This AMA-winning brokerage is redefining broking in regional areas through sophisticated marketing to its local community

Tropical north Queensland is a far from obvious location for an award-winning brokerage. Nor are such brokerages typically run by a husband and wife team focusing mainly on residential owner-occupier mortgages. Cairns Mortgage Brokers is all those things, and it’s taking a fresh strategic approach to regional broking.

Roger Ward and his wife Michelle are in fact from Sydney, and Roger has been in broking since 1995, when he started at Aussie. “It was a brilliant entry into the finance business. Aussie was a great training ground in those days.”

After stints at Westpac and ANZ, Roger set up WardFinance.com.au in 2002. Michelle’s background is in sales, including at Fairfax’s real estate giant Domain.com.au from 2005.

Although their careers were going well, after surviving the GFC it was time for a change, Roger recalls. “We didn’t have enough time for ourselves and raising our family.”

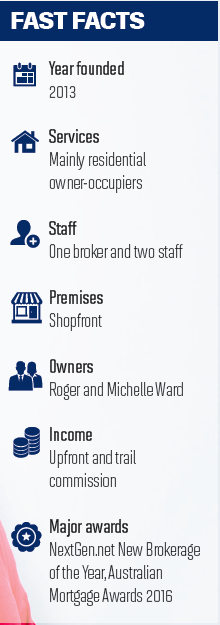

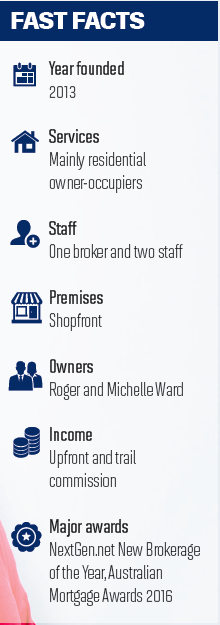

A year’s sabbatical in Port Douglas in 2011 was followed by a permanent move to Cairns and the founding of Cairns Mortgage Brokers in 2013.

A year’s sabbatical in Port Douglas in 2011 was followed by a permanent move to Cairns and the founding of Cairns Mortgage Brokers in 2013.

The brokerage is very much a product of these years of experience, Roger explains.

“When we started Cairns Mortgage Brokers it was about Michelle and I: how we wanted to run a business, and how it should be run.”

By 2013 Roger had a Diploma of Mortgage Lending and a Diploma of Financial Planning, and was one of the very few senior fellows of Finsia [the Finance Institute of Australia], while Michelle had experience in marketing, building websites and SEO [search engine optimisation]. They wanted to create a brokerage that could trade on that expertise.

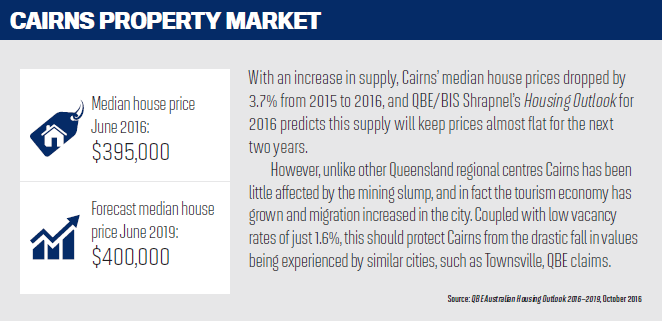

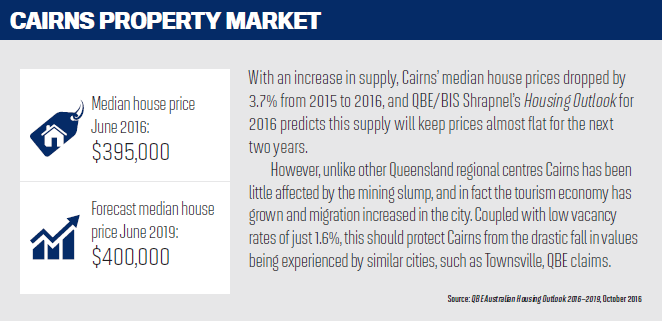

Having a point of difference was vital, because – contrary to expectations – competition between brokers in regional centres like Cairns was tough. Banks have long struggled in regional areas because their experienced lending staff tend to move or get promoted away, leaving brokers to fill the void. Aussie and Smartline have shopfronts in Cairns, in addition to several independent brokerages which were well established by the time the Wards arrived. Brokerages have to deal with another challenge: a much lower average property price, and hence commission, means brokers have to account for every hour spent on a deal.

The brokerage needed to start strong and get its name out quickly, Roger says. “We wanted to establish ourselves and own that space as an expert, as a professional, as a person who had proper qualifications to advise on finance, and we did that by establishing excellent relationships with the local media.”

He became a regular expert commentator for ABC Far North and the Cairns Post, while writing a column on Port Douglas’s local news website Newsport. Getting the attention of the local media requires preparation, Ward insists. “You can’t ask for these sorts of things; you’ve got to have the stories prepared beforehand, with background information to read and good-quality comment.”

Cairns Mortgage Brokers had those stories, because from the get-go they had run a pro bono program helping local women who had been in financially destructive relationships. Roger put his experience and reputation in financial services to good use, such as in the case of a woman whose ex-husband had caused a default on a jointly held loan. “When she went to buy a home – a very humble home, but something very necessary to create a stable environment for the children – she was being knocked back by all and sundry.” He personally wrote to all the banks and explained her otherwise perfect financial history and they removed the default notice.

The Wards also invested heavily in the brokerage’s website. “I have had an unfair advantage up here,” Roger jokes. “A full-time marketing professional working on a business like mine, which is absolutely unheard of.”

Michelle built the brokerage’s website and then positioned it so that it came top of organic Google searches, which gave the brokerage a huge advantage because of the importance of the internet to regional consumers. Subsequently, Cairns Mortgage Brokers was a finalist for the Most Effective Internet Presence award at the AMAs.

The Wards are now well established in Cairns, but the brokerage still has a long way to go, Roger says. “We’re making inroads into market share and expect that to be growing year-on-year.”

They currently have one member of staff, who works on processing, but that number is set to increase. They are also diversifying and have set up CairnsCommercialLoans.com.au to capture the attention of local business customers; the website was again built by Michelle.

It’s all about pushing the brokerage forward regardless of what others are doing, Roger says. “We understood what the competition was about, but our success had to be built on our own high standards.”

Roger Ward and his wife Michelle are in fact from Sydney, and Roger has been in broking since 1995, when he started at Aussie. “It was a brilliant entry into the finance business. Aussie was a great training ground in those days.”

After stints at Westpac and ANZ, Roger set up WardFinance.com.au in 2002. Michelle’s background is in sales, including at Fairfax’s real estate giant Domain.com.au from 2005.

Although their careers were going well, after surviving the GFC it was time for a change, Roger recalls. “We didn’t have enough time for ourselves and raising our family.”

A year’s sabbatical in Port Douglas in 2011 was followed by a permanent move to Cairns and the founding of Cairns Mortgage Brokers in 2013.

A year’s sabbatical in Port Douglas in 2011 was followed by a permanent move to Cairns and the founding of Cairns Mortgage Brokers in 2013.The brokerage is very much a product of these years of experience, Roger explains.

“When we started Cairns Mortgage Brokers it was about Michelle and I: how we wanted to run a business, and how it should be run.”

By 2013 Roger had a Diploma of Mortgage Lending and a Diploma of Financial Planning, and was one of the very few senior fellows of Finsia [the Finance Institute of Australia], while Michelle had experience in marketing, building websites and SEO [search engine optimisation]. They wanted to create a brokerage that could trade on that expertise.

Having a point of difference was vital, because – contrary to expectations – competition between brokers in regional centres like Cairns was tough. Banks have long struggled in regional areas because their experienced lending staff tend to move or get promoted away, leaving brokers to fill the void. Aussie and Smartline have shopfronts in Cairns, in addition to several independent brokerages which were well established by the time the Wards arrived. Brokerages have to deal with another challenge: a much lower average property price, and hence commission, means brokers have to account for every hour spent on a deal.

The brokerage needed to start strong and get its name out quickly, Roger says. “We wanted to establish ourselves and own that space as an expert, as a professional, as a person who had proper qualifications to advise on finance, and we did that by establishing excellent relationships with the local media.”

He became a regular expert commentator for ABC Far North and the Cairns Post, while writing a column on Port Douglas’s local news website Newsport. Getting the attention of the local media requires preparation, Ward insists. “You can’t ask for these sorts of things; you’ve got to have the stories prepared beforehand, with background information to read and good-quality comment.”

Cairns Mortgage Brokers had those stories, because from the get-go they had run a pro bono program helping local women who had been in financially destructive relationships. Roger put his experience and reputation in financial services to good use, such as in the case of a woman whose ex-husband had caused a default on a jointly held loan. “When she went to buy a home – a very humble home, but something very necessary to create a stable environment for the children – she was being knocked back by all and sundry.” He personally wrote to all the banks and explained her otherwise perfect financial history and they removed the default notice.

The Wards also invested heavily in the brokerage’s website. “I have had an unfair advantage up here,” Roger jokes. “A full-time marketing professional working on a business like mine, which is absolutely unheard of.”

Michelle built the brokerage’s website and then positioned it so that it came top of organic Google searches, which gave the brokerage a huge advantage because of the importance of the internet to regional consumers. Subsequently, Cairns Mortgage Brokers was a finalist for the Most Effective Internet Presence award at the AMAs.

The Wards are now well established in Cairns, but the brokerage still has a long way to go, Roger says. “We’re making inroads into market share and expect that to be growing year-on-year.”

They currently have one member of staff, who works on processing, but that number is set to increase. They are also diversifying and have set up CairnsCommercialLoans.com.au to capture the attention of local business customers; the website was again built by Michelle.

It’s all about pushing the brokerage forward regardless of what others are doing, Roger says. “We understood what the competition was about, but our success had to be built on our own high standards.”