Books about the day-to-day reality of small businesses are rare, but Paul Downs’ Boss Life is a refreshingly honest look at the subject

"If this were a standard business book,” begins Paul Downs’ Boss Life, “I would tell you all the smart things I did to achieve financial success, and maybe trot out a few mistakes to show some humility. Unfortunately, I’m not a business genius and I’m not rich. My story has neither tidy conclusions nor a triumphant ending.”

Boss Life, written by Paul Downs and published in August 2015, is one of those books in which you get the uncanny sense that the author is writing just for you and nobody else. It’s also one of those books that struggles to be categorised. Forbes magazine named the book among its 2015 best business books of the year, yet by the author’s own admission it’s no such thing. Instead, it’s a book about business, although it’s one that you’ve never seen before.

But first, who is Paul Downs and what makes him qualifi ed to write about business? In his day job, Downs is the owner and manager of Paul Downs Cabinetmakers, a manufacturer of custom conference tables, based in the US state of Pennsylvania. With fewer than 50 employees, the company is not particularly large, nor has it invented anything, and whilst its conference tables are certainly impressive, the company is not likely to be on anyone’s ‘one to watch’ list any time soon. It’s very much a regular small business, with all the challenges that entails – and that’s the point.

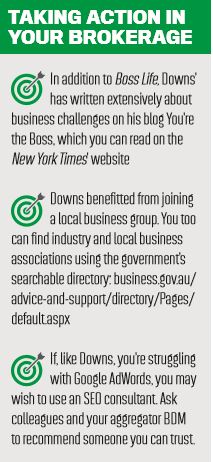

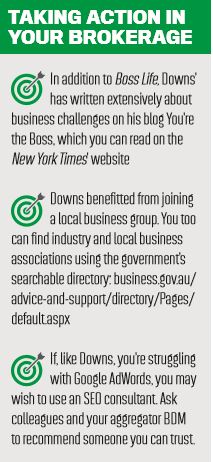

The book is more memoir than guide. Coming off the back of a blog Downs wrote for the New York Times, it goes month by month through the year of 2012. At the start of every month, Downs lists his bank balance, net cash and new contract value year-to-date numbers, then describes what happens. At some points, he’ll take you into the room with him; at others, he will talk about the highlights of his week. It’s a diary, but in the present tense. There are no bullet points, mind maps or flowcharts, although there are pictures of tables and screenshots. All of which makes it far, far easier to read than your average business book.

The Plot

The Plot

Boss Life is not a story about woodworking, although you’ll learn a surprising amount about this craft as you read the book. The plot is far simpler – the survival of a small business as their sales fall through the floor. Downs walks a precarious tightrope between incoming orders and outgoing costs, with the in-balance gradually depleting his cash reserves to the verge of disaster, at one point remarking that “at our current rate of spending, that’s enough to operate the shop for 15 working days.”

At the start of the year, the company’s problems are not immediately apparent. In a situation familiar to many small business owners, Downs is perennially distracted by multiple and competing responsibilities, including “managing employees, keeping track of money, dealing with bureaucrats, negotiating with the landlord… These tasks land in the boss’ lap. No matter that the boss may have little or no training, and no desire to spend time on them.”

In addition, he’s trying to find new clients abroad, flying to Germany and Dubai on exhausting, but largely fruitless, endeavours. Boss Life chronicles his realisation of the company’s problems and struggle to bring it back to health, whilst himself trying to stay financially and physically healthy.

Small business’ struggles are age-old and Boss Life could have been written 50 years ago, if not for an intriguing sub-plot. Downs’ company is heavily dependent on Google AdWords, the service where you can pay for your website to be listed above all other results when readers search for certain terms. Downs finds that despite raising his ad spend, the number and quality of enquiries are declining and, without any SEO expertise, he sets out to discover why.

The challenges

The AdWords saga is just one of many stories woven into the book, which conveniently and comprehensively covers the typical challenges of small business owners. This starts with clients. As products, custom conference tables and financial products could not seem more different. Yet both suffer from similar troublesome clients, such as the client who, despite several (free) consultations, can’t commit. Then there’s the client who doesn’t read the brief and complains about the product, not to mention the clients who play off Downs against his competitors, don’t pay bills, and generally make life miserable. Downs discusses how his sales team deals with such people, and how their methods of dealing improve as the year progresses.

Then there are staff. Being a good employer is clearly a major driver for Downs, as he writes in his introduction: “Consistently meeting a payroll is a real accomplishment. A business can provide for the security and growth of both boss and employees.” Yet he also sensitively describes the emotional challenge of firing a staff member who faked their time sheets, and his struggle with his talented but uncommunicative foreman Steve Maturin, who is vital to Downs’ operation but is holding it back from real innovation.

On top of all of this, Downs writes sensitively about family problems. A man writing about family in a business book is still surprisingly rare, but clearly should be more common. Downs talks frankly about his disabled teenage son, Henry, and how it adds to the stress of a struggling business. Downs suggests the solution is to be open about both challenges. “Keeping a barrier between my work and home lives was a mistake. When my wife had a clear picture of the situation, she became an ally instead of an adversary.”

Fighting back

Fighting back

There are certainly lessons to be learnt from Downs’ book, and they don’t require much digging below the surface. As in his NYT blog, Downs runs through the various strategies he implements, describing their successes and failures, answering many of the questions small business people are desperate to ask, but don’t know how.

Take the current vogue for referral partners. Downs works with other companies, some looking for a presence in the US, others wanting to leverage his expertise, but Downs’ success with such clients is often mixed. One European manufacturer, who Downs dubs ‘Eurofurn’, are particularly tricky. Downs leaves one meeting in a ‘mixed mood’ – “I feel his projection of sales volume is nonsense, and I know that without significant outside investment I won’t be able to handle their million dollars in orders… but now isn’t the moment to put the brakes on.” He continues being strung along throughout the year, as Eurofurn demands he invest without guaranteeing they’ll provide the sales he requires.

More encouragingly, Downs finds support and advice in a group for local business people called Vistage. There, he meets staircase manufacturer Sam Saxton and visits his factory, looking for inspiration. He finds that Saxton’s business has a number of fundamental differences, particularly when it comes to selling. “The approach is very different from ours – the design itself isn’t highlighted as much as the numbers. It doesn’t sell itself.” Downs realises Saxton’s salespeople are more persuasive than his own, which drives Downs to engage the services of a sales consultant.

Using a consultant is something many business owners consider, but are reluctant to spend money experimenting with. This is what makes following Downs’ experiences with his sales consultant, Bob Waks, particularly interesting. Whilst the overall result is positive, Downs eloquently expresses his doubts at the beginning of the process, and describes the practical steps recommended by his consultant. Downs openly discusses what Waks reveals about his own limitations, such as their lack of a customer relationship management system.

Indeed, Downs often appears more comfortable discussing his own limitations than his strengths, despite asserting that he’s an optimist. Yet, there are moments of inspiration for readers. Confronted by a talented but young employee looking for a pay rise, he finds a way to keep the employee and drive innovation by promoting that employee to foreman. As Downs jokes, the situation was typical of “the Zen of a very small business: When the Boss is Ready, the Solution Will Appear (Sometimes).”

The year of living dangerously

The story ends at Christmas and, as Downs originally promised, without triumph. Despite the company limping back to health, Downs is forced to cut the Christmas bonuses. It’s an ending that suits the book itself, with its focus on the day-to-day realities rather than the glittering possibilities of success. Evidently, 2012 was not a successful year for Paul Downs Cabinetmakers, as Downs himself reflects. “Whatever way you measure it, either on a cash flow or accrual basis, I’ve lost money.”

Yet, in the case of Boss Life, readers benefit far more from the journey than the destination – Downs’ efforts to work out his company’s problems and find a solution. The lessons to be learnt are not restricted to manufacturing, as Downs’ key focus is on sales, marketing, and the challenges of the SME boss. The book is filled with practical business tips, but unlike other business books they won’t be highlighted and framed for your convenience. Instead, they emerge from the day-to-day experiences, much like they would in reality.

What makes this book stand out above all, however, is its honesty. As Downs dryly observes, business journalism is focused on success and aspiration, and lacks the depth to reflect on the complexity of business problems. And whilst business books refer to honesty, they rarely lay bare the brutal, and occasionally overwhelming, truths that Downs conveys on the realities of running a business. His book can, therefore, be considered a must read for anyone currently living the ‘Boss Life’, or looking for a depiction of what it’s actually like.

IN NEED OF INSPIRATION?

Although there’s no direct equivalent to Boss Life for the mortgage industry, the industry’s leading brokers speak often and eloquently about the challenges of the profession. Take these fi ve quotes from leading Top 100 Brokers.

“If you’re doing something well, remain focused, remain consistent, and the results – at whatever level anyone wants to achieve – will get there” Jeremy Fisher, 1st Street Home Loans

“Take it two months at a time. Once you’re six months in, every month thereafter you realise how much you’ve learnt” Deanna Ezzy, Trilogy Funding

“Don’t do it for the volume or the money – you need to enjoy helping people grow their portfolio and wealth” Jack Wei, Financial Genius

“It gets back to not being an order-taker, but giving all-round advice – not just doing what they ask you to do, because that isn’t necessarily what’s best for them” Wendy Higgins, Mortgage Choice Glenelg

“To do these numbers, you have to live and breathe it. You have to be very committed… be at the coalface every day, and be committed” Mark Davis, The Australian Lending and Investment Centre

Boss Life, written by Paul Downs and published in August 2015, is one of those books in which you get the uncanny sense that the author is writing just for you and nobody else. It’s also one of those books that struggles to be categorised. Forbes magazine named the book among its 2015 best business books of the year, yet by the author’s own admission it’s no such thing. Instead, it’s a book about business, although it’s one that you’ve never seen before.

But first, who is Paul Downs and what makes him qualifi ed to write about business? In his day job, Downs is the owner and manager of Paul Downs Cabinetmakers, a manufacturer of custom conference tables, based in the US state of Pennsylvania. With fewer than 50 employees, the company is not particularly large, nor has it invented anything, and whilst its conference tables are certainly impressive, the company is not likely to be on anyone’s ‘one to watch’ list any time soon. It’s very much a regular small business, with all the challenges that entails – and that’s the point.

The book is more memoir than guide. Coming off the back of a blog Downs wrote for the New York Times, it goes month by month through the year of 2012. At the start of every month, Downs lists his bank balance, net cash and new contract value year-to-date numbers, then describes what happens. At some points, he’ll take you into the room with him; at others, he will talk about the highlights of his week. It’s a diary, but in the present tense. There are no bullet points, mind maps or flowcharts, although there are pictures of tables and screenshots. All of which makes it far, far easier to read than your average business book.

The Plot

The PlotBoss Life is not a story about woodworking, although you’ll learn a surprising amount about this craft as you read the book. The plot is far simpler – the survival of a small business as their sales fall through the floor. Downs walks a precarious tightrope between incoming orders and outgoing costs, with the in-balance gradually depleting his cash reserves to the verge of disaster, at one point remarking that “at our current rate of spending, that’s enough to operate the shop for 15 working days.”

At the start of the year, the company’s problems are not immediately apparent. In a situation familiar to many small business owners, Downs is perennially distracted by multiple and competing responsibilities, including “managing employees, keeping track of money, dealing with bureaucrats, negotiating with the landlord… These tasks land in the boss’ lap. No matter that the boss may have little or no training, and no desire to spend time on them.”

In addition, he’s trying to find new clients abroad, flying to Germany and Dubai on exhausting, but largely fruitless, endeavours. Boss Life chronicles his realisation of the company’s problems and struggle to bring it back to health, whilst himself trying to stay financially and physically healthy.

Small business’ struggles are age-old and Boss Life could have been written 50 years ago, if not for an intriguing sub-plot. Downs’ company is heavily dependent on Google AdWords, the service where you can pay for your website to be listed above all other results when readers search for certain terms. Downs finds that despite raising his ad spend, the number and quality of enquiries are declining and, without any SEO expertise, he sets out to discover why.

The challenges

The AdWords saga is just one of many stories woven into the book, which conveniently and comprehensively covers the typical challenges of small business owners. This starts with clients. As products, custom conference tables and financial products could not seem more different. Yet both suffer from similar troublesome clients, such as the client who, despite several (free) consultations, can’t commit. Then there’s the client who doesn’t read the brief and complains about the product, not to mention the clients who play off Downs against his competitors, don’t pay bills, and generally make life miserable. Downs discusses how his sales team deals with such people, and how their methods of dealing improve as the year progresses.

Then there are staff. Being a good employer is clearly a major driver for Downs, as he writes in his introduction: “Consistently meeting a payroll is a real accomplishment. A business can provide for the security and growth of both boss and employees.” Yet he also sensitively describes the emotional challenge of firing a staff member who faked their time sheets, and his struggle with his talented but uncommunicative foreman Steve Maturin, who is vital to Downs’ operation but is holding it back from real innovation.

On top of all of this, Downs writes sensitively about family problems. A man writing about family in a business book is still surprisingly rare, but clearly should be more common. Downs talks frankly about his disabled teenage son, Henry, and how it adds to the stress of a struggling business. Downs suggests the solution is to be open about both challenges. “Keeping a barrier between my work and home lives was a mistake. When my wife had a clear picture of the situation, she became an ally instead of an adversary.”

Fighting back

Fighting back There are certainly lessons to be learnt from Downs’ book, and they don’t require much digging below the surface. As in his NYT blog, Downs runs through the various strategies he implements, describing their successes and failures, answering many of the questions small business people are desperate to ask, but don’t know how.

Take the current vogue for referral partners. Downs works with other companies, some looking for a presence in the US, others wanting to leverage his expertise, but Downs’ success with such clients is often mixed. One European manufacturer, who Downs dubs ‘Eurofurn’, are particularly tricky. Downs leaves one meeting in a ‘mixed mood’ – “I feel his projection of sales volume is nonsense, and I know that without significant outside investment I won’t be able to handle their million dollars in orders… but now isn’t the moment to put the brakes on.” He continues being strung along throughout the year, as Eurofurn demands he invest without guaranteeing they’ll provide the sales he requires.

More encouragingly, Downs finds support and advice in a group for local business people called Vistage. There, he meets staircase manufacturer Sam Saxton and visits his factory, looking for inspiration. He finds that Saxton’s business has a number of fundamental differences, particularly when it comes to selling. “The approach is very different from ours – the design itself isn’t highlighted as much as the numbers. It doesn’t sell itself.” Downs realises Saxton’s salespeople are more persuasive than his own, which drives Downs to engage the services of a sales consultant.

Using a consultant is something many business owners consider, but are reluctant to spend money experimenting with. This is what makes following Downs’ experiences with his sales consultant, Bob Waks, particularly interesting. Whilst the overall result is positive, Downs eloquently expresses his doubts at the beginning of the process, and describes the practical steps recommended by his consultant. Downs openly discusses what Waks reveals about his own limitations, such as their lack of a customer relationship management system.

Indeed, Downs often appears more comfortable discussing his own limitations than his strengths, despite asserting that he’s an optimist. Yet, there are moments of inspiration for readers. Confronted by a talented but young employee looking for a pay rise, he finds a way to keep the employee and drive innovation by promoting that employee to foreman. As Downs jokes, the situation was typical of “the Zen of a very small business: When the Boss is Ready, the Solution Will Appear (Sometimes).”

The year of living dangerously

The story ends at Christmas and, as Downs originally promised, without triumph. Despite the company limping back to health, Downs is forced to cut the Christmas bonuses. It’s an ending that suits the book itself, with its focus on the day-to-day realities rather than the glittering possibilities of success. Evidently, 2012 was not a successful year for Paul Downs Cabinetmakers, as Downs himself reflects. “Whatever way you measure it, either on a cash flow or accrual basis, I’ve lost money.”

Yet, in the case of Boss Life, readers benefit far more from the journey than the destination – Downs’ efforts to work out his company’s problems and find a solution. The lessons to be learnt are not restricted to manufacturing, as Downs’ key focus is on sales, marketing, and the challenges of the SME boss. The book is filled with practical business tips, but unlike other business books they won’t be highlighted and framed for your convenience. Instead, they emerge from the day-to-day experiences, much like they would in reality.

What makes this book stand out above all, however, is its honesty. As Downs dryly observes, business journalism is focused on success and aspiration, and lacks the depth to reflect on the complexity of business problems. And whilst business books refer to honesty, they rarely lay bare the brutal, and occasionally overwhelming, truths that Downs conveys on the realities of running a business. His book can, therefore, be considered a must read for anyone currently living the ‘Boss Life’, or looking for a depiction of what it’s actually like.

IN NEED OF INSPIRATION?

Although there’s no direct equivalent to Boss Life for the mortgage industry, the industry’s leading brokers speak often and eloquently about the challenges of the profession. Take these fi ve quotes from leading Top 100 Brokers.

“If you’re doing something well, remain focused, remain consistent, and the results – at whatever level anyone wants to achieve – will get there” Jeremy Fisher, 1st Street Home Loans

“Take it two months at a time. Once you’re six months in, every month thereafter you realise how much you’ve learnt” Deanna Ezzy, Trilogy Funding

“Don’t do it for the volume or the money – you need to enjoy helping people grow their portfolio and wealth” Jack Wei, Financial Genius

“It gets back to not being an order-taker, but giving all-round advice – not just doing what they ask you to do, because that isn’t necessarily what’s best for them” Wendy Higgins, Mortgage Choice Glenelg

“To do these numbers, you have to live and breathe it. You have to be very committed… be at the coalface every day, and be committed” Mark Davis, The Australian Lending and Investment Centre