Commercial lending is losing its exclusive big-money deals image, as streamlined applications and improved support make it a realistic option for everyday diversification

Commercial lending is losing its exclusive big-money deals image, as streamlined applications and improved support make it a realistic option for everyday diversification

Commercial lending is coming back down to earth. In early 2015 the MFAA will publish a white paper studying the challenges facing commercial brokers, but some lenders already seem to be anticipating its conclusions. Now, in stark contrast to an increasingly frenzied residential sector, with its ever-more dizzying sums and profits, commercial focused lenders are looking to become an integral part of everyday broking, not just the occasional lucrative deal. Large corporates are out; SMEs are in, and an at times offputtingly technical sector is reconnecting with normal brokers.

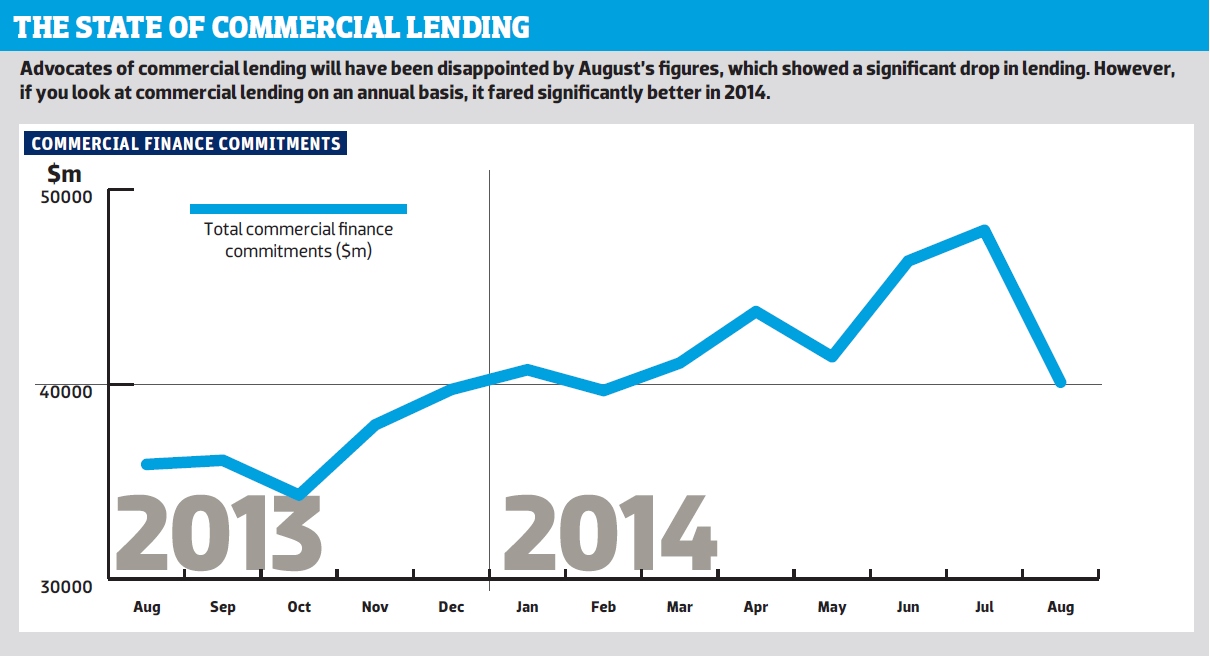

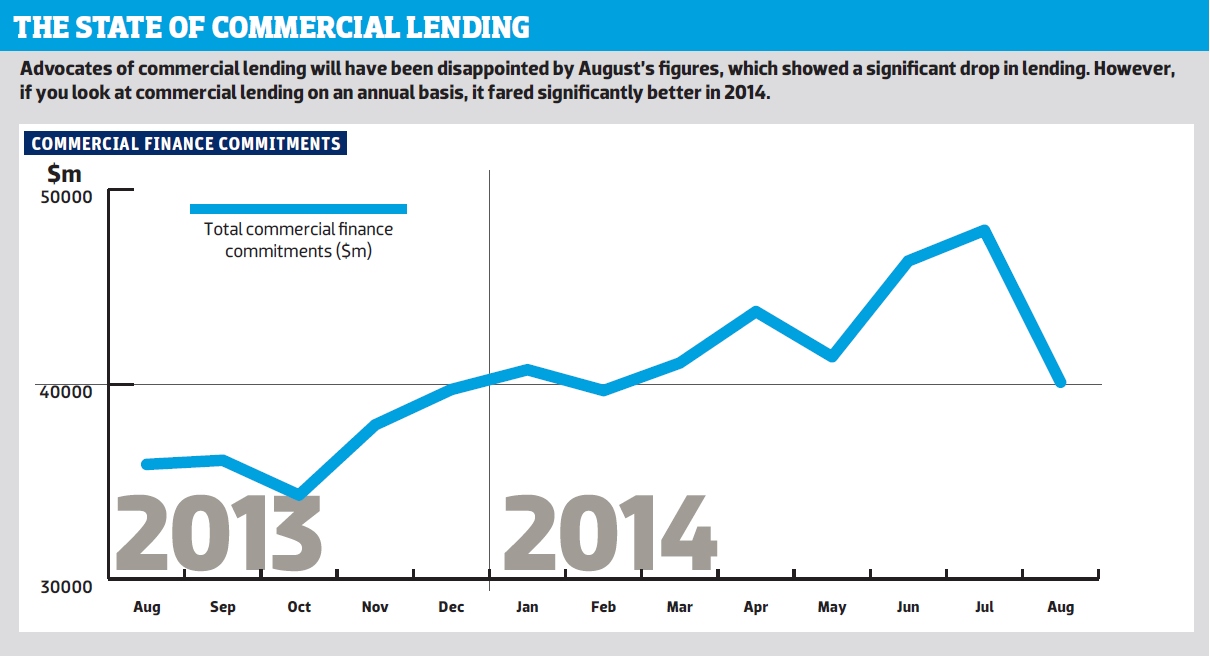

The cynical among us might suggest that this newfound atmosphere of humility is not entirely unconnected with the calm if not stagnant state of business confidence over 2014. A 16.3% drop in commercial lending in July could be treated as a one-off, but commercial property values certainly appear flat in comparison to residential property.

Yet interest rates continue to remain low – historically low – and commercial lenders insist business owners won’t ignore the opportunities this presents. According to Jonathan Street, CEO of commercial specialist lender Thinktank, “certainty or semi-certainty over interest rates can feed very positively into investment decisions”. The NAB Commercial Property Index is positive for the first time since the first quarter of 2011, and George Sotiros of building society IMB urges brokers that “everything is indicating we really are at a stage where the market is not expecting any significant changes; it’s a good time to consider investment into commercial”.

SMALL DEALS

If commercial investment recovers, there’s a good chance it’ll start small. NAB’s SME survey recorded small business conditions rising to above average levels, noting that “conditions facing SMEs are better than those of the broader economy… especially in construction, business services, transport and retail”. FAST chief Brendan Wright puts it rather more forcefully: “there’s 2.8 million small businesses that make up the engine room of the Australian economy and they are screaming out for help and advice around funding their business and also their personal needs being met. That’s the opportunity, and there are just not enough business bankers among the banks to go around”.

If commercial investment recovers, there’s a good chance it’ll start small. NAB’s SME survey recorded small business conditions rising to above average levels, noting that “conditions facing SMEs are better than those of the broader economy… especially in construction, business services, transport and retail”. FAST chief Brendan Wright puts it rather more forcefully: “there’s 2.8 million small businesses that make up the engine room of the Australian economy and they are screaming out for help and advice around funding their business and also their personal needs being met. That’s the opportunity, and there are just not enough business bankers among the banks to go around”.

Smaller deals are changing the meaning of commercial lending. They’re easier for brokers, because they’re easier for lenders; deals under $1m are treated by APRA in a similar way to residential deals. Small deals are what Australian First Mortgage director Iain Forbes terms ‘low hanging fruit’; “not complicated, straightforward buildings, not specialised” – single properties secured by bricks and mortar, not business assets. A light industrial property, office or shop already with a tenant, claims Thinktank’s CEO Street, “almost presents in the same fashion as a PAYG investment loan or a self-employed person’s residential loan”.

Simpler applications also mean that deals under $1m are the first area of commercial lending where technology is having an impact. “The technology opportunity for processing those applications is significant”, Wright argues. “Some lenders are already into this space, some aggregators are starting to look at it; we are certainly very keen and working with a number of partners to develop our software Podium to process asset finance and commercial deals”.

The same can’t be said for more complicated deals, warns Bankwest’s head of Broker & Acquisition Antonia Albanese; “in verifying income there are quite a lot of sources you need to go to, so we’ll never ever get to that sort of paperless application I don’t think, but we certainly can improve”.

Potential small-deal clients are more likely to evolve from a residential broker’s existing database. More complicated commercial broking requires building a network of referral sources – accountants, conveyancing firms, planners ; although aggregators often introduce brokers to such partners, such as FAST’s Partner Planner. Yet La Trobe’s head of distribution Cory Bannister notes that “too many brokers fail to realise they are sitting on the best commercial lead generating tools without even knowing – the data in their Customer Relationship Management (CRM) systems”. Many residential clients are likely to be SME owners, not to mention the growing proportion of self-employed borrowers. Furthermore a huge number of residential clients could also be potential SMSF investors, an area Street expects to grow ‘exponentially’ over the next couple of years.

Potential small-deal clients are more likely to evolve from a residential broker’s existing database. More complicated commercial broking requires building a network of referral sources – accountants, conveyancing firms, planners ; although aggregators often introduce brokers to such partners, such as FAST’s Partner Planner. Yet La Trobe’s head of distribution Cory Bannister notes that “too many brokers fail to realise they are sitting on the best commercial lead generating tools without even knowing – the data in their Customer Relationship Management (CRM) systems”. Many residential clients are likely to be SME owners, not to mention the growing proportion of self-employed borrowers. Furthermore a huge number of residential clients could also be potential SMSF investors, an area Street expects to grow ‘exponentially’ over the next couple of years.

With such a similarity to residential business, small commercial deals certainly have the potential to reconnect commercial lenders with residential brokers. “Our products are designed to look and feel like standard residential transactions,” says La Trobe’s Bannister. “We use the same application form, serviceability calculator, income verification methods and loan documents, and it’s the same accreditation.”

TAKING IT UP A NOTCH

We’ve heard some of this language before: lenders declaring that ‘commercial is the new residential’ without giving brokers the resources or motivation to make commercial more than an occasional indulgence. A gap exists between those spot-and-refer commercial brokers, and those who made it a valued part of their business. But with more emphasis on BDMs and education in the industry, this gap is becoming easier to bridge.

We’ve heard some of this language before: lenders declaring that ‘commercial is the new residential’ without giving brokers the resources or motivation to make commercial more than an occasional indulgence. A gap exists between those spot-and-refer commercial brokers, and those who made it a valued part of their business. But with more emphasis on BDMs and education in the industry, this gap is becoming easier to bridge.

Bankwest’s Albanese insists good commercial broking still utilises those same broker relationship skills. “The most critical skill you can have [is] the ability to really understand what motivates and matters to people, and that’s relevant whether it’s an individual or commercial customer… it often just comes down to confidence, and that’s why we’ve been supporting our brokers by giving them the terminology around the business”.

Traditionally commercial lenders and aggregators have always emphasised their ‘handholding’ of inexperienced brokers, but recently have begun to back this up with more structured (and less patronising) support. Bankwest has a phone line for brokers to get in touch with a commercial analyst; brokers with Thinktank go through the same BDM throughout a loan application. IMB’s Sotiros suggests mentoring as a way to gain commercial expertise: “More and more aggregators understand the idea of diversification, there’s a great depth of experience among their own people who’ve been doing commercial for years, and generally people, if approached the right way, are happy to impart their knowledge and wisdom.”

Yet the daunting requirements of commercial accreditation, often required for deals of more than $1m, SMSF investing and when dealing with the larger banks, remains a problem that BDM support alone can’t solve. Some aggregators help with this; FAST argues for their brokers to be exempted from lenders’ minimum volume requirements; it can do that, explains Wright, because “we are very particular about the brokers we accredit; we have a long history in this space and know what a good commercial broker looks like”.

The State of Commercial Lending (Click to enlarge)

Commercial education is clearly needed, and lenders and industry bodies are starting to deliver it. The MFAA has taken a much stronger interest in commercial broking of late, and run training courses in conjunction with the Australian Institute of Management. There are three tiers of training available, and brokers can get information about the courses through their aggregators. The MFAA also offers website marketing content for commercial brokers, and they can use its newly-launched broker comparison site.

Commercial education is clearly needed, and lenders and industry bodies are starting to deliver it. The MFAA has taken a much stronger interest in commercial broking of late, and run training courses in conjunction with the Australian Institute of Management. There are three tiers of training available, and brokers can get information about the courses through their aggregators. The MFAA also offers website marketing content for commercial brokers, and they can use its newly-launched broker comparison site.

Lenders like Thinktank are also starting to run workshops. “You wouldn’t have to go back to university,” argues Street. “The best method for breaching that gap is experience and getting deals under your belt.” FAST’s Wright holds a similar opinion, although he says it is likely experienced commercial brokers will have picked up qualifications along the way.

MASTERING COMMERCIAL BROKING

Even the image of elite commercial broking has softened in recent months. Both top brokers and lenders are increasingly pointing to commercial’s place alongside residential business as part of a diversified portfolio. The number one broker in MPA’s recent Top 10 Commercial Brokers, Diana Liu, still writes residential loans, despite settling $100,832,000 worth of commercial business in the last financial year. “It’s good to have a mixed client base, in terms of the income they provide,” she told MPA magazine, arguing the longer trails for residential lending make it more “sustainable”.

Specialised and general lenders offer to established commercial brokers. Thinktank only offers commercial loans through brokers, and claims this gives them flexibility and expertise to look at deals other lenders can’t handle, while avoiding cross-selling. However, Bankwest’s Albanese argues cross-selling is crucial. “When talking to customers, their needs are very diverse; you need to be in contact with a bank like Bankwest that can provide a wide range of services.” The bank offers a commission reward system for commercial brokers who cross sell.

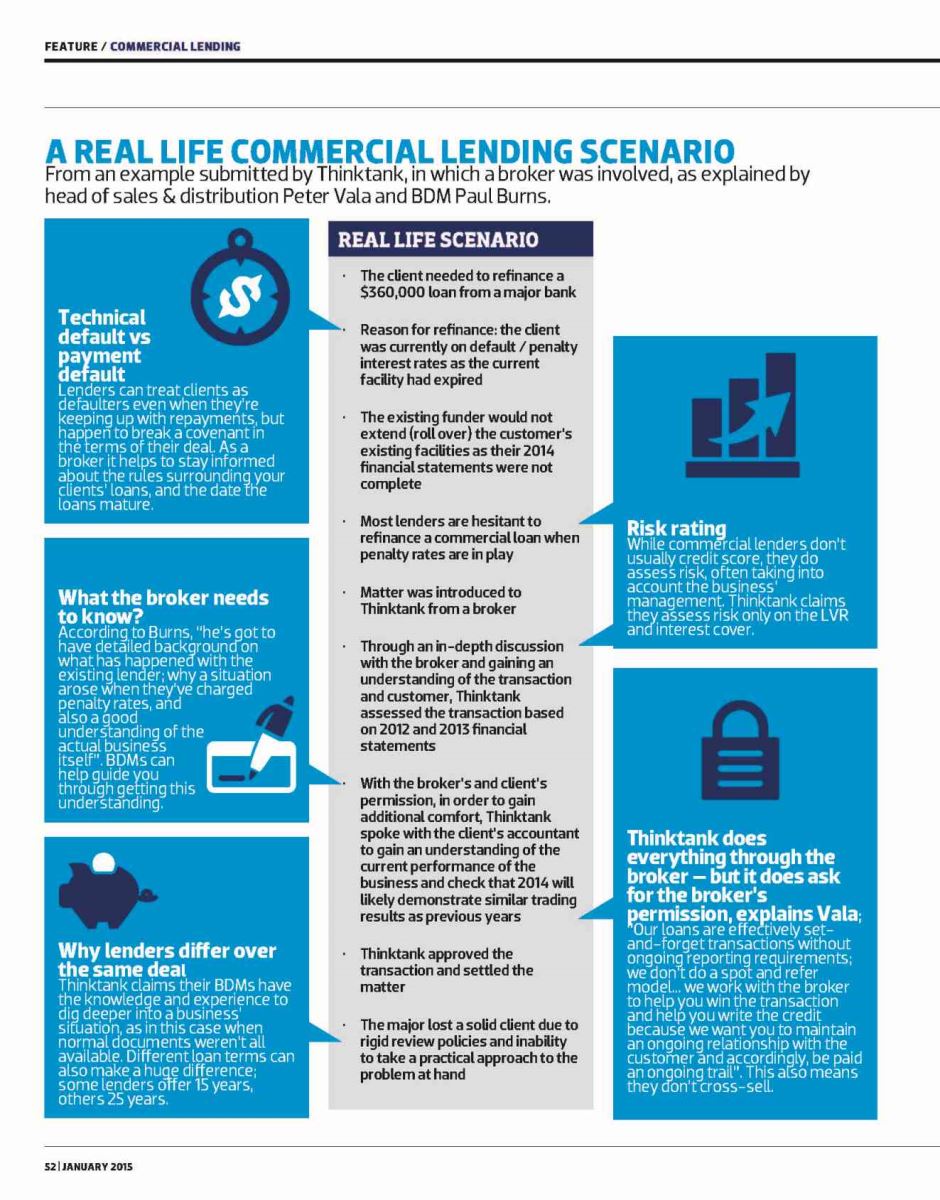

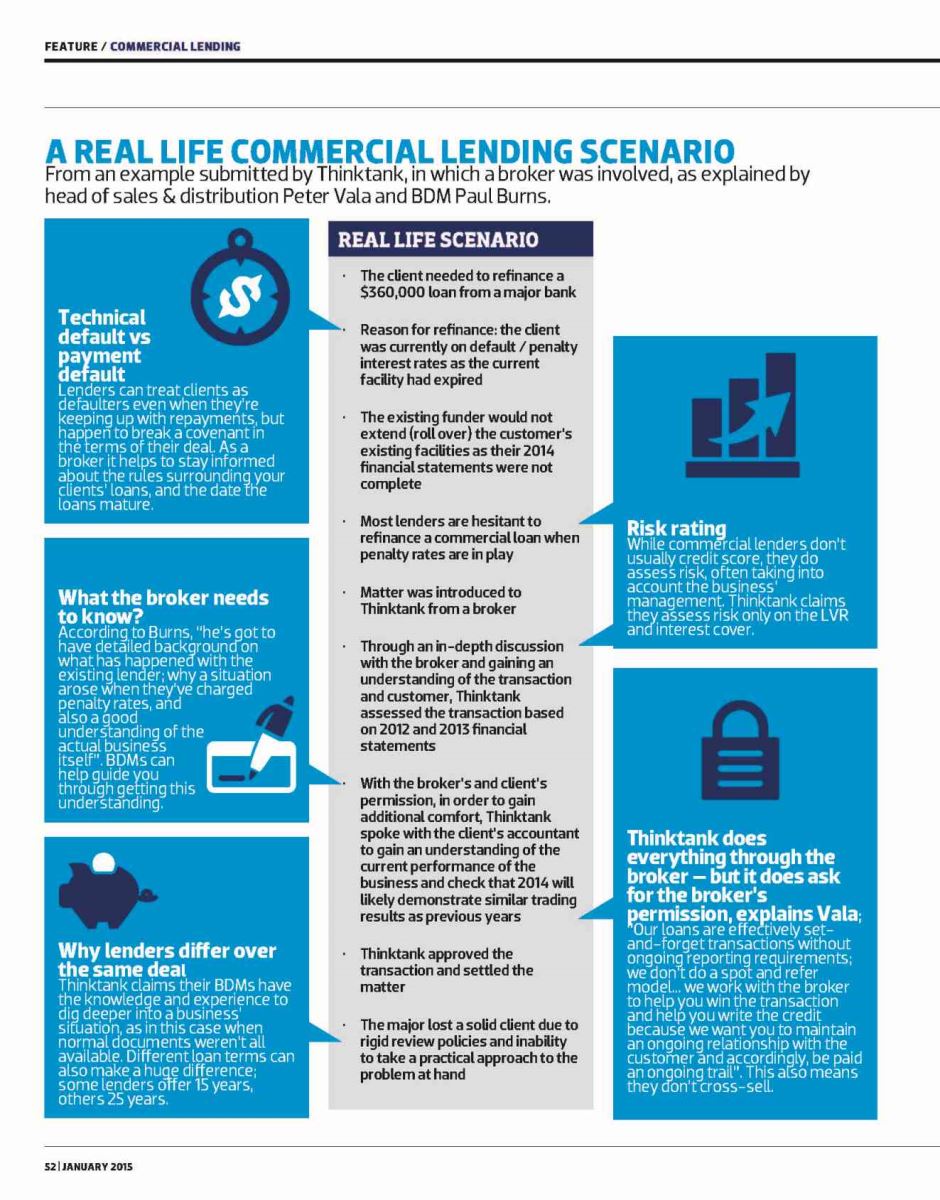

Real Life Lending Scenario (Click to enlarge)

MPA’s Top 10 commercial brokers were also divided on this question of diversified services. Joshua Vecchio of Discovering Finance group warned against going beyond core expertise, even if this meant turning away clients: “In the beginning you try to be all things to all people, but realise that you’re wasting everyone’s time.” Niches are undoubtedly important, argued Daniel Green of Green Finance group: “If you’re a general commercial broker, you’re really up against a lot of brokers who can do general commercial lending. Right now, in Australia, I’m the only finance broker who specialises in hotels.”

It’s notable, however, that Green Finance itself offers a much wider range of services, having specialists in healthcare, construction, equipment finance, as well as financial planners and insurance brokers. Moreover a number of full-service brokerages have begun making waves in commercial broking recently: Jeremy Fisher of 1st Street Home Loans made MPA’s top 10 while Mark Davis of the Australian Lending and Investment Centre secured the Australian Mortgage Award for Finance Broker of the Year.

CONCLUSION

CONCLUSION

When even those at the top of the commercial game offer a range of services, it’s obvious the residential-commercial gap is closing. That’s not to suggest the two sectors will ever be the same; in fact the unique nature of commercial business certainly holds its own attractions. “Commercial lending is the most interesting thing we do,” explains Albanese. “You don’t only get to know people, you get to understand their business and the people who work in their business… you can meet a lot more people through commercial lending.”

Nevertheless for those predominantly residential brokers who are simply looking to diversify their business, the barriers to doing so have been lowered at every level of ability. The streamlining of applications for small deals makes these an obvious starting point, and the support and educational opportunities are improving for those who want to increase their commercial business without a huge expenditure of time and effort. Evidently, it no longer makes sense to describe the non-conforming market as ‘recovering’. That era is over; a number of aggressive and ambitious players have now emerged, no longer content to stay in the nonconforming sphere, proud of their alternative approach. All state their commitment to the third-party channel, but brokers who ignore the sector face pressure from both sides, as rebranding eventually impacts on borrowers’ thinking. As Rehayem concludes, “those brokers who don’t make non-conforming part of their business model should be worried: the best of the best use it, so why don’t they?”

Also in MPA 15.01

Sam Boer: Beyond The Pipeline

Louis Kovanis: The Mortgage Doctor

And read the full e-mag here

Commercial lending is coming back down to earth. In early 2015 the MFAA will publish a white paper studying the challenges facing commercial brokers, but some lenders already seem to be anticipating its conclusions. Now, in stark contrast to an increasingly frenzied residential sector, with its ever-more dizzying sums and profits, commercial focused lenders are looking to become an integral part of everyday broking, not just the occasional lucrative deal. Large corporates are out; SMEs are in, and an at times offputtingly technical sector is reconnecting with normal brokers.

The cynical among us might suggest that this newfound atmosphere of humility is not entirely unconnected with the calm if not stagnant state of business confidence over 2014. A 16.3% drop in commercial lending in July could be treated as a one-off, but commercial property values certainly appear flat in comparison to residential property.

Yet interest rates continue to remain low – historically low – and commercial lenders insist business owners won’t ignore the opportunities this presents. According to Jonathan Street, CEO of commercial specialist lender Thinktank, “certainty or semi-certainty over interest rates can feed very positively into investment decisions”. The NAB Commercial Property Index is positive for the first time since the first quarter of 2011, and George Sotiros of building society IMB urges brokers that “everything is indicating we really are at a stage where the market is not expecting any significant changes; it’s a good time to consider investment into commercial”.

SMALL DEALS

If commercial investment recovers, there’s a good chance it’ll start small. NAB’s SME survey recorded small business conditions rising to above average levels, noting that “conditions facing SMEs are better than those of the broader economy… especially in construction, business services, transport and retail”. FAST chief Brendan Wright puts it rather more forcefully: “there’s 2.8 million small businesses that make up the engine room of the Australian economy and they are screaming out for help and advice around funding their business and also their personal needs being met. That’s the opportunity, and there are just not enough business bankers among the banks to go around”.

If commercial investment recovers, there’s a good chance it’ll start small. NAB’s SME survey recorded small business conditions rising to above average levels, noting that “conditions facing SMEs are better than those of the broader economy… especially in construction, business services, transport and retail”. FAST chief Brendan Wright puts it rather more forcefully: “there’s 2.8 million small businesses that make up the engine room of the Australian economy and they are screaming out for help and advice around funding their business and also their personal needs being met. That’s the opportunity, and there are just not enough business bankers among the banks to go around”.Smaller deals are changing the meaning of commercial lending. They’re easier for brokers, because they’re easier for lenders; deals under $1m are treated by APRA in a similar way to residential deals. Small deals are what Australian First Mortgage director Iain Forbes terms ‘low hanging fruit’; “not complicated, straightforward buildings, not specialised” – single properties secured by bricks and mortar, not business assets. A light industrial property, office or shop already with a tenant, claims Thinktank’s CEO Street, “almost presents in the same fashion as a PAYG investment loan or a self-employed person’s residential loan”.

Simpler applications also mean that deals under $1m are the first area of commercial lending where technology is having an impact. “The technology opportunity for processing those applications is significant”, Wright argues. “Some lenders are already into this space, some aggregators are starting to look at it; we are certainly very keen and working with a number of partners to develop our software Podium to process asset finance and commercial deals”.

The same can’t be said for more complicated deals, warns Bankwest’s head of Broker & Acquisition Antonia Albanese; “in verifying income there are quite a lot of sources you need to go to, so we’ll never ever get to that sort of paperless application I don’t think, but we certainly can improve”.

Potential small-deal clients are more likely to evolve from a residential broker’s existing database. More complicated commercial broking requires building a network of referral sources – accountants, conveyancing firms, planners ; although aggregators often introduce brokers to such partners, such as FAST’s Partner Planner. Yet La Trobe’s head of distribution Cory Bannister notes that “too many brokers fail to realise they are sitting on the best commercial lead generating tools without even knowing – the data in their Customer Relationship Management (CRM) systems”. Many residential clients are likely to be SME owners, not to mention the growing proportion of self-employed borrowers. Furthermore a huge number of residential clients could also be potential SMSF investors, an area Street expects to grow ‘exponentially’ over the next couple of years.

Potential small-deal clients are more likely to evolve from a residential broker’s existing database. More complicated commercial broking requires building a network of referral sources – accountants, conveyancing firms, planners ; although aggregators often introduce brokers to such partners, such as FAST’s Partner Planner. Yet La Trobe’s head of distribution Cory Bannister notes that “too many brokers fail to realise they are sitting on the best commercial lead generating tools without even knowing – the data in their Customer Relationship Management (CRM) systems”. Many residential clients are likely to be SME owners, not to mention the growing proportion of self-employed borrowers. Furthermore a huge number of residential clients could also be potential SMSF investors, an area Street expects to grow ‘exponentially’ over the next couple of years.With such a similarity to residential business, small commercial deals certainly have the potential to reconnect commercial lenders with residential brokers. “Our products are designed to look and feel like standard residential transactions,” says La Trobe’s Bannister. “We use the same application form, serviceability calculator, income verification methods and loan documents, and it’s the same accreditation.”

TAKING IT UP A NOTCH

We’ve heard some of this language before: lenders declaring that ‘commercial is the new residential’ without giving brokers the resources or motivation to make commercial more than an occasional indulgence. A gap exists between those spot-and-refer commercial brokers, and those who made it a valued part of their business. But with more emphasis on BDMs and education in the industry, this gap is becoming easier to bridge.

We’ve heard some of this language before: lenders declaring that ‘commercial is the new residential’ without giving brokers the resources or motivation to make commercial more than an occasional indulgence. A gap exists between those spot-and-refer commercial brokers, and those who made it a valued part of their business. But with more emphasis on BDMs and education in the industry, this gap is becoming easier to bridge.Bankwest’s Albanese insists good commercial broking still utilises those same broker relationship skills. “The most critical skill you can have [is] the ability to really understand what motivates and matters to people, and that’s relevant whether it’s an individual or commercial customer… it often just comes down to confidence, and that’s why we’ve been supporting our brokers by giving them the terminology around the business”.

Traditionally commercial lenders and aggregators have always emphasised their ‘handholding’ of inexperienced brokers, but recently have begun to back this up with more structured (and less patronising) support. Bankwest has a phone line for brokers to get in touch with a commercial analyst; brokers with Thinktank go through the same BDM throughout a loan application. IMB’s Sotiros suggests mentoring as a way to gain commercial expertise: “More and more aggregators understand the idea of diversification, there’s a great depth of experience among their own people who’ve been doing commercial for years, and generally people, if approached the right way, are happy to impart their knowledge and wisdom.”

Yet the daunting requirements of commercial accreditation, often required for deals of more than $1m, SMSF investing and when dealing with the larger banks, remains a problem that BDM support alone can’t solve. Some aggregators help with this; FAST argues for their brokers to be exempted from lenders’ minimum volume requirements; it can do that, explains Wright, because “we are very particular about the brokers we accredit; we have a long history in this space and know what a good commercial broker looks like”.

The State of Commercial Lending (Click to enlarge)

Commercial education is clearly needed, and lenders and industry bodies are starting to deliver it. The MFAA has taken a much stronger interest in commercial broking of late, and run training courses in conjunction with the Australian Institute of Management. There are three tiers of training available, and brokers can get information about the courses through their aggregators. The MFAA also offers website marketing content for commercial brokers, and they can use its newly-launched broker comparison site.

Commercial education is clearly needed, and lenders and industry bodies are starting to deliver it. The MFAA has taken a much stronger interest in commercial broking of late, and run training courses in conjunction with the Australian Institute of Management. There are three tiers of training available, and brokers can get information about the courses through their aggregators. The MFAA also offers website marketing content for commercial brokers, and they can use its newly-launched broker comparison site.Lenders like Thinktank are also starting to run workshops. “You wouldn’t have to go back to university,” argues Street. “The best method for breaching that gap is experience and getting deals under your belt.” FAST’s Wright holds a similar opinion, although he says it is likely experienced commercial brokers will have picked up qualifications along the way.

MASTERING COMMERCIAL BROKING

Even the image of elite commercial broking has softened in recent months. Both top brokers and lenders are increasingly pointing to commercial’s place alongside residential business as part of a diversified portfolio. The number one broker in MPA’s recent Top 10 Commercial Brokers, Diana Liu, still writes residential loans, despite settling $100,832,000 worth of commercial business in the last financial year. “It’s good to have a mixed client base, in terms of the income they provide,” she told MPA magazine, arguing the longer trails for residential lending make it more “sustainable”.

Specialised and general lenders offer to established commercial brokers. Thinktank only offers commercial loans through brokers, and claims this gives them flexibility and expertise to look at deals other lenders can’t handle, while avoiding cross-selling. However, Bankwest’s Albanese argues cross-selling is crucial. “When talking to customers, their needs are very diverse; you need to be in contact with a bank like Bankwest that can provide a wide range of services.” The bank offers a commission reward system for commercial brokers who cross sell.

Real Life Lending Scenario (Click to enlarge)

MPA’s Top 10 commercial brokers were also divided on this question of diversified services. Joshua Vecchio of Discovering Finance group warned against going beyond core expertise, even if this meant turning away clients: “In the beginning you try to be all things to all people, but realise that you’re wasting everyone’s time.” Niches are undoubtedly important, argued Daniel Green of Green Finance group: “If you’re a general commercial broker, you’re really up against a lot of brokers who can do general commercial lending. Right now, in Australia, I’m the only finance broker who specialises in hotels.”

It’s notable, however, that Green Finance itself offers a much wider range of services, having specialists in healthcare, construction, equipment finance, as well as financial planners and insurance brokers. Moreover a number of full-service brokerages have begun making waves in commercial broking recently: Jeremy Fisher of 1st Street Home Loans made MPA’s top 10 while Mark Davis of the Australian Lending and Investment Centre secured the Australian Mortgage Award for Finance Broker of the Year.

CONCLUSION

CONCLUSIONWhen even those at the top of the commercial game offer a range of services, it’s obvious the residential-commercial gap is closing. That’s not to suggest the two sectors will ever be the same; in fact the unique nature of commercial business certainly holds its own attractions. “Commercial lending is the most interesting thing we do,” explains Albanese. “You don’t only get to know people, you get to understand their business and the people who work in their business… you can meet a lot more people through commercial lending.”

Nevertheless for those predominantly residential brokers who are simply looking to diversify their business, the barriers to doing so have been lowered at every level of ability. The streamlining of applications for small deals makes these an obvious starting point, and the support and educational opportunities are improving for those who want to increase their commercial business without a huge expenditure of time and effort. Evidently, it no longer makes sense to describe the non-conforming market as ‘recovering’. That era is over; a number of aggressive and ambitious players have now emerged, no longer content to stay in the nonconforming sphere, proud of their alternative approach. All state their commitment to the third-party channel, but brokers who ignore the sector face pressure from both sides, as rebranding eventually impacts on borrowers’ thinking. As Rehayem concludes, “those brokers who don’t make non-conforming part of their business model should be worried: the best of the best use it, so why don’t they?”

Also in MPA 15.01

Sam Boer: Beyond The Pipeline

Louis Kovanis: The Mortgage Doctor

And read the full e-mag here