diversity of brokers, funders and products, but the consistency is a very stable, experienced credit and BDM team that act as that first gatekeeper; what product is going to fit, and where are we going to place it, providing the broker with recommendations for their customer ... we have a team of support officers who work with credit, so once the conditional has gone out they work with the broker to make sure the conditions are being met and we can get a formal out of it.

MPA: Does Homeloans look to compete with the major banks?

RH: We look to compete with everyone in the mortgage market because of our diversity of product range, in terms of specialist, near prime, prime. We’ve got such a range of products we think we can provide a solution to most home loan opportunities; our challenge is not which of the banks we’re competing with but whether we can get brokers to consider us as the first port of call, instead of those usual competitors to the majors.

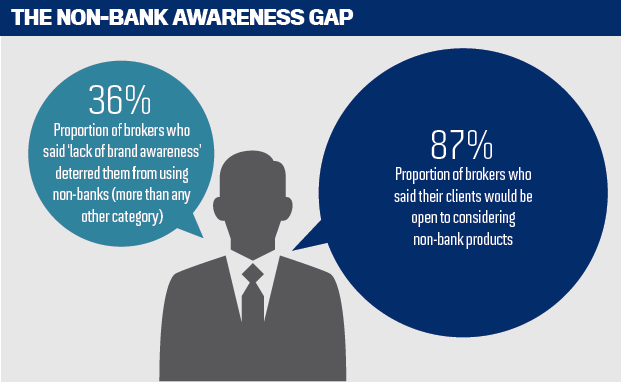

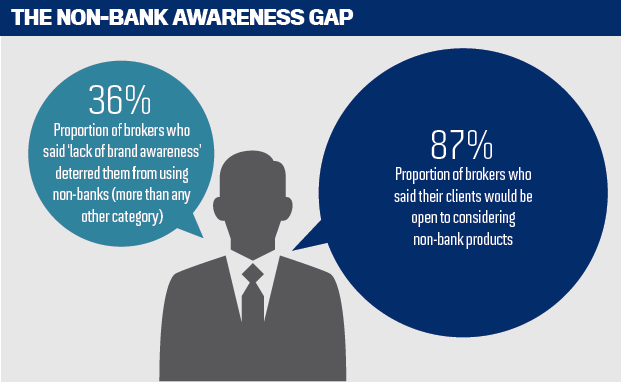

MPA: How can Homeloans – and the nonbank sector more generally-increase its consumer awareness?

RH: Our sponsorship of the Perth Scorchers in the Twenty20 Cricket has been a major success for us, on the back of the Perth Scorchers’ success, but also the successful broadcasting of that event into nearly every Australian household during the summer, when there were few alternatives for people to watch.

RH: Our sponsorship of the Perth Scorchers in the Twenty20 Cricket has been a major success for us, on the back of the Perth Scorchers’ success, but also the successful broadcasting of that event into nearly every Australian household during the summer, when there were few alternatives for people to watch.

We also use Matthew Pavlich as our brand ambassador, and whilst Matthew’s footballing career is in its last season, he has been an extremely good ambassador in the market for us, in terms of our values and his profile and his values. The rest of it is the online, the social media: Will Keall, our online marketing manager has driven a very successful campaign … our biggest challenge is the Perth Scorchers, because as they get more successful the price goes up, as you’d expect, so we need to continue looking for cost-effective marketing opportunities and take advantage of that.

MPA: What’s in the pipeline for the next 12 months?

RH: I don't want to be boring, but more of the same in a sense ... we’d like to have funding lines that are more proprietary and therefore unique to us … finding some unique to Homeloans offers is very high on our priority list … we want brokers to be seen by customers as the heroes, and if we can do that we’re doing our job.

MPA: What has Homeloans changed over the past year to go from runner-up to the number one spot?

Ray Hair: It’s been a two-year transition, and it’s been the fundamentals … Homeloans is a traditional mortgage manager; a hightouch, high-service proposition, not a pricing proposition, although price is very important. We’ve got good people in our business at BDM level: experienced lenders who know how to pull apart and construct a deal and know how things best stick with our six different funders so we’ve got that diversity of funding … everybody knows why they’re there and what their job is, and I think that’s reflected in broker feedback around turnaround, service, BDM availability and knowledge, and that transition from second to fi rst is about improving and developing on that service proposition.

MPA: Were there any particular products that you think drove broker interest?

RH: Because we have six different funders and diversity therefore available to us in terms of what we can offer and/or promote… we’ve introduced RedZed as a funder this year, which gives us an extended component of specialist lending and our fi rst opportunity to do commercial lending. With Pepper as a funder, we introduced the near-prime construction product, which was very much about listening to the market.

MPA: When you’re dealing with a range of prime and specialist products, how do you maintain a fast turnaround time?

RH: There’s a diversity of brokers, funders and products, but the consistency is a very stable, experienced credit and BDM team that act as that first gatekeeper; what product is going to fit, and where are we going to place it, providing the broker with recommendations for their customer ... we have a team of support officers who work with credit, so once the conditional has gone out they work with the broker to make sure the conditions are being met and we can get a formal out of it.

MPA: Does Homeloans look to compete with the major banks?

RH: We look to compete with everyone in the mortgage market because of our diversity of product range, in terms of specialist, near prime, prime. We’ve got such a range of products we think we can provide a solution to most home loan opportunities; our challenge is not which of the banks we’re competing with but whether we can get brokers to consider us as the first port of call, instead of those usual competitors to the majors.

MPA: How can Homeloans – and the nonbank sector more generally-increase its consumer awareness?

RH: Our sponsorship of the Perth Scorchers in the Twenty20 Cricket has been a major success for us, on the back of the Perth Scorchers’ success, but also the successful broadcasting of that event into nearly every Australian household during the summer, when there were few alternatives for people to watch.

RH: Our sponsorship of the Perth Scorchers in the Twenty20 Cricket has been a major success for us, on the back of the Perth Scorchers’ success, but also the successful broadcasting of that event into nearly every Australian household during the summer, when there were few alternatives for people to watch.We also use Matthew Pavlich as our brand ambassador, and whilst Matthew’s footballing career is in its last season, he has been an extremely good ambassador in the market for us, in terms of our values and his profile and his values. The rest of it is the online, the social media: Will Keall, our online marketing manager has driven a very successful campaign … our biggest challenge is the Perth Scorchers, because as they get more successful the price goes up, as you’d expect, so we need to continue looking for cost-effective marketing opportunities and take advantage of that.

MPA: What’s in the pipeline for the next 12 months?

RH: I don't want to be boring, but more of the same in a sense ... we’d like to have funding lines that are more proprietary and therefore unique to us … finding some unique to Homeloans offers is very high on our priority list … we want brokers to be seen by customers as the heroes, and if we can do that we’re doing our job.