Australia might be a big continent, but there are millions of customers beyond our shores that you could be servicing.

Intense competition, new enabling technologies, and a desire to grow are some of key drivers leading firms to expand abroad. International expansion can be very rewarding but may also carry significant risk.

Why expand

It is well known that expansion is risky. In the late 1950s Edith Penrose noted that “there are important administrative restraints on the speed of the firm’s growth. Human resources required for the management of change are tied to the individual firm and so are internally scarce. Expansion requires the recruitment of more such resources. New recruits cannot become fully effective overnight. The growth process is, therefore, dynamically constrained”.

This is still true today. Nevertheless, many firms have forgotten this reality. According to Fortune magazine, the three fastest-growing US firms in 2005 were Yahoo, CompuCredit, and Ceradyne. A decade on, Yahoo is in a struggle to survive; CompuCredit was a subprime lender and has been involved in legal battles culminating in a name change and a fight to survive; and Ceradyne has fared worst of these three superstars of 2005: it no longer exists as an independent firm after acquisition.

Given these troubles, why would firms want to expand? In fact, there are many good reasons why businesses need to manage the curse of rapid growth. For some, growth is driven by strategy. With high-tech start-ups for example, fast growth is important to lock down a first-mover advantage, especially where the business model is based on having a critical mass of customers or users. For other businesses, moving outside their domestic base becomes the only means of growth.

Again, expansion into new markets – such as establishing a new presence in the growth markets of Asia – becomes imperative.

Having sufficient means to innovate – or to acquire innovative firms – inevitably means global expansion

Having sufficient means to innovate – or to acquire innovative firms – inevitably means global expansion

Finally, rapidly evolving markets and accelerating rates of innovation mean competitors taking market share. Having sufficient means to innovate – or to acquire innovative firms – inevitably means global expansion. Yet the rate at which firms attempt to grow, and the means by which they aim to achieve this, differs enormously from business to business. Some firms will try to expand quickly and make growth the number one priority, while others pursue slow but steady growth for the sake of being profitable and getting things right. Amazon, for example, has expanded to a physical presence in just 10 countries after 21 years of operation, despite having over 200,000 employees and revenues greater than $130bn.

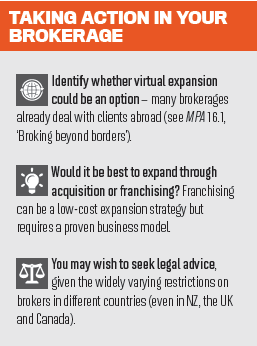

In deciding to expand, firms need to balance the risks and rewards. Key risks include political risks, cultural and people issues, and compliance and legal issues. In the financial industry, legal obstacles to expansion are formidable. Banking licences are hard to obtain and registering as a financial adviser is not trivial. Taxation, disclosure, and data security regulation add to the burden of expansion. However, the precise nature of the risks that individual firms are likely to face will vary greatly from industry to industry.

Virtual expansion

With the growing prevalence of new internetbased platforms, firms can expand virtually, physically, or use a combination of both. Virtual expansion happens through digital offerings outside the current market, while physical expansion may occur through the opening of new offices, or through acquisitions or franchising.

Virtual expansion is typically the fastest approach to expansion. It is usually cheaper and will generally face fewer regulatory burdens than are encountered in establishing a physical presence. Virtual expansion through the internet and mobile networks has revolutionised financial services provision. Because financial services are often provided as ‘bits’ to customers, the possible opportunity for new entrants to be disruptive is large.

For example, BillGuard offers alerts to users on hidden fees and integrates different accounts. This provides users with far greater transparency with any transaction, and allows them to select the least costly account for a type of service. If adopted broadly, this has the potential to revolutionise the financial industry in the same way that the music and publishing industries have changed. SocietyOne, an Australian fintech start-up based in Sydney, provides crowdsourced personal loans to individuals. It has, for example, found a ready market among farmers wishing to raise capital to buy new stock. The compulsory RIFD tagging of cattle in Australia means that potential lenders have a great deal more information about the quality of stock and their provenance that they are being asked to loan against.

Virtual expansion is also typically much cheaper than establishing a physical presence. While Amazon has a physical presence in just a few countries, the Amazon app store sells in more than 200 countries. By contrast, internet behemoths such as Google, Dropbox, and Netflix are now present in almost all countries. One reason why such expansion is possible is that it does not draw on scarce human resources and therefore removes much of the constraints Edith Penrose considered critical in the expansion process.

While virtual expansion may not have the same resource constraints that physical expansion imposes, slow expansion may still be needed. Take Seek.com, for example, a leading provider of employment marketplaces. Seek has expanded to 17 countries, recognising that it needs to have good market share for it to make a difference. People seeking employment only apply to job marketplaces if sufficient jobs are offered, while employers require a steady supply of qualified jobseekers. An additional reason for Seek to take a steady approach to growth is that it is easier to retain ownership of the firm as capital requirements for expansion are lower.

While virtual expansion may not have the same resource constraints that physical expansion imposes, slow expansion may still be needed

For companies, expensive growth strategies often imply capital acquisition through share offerings, which subsequently dilutes ownership. Envato, a digital marketplace for creative assets to build websites, videos, apps, and graphics, has chosen a similar steady growth path. It found that after very rapid initial expansion the quality of the services offered on its marketplace was occasionally lacking. Through slower growth quality could be assured, which in turn meant it was a more appealing place for its buyers.

Physical expansion

Expanding by opening operations abroad is much costlier but in many instances is the only option. Complex financial products, such as advice on share offerings, require people and operations ‘on the ground’, while for other financial products, such as private banking, physical operations are the norm.

Firms choosing to expand can either do so by opening their own operations; through acquisition; or by seeking outside help to expand. Own operations are relatively expensive but can be managed directly.

Acquiring companies requires careful due diligence, is often expensive, and typically involves a degree of resistance from the acquired company. It is also high-key and may tip off competition, but established operations and likely prior success help. Acquiring outside help to expand might seem unusual, but the approach – franchising – is highly common in the hospitality and restaurant businesses. Think, for example, Marriott, McDonald’s or Subway. Franchising involves helping in operations, setting operating guidelines, and drafting specific contracts in return for which franchisees pay royalties.

Franchising is also viable for financial services. It is, for example, quite common in tax preparation, insurance, and financial planning. The critical benefits associated with franchising are lower capital needs, lower risk for the franchisor, and inherent franchisee motivation because the franchisee commits capital to the business and works for profit rather than a salary.

In turn, for the franchisee it represents an easier and less risky pathway into entrepreneurship, and provides ready access to a brand, ideas, knowledge, and business systems which would otherwise be costly to access or develop. Importantly, it also lowers the risk compared to going it alone. Even if you are currently a franchisee, franchising abroad may be possible. Many franchisors allow master franchisees that run multiple businesses and set their expansion plans in conjunction with the franchisor.

GOING GLOBAL THROUGH NEW TECHNOLOGY

TransferWise is a peer-to-peer financial firm which has disrupted the profitable market for retail customer currency exchanges and money transfers. TransferWise offers a digital platform through which money is transferred by matching up buyers and sellers of currencies. TransferWise asks 0.5–0.7% for this service when transferring Australian dollars, considerably less than most banks or exchange bureaus charge. Since it was first launched in 2010, according to CNBC, TransferWise has grown to become the eighth most disruptive firm in 2015. TransferWise has transferred around $US4.5bn across nearly 300 currencies.

NEW COMPETITORS FROM ABROAD

While you may want to consider expanding abroad, others have considered entering Australia. ING DIRECT, a bank originating in the Netherlands, commenced in 1999 in Australia and has over 1.5 million savings and mortgage customers.

The Rabobank focuses on agribusiness and commenced in 1990. It now operates 61 branches throughout Australia. Both businesses compete successfully through differentiation, but have also considerably adapted their business models when expanding abroad.

A critical risk faced by a business expanding into a new country is whether their existing business model, however successful, is fit for purpose in a different environment. There are many reasons why such a business would need to consider how best to adapt their business model. Adaptation may be needed because of regulatory requirements and cultural and management differences. Adaptation may also be needed because expansion abroad involves a new set of competitors who themselves operate differently, using models that your business has likely not dealt with in your home market. Economic instability can add to these woes. For example, Barclays and ABN AMRO found that their expansion was much short of success.

Entering a new market via a physical presence also requires careful consideration of the pros and cons associated with relocating personnel from an established location to run the operation, or looking to hire local staff with knowledge of the sector, or some mix of both.

Entering a new market via a physical presence requires careful consideration of the pros and cons associated with relocating personnel

ConclusionAs Edith Penrose noted, growth is dynamically constrained. When expanding physically, constraints are particularly important, but virtual expansion suffers less from the constraints that Penrose considered critical. Through careful consideration of the risks, in particular HR constraints, firms can grow through international expansion.

Physical expansion is typically costlier than virtual expansion, but in some cases is needed because the products sold require it or because operations on the ground are the norm and expected by customers. When physical expansion is needed, franchising is less costly than setting up own operations or acquisition of other companies, but this also comes with constraints: franchisees are harder to manage and require a degree of independence. Acquisition is typically very expensive and requires careful due diligence. Virtual expansion is in comparison typically much cheaper and faster but requires more careful consideration of data storage, and good digital platforms need to be available for it to be a success.