Canstar’s group executive of financial services explains why rate hikes aren’t ending anytime soon

Canstar’s group executive of financial services explains why rate hikes aren’t ending anytime soon

Since the last decrease of the RBA Cash Rate in August 2016, we have seen tightening qualitative measures from APRA and a predictable reaction of out-of-cycle rate increases from the banks.

Canstar has interrogated its database to identify the macro-trends in rates since 1st September 2016, a time when the August cash rate cut would have washed through the base data and standard variable rates to better track changes.

Casting our eyes back a little more than 12 months ago, the interest rate regime was pretty straightforward – investment, owner occupied, interest-only and principal and interest were all one rate. Fast forward to today and you will struggle to find this model.

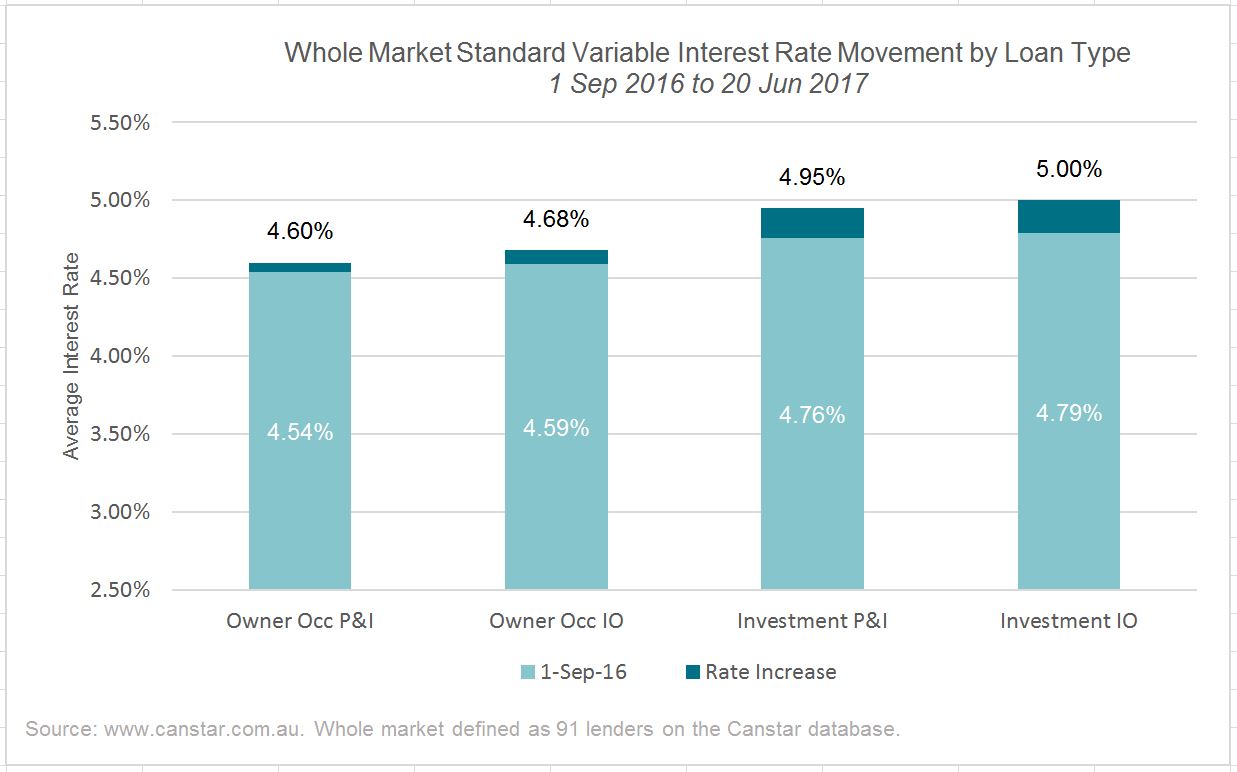

Across the market (the population of 91 Canstar listed lenders) currently the average margin for interest-only investment over principal and interest owner occupied rates is 40 basis points. The trend had started before the 1st September but has since widened from its then 25 basis point.

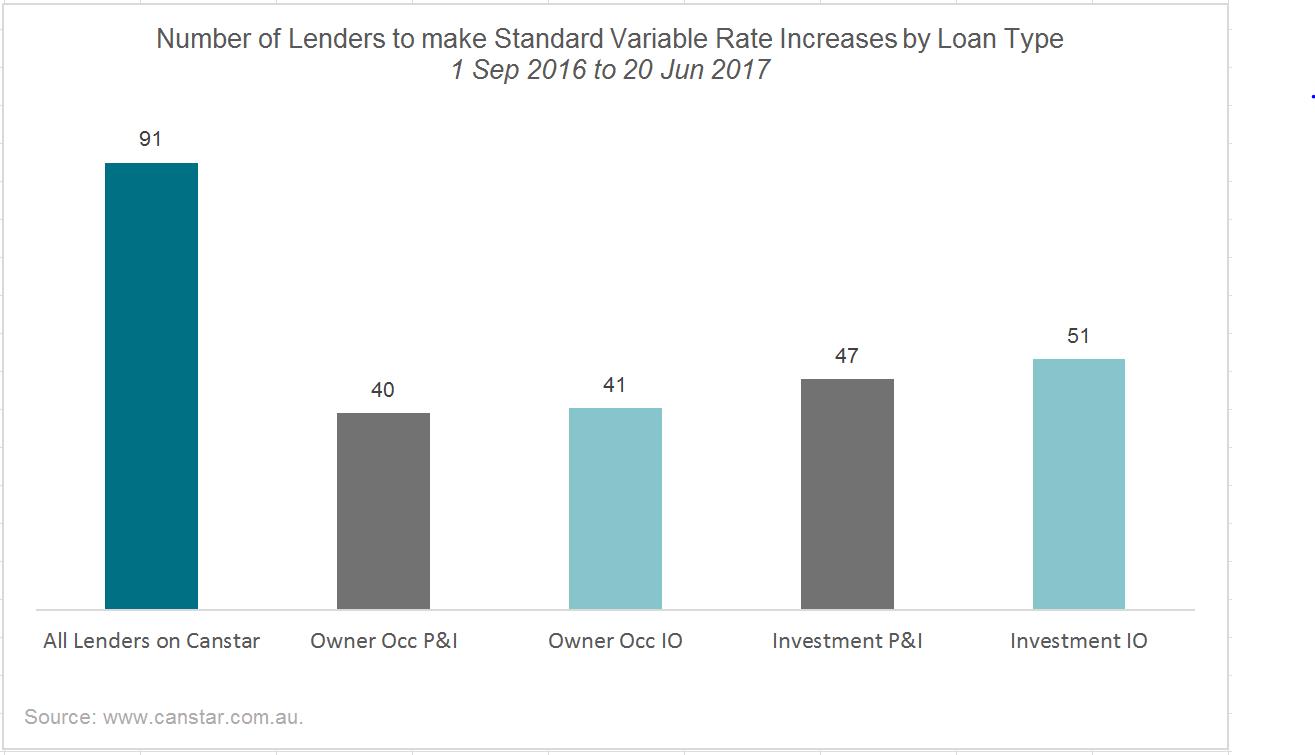

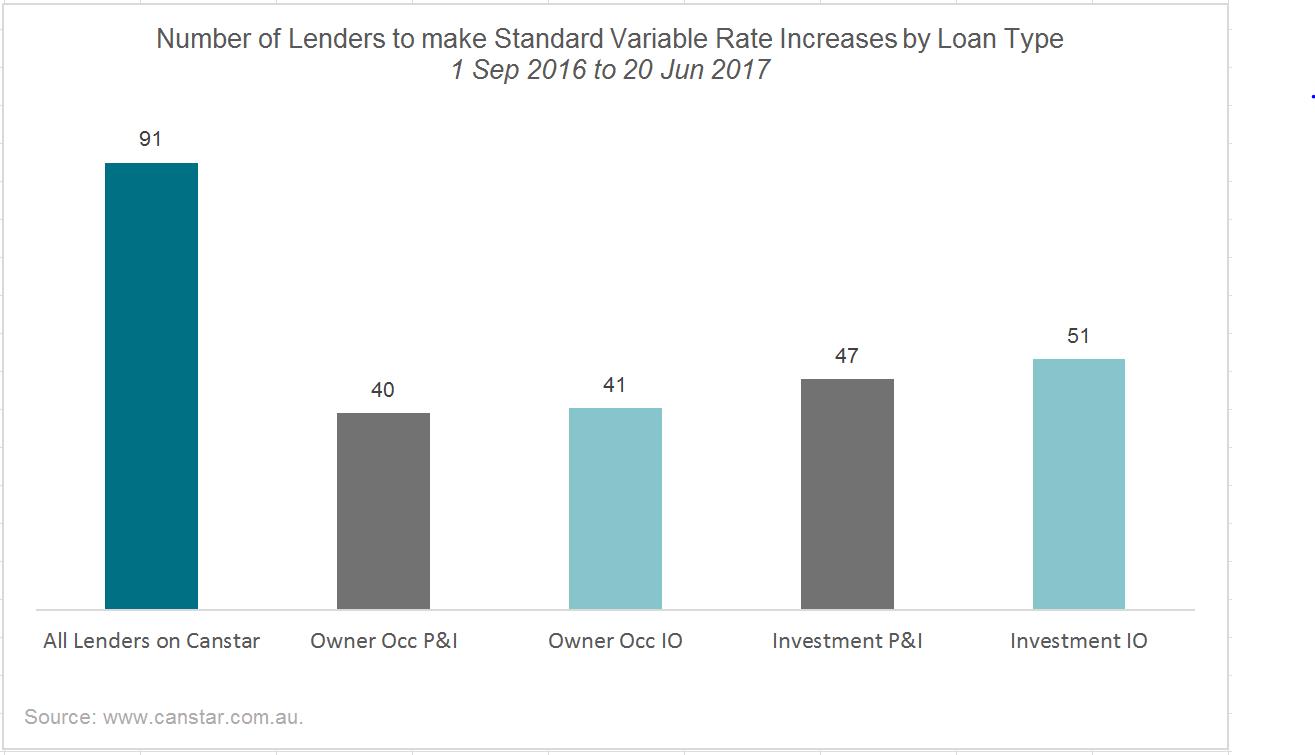

Of the 91 lenders on the Canstar database, 51 have since September 2016 increased their investment interest-only rate, compared to 40 who have lifted their owner-occupied principal and interest rate.

The big four major banks have led the way

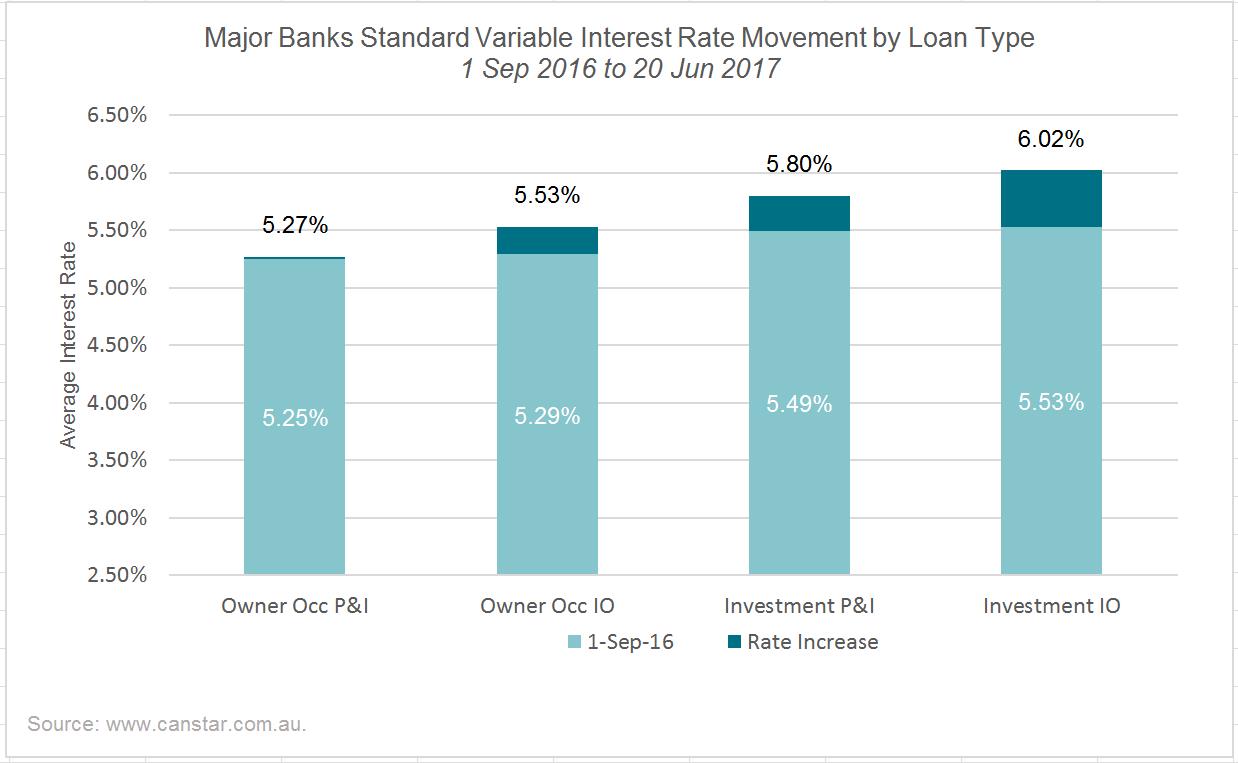

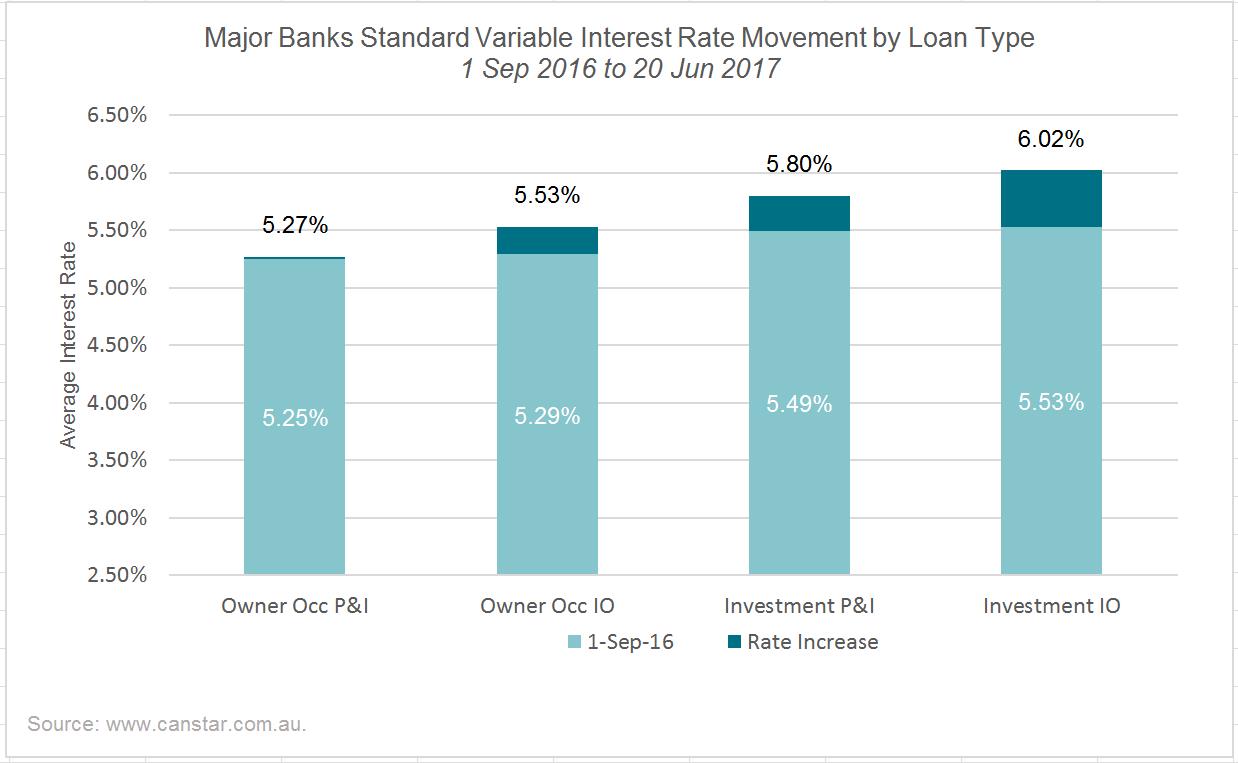

The big four major banks have all increased rates for investment interest-only loans, and three of the four have increased rates for owner-occupied principal and interest loans. Owner occupied principal and interest rates aside (which only saw a 2 basis point increase from the major banks), the average increase has exceeded the average increase from the whole of market – investment interest-only has been increased 49 basis points, compared to the whole of market increase of 21 basis points. An investor wishing to preserve cash and tax deductibility can now expect on average to pay 75 basis points more than an owner occupier amortising their loan!

Incidentally, fixed rates have not been spared the same treatment.

What will the future bring? Best guess would be more of the same. NAB and Westpac have already announced rate increases since we extracted our data. Some of the big banks have been back to customers to make rate adjustments four or five times since the August cash rate cut. They have gauged the political and customer fallout, competitive reaction and the price elasticity of their book. Why would we expect it to stop now?

Steve Mickenbecker is the group executive of financial services at financial comparison site Canstar. He previously worked for Suncorp and before that NAB in a variety of roles including strategy, small business lending and credit.

Steve Mickenbecker is the group executive of financial services at financial comparison site Canstar. He previously worked for Suncorp and before that NAB in a variety of roles including strategy, small business lending and credit.

Since the last decrease of the RBA Cash Rate in August 2016, we have seen tightening qualitative measures from APRA and a predictable reaction of out-of-cycle rate increases from the banks.

Canstar has interrogated its database to identify the macro-trends in rates since 1st September 2016, a time when the August cash rate cut would have washed through the base data and standard variable rates to better track changes.

Casting our eyes back a little more than 12 months ago, the interest rate regime was pretty straightforward – investment, owner occupied, interest-only and principal and interest were all one rate. Fast forward to today and you will struggle to find this model.

Across the market (the population of 91 Canstar listed lenders) currently the average margin for interest-only investment over principal and interest owner occupied rates is 40 basis points. The trend had started before the 1st September but has since widened from its then 25 basis point.

Of the 91 lenders on the Canstar database, 51 have since September 2016 increased their investment interest-only rate, compared to 40 who have lifted their owner-occupied principal and interest rate.

The big four major banks have led the way

The big four major banks have all increased rates for investment interest-only loans, and three of the four have increased rates for owner-occupied principal and interest loans. Owner occupied principal and interest rates aside (which only saw a 2 basis point increase from the major banks), the average increase has exceeded the average increase from the whole of market – investment interest-only has been increased 49 basis points, compared to the whole of market increase of 21 basis points. An investor wishing to preserve cash and tax deductibility can now expect on average to pay 75 basis points more than an owner occupier amortising their loan!

Incidentally, fixed rates have not been spared the same treatment.

What will the future bring? Best guess would be more of the same. NAB and Westpac have already announced rate increases since we extracted our data. Some of the big banks have been back to customers to make rate adjustments four or five times since the August cash rate cut. They have gauged the political and customer fallout, competitive reaction and the price elasticity of their book. Why would we expect it to stop now?

Steve Mickenbecker is the group executive of financial services at financial comparison site Canstar. He previously worked for Suncorp and before that NAB in a variety of roles including strategy, small business lending and credit.

Steve Mickenbecker is the group executive of financial services at financial comparison site Canstar. He previously worked for Suncorp and before that NAB in a variety of roles including strategy, small business lending and credit.