Louis Kovanis of Genius Loan Solutions has found and mastered a niche in the market, becoming one of Australia’s top 10 brokers in the process

Louis Kovanis’ small office is a somewhat clinical oasis of air-conditioned calm in a sweltering Wolli Creek. Yet its occupant, No. 8 in MPA’s Top 100 Brokers of 2014, is nowhere to be seen. Standing in the empty office, you can’t help but wonder: Did $174,921,276 of residential business really pass through here? And how do you achieve that total with just 133 loans?

Louis Kovanis’ small office is a somewhat clinical oasis of air-conditioned calm in a sweltering Wolli Creek. Yet its occupant, No. 8 in MPA’s Top 100 Brokers of 2014, is nowhere to be seen. Standing in the empty office, you can’t help but wonder: Did $174,921,276 of residential business really pass through here? And how do you achieve that total with just 133 loans?These questions are rapidly answered on Kovanis’ return. As you’d expect from a top performer, his phone has a life of its own, constantly buzzing with clients, including one looking to finance a top-end sports car. But it’s not playboys who make up Kovanis’ client base; not even those usual suspects, the wealthy foreign investors. Genius Loan Solutions deals exclusively with Australia’s medical professionals, a niche that is proving to be extraordinarily profitable.

"Given that in Australia we have a growing, ageing population, there's going to be a bigger demand for the services of these healthcare professionals"

Kovanis himself has no medical experience to speak of; instead, his story is a textbook study of specialisation and diversification in practice, which all brokers should take note of. Coming from Sydney, Kovanis’ education at The Scots College and later at the University of Sydney provided him with useful connections but nothing particularly out of the ordinary; a BA in economics; and an early career at banks including Citibank and HSBC.

Nor was switching to broking in the late 1990s particularly unique, Kovanis explains. “Australia was in the midst of a big housing boom,” he says, “and the topic of conversation at dinner parties was ‘what’s your rate?’ John Symond had launched Aussie in ’92, and there were a lot of people entering the industry; the barriers to entry were very low.”

Genius Loan Solutions, founded in 2000, was originally a standard brokerage. “At the time, obviously I took on any type of client,” Kovanis says.

The decision to specialise was not exactly a light-bulb moment, Kovanis jokingly recalls. “I’ve always had that perception … well, obviously I’d been to my dentist and could see what he was charging, so I thought, you know what, these guys are very aggressive with their fees, they’ll probably be big borrowers. And sure enough, they proved me correct.” From dentists Kovanis went on to optometrists, from optometrists to pharmacists, and so on.

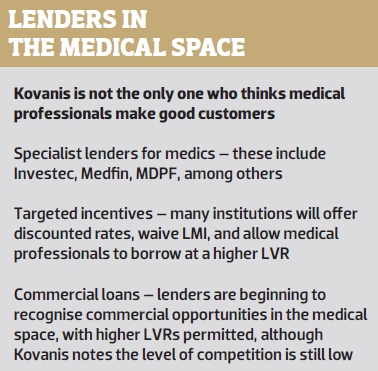

Big money in Australia is inevitably equated with FIFO miners, construction magnates and financiers. Yet, according to Kovanis, medical professionals make truly ideal clients. “They have good job security, very low propensity to default, the assets they have are very good assets, they have very good incomes – and given that in Australia we have a growing ageing population, there’s going to be a bigger demand for the services of these healthcare professionals.”

Crucially, many medical professionals are self-employed and therefore present many more finance opportunities than other relatively wealthy professionals. Many doctors will want to purchase and renovate their surgeries; radiologists’ CT scanners require many thousands of dollars in asset finance, and plastic surgeons, as Kovanis puts it, need money to “look good”. That’s not to mention the sports cars and new-build mansions that come with professional success.

"Obviously I've been to my dentist and could see what he was charging, so I thought, you know what, these guys are very aggressive with their fees, they'll probably be big borrowers. And sure enough, they proved me correct"

If it was so easy, everyone would be doing it, the saying goes, and Kovanis’ move into the medical sector has involved a battle against low expectations. This started with reassuring clients who thought mortgage brokers were just for bad borrowers. “I only do full-doc lending,” he’d say. “I deal with the mainstream lenders, so I’m not going to put you with a lender you’ve never heard of.”

It’s still a struggle, Kovanis argues: “If you go to a traditional late-fifties early-sixties surgeon at St Vincent’s, most of those guys won’t talk to brokers; they have their private banker, their status symbol. The mere fact of being told they’re in executive banking makes them feel good.”

Therefore, Kovanis is transforming Genius Loan Solutions into a boutique executive-style operation. While the brokerage has a slick website, Kovanis feels there is no advantage in advertising. “These people have absolutely no time … I’d attract the intern [ junior doctor] at a hospital, but I’m looking for the specialists … [as for attracting] the established specialist, forget it.”

He’s wary of ‘diluting the portfolio’, and only deals with non-medical clients when referred by existing long-term clients. “I’m not going to be the Aussie John Symond of this world,” Kovanis explains. “It’s a niche little broking business.”

That doesn’t mean Kovanis isn’t interested in expanding. A bigger office and a support team go hand in hand with providing the executive service clients expect, he argues. He’ll still be at the end of the phone but have “a network of people in the business who will manage the portfolio of these clients and give them that executive service”.

The goal is to settle $1.25bn of business over the next five years; with an average residential loan size of $1.3m, that means doing 193 deals a year, a significant increase on the 133 loans of 2013/14 – but of course that’s only counting residential deals.

Herein lies the apparent irony of Kovanis’ business: $1.25bn seems a lot to demand from a niche sector. Kovanis doesn’t agree. “The market’s huge; it’s not that small.”

What makes medical professionals a niche area, he suggests, is the skills that dealing with them requires. “It’s a more complicated loan application; you’ve got to have certain skills. People think it’s easy, but it’s not. The doctors, they demand the best interest rates; they are so rate focused.”

Kovanis is convinced that he’s discovered a goldmine, and he’s not keeping quiet about it. In fact he has a message to would-be competitors. “My point to the new guys out there is good luck if you can get the best rates, because that’s what they want … a fairly large reduction on what they’re paying, otherwise they say, ‘It’s not worth my while pulling my tax returns out’. To you and I, a $3,000 to $4,000 per annum saving is a huge amount. To these guys it’s nothing; it’s a drop in the ocean."

Past broker profiles

Kelly Cameron-Tull: The long road to broking

Kiran Thapa: engineer, author, broker