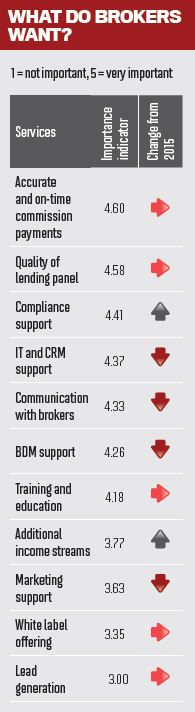

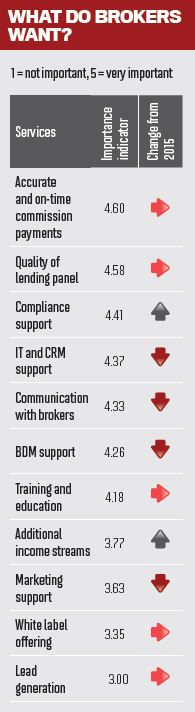

Aggregators respond to your top concerns around commission payments, lender panels and compliance support and tell MPA what they’re doing to improve

When it comes to lenders you can pick and choose, but changing aggregators remains a major challenge. To justify the disruption to your business, you need to have absolute confidence in how changing aggregator could help your business, which is why for several years we’ve detailed aggregator strengths and weaknesses in our Brokers on Aggregators survey.

Highlighting problems doesn’t necessarily mean they get fixed, however. Furthermore unlike banks, which heavily promote new offers, improvements within aggregators can be gradual and difficult to discern. That’s why we decided to go back to seven leading aggregators to find out how they were investing and improving in the areas you told us were most important to your business: accurate and on-time commission payments, their lender panel and compliance support.

Although these concerns have been around for as long as aggregators have existed, they’ve acquired a sense of urgency over the past year. Commission payments are the lifeblood of a brokerage, and as brokers acquire ever more complicated referral networks, aggregators cannot afford to slip up.

When it comes to lender panels, a profusion of new tech-driven personal and business finance lenders offers brokers new opportunities – but only if their aggregator properly finds and on-boards these lenders.

Finally, compliance has become the shadow hanging over their business due to constant reviews by regulators and lenders. Brokers need timely information on regulatory changes, and we asked aggregators what guidance they could provide.

Evidently, aggregators are evolving, as the long list of new lenders on their panels demonstrates. There are several examples of better software being used to improve commission payments and compliance support. Yet personal support – that one-toone chat with our partnership manager – remains the bedrock of aggregator support and it’s encouraging to see more aggregators going beyond generalised PD days to offer more personalised coaching.

Before reading this report, have a look at the MPA’s Brokers on Aggregators survey, from which the topics of this report are drawn. You can find it in MPA 16.10, which is available online as an e-magazine.

Accurate and on-time commission payments

Every year, accurate and on-time commission payments are the most important service an aggregator provides, according to brokers. Yet commission payments remain an area of friction, where differing lender and broker systems clash and late and missed payments are an all too frequent result.

Finding better ways to manage that clash is hugely important to aggregators. As National Mortgage Brokers (NMB) managing director Gerald Foley says, “As an aggregator who works on a commissionshare model, we have a vested interest in maximising the amount of commission our lenders pay us.”

Aggregators take a number of different approaches to that challenge. PLAN Australia uses an independent trustee for its weekly commission payments, which new CEO Anja Pannek says delivers “a secure cash-flow system and peace of mind”.

Outsource pays commission twice a month, for lenders who pay before and after the 20th, ensuring that “members do not have to wait weeks for payments from lenders that pay after the normal commission run disbursement”, explains CEO Tanya Sale.

Specialist Finance Group takes yet another approach, with their “no orphan commissions” policy, whereby any commissions received are paid out and no unclaimed commissions are permitted to remain on the books.

While most aggregators are not planning to radically change their approaches, many look to IT to increase transparency around commission payments.

eChoice Aggregation’s FLeaTS CRM system is being continually improved, explains general manager Blake Buchanan, and now allows brokers to access reports including “specific information on their conversion statistics, lead origination details, lender specific reporting, settlements and commission data”.

Choice Aggregation Services is incorporating commission data into brokers’ CRM systems, says CEO Stephen Moore, “to help brokers segment their database and identify those customers who are of the highest value to them.”

Another advantage of integrating these two data sets is quicker reconciliation of referral disagreements, adds Simon Southwell, head of southern region at FAST. FAST also provides automated reporting of commission monthly variations to keep brokers in the loop.

Transparent systems have another advantage, in helping brokers manage increasingly complicated referral networks. Aggregators have picked up on this, and PLAN and Outsource both mention referrer-related improvements.

PLAN allows incoming commissions to split between referral agreements, which Pannek claims can reduce bureaucracy for brokers. Outsource aims to help brokers strategically manage their referrers, and has developed a new IT system that allows members to “track settlements related to their referrers and to be able to create a report of the settlements for the current year and conduct a comparison to settlements in the previous year.”

Training also plays a role in many aggregators’ strategies.

“Accuracy depends on the input from the members and ensuring that our members know the intricacies of the lenders,” says Sale.

Therefore Outsource offers online videos and courses to its members. Similarly, FAST uses its network of partnership managers “so they know what to expect and when”.

For all the investment in IT, new systems and training, commissions require collaborative action across the industry, as several of our aggregators pointed out.

“Our greatest challenge around accuracy is getting timely and accurate information from some suppliers,” says Foley. “We are continually chasing lenders for commissions due to our brokers. This is an area where many lenders need to step up their service delivery.”

According to Southwell, “aggregators and lenders across the country need to work together to ensure that commission payments are paid more accurately and on time.”

FAST are leading a working group, involving 11 major aggregators, to create common standards for commission payments and address other commission-related challenges. As Southwell explains, its aim is to agitate “for positive change regarding commission payments that will benefit not only FAST brokers but the whole industry.”

Quality of lending panel

Quality of lending panel

Five years ago, there was little to differentiate aggregators’ lending panels: all the majors, many of the non-majors and a smattering of established non-banks.

Today that situation is completely different; we’ve seen a deluge of new tech-driven lenders, many of them in the commercial,personal lending and assets space. However brokers expect more from their aggregator than simply adding all new lenders to the panel – it’s about selecting quality lenders and showing brokers how to use them.

You can find a full list of each aggregator’s recent panel additions in the accompanying sidebar. A quick glance at these new lenders gives an idea of the changing face of lending.

Says Sale: “What we’ve seen in the last 12 months is the need for a reverse mortgage product, personal lending that is away from the normal holidays/cars and more to the leisure side, such as marine crafts and motor bikes and a commercial offering that’s unsecured.”

Responding to these needs, Specialist added reverse mortgage provider Heartland Seniors Finance and unsecured commercial lender Prospa to their panel. Almost every aggregator’s panel added several asset finance providers, from Mildura Finance at eChoice to Silver Chef at PLAN. FAST even launched their own white-label asset finance product FAST Xpress, funded by Westpac – the first time a major has funded a white-label asset finance product, according to Southwell.

2016 actually saw very few big name panel additions; only Virgin Money’s launch with PLAN and FAST really made waves. Instead, the focus is turning to the aforementioned asset finance providers and smaller former and current mutuals and credit unions, such as Bank Australia, who eChoice added to their panel this year.

In order to find other smaller and alternative lenders, Buchanan says: “We have a series of proactive steps to regularly audit and engage our brokers so the whole network benefits from the collective information and experience gathered at the industry coalface.”

Specialist and FAST also noted that they conduct regular reviews of emerging lenders to make sure potentially useful additions aren’t overlooked.

While generally enthusiastic, some aggregators were wary about adding unproven smaller lenders to their panels.

“You have to be careful about thinking you can be everything to everyone – this will only end in tears,” says Sale. “Why waste everyone’s time if you might be able to give them a deal now and again? Outsource gets approached all the time and us being totally transparent will provide a form of respect.”

Foley says NMB “would much rather provide greater flows to our current lenders who have supported us over many years,rather than bringing on new lenders.”

Our aggregators made it clear that diversification has become the main determinant of their lender panel additions.

“The aim is to assist members to transition from transaction-based to relationship-based, mitigate risk and increase their income through diversification of services,” says Frank Paratore, Specialist’s national operations manager.

Highlighting problems doesn’t necessarily mean they get fixed, however. Furthermore unlike banks, which heavily promote new offers, improvements within aggregators can be gradual and difficult to discern. That’s why we decided to go back to seven leading aggregators to find out how they were investing and improving in the areas you told us were most important to your business: accurate and on-time commission payments, their lender panel and compliance support.

Although these concerns have been around for as long as aggregators have existed, they’ve acquired a sense of urgency over the past year. Commission payments are the lifeblood of a brokerage, and as brokers acquire ever more complicated referral networks, aggregators cannot afford to slip up.

When it comes to lender panels, a profusion of new tech-driven personal and business finance lenders offers brokers new opportunities – but only if their aggregator properly finds and on-boards these lenders.

Finally, compliance has become the shadow hanging over their business due to constant reviews by regulators and lenders. Brokers need timely information on regulatory changes, and we asked aggregators what guidance they could provide.

Evidently, aggregators are evolving, as the long list of new lenders on their panels demonstrates. There are several examples of better software being used to improve commission payments and compliance support. Yet personal support – that one-toone chat with our partnership manager – remains the bedrock of aggregator support and it’s encouraging to see more aggregators going beyond generalised PD days to offer more personalised coaching.

Before reading this report, have a look at the MPA’s Brokers on Aggregators survey, from which the topics of this report are drawn. You can find it in MPA 16.10, which is available online as an e-magazine.

Accurate and on-time commission payments

Every year, accurate and on-time commission payments are the most important service an aggregator provides, according to brokers. Yet commission payments remain an area of friction, where differing lender and broker systems clash and late and missed payments are an all too frequent result.

Finding better ways to manage that clash is hugely important to aggregators. As National Mortgage Brokers (NMB) managing director Gerald Foley says, “As an aggregator who works on a commissionshare model, we have a vested interest in maximising the amount of commission our lenders pay us.”

Aggregators take a number of different approaches to that challenge. PLAN Australia uses an independent trustee for its weekly commission payments, which new CEO Anja Pannek says delivers “a secure cash-flow system and peace of mind”.

Outsource pays commission twice a month, for lenders who pay before and after the 20th, ensuring that “members do not have to wait weeks for payments from lenders that pay after the normal commission run disbursement”, explains CEO Tanya Sale.

Specialist Finance Group takes yet another approach, with their “no orphan commissions” policy, whereby any commissions received are paid out and no unclaimed commissions are permitted to remain on the books.

While most aggregators are not planning to radically change their approaches, many look to IT to increase transparency around commission payments.

eChoice Aggregation’s FLeaTS CRM system is being continually improved, explains general manager Blake Buchanan, and now allows brokers to access reports including “specific information on their conversion statistics, lead origination details, lender specific reporting, settlements and commission data”.

Choice Aggregation Services is incorporating commission data into brokers’ CRM systems, says CEO Stephen Moore, “to help brokers segment their database and identify those customers who are of the highest value to them.”

Another advantage of integrating these two data sets is quicker reconciliation of referral disagreements, adds Simon Southwell, head of southern region at FAST. FAST also provides automated reporting of commission monthly variations to keep brokers in the loop.

Transparent systems have another advantage, in helping brokers manage increasingly complicated referral networks. Aggregators have picked up on this, and PLAN and Outsource both mention referrer-related improvements.

PLAN allows incoming commissions to split between referral agreements, which Pannek claims can reduce bureaucracy for brokers. Outsource aims to help brokers strategically manage their referrers, and has developed a new IT system that allows members to “track settlements related to their referrers and to be able to create a report of the settlements for the current year and conduct a comparison to settlements in the previous year.”

Training also plays a role in many aggregators’ strategies.

“Accuracy depends on the input from the members and ensuring that our members know the intricacies of the lenders,” says Sale.

Therefore Outsource offers online videos and courses to its members. Similarly, FAST uses its network of partnership managers “so they know what to expect and when”.

For all the investment in IT, new systems and training, commissions require collaborative action across the industry, as several of our aggregators pointed out.

“Our greatest challenge around accuracy is getting timely and accurate information from some suppliers,” says Foley. “We are continually chasing lenders for commissions due to our brokers. This is an area where many lenders need to step up their service delivery.”

According to Southwell, “aggregators and lenders across the country need to work together to ensure that commission payments are paid more accurately and on time.”

FAST are leading a working group, involving 11 major aggregators, to create common standards for commission payments and address other commission-related challenges. As Southwell explains, its aim is to agitate “for positive change regarding commission payments that will benefit not only FAST brokers but the whole industry.”

“Our greatest challenge around accuracy is getting timely and accurate information from some suppliers” Gerald Foley, National Mortgage Brokers

Quality of lending panel

Quality of lending panelFive years ago, there was little to differentiate aggregators’ lending panels: all the majors, many of the non-majors and a smattering of established non-banks.

Today that situation is completely different; we’ve seen a deluge of new tech-driven lenders, many of them in the commercial,personal lending and assets space. However brokers expect more from their aggregator than simply adding all new lenders to the panel – it’s about selecting quality lenders and showing brokers how to use them.

You can find a full list of each aggregator’s recent panel additions in the accompanying sidebar. A quick glance at these new lenders gives an idea of the changing face of lending.

Says Sale: “What we’ve seen in the last 12 months is the need for a reverse mortgage product, personal lending that is away from the normal holidays/cars and more to the leisure side, such as marine crafts and motor bikes and a commercial offering that’s unsecured.”

Responding to these needs, Specialist added reverse mortgage provider Heartland Seniors Finance and unsecured commercial lender Prospa to their panel. Almost every aggregator’s panel added several asset finance providers, from Mildura Finance at eChoice to Silver Chef at PLAN. FAST even launched their own white-label asset finance product FAST Xpress, funded by Westpac – the first time a major has funded a white-label asset finance product, according to Southwell.

2016 actually saw very few big name panel additions; only Virgin Money’s launch with PLAN and FAST really made waves. Instead, the focus is turning to the aforementioned asset finance providers and smaller former and current mutuals and credit unions, such as Bank Australia, who eChoice added to their panel this year.

In order to find other smaller and alternative lenders, Buchanan says: “We have a series of proactive steps to regularly audit and engage our brokers so the whole network benefits from the collective information and experience gathered at the industry coalface.”

Specialist and FAST also noted that they conduct regular reviews of emerging lenders to make sure potentially useful additions aren’t overlooked.

While generally enthusiastic, some aggregators were wary about adding unproven smaller lenders to their panels.

“You have to be careful about thinking you can be everything to everyone – this will only end in tears,” says Sale. “Why waste everyone’s time if you might be able to give them a deal now and again? Outsource gets approached all the time and us being totally transparent will provide a form of respect.”

Foley says NMB “would much rather provide greater flows to our current lenders who have supported us over many years,rather than bringing on new lenders.”

Our aggregators made it clear that diversification has become the main determinant of their lender panel additions.

“The aim is to assist members to transition from transaction-based to relationship-based, mitigate risk and increase their income through diversification of services,” says Frank Paratore, Specialist’s national operations manager.