Borrowers don’t want to pay over the odds for their mortgage, but six out of 10 don’t even know their current interest rate, a new report by CUA suggests.

As one popular comparison site advert puts it, no one wants to be an April fool when it comes to money. Australian mortgage holders are aware of recent interest changes and don’t want to pay above the odds, according to a new report by CUA, the country’s largest mutual lender, released in February.

However, CUA’s survey – conducted in January, with 1,007 respondents aged between 25 and 49, and 504 of these being current mortgage holders – found that the growing consumer appetite for refinancing was being undermined by an alarming level of ignorance regarding what they’re actually paying.

This level of ignorance is alarming, but also an excellent reason for you to get back in touch with your clients. Simply reminding your client about their current interest rate – a question they could be too embarrassed to ask themselves – could be a way to start a conversation that leads to refinancing and other opportunities.

Furthermore, keeping customers updated about what they’re paying is arguably part of a broker’s duty of care. Recent reports in the Australian Financial Review and abroad have cast doubt on the ability of Aussie borrowers to cope with interest rate rises or the struggling economy. These reports pointed the finger at brokers, yet it’s responsible brokers who help their clients adjust to changing conditions who will play a major role if and when interest rates start rising again.

WHO CARES ABOUT INTEREST RATES?

Men and wealthier Australians are more likely to know the current interest rate that they’re paying, according to CUA. Forty-six percent of higher-income borrowers knew their exact rate, compared to 31% of lower-income borrowers, while 48% of men said they knew their exact rate, compared to 31% of women.

Knowing that lower-income borrowers are less likely to know their interest rates is alarming, and of course highly relevant to brokers. However, making generalisations based on the gender statistics is more problematic. ING Direct’s Women & Finance report, published in September 2015, showed younger women are increasingly likely to take responsibility for their finances. And anecdotal evidence from brokers suggests women are the decision-makers in couples’ home-buying decisions. Therefore it’s difficult to claim that a lack of interest-rate awareness equates to a lack of engagement with finance on the part of women.

BORROWERS ARE GETTING ITCHY FEET

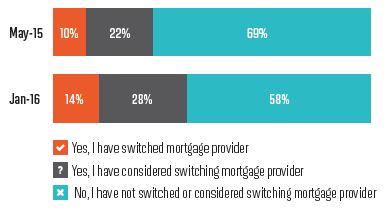

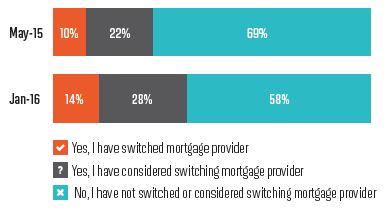

CUA found that the proportion of borrowers considering switching mortgage providers has increased – along with the number actually switching.

Have you switched or considered switching mortgage provider in the last 6 months?

SICK OF RATE RISES

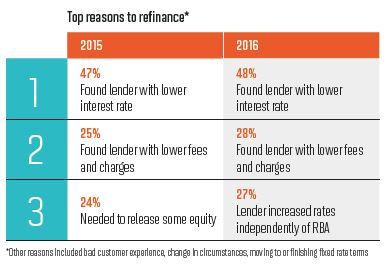

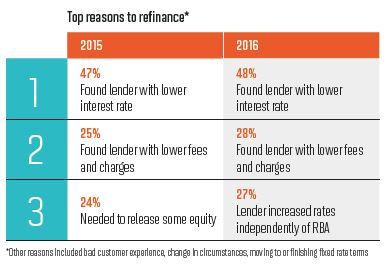

Borrowers are punishing banks for out-of-cycle rate rises, CUA’s results suggest, with this becoming the third most popular reason to refinance. More generally, the desire to save money is dominating refinancing intentions.

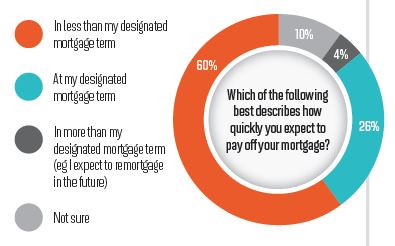

PAYING OFF THE LOAN

Borrowers are keen to pay off their mortgage, and optimistic they’ll be able to do in less than their designated mortgage term, according to CUA’s results. Counter-intuitively, brokers may want to orient their post-settlement marketing to address borrowers’ interest in paying down debt.

Borrowers are keen to pay off their mortgage, and optimistic they’ll be able to do in less than their designated mortgage term, according to CUA’s results. Counter-intuitively, brokers may want to orient their post-settlement marketing to address borrowers’ interest in paying down debt.

However, CUA’s survey – conducted in January, with 1,007 respondents aged between 25 and 49, and 504 of these being current mortgage holders – found that the growing consumer appetite for refinancing was being undermined by an alarming level of ignorance regarding what they’re actually paying.

This level of ignorance is alarming, but also an excellent reason for you to get back in touch with your clients. Simply reminding your client about their current interest rate – a question they could be too embarrassed to ask themselves – could be a way to start a conversation that leads to refinancing and other opportunities.

Furthermore, keeping customers updated about what they’re paying is arguably part of a broker’s duty of care. Recent reports in the Australian Financial Review and abroad have cast doubt on the ability of Aussie borrowers to cope with interest rate rises or the struggling economy. These reports pointed the finger at brokers, yet it’s responsible brokers who help their clients adjust to changing conditions who will play a major role if and when interest rates start rising again.

WHO CARES ABOUT INTEREST RATES?

Men and wealthier Australians are more likely to know the current interest rate that they’re paying, according to CUA. Forty-six percent of higher-income borrowers knew their exact rate, compared to 31% of lower-income borrowers, while 48% of men said they knew their exact rate, compared to 31% of women.

Knowing that lower-income borrowers are less likely to know their interest rates is alarming, and of course highly relevant to brokers. However, making generalisations based on the gender statistics is more problematic. ING Direct’s Women & Finance report, published in September 2015, showed younger women are increasingly likely to take responsibility for their finances. And anecdotal evidence from brokers suggests women are the decision-makers in couples’ home-buying decisions. Therefore it’s difficult to claim that a lack of interest-rate awareness equates to a lack of engagement with finance on the part of women.

BORROWERS ARE GETTING ITCHY FEET

CUA found that the proportion of borrowers considering switching mortgage providers has increased – along with the number actually switching.

Have you switched or considered switching mortgage provider in the last 6 months?

SICK OF RATE RISES

Borrowers are punishing banks for out-of-cycle rate rises, CUA’s results suggest, with this becoming the third most popular reason to refinance. More generally, the desire to save money is dominating refinancing intentions.

PAYING OFF THE LOAN

Borrowers are keen to pay off their mortgage, and optimistic they’ll be able to do in less than their designated mortgage term, according to CUA’s results. Counter-intuitively, brokers may want to orient their post-settlement marketing to address borrowers’ interest in paying down debt.

Borrowers are keen to pay off their mortgage, and optimistic they’ll be able to do in less than their designated mortgage term, according to CUA’s results. Counter-intuitively, brokers may want to orient their post-settlement marketing to address borrowers’ interest in paying down debt.