How Altfi lenders are pioneering online, flexible and quick lending to SMEs and beyond

It’s not funding that makes alternative lenders important to brokers, but their approach to lending – online, flexible and, above all, quick, writes MPA editor Sam Richardson

Brokers, as a group, still think they’re the big disruptors. The stories of Symonds, Bouris and co. bursting onto the lending scene in the early ’90s to challenge the banks continues to define the industry, both in the minds of brokers themselves and for the general public.

That’s all true; what’s no longer true is that brokers are the only disruptors in town. Australia’s banks, warned Morgan Stanley equity analyst Richard Wiles, “are more vulnerable to disruption than at any time in the past 25 years”. The catch? Wiles was speaking not at a broker conference but at Australia’s inaugural Alternative Finance Summit, held earlier this year in Sydney.

Alternative finance has, for a number of years, been considered just another one of the many post-GFC developments that were meant to bring banks down but failed to do so. Yet bankers, academics and regulators increasingly see alternative finance as different. Robert Wardrop, executive director at Cambridge University’s Centre for Alternative Finance (CCAF) in the UK, began studying the sector several years ago. “We realised that what was going on was not a cyclical change; it was not something going on because people didn’t trust banks anymore,” he says. “It really was a technology-driven phenomenon and a behaviour change-driven phenomenon.”

Morgan Stanley, reporting on the sector in June 2015, called Australia “a market to watch recent changes in credit reporting, among other factors, bode well for innovators”. Our financial system is being ‘disrupted’ – even if the extent of that disruption can be debated – and brokers are perhaps for the first time one of the incumbents. Alternative finance providers, and the fintech sector more generally, launched with an ambition to challenge reigning incumbents by going direct to the consumer, Wardrop explains. “Fintech entrepreneurs say, ‘we’re going to put the banks out of business’ – and here you can substitute ‘broker’ for ‘bank’.” Or as Mitchel Harad of marketplace lender SocietyOne put it at the AltFi Summit: “I find the Australian market to be dramatically more enticing; the Australian consumer gets absolutely screwed.”

In this piece we look at the areas of a broker’s business that are being touched by marketplace lending: unsecured consumer lending, SME finance, and even mortgages. We’ll consider how these lenders work (or don’t work) with brokers, and what brokers can learn from their approach to sales. We’ll also look at the rate of growth; marketplace lending for mortgages is small, but with huge prospects, according to Wardrop. “What you’re going to see is that as these markets develop, this segment explodes in growth. I mean, explodes.”

Understanding the development of alternative finance

Three events mark the ‘arrival’ of alternative finance as a real force on these shores. The first was the above-mentioned AltFi Summit; the second – for reasons that will be explained later – was Westpac’s venture capital fund buying into marketplace lender SocietyOne in March 2014, and the third was the publication of the CCAF’s Asia-Pacific Alternative Finance Benchmarking Report in March 2016, which provided detailed data on Australia’s alternative finance sector.

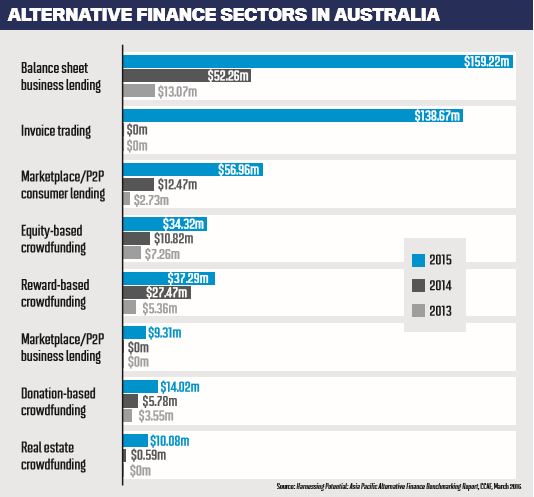

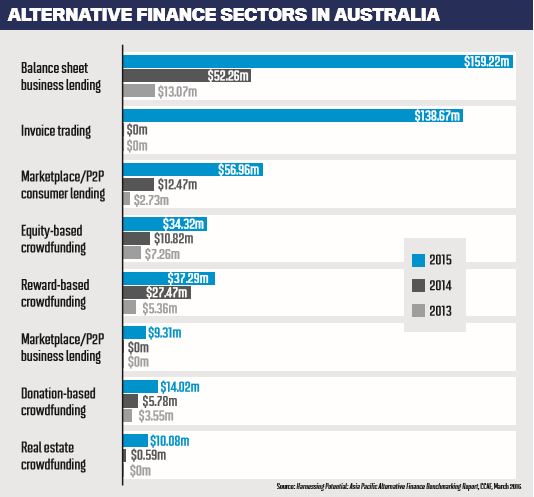

According to the report, Australia’s alternative finance market grew 320% in 2015, leading the region on balance sheet lending and invoice trading. The report noted that “the development of the alternative consumer and business lending sector in Australia has been able to scale rapidly in such a short time, bolstered by institutional funding”. Threats to growth could come from regulation, the report noted, which 30% of surveyed platforms in Australia thought was too strict and excessive.

At the AltFi Summit, there was a sense that alternative lenders were waiting for regulators to catch up. Tony Triebel, CEO of marketplace lender Spotcap, told MPA’s sister publication Australian Broker that a legal framework “fosters credibility and trust amongst our target client base and gives the framework for good and solid players to function in”.

Overall, however, lenders were positive, and most of the discussion of the day centred on the SME space. “I think there’s a huge opportunity in the Australian market to grow that small business space,” Lisa Jacobs, chief strategy officer of Funding Circle, told Australian Broker.

Balance sheet lending for businesses is the biggest form of alternative finance in Australia, worth almost $160m, according to the APAC report, followed by invoice trading, and while marketplace lending to businesses ($9m) lags behind its consumer counterpart ($57m), it’s apparent that marketplace lenders here, including the above-mentioned Spotcap, Funding Circle and SocietyOne, are focused on businesses.

“From a borrower’s perspective we’re no different from any other lender,” explained CEO John Goodall. “Some of them wouldn’t even know we’re a peer-to-peer lender, and we don’t advertise that.” While the underwriting is more complicated on the investor side, the basic process is simple: “You can invest £100 upwards; we divide mortgages into micro loans, and you get fractional ownership of mortgages”, Goodall said. As Landbay is regulated as a peer-to-peer lender, rather than a mortgage lender, it only lends to investment properties.

Investment properties are a huge market in Australia, for many of the same reasons as in the UK. Marketplace lenders in this area can get funding from retail investors because of public familiarity with property investment, Wardrop explains. “Everybody here has a neighbour who has built the retirement portfolio successfully over the past 15–20 years with buy-to-let properties.” On the demand side, the UK Government has been working to restrict bank funding for investors – which is not too dissimilar to APRA’s intervention in this market in Australia. Goodall is “sure” marketplace mortgage lending will come to Australia, and Wardrop says “subject to the regulatory environment you’re going to see this happen faster than two years”.

Taking an alternative approach to lending

Marketplace lending is new for two reasons: its peer-to-peer funding base, and the way it lends – online through smart data. That funding base, however, may not be so disruptive after all, according to Mike Abel, managing director of financial services at Accenture Australia. “Peer-to-peer is not a space that we focus a lot of attention on, and probably I’m answering your question with that statement alone,” Abel says.

Instead peer-to-peer lending is an area of interest for Australia’s banks, he says. “They look at it and follow it, only because it’s a potential disruptor and it has had a disruptive influence in overseas markets – the US and UK.”

Australia’s major banks survived brokers, the GFC and the efforts of non-majors and aren’t too concerned, as CBA’s head of partnerships, Toby Norton-Smith, noted at the recent AltFi Summit. “It’s fairly clear as a bank we don’t see a meteorite approaching ... [however] the rate of evolution has increased.”

Many marketplace lenders are also fintechs; unburdened by legacy systems they can use big data to make smarter and quicker lending decisions, with borrowers applying online. Morgan Stanley saw why that technology would be attractive for banks back in 2015. “The fastest growing marketplace platforms are not really peer-to-peer but institutional investors,” analyst Smittipon Srethapramote wrote, “partnering with tech platforms to cherry-pick borrowers, often with offline marketing.”

Australian banks are more than just interested: CBA recently partnered with SME lender OnDeck, and Norton-Smith noted that “the talent that is associated with [fintechs] is an incredible pool of innovation for banks to tap into”. Additionally, Westpac is funding Prospa and ANZ is partnering with SME tech platform Honcho; and smaller lenders have also got in on the game, with Auswide partnering with MoneyPlace.

Marketplace lenders are enthusiastic about these partnerships, with Spotcap boss Triebel commenting that “the biggest groundbreaking innovation will probably come from collaboration: collaboration with banks, collaboration with institutions”.

Would marketplace lenders be so enthusiastic about partnering with brokers? In fact, they already are: all of the lenders mentioned so far in this article, with the exception of OnDeck, currently work with brokers. Landbay, the UK mortgage lender, has “more demand from brokers than we can handle”. The UK underwent a process of ‘reintermediation’, according to AltFi Summit organiser David Stevenson, because marketplace lenders needed the credibility and distribution network brokers could provide.

Brokers provide the emerging marketplace lending sector with a helpful leg-up, but alternative finance has not developed far enough in any market to demonstrate what comes next. “These online platforms are a threat for a poor broker and an opportunity for a good broker,” argued Wardrop. “A broker reputation with a track record becomes a signal of quality for a deal.” Nevertheless, CCAF’s Wardrop believes some lenders will always see brokers as a dispensable part of an “inefficient” system. “What’s going to happen is you’re probably going to see brokers start platforms and say, ‘we need to change our business model or diversify’.”

Diversifying could solve two problems for brokers. “I think the brokers are in the same boat as the banks,” says Accenture boss Abel. “Right now they provide a particular product across a much wider service: that service is buying a house … there will be trouble when somebody comes along and provides the whole process.”

Abel suggests brokers should diversify in order to provide services across the entire home-buying process, and indeed some already do: in MPA 16.5 we looked at diversifying brokerages, including Cube Central, run by Scott Beattie. Cube Central has a service called Cube Connect, which is all about what happens after the loan settles. “Chances are when you move into your new home you’re going to need phone, electricity, gas; we arrange all of those things for you … it has probably the least effect on income generation, but it’s the thing we’re getting the most positive feedback from,” Beattie told MPA.

Keep an eye on the technology

Abel’s ultimate message – that the method by which marketplace lenders lend is more important than where they get their funding – is also a good takeaway for brokers. It’s extremely difficult to predict the degree of disruption that marketplace lending in terms of peer-to-peer funding will have on the market. While there are certainly immediate opportunities in partnering with these lenders, brokers should keep an eye on where the technology is moving, because the banks are certainly watching with interest.

Most of all, brokers must accept that they, along with the banks, are the incumbent force disruptors are targeting. As Wardrop explains, that’s a concern which should be constantly on brokers’ minds. “So as long as no one moves, nothing’s going to change, but someone’s going to want to disrupt an inefficient market at some point; it’s inevitable."

Brokers, as a group, still think they’re the big disruptors. The stories of Symonds, Bouris and co. bursting onto the lending scene in the early ’90s to challenge the banks continues to define the industry, both in the minds of brokers themselves and for the general public.

That’s all true; what’s no longer true is that brokers are the only disruptors in town. Australia’s banks, warned Morgan Stanley equity analyst Richard Wiles, “are more vulnerable to disruption than at any time in the past 25 years”. The catch? Wiles was speaking not at a broker conference but at Australia’s inaugural Alternative Finance Summit, held earlier this year in Sydney.

Alternative finance has, for a number of years, been considered just another one of the many post-GFC developments that were meant to bring banks down but failed to do so. Yet bankers, academics and regulators increasingly see alternative finance as different. Robert Wardrop, executive director at Cambridge University’s Centre for Alternative Finance (CCAF) in the UK, began studying the sector several years ago. “We realised that what was going on was not a cyclical change; it was not something going on because people didn’t trust banks anymore,” he says. “It really was a technology-driven phenomenon and a behaviour change-driven phenomenon.”

“When you see disruptions in other markets it doesn’t take a rocket scientist to see the trajectory in your market”

A quick glance at the CCAF’s numbers confirms that alternative finance has come a long way since then. The market in Australia is now worth $457m, the CCAF reported in March, and is the third largest in the Asia-Pacific region. It’s worth $4.2bn in the UK, a country with less than three times the population of Australia, and Wardrop sees Australia following a similar path. “When you see disruptions in other markets it doesn’t take a rocket scientist to see the trajectory in your market,” he says.Morgan Stanley, reporting on the sector in June 2015, called Australia “a market to watch recent changes in credit reporting, among other factors, bode well for innovators”. Our financial system is being ‘disrupted’ – even if the extent of that disruption can be debated – and brokers are perhaps for the first time one of the incumbents. Alternative finance providers, and the fintech sector more generally, launched with an ambition to challenge reigning incumbents by going direct to the consumer, Wardrop explains. “Fintech entrepreneurs say, ‘we’re going to put the banks out of business’ – and here you can substitute ‘broker’ for ‘bank’.” Or as Mitchel Harad of marketplace lender SocietyOne put it at the AltFi Summit: “I find the Australian market to be dramatically more enticing; the Australian consumer gets absolutely screwed.”

In this piece we look at the areas of a broker’s business that are being touched by marketplace lending: unsecured consumer lending, SME finance, and even mortgages. We’ll consider how these lenders work (or don’t work) with brokers, and what brokers can learn from their approach to sales. We’ll also look at the rate of growth; marketplace lending for mortgages is small, but with huge prospects, according to Wardrop. “What you’re going to see is that as these markets develop, this segment explodes in growth. I mean, explodes.”

Understanding the development of alternative finance

Three events mark the ‘arrival’ of alternative finance as a real force on these shores. The first was the above-mentioned AltFi Summit; the second – for reasons that will be explained later – was Westpac’s venture capital fund buying into marketplace lender SocietyOne in March 2014, and the third was the publication of the CCAF’s Asia-Pacific Alternative Finance Benchmarking Report in March 2016, which provided detailed data on Australia’s alternative finance sector.

According to the report, Australia’s alternative finance market grew 320% in 2015, leading the region on balance sheet lending and invoice trading. The report noted that “the development of the alternative consumer and business lending sector in Australia has been able to scale rapidly in such a short time, bolstered by institutional funding”. Threats to growth could come from regulation, the report noted, which 30% of surveyed platforms in Australia thought was too strict and excessive.

At the AltFi Summit, there was a sense that alternative lenders were waiting for regulators to catch up. Tony Triebel, CEO of marketplace lender Spotcap, told MPA’s sister publication Australian Broker that a legal framework “fosters credibility and trust amongst our target client base and gives the framework for good and solid players to function in”.

Overall, however, lenders were positive, and most of the discussion of the day centred on the SME space. “I think there’s a huge opportunity in the Australian market to grow that small business space,” Lisa Jacobs, chief strategy officer of Funding Circle, told Australian Broker.

Balance sheet lending for businesses is the biggest form of alternative finance in Australia, worth almost $160m, according to the APAC report, followed by invoice trading, and while marketplace lending to businesses ($9m) lags behind its consumer counterpart ($57m), it’s apparent that marketplace lenders here, including the above-mentioned Spotcap, Funding Circle and SocietyOne, are focused on businesses.

“From a borrower’s perspective we’re no different from any other lender”

Real estate lending has been much slower to develop, for various reasons: the large sums involved; the reluctance of borrowers, and, adds the CCAF’s Wardrop, the complexities of dividing secured lending between multiple lenders. However, his ‘explosion’ prediction is beginning to materialise in the UK, where finance funding of real estate grew to $700m in February, according to the CCAF’s UK benchmarking report. There are growing marketplace lenders for mortgages in the UK, with the first being Landbay, whose founder talked to MPA about the challenges involved for this type of lender.“From a borrower’s perspective we’re no different from any other lender,” explained CEO John Goodall. “Some of them wouldn’t even know we’re a peer-to-peer lender, and we don’t advertise that.” While the underwriting is more complicated on the investor side, the basic process is simple: “You can invest £100 upwards; we divide mortgages into micro loans, and you get fractional ownership of mortgages”, Goodall said. As Landbay is regulated as a peer-to-peer lender, rather than a mortgage lender, it only lends to investment properties.

Investment properties are a huge market in Australia, for many of the same reasons as in the UK. Marketplace lenders in this area can get funding from retail investors because of public familiarity with property investment, Wardrop explains. “Everybody here has a neighbour who has built the retirement portfolio successfully over the past 15–20 years with buy-to-let properties.” On the demand side, the UK Government has been working to restrict bank funding for investors – which is not too dissimilar to APRA’s intervention in this market in Australia. Goodall is “sure” marketplace mortgage lending will come to Australia, and Wardrop says “subject to the regulatory environment you’re going to see this happen faster than two years”.

Taking an alternative approach to lending

Marketplace lending is new for two reasons: its peer-to-peer funding base, and the way it lends – online through smart data. That funding base, however, may not be so disruptive after all, according to Mike Abel, managing director of financial services at Accenture Australia. “Peer-to-peer is not a space that we focus a lot of attention on, and probably I’m answering your question with that statement alone,” Abel says.

Instead peer-to-peer lending is an area of interest for Australia’s banks, he says. “They look at it and follow it, only because it’s a potential disruptor and it has had a disruptive influence in overseas markets – the US and UK.”

Australia’s major banks survived brokers, the GFC and the efforts of non-majors and aren’t too concerned, as CBA’s head of partnerships, Toby Norton-Smith, noted at the recent AltFi Summit. “It’s fairly clear as a bank we don’t see a meteorite approaching ... [however] the rate of evolution has increased.”

“The fastest growing marketplace platforms are not really peer-to-peer but institutional investors”

Norton-Smith’s attendance at the summit was prompted by a different reason: banks are increasingly partnering with marketplace lenders who lend in a different way. “Anyone can originate; anyone can fund businesses,” David Goldin, CEO of Capify, told Australian Broker. “The real challenge and the real talent is having the underwriting model and the discipline to make sure you’re helping business owners, not hurting them.”Many marketplace lenders are also fintechs; unburdened by legacy systems they can use big data to make smarter and quicker lending decisions, with borrowers applying online. Morgan Stanley saw why that technology would be attractive for banks back in 2015. “The fastest growing marketplace platforms are not really peer-to-peer but institutional investors,” analyst Smittipon Srethapramote wrote, “partnering with tech platforms to cherry-pick borrowers, often with offline marketing.”

Australian banks are more than just interested: CBA recently partnered with SME lender OnDeck, and Norton-Smith noted that “the talent that is associated with [fintechs] is an incredible pool of innovation for banks to tap into”. Additionally, Westpac is funding Prospa and ANZ is partnering with SME tech platform Honcho; and smaller lenders have also got in on the game, with Auswide partnering with MoneyPlace.

Marketplace lenders are enthusiastic about these partnerships, with Spotcap boss Triebel commenting that “the biggest groundbreaking innovation will probably come from collaboration: collaboration with banks, collaboration with institutions”.

A BRIEF GUIDE TO ALTERNATIVE FINANCE

Alternative finance is a catch-all term for lenders and funding models not associated with existing banks. While marketplace lending and peer-to-peer (P2P) lending are often assumed to be the same, marketplace lending includes both individual and institutional (bank) funders; peer-to-peer is strictly funding from individuals.

The 2016 Asia-Pacific Alternative Finance Benchmarking Report used the following definitions:

Marketplace/P2P business lending

Individuals or institutional funders provide a loan to a business borrower

Marketplace/P2P real estate lending

Individuals or institutional funders provide a loan secured against a property to a consumer or business borrower

Balance sheet business lending

The platform entity provides a loan directly to a business borrower

Invoice trading

Individuals or institutional funders purchase invoices or receivable notes from a business (at a discount)

Equity-based crowdfunding

Individuals or institutional funders purchase equity issued by a company

Alternative finance is a catch-all term for lenders and funding models not associated with existing banks. While marketplace lending and peer-to-peer (P2P) lending are often assumed to be the same, marketplace lending includes both individual and institutional (bank) funders; peer-to-peer is strictly funding from individuals.

The 2016 Asia-Pacific Alternative Finance Benchmarking Report used the following definitions:

Marketplace/P2P business lending

Individuals or institutional funders provide a loan to a business borrower

Marketplace/P2P real estate lending

Individuals or institutional funders provide a loan secured against a property to a consumer or business borrower

Balance sheet business lending

The platform entity provides a loan directly to a business borrower

Invoice trading

Individuals or institutional funders purchase invoices or receivable notes from a business (at a discount)

Equity-based crowdfunding

Individuals or institutional funders purchase equity issued by a company

Would marketplace lenders be so enthusiastic about partnering with brokers? In fact, they already are: all of the lenders mentioned so far in this article, with the exception of OnDeck, currently work with brokers. Landbay, the UK mortgage lender, has “more demand from brokers than we can handle”. The UK underwent a process of ‘reintermediation’, according to AltFi Summit organiser David Stevenson, because marketplace lenders needed the credibility and distribution network brokers could provide.

Brokers provide the emerging marketplace lending sector with a helpful leg-up, but alternative finance has not developed far enough in any market to demonstrate what comes next. “These online platforms are a threat for a poor broker and an opportunity for a good broker,” argued Wardrop. “A broker reputation with a track record becomes a signal of quality for a deal.” Nevertheless, CCAF’s Wardrop believes some lenders will always see brokers as a dispensable part of an “inefficient” system. “What’s going to happen is you’re probably going to see brokers start platforms and say, ‘we need to change our business model or diversify’.”

Diversifying could solve two problems for brokers. “I think the brokers are in the same boat as the banks,” says Accenture boss Abel. “Right now they provide a particular product across a much wider service: that service is buying a house … there will be trouble when somebody comes along and provides the whole process.”

Abel suggests brokers should diversify in order to provide services across the entire home-buying process, and indeed some already do: in MPA 16.5 we looked at diversifying brokerages, including Cube Central, run by Scott Beattie. Cube Central has a service called Cube Connect, which is all about what happens after the loan settles. “Chances are when you move into your new home you’re going to need phone, electricity, gas; we arrange all of those things for you … it has probably the least effect on income generation, but it’s the thing we’re getting the most positive feedback from,” Beattie told MPA.

Keep an eye on the technology

Abel’s ultimate message – that the method by which marketplace lenders lend is more important than where they get their funding – is also a good takeaway for brokers. It’s extremely difficult to predict the degree of disruption that marketplace lending in terms of peer-to-peer funding will have on the market. While there are certainly immediate opportunities in partnering with these lenders, brokers should keep an eye on where the technology is moving, because the banks are certainly watching with interest.

Most of all, brokers must accept that they, along with the banks, are the incumbent force disruptors are targeting. As Wardrop explains, that’s a concern which should be constantly on brokers’ minds. “So as long as no one moves, nothing’s going to change, but someone’s going to want to disrupt an inefficient market at some point; it’s inevitable."

TAKING ACTION IN YOUR BROKERAGE

-Next time you’re dealing with an SME, see if there are any alternative lenders on your panel. Consider reaching out to reputable off-panel lenders now

-Keep an eye on the news for altfi mortgage providers expanding to Australia, particularly in our sister publication BrokerNews.com.au

-Look at cost-effective ways to help buyers across the entire lending process. Our report on diversification in MPA 16.5 talks to brokerages that are pioneering this (and includes an extensive interview with Cube Central)

-Next time you’re dealing with an SME, see if there are any alternative lenders on your panel. Consider reaching out to reputable off-panel lenders now

-Keep an eye on the news for altfi mortgage providers expanding to Australia, particularly in our sister publication BrokerNews.com.au

-Look at cost-effective ways to help buyers across the entire lending process. Our report on diversification in MPA 16.5 talks to brokerages that are pioneering this (and includes an extensive interview with Cube Central)