Non-conforming lenders aren’t just back in business; they’re taking on stereotypes, sceptics and the big players with a new generation of specialised products and technological innovations

Non-conforming lenders aren’t just back in business; they’re taking on stereotypes, sceptics and the big players with a new generation of specialised products and technological innovations

Australia’s non-conforming lenders have not had a great winter in the press. August saw international ratings agency Moody’s reveal that $3bn worth of non-conforming loans were written in 18 months, a move that ABC instantly portrayed as a revival of subprime. What could have been a celebration of non-conforming lenders’ success in recovering from the GFC and adapting to NCCP regulations instead was seen as reflecting fragility, conjuring up memories of cowboy subprime lenders from the pre-GFC years.

Non-conforming lenders know these stereotypes this will always be a struggle, but they believe their internal processes and Australian regulations now make the subprime comparison impossible. Indeed Moody’s analyst Roberto Baldi argued that the National Consumer Credit Protection Act “gets around the fact that in the US you saw those loans being written to borrowers pre-2008 with little to no income verification; in Australia that just can’t happen”. Another ratings agency, Standard and Poor’s, gave Pepper a ‘strong’ rating in March, and many other non-bank lenders are also highly rated. What recent events have done is to accelerate a trend, whereby lenders are moving away from the old ‘non-conforming’ – in both name and product offerings. Lenders feel that many brokers are yet to grasp the new reality.

CONFRONTING STEREOTYPES

“What we do is a traditional home loan,” Bluestone’s Royden D’Vaz insists. “It’s just that we have to price it differently due to the higher risks.” This is a message repeated by all the lenders; they want brokers to see them as another option in their panel, not a last resort. Moving away from the latter has involved an extensive process of rebranding their businesses and customers.

While all the lenders commend 2010’s NCCP regulations, many highlight that while the number of potential borrowers has increased, fewer brokers feel qualified to handle such borrowers. Stricter rules on bank lending have pushed customers into the non-conforming sector, explains AFM’s Paul Grant: “Banks’ scoring policing [is] strict and [is] not suiting or accommodating, for example, the current way people are being paid.” Pepper’s Mario Rehayem argues that bank reluctance has “nothing to do with the borrower themselves; it’s about the market squeeze out there”. Resimac estimates 80% of their borrowers have clear credit.

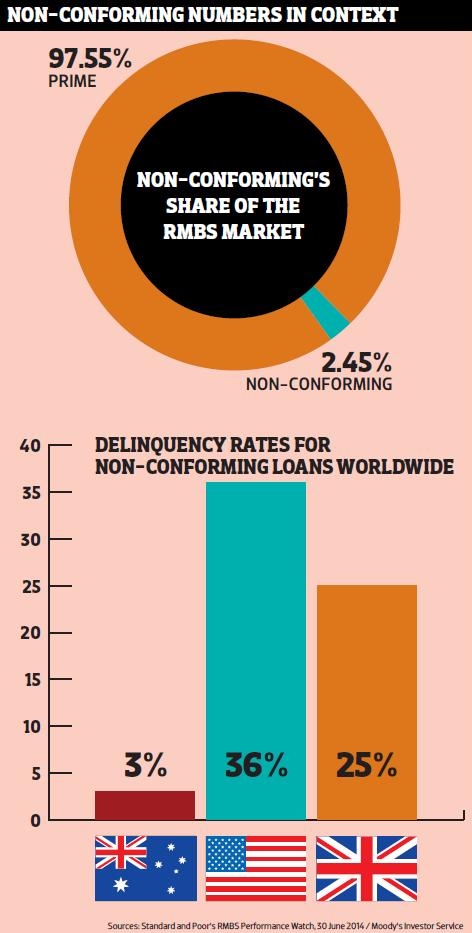

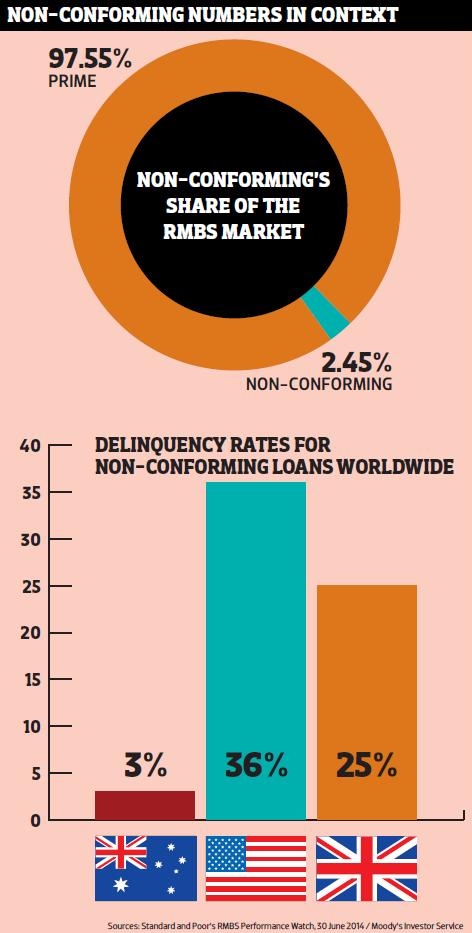

Despite this, non-conforming products are still “the most underrated product within the market”, laments Rehayem. Non-conforming lenders still have a tiny share of the market – around 3% of outstanding residential mortgage backed securities (RMBS), according to Standard and Poor’s, and this is partly because many brokers still believe NCCP regulations make it just too difficult to write non-conforming loans.

Non-conforming clients are still a relatively rare occurrence for brokers. “You could go three months without seeing a client like this,” reckons Resimac’s Allan Savins. Evidently many brokers feel they’re not worth the effort.

The response from lenders is unwaveringly direct. Those who turn down non-conforming clients “need to be a broker, not just a bank broker”, says Rehayem. Similarly, Savins reasons that “when you start off being a broker, writing a prime loan isn’t really what it’s about; it’s about providing a solution … specialist provides that; it’s about not letting your client walk out the door, providing brokers with a client-for-life opportunity”. For La Trobe’s Paul Wells, “it’s about maximising earning potential, and [brokers] owe it to themselves to assist all loans that they inevitably come across”. He says: “Never put all your eggs into one prime basket.”

THE INDIVIDUAL APPROACH

In conjunction with rebranding, lenders are reforming their processing to counter brokers’ perceptions that non-conforming borrowers require more work. But they are also increasingly eager to stress how their assessment process differs from banks, and can in fact be superior to institutional models, a crucial claim as they transform from ‘non-conforming’ to ‘specialist’ lenders.

“There’s an art to this type of lending, which makes it specialist by nature,” stresses Resimac’s Savins. Homeloans’ Ray Hair is more circumspect: “Whether you call it non-conforming or specialist, I don’t think is really the issue. It’s around understanding that it’s an individualised approach to credit assessment as opposed to a credit scoring or institutionalised model.”

For all these lenders, assessment necessitates an analyst looking at each and every application. The sheer volumes handled by banks make them “more like a production line”, argues Pepper’s Rehayem, whereas Pepper’s approach is “like the old days when you use to walk into a branch and have the bank manager look you in the eyes”.

Assessment processes are in reality a little bit more advanced than that. Some lenders, like Better Mortgage Management, have taken to viewing borrowers’ properties on Google Street View, for example. Yet a number of mantras remain, such as Bluestone’s and Resimac’s ‘three S’s’, these being security, serviceability, and scenario (ie story). Acquiring information for the latter is what separates specialist lenders from the traditional approach; they need documents to back up the story. This also requires brokers to go a little deeper in their research. Resimac gave one example in which a borrower had a huge one-off credit card bill on record. The reason? They had just paid for a course of IVF – an emotional decision, but hardly one that made them a bad borrower.

While this is extra work, lenders are prepared to do much of it themselves. What they disagree on is how far to respect a broker’s control over the client. Pepper and Homeloans say they never talk directly to borrowers; La Trobe and Better Mortgage Management make it a requirement for an application, feeling it’s a vital step in checking details. “At first some of our broker partners have been a little surprised by that,” recalls Better Mortgage Management’s Murray Cowan, “but once we explained to them that it helps with compliance for us, for them and their aggregator, they normally don’t mind that.”

PROMOTING TECHNOLOGY

Most lenders claim that, for properly submitted loan applications, their rejection rates are very low – around 10–20%. The same applies to turnaround times, which are usually 24–48 hours. To help brokers write non-conforming loans, they’ve developed a number of tools, ranging from standard checklists to specialised online assessment programs.

Smart educational tools are becoming a core offering for non-conforming lenders. There was considerable media attention when Pepper recently launched a new module on specialist lending for its Better Business E-Learning Hub. Other lenders have similar tools. Better Mortgage Management has its PAL (place a loan) system, through which brokers present criteria about a client, such as whether financials are available, and they’ll be directed to a loan. Resimac’s ASK tool also allows brokers to test scenarios before submitting applications. Homeloans has LoanZone, a website for brokers, with calculators and other tools and a single application form for all their products.

Of course all these IT pre-application systems could be seen as putting work back into brokers’ laps. But Resimac’s Savins doesn’t agree: “We’ve got a 300-page policy document sitting in Resimac, but you don’t have to remember anything because our rules are sitting in the system.” Such systems, he argues, are already standard for mainstream lenders, so brokers don’t have to do any extra work. He believes technology will increasingly replace checklists and guidelines sheets – “we can’t expect our distributors to remember every lender’s policy”.

Nevertheless, lenders still emphasise the contribution made by their BDMs and sales teams. Better Mortgage Management runs training workshops, while Resimac’s selling team “help with selling skills, overcoming objections, such as how do we stop selling on rate all the time, because everyone is so fixated on interest rates”, Savins says. “We teach them skills of breaking the payment down to a weekly rate.” Training also aims to improve broker confidence, he explains. “A lot of the time the broker says, ‘we can’t offer that interest rate; they won’t take it’. How do you know they won’t take it?”

Non-conforming numberes in concets (click on image for larger image)

EMBRACING PRIME LENDING

Perhaps the ultimate – and some might say most brazen – example of rebranding the term nonconforming is the move of such lenders into prime lending. It’s important, however, to point out that this isn’t a new phenomenon: Resimac, Homeloans and Better Mortgage Management started as prime lenders, and many others have been tentatively involved in the sector for some time. Recently, however, the move towards having a ‘wide shopfront’ has markedly accelerated.

The beginning of 2014 saw Pepper move into prime lending with its Pepper Essential product. “We moved into the area,” explains Rehayem, “purely because brokers and borrowers demanded we have some sort of exit strategy for them.” Prime lending, for Pepper, was at least in part a distribution strategy. Australian First Mortgage’s Paul Grant also notes that AFM’s specialist products were “short-term in nature and will involve an exit strategy”. The emphasis on exit strategies resulted in part from the emphasis on responsible lending. “It helps to give the customer something to work towards,” says Better Mortgage Management’s Cowan.

Proactively moving borrowers to prime loans is a strategy also aimed at brokers. “We’re looking to transition the borrower over time,” Resimac’s Savins explains. “If you have 12 on-time payments your rate will reduce accordingly, so it’s a great one for our brokers because it gives them an ability to touch base with the client again in 12 months.” Homeloans is also developing a process to automatically move non-conforming customers to prime or transitional products, in consultation with the broker. Pepper claims that brokers prefer to keep clients with them, because its policy of no direct contact distinguishes it from banks, who can attempt to cross-sell to borrowers.

Whether non-conforming lenders can go beyond rehabilitating their borrowers and genuinely compete in the prime lending space is open to question. Both Bluestone and La Trobe feel that prime lending is too much of a distraction from their core focus. “The two propositions are different,” argues La Trobe, “and any reason to bridge the two requires careful consideration.” Prime lending makes up about 25% of La Trobe’s deal flow.

Bluestone’s D’Vaz is even less convinced. “The alternatives that the broker has [in prime lending] are massive. We want to play in the space where we feel the competition is minimal … we want to concentrate on our core offering.”

Nevertheless, the move towards prime and transitional products does not look likely to slow down any time soon. All non-conforming lenders tell brokers that a non-conforming client could be a good client for life; many see moving clients to prime products as a key step in forming that relationship. Furthermore, many non-conforming lenders are already well-known non-bank contenders: Better Mortgage Management came top in MPA’s recent Brokers on Non-Banks survey. Pepper’s Rehayem is particularly insistent on that point: “Any non-conforming lender that’s in the business that’s serious about client retention, servicing clients and brokers, then they must have a prime product to make sure they’ve got longevity”.

UN-CAUTIOUS OPTIMISM

Over the last few years, the future has been unerringly bright for non-conforming lenders. The GFC has played a part in this, admits Pepper’s Rehayem: “In all honesty, the market from 2011 started from a very low base.” Many non-conforming lenders took huge hits, and Bluestone only re-entered the market in 2013, for example. So in the years since 2008, a recovering economy and cheaper credit have obviously helped these firms. Several lenders commented on both the reducing cost of funds and the increasing appetite of the RMBS market, highlighted by Moody’s announcement, as key drivers of the non-conforming market. “We have seen month-on-month growth,” Pepper boasts. “Hockey stick growth is an understatement.”

Changes in credit reporting models could also boost the non-conforming sector, Homeloans’ Ray Hair predicts. Clearly the entire sector’s recovery has owed much to banks’ caution in taking on borrowers. However, the move to Comprehensive Credit Reporting earlier this year by the Australian Retail Credit Association could push many more borrowers out of the banking system, as these borrowers become penalised for late payment, where previously only defaults counted. Hair notes that, in the short term, non-conforming lenders’ individualised approach will benefit: “It will take some time for credit models to build up the experience around such things to make any allowance for them, and if you’re a large-volume player the economics of accommodating that don’t stack up.”

Evidently, it no longer makes sense to describe the non-conforming market as ‘recovering’. That era is over; a number of aggressive and ambitious players have now emerged, no longer content to stay in the non-conforming sphere, proud of their alternative approach. All state their commitment to the third-party channel, but brokers who ignore the sector face pressure from both sides, as rebranding eventually impacts on borrowers’ thinking. As Rehayem concludes, “those brokers who don’t make non-conforming part of their business model should be worried: the best of the best use it, so why don’t they?”

Australia’s non-conforming lenders have not had a great winter in the press. August saw international ratings agency Moody’s reveal that $3bn worth of non-conforming loans were written in 18 months, a move that ABC instantly portrayed as a revival of subprime. What could have been a celebration of non-conforming lenders’ success in recovering from the GFC and adapting to NCCP regulations instead was seen as reflecting fragility, conjuring up memories of cowboy subprime lenders from the pre-GFC years.

Non-conforming lenders know these stereotypes this will always be a struggle, but they believe their internal processes and Australian regulations now make the subprime comparison impossible. Indeed Moody’s analyst Roberto Baldi argued that the National Consumer Credit Protection Act “gets around the fact that in the US you saw those loans being written to borrowers pre-2008 with little to no income verification; in Australia that just can’t happen”. Another ratings agency, Standard and Poor’s, gave Pepper a ‘strong’ rating in March, and many other non-bank lenders are also highly rated. What recent events have done is to accelerate a trend, whereby lenders are moving away from the old ‘non-conforming’ – in both name and product offerings. Lenders feel that many brokers are yet to grasp the new reality.

CONFRONTING STEREOTYPES

“What we do is a traditional home loan,” Bluestone’s Royden D’Vaz insists. “It’s just that we have to price it differently due to the higher risks.” This is a message repeated by all the lenders; they want brokers to see them as another option in their panel, not a last resort. Moving away from the latter has involved an extensive process of rebranding their businesses and customers.

HISTORY OF THE TERM ‘NON-CONFORMING’

One reason ‘specialist’ lenders have dropped the term ‘non-conforming’ is its background. The term originates in the US, explains La Trobe’s Paul Wells. There, he says, “a loan either conformed to the government funding programs - FHA, VA, Freddie Mac or Fannie Mae - or it was non-conforming”.

“Most brokers have no idea about that technical derivation,” Wells continues, “and are left guessing what it really means here in Australia.” While non-conforming‘s US roots are known, the original meaning has been confused with subprime lending’s role in the GFC, a purely American phenomenon, Australian lenders argue.

One reason ‘specialist’ lenders have dropped the term ‘non-conforming’ is its background. The term originates in the US, explains La Trobe’s Paul Wells. There, he says, “a loan either conformed to the government funding programs - FHA, VA, Freddie Mac or Fannie Mae - or it was non-conforming”.

“Most brokers have no idea about that technical derivation,” Wells continues, “and are left guessing what it really means here in Australia.” While non-conforming‘s US roots are known, the original meaning has been confused with subprime lending’s role in the GFC, a purely American phenomenon, Australian lenders argue.

While all the lenders commend 2010’s NCCP regulations, many highlight that while the number of potential borrowers has increased, fewer brokers feel qualified to handle such borrowers. Stricter rules on bank lending have pushed customers into the non-conforming sector, explains AFM’s Paul Grant: “Banks’ scoring policing [is] strict and [is] not suiting or accommodating, for example, the current way people are being paid.” Pepper’s Mario Rehayem argues that bank reluctance has “nothing to do with the borrower themselves; it’s about the market squeeze out there”. Resimac estimates 80% of their borrowers have clear credit.

Despite this, non-conforming products are still “the most underrated product within the market”, laments Rehayem. Non-conforming lenders still have a tiny share of the market – around 3% of outstanding residential mortgage backed securities (RMBS), according to Standard and Poor’s, and this is partly because many brokers still believe NCCP regulations make it just too difficult to write non-conforming loans.

Non-conforming clients are still a relatively rare occurrence for brokers. “You could go three months without seeing a client like this,” reckons Resimac’s Allan Savins. Evidently many brokers feel they’re not worth the effort.

The response from lenders is unwaveringly direct. Those who turn down non-conforming clients “need to be a broker, not just a bank broker”, says Rehayem. Similarly, Savins reasons that “when you start off being a broker, writing a prime loan isn’t really what it’s about; it’s about providing a solution … specialist provides that; it’s about not letting your client walk out the door, providing brokers with a client-for-life opportunity”. For La Trobe’s Paul Wells, “it’s about maximising earning potential, and [brokers] owe it to themselves to assist all loans that they inevitably come across”. He says: “Never put all your eggs into one prime basket.”

THE INDIVIDUAL APPROACH

In conjunction with rebranding, lenders are reforming their processing to counter brokers’ perceptions that non-conforming borrowers require more work. But they are also increasingly eager to stress how their assessment process differs from banks, and can in fact be superior to institutional models, a crucial claim as they transform from ‘non-conforming’ to ‘specialist’ lenders.

“There’s an art to this type of lending, which makes it specialist by nature,” stresses Resimac’s Savins. Homeloans’ Ray Hair is more circumspect: “Whether you call it non-conforming or specialist, I don’t think is really the issue. It’s around understanding that it’s an individualised approach to credit assessment as opposed to a credit scoring or institutionalised model.”

For all these lenders, assessment necessitates an analyst looking at each and every application. The sheer volumes handled by banks make them “more like a production line”, argues Pepper’s Rehayem, whereas Pepper’s approach is “like the old days when you use to walk into a branch and have the bank manager look you in the eyes”.

Assessment processes are in reality a little bit more advanced than that. Some lenders, like Better Mortgage Management, have taken to viewing borrowers’ properties on Google Street View, for example. Yet a number of mantras remain, such as Bluestone’s and Resimac’s ‘three S’s’, these being security, serviceability, and scenario (ie story). Acquiring information for the latter is what separates specialist lenders from the traditional approach; they need documents to back up the story. This also requires brokers to go a little deeper in their research. Resimac gave one example in which a borrower had a huge one-off credit card bill on record. The reason? They had just paid for a course of IVF – an emotional decision, but hardly one that made them a bad borrower.

While this is extra work, lenders are prepared to do much of it themselves. What they disagree on is how far to respect a broker’s control over the client. Pepper and Homeloans say they never talk directly to borrowers; La Trobe and Better Mortgage Management make it a requirement for an application, feeling it’s a vital step in checking details. “At first some of our broker partners have been a little surprised by that,” recalls Better Mortgage Management’s Murray Cowan, “but once we explained to them that it helps with compliance for us, for them and their aggregator, they normally don’t mind that.”

ASSESSING NON-CONFORMING CLIENTS: THE 3 S’S

Security

“Two of the 3 S’s are exactly the same as you get for prime lending,” Resimac’s Allan Savins argues. “They are security and servicing.” Security is often determined from credit reports, but some, like Better Mortage Management, will go as far as to look at borrowers’ properties on Google Street View.

Servicing

A crucial question that Bluestone’s Royden D’Vaz asks is: do they service the loan? That also extends to whether they can service the loan. Resimac insists that “we will not put a borrower in a worse position – there has to a financial benefit for that client”.

Scenario

This is what non-conforming lenders pride themselves on understanding. As Royden D’Vaz explains, “What we ask is, if you’re falling behind on your repayments, what’s your story? What happened?” Lenders look to distinguish the one-off unlucky borrower from habitual defaulters.

Security

“Two of the 3 S’s are exactly the same as you get for prime lending,” Resimac’s Allan Savins argues. “They are security and servicing.” Security is often determined from credit reports, but some, like Better Mortage Management, will go as far as to look at borrowers’ properties on Google Street View.

Servicing

A crucial question that Bluestone’s Royden D’Vaz asks is: do they service the loan? That also extends to whether they can service the loan. Resimac insists that “we will not put a borrower in a worse position – there has to a financial benefit for that client”.

Scenario

This is what non-conforming lenders pride themselves on understanding. As Royden D’Vaz explains, “What we ask is, if you’re falling behind on your repayments, what’s your story? What happened?” Lenders look to distinguish the one-off unlucky borrower from habitual defaulters.

PROMOTING TECHNOLOGY

Most lenders claim that, for properly submitted loan applications, their rejection rates are very low – around 10–20%. The same applies to turnaround times, which are usually 24–48 hours. To help brokers write non-conforming loans, they’ve developed a number of tools, ranging from standard checklists to specialised online assessment programs.

Smart educational tools are becoming a core offering for non-conforming lenders. There was considerable media attention when Pepper recently launched a new module on specialist lending for its Better Business E-Learning Hub. Other lenders have similar tools. Better Mortgage Management has its PAL (place a loan) system, through which brokers present criteria about a client, such as whether financials are available, and they’ll be directed to a loan. Resimac’s ASK tool also allows brokers to test scenarios before submitting applications. Homeloans has LoanZone, a website for brokers, with calculators and other tools and a single application form for all their products.

Of course all these IT pre-application systems could be seen as putting work back into brokers’ laps. But Resimac’s Savins doesn’t agree: “We’ve got a 300-page policy document sitting in Resimac, but you don’t have to remember anything because our rules are sitting in the system.” Such systems, he argues, are already standard for mainstream lenders, so brokers don’t have to do any extra work. He believes technology will increasingly replace checklists and guidelines sheets – “we can’t expect our distributors to remember every lender’s policy”.

Nevertheless, lenders still emphasise the contribution made by their BDMs and sales teams. Better Mortgage Management runs training workshops, while Resimac’s selling team “help with selling skills, overcoming objections, such as how do we stop selling on rate all the time, because everyone is so fixated on interest rates”, Savins says. “We teach them skills of breaking the payment down to a weekly rate.” Training also aims to improve broker confidence, he explains. “A lot of the time the broker says, ‘we can’t offer that interest rate; they won’t take it’. How do you know they won’t take it?”

Non-conforming numberes in concets (click on image for larger image)

EMBRACING PRIME LENDING

Perhaps the ultimate – and some might say most brazen – example of rebranding the term nonconforming is the move of such lenders into prime lending. It’s important, however, to point out that this isn’t a new phenomenon: Resimac, Homeloans and Better Mortgage Management started as prime lenders, and many others have been tentatively involved in the sector for some time. Recently, however, the move towards having a ‘wide shopfront’ has markedly accelerated.

The beginning of 2014 saw Pepper move into prime lending with its Pepper Essential product. “We moved into the area,” explains Rehayem, “purely because brokers and borrowers demanded we have some sort of exit strategy for them.” Prime lending, for Pepper, was at least in part a distribution strategy. Australian First Mortgage’s Paul Grant also notes that AFM’s specialist products were “short-term in nature and will involve an exit strategy”. The emphasis on exit strategies resulted in part from the emphasis on responsible lending. “It helps to give the customer something to work towards,” says Better Mortgage Management’s Cowan.

Proactively moving borrowers to prime loans is a strategy also aimed at brokers. “We’re looking to transition the borrower over time,” Resimac’s Savins explains. “If you have 12 on-time payments your rate will reduce accordingly, so it’s a great one for our brokers because it gives them an ability to touch base with the client again in 12 months.” Homeloans is also developing a process to automatically move non-conforming customers to prime or transitional products, in consultation with the broker. Pepper claims that brokers prefer to keep clients with them, because its policy of no direct contact distinguishes it from banks, who can attempt to cross-sell to borrowers.

Whether non-conforming lenders can go beyond rehabilitating their borrowers and genuinely compete in the prime lending space is open to question. Both Bluestone and La Trobe feel that prime lending is too much of a distraction from their core focus. “The two propositions are different,” argues La Trobe, “and any reason to bridge the two requires careful consideration.” Prime lending makes up about 25% of La Trobe’s deal flow.

Bluestone’s D’Vaz is even less convinced. “The alternatives that the broker has [in prime lending] are massive. We want to play in the space where we feel the competition is minimal … we want to concentrate on our core offering.”

Nevertheless, the move towards prime and transitional products does not look likely to slow down any time soon. All non-conforming lenders tell brokers that a non-conforming client could be a good client for life; many see moving clients to prime products as a key step in forming that relationship. Furthermore, many non-conforming lenders are already well-known non-bank contenders: Better Mortgage Management came top in MPA’s recent Brokers on Non-Banks survey. Pepper’s Rehayem is particularly insistent on that point: “Any non-conforming lender that’s in the business that’s serious about client retention, servicing clients and brokers, then they must have a prime product to make sure they’ve got longevity”.

UN-CAUTIOUS OPTIMISM

Over the last few years, the future has been unerringly bright for non-conforming lenders. The GFC has played a part in this, admits Pepper’s Rehayem: “In all honesty, the market from 2011 started from a very low base.” Many non-conforming lenders took huge hits, and Bluestone only re-entered the market in 2013, for example. So in the years since 2008, a recovering economy and cheaper credit have obviously helped these firms. Several lenders commented on both the reducing cost of funds and the increasing appetite of the RMBS market, highlighted by Moody’s announcement, as key drivers of the non-conforming market. “We have seen month-on-month growth,” Pepper boasts. “Hockey stick growth is an understatement.”

Changes in credit reporting models could also boost the non-conforming sector, Homeloans’ Ray Hair predicts. Clearly the entire sector’s recovery has owed much to banks’ caution in taking on borrowers. However, the move to Comprehensive Credit Reporting earlier this year by the Australian Retail Credit Association could push many more borrowers out of the banking system, as these borrowers become penalised for late payment, where previously only defaults counted. Hair notes that, in the short term, non-conforming lenders’ individualised approach will benefit: “It will take some time for credit models to build up the experience around such things to make any allowance for them, and if you’re a large-volume player the economics of accommodating that don’t stack up.”

Evidently, it no longer makes sense to describe the non-conforming market as ‘recovering’. That era is over; a number of aggressive and ambitious players have now emerged, no longer content to stay in the non-conforming sphere, proud of their alternative approach. All state their commitment to the third-party channel, but brokers who ignore the sector face pressure from both sides, as rebranding eventually impacts on borrowers’ thinking. As Rehayem concludes, “those brokers who don’t make non-conforming part of their business model should be worried: the best of the best use it, so why don’t they?”