Construction specialist Steve Matsoukas explains how he built his powerhouse brokerage through builder partnerships and a scientific approach to hiring

The director of Loan Gallery Finance in Victoria’s Thomastown, Matsoukas thought broking wasn’t quite suited to him when he first started as a sole operator. Yet 14 years later he has carved a niche in construction, specialising in loans for house and land packages, with 44 loan writers throughout Victoria and in Queensland.

Although he registered Loan Gallery Finance in 2012 after changing aggregators to AFG, Matsoukas has been building up his business since 2002. “In the background it’s been the same company and people the whole way through,” he says.

He has won AFG’s Master Agent award three years running, and Loan Gallery also made MPA’s Top 10 Independent Brokerages list in 2013 and was an MFAA Excellence Awards finalist for Victoria for the Commonwealth Bank Finance Broker Business Award – 6+ Writers.

Niche in construction

Loan Gallery has built a reputation as a specialist in construction loans, working directly with builders and development companies. “Very early on, because I liked new homes, we started specialising in construction and house and land packages,” Matsoukas explains. “Off the back of that we became quite good at it.”

As its expertise in this area became noticed, large-volume builders approached Loan Gallery for help and it teamed up with a major Victorian builder. “We started in one of their regions, in metro north, and we slowly picked up the rest of their metropolitan regions.” Then the brokerage expanded into the regional areas and had the whole state covered before expanding to Brisbane and partnering with major builder Metricon in 2013.

“So we jumped from one volume builder to probably the best volume builder in the country. I know I’m biased but there it is. We haven’t looked back since – it’s been a magnificent journey with Metricon.”

The company is constantly growing, but Matsoukas says a turning point for him was the uncertain times during the GFC when many brokers were quitting the industry. “Where there’s uncertainty, there’s opportunity,” he says. “Basically what we did was we capitalised on the opportunities that were available, and from then it’s almost been an exponential growth path. Every time we achieve something, we find that more opportunities present themselves.”

During 2012 and 2013, Loan Gallery rapidly increased its settlement loan values from $344m to $480m and is targeting $850m for the end of FY2016/17. The company has also achieved a broker benchmark of under 10% finance applications being rejected; introducing a VEDA pre-submission credit check on new

applications made a huge difference in achieving this figure.

Matsoukas points out that the extra time they spend with the client at the beginning of the loan process pays off as it reduces the chance of problems further down the track. “Both our builder referrers and our clients took confidence in the fact that we would actually spend the time to explain to them what they needed to do to make sure they had no problems, so we’re spending that extra time upfront. They can make an educated decision.

“I tell people quite simply, ‘If doing this is going to keep you awake at night, then don’t do it’ – it’s a very simple rule of thumb.”

As the business has continued to expand and takes on more staff, Matsoukas has honed his recruitment process into a fine art. “We’re at 44 [brokers] and we’re still recruiting fairly aggressively. We could probably comfortably accommodate another 30 or 40, but we’re a long way from that.”

“I tell people quite simply, ‘If doing this is going to keep you awake at night then don’t do it’ – it’s a very simple rule of thumb”

A finely tuned recruitment process

Loan Gallery recently changed its recruitment strategy and now employs brokers on salaries rather than on contract. Matsoukas says as a business owner it’s easier for salaried brokers to conform to their compliance requirements than for self-employed contractors. He has also noticed that applicants applying for salaried positions are of higher quality.

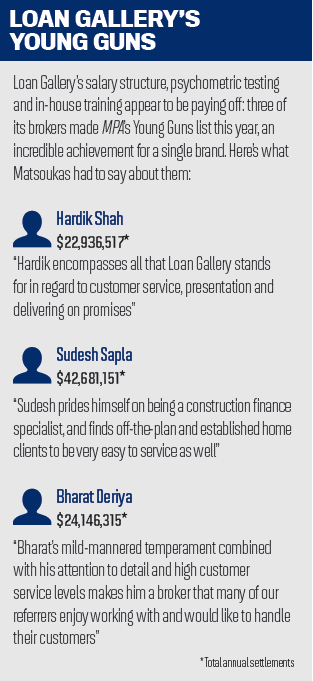

There is also a psychometric test as part of the recruitment process to gain insight into a person’s character. “Basically we’re looking for an indication of the character of someone before we put them on. We can train for skill, we can train them for credit, but we want the right people to start with. The test was developed with consulting psychiatrists in Sydney and tailored for the company and its needs,” Matsoukas says.

“In the past, it was a case of if you had a Cert IV and a pulse then off you go.” But now they have upped the requirements and also have a comprehensive training program in place.

New recruits need to be diploma-qualified or in the process of completing a diploma within a certain timeframe; they will be office-bound for one to three months as they undertake training, and the training includes credit policy, selling, relationship building, debriefing client phone calls, and simulating client interviews with senior brokers.

As the company has shifted from contracted to salaried positions, the processing of a file has been split between front office (brokers) and back office (loan processors – where the broker passes on the completed files to a loan processor, who takes over after submission through to settlement).

“It frees the broker up to see more people and help more people, and also for us it’s a good training ground for future brokers; the intention is the loan processors will eventually step up into a broking role.”

Having been part of the industry for 14 years, Matsoukas says brokers really need to put more emphasis on compliance. “I think we’ve got a compliance program internally which is probably industry-leading – we don’t audit just for NCCP; we actually go into a lot more detail with our files.

“I think compliance has had a bad rap – people see it as a big stick, while my attitude to compliance is compliance is your best friend. From a broker’s perspective your compliance manager should be the person you speak to the most, just to make sure you’re helping people in the correct manner.”

He would also like to see more rigorous educational programs that include a focus on things like relationship building. “A broker’s business is all about symbiotic relationships – I don’t think that’s covered off in enough detail,” he says, pointing out that looking after your customer goes beyond the person you’re writing a loan for and includes the lender, aggregator and valuers too.

And building those relationships doesn’t come easy. “Work really hard,” says Matsoukas, advising new brokers to build a solid foundation of credit and policy knowledge. “You need to know your credit policy – you need to know the differences between the major lenders and how they treat house and land.

“There isn’t a one-size-fits-all rule; they aren’t all the same – different lenders have different amounts that they’ll release at a land settlement or a house and land package. You need to know what those differences are, so that when you’re talking to people you are the expert that they can rely on.”

And it’s all worthwhile, Matsoukas says, as it’s great to see the difference you make in people’s lives. In the early days, he recalls how he would personally hand the final cheque to the client – often a first home buyer client – on-site so they could give it to the builder.

“Seeing the joy on their faces – how happy they were and how excited – I got a real buzz out of it. You can see that you’ve made a difference to people.

“The fact that we can help so many people achieve the things that they want to achieve – it makes a big difference to me. It’s not just helping one person; it’s literally helping thousands.”