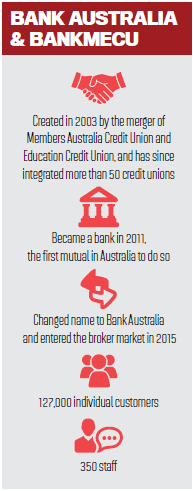

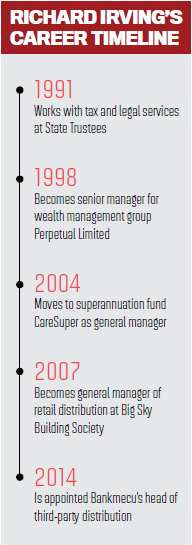

Bank Australia's Richard Irving on what the reincarnation of BankMecu means for the broker market.

Customer-owned Bankmecu has transformed into Bank Australia, and alongside the name change comes a serious drive to expand into the broker market, its head of third party tells MPA.

MPA: How would you like brokers to interpret the re-branding of Bankmecu to Bank Australia?

Richard Irving: For us, we’re just entering the broker space, and we’ve not got a history of distributing our products through brokers; it’s previously been purely retail through our communities. Part of the positioning was to have a stronger, bolder, unambiguous brand to bring to the market, and I think for brokers, Bank Australia is a very strong brand that is easy to explain – it’s

MPA: So Bank Australia hasn’t previously been involved in the third-party channel?

RI: Up until this point, we had a purely retail distribution model. What we’re finding increasingly is that the appetite from brokers has been very strong; we’ve had a number of requests from brokers who want to utilise our products, and really now, for us, it’s about a considered entry into the broker market.

We’ve seen other entrants come in who have potentially underestimated the volume and the capacity requirements. So we’ve really invested a lot of time and money to get our infrastructure right, and we want to make sure we work with like- minded brokers over the next six to nine months before we launch more broadly.

MPA: Bank Australia is based in Victoria, but will your products be available to brokers nationwide?

RI: Initially we’re launching into Victoria and New South Wales, but we have customers nationwide through our retail network. The plan with AFG is to go national, but we’ll do that once bedded down in Victoria and NSW. One thing we’ll do before the end of this calendar year is launch a flagship branch in Sydney CBD. We want to align our expansion on the retail side with our expansion into the broker market.

At the moment we’ve just got business development managers here in Victoria, but the next appointment we make will be in NSW, and we’ll probably look to Queensland after that as part of the next level of expansion.

MPA: Does the move to Bank Australia involve any new products, policies or focus on a particular customer segment?

RI: What we’ve actually done is really rationalise our products for the broker market. We have arguably the best basic interest rate in the market at the moment: 4.10%, with a comparison rate of 4.11%. We’ve also redesigned all of our home loan package products as well in order to be very competitive in the broker market.

Initially we’re coming to the broker market to focus on residential lending, due to some of the changes that have happened recently around investor lending. We’ll continue to offer investor lending through our retail channel, but for the moment, we’re not going to expand investor lending in the broker market. We really want to be competitive with residential lending in the broker market – focus on refinancers, focus on first home buyers – and that’ll be at a very competitive level for brokers.

We’ve also realigned our upfront commission structure for our premium products. Our upfront commission structure will be starting at 60 bps and going up to 80 bps for customers who go into our premium package products.

MPA: So are you competing on rate here, or are there any other ways you’re appealing to brokers?

RI: In the discussions we’ve had with brokers to date, we’ve always had very flexible policy guidelines. We’ve done that for our retail customers for years, thanks to our flatter structure, our ability to make decisions, our ability to service one-on-one. Brokers can get a quick decision; we’ve got a

dedicated lending centre that’s purely looking out for the broker market – we’ve already got that established – and we’ll be integrating our application process into NextGen. We want to get straight-through processing and quick decisions out to the market.

MPA: How would you like brokers to explain the idea of

RI: I think there are probably three or four points to make about

I think if you look at the ownership structure, it’s very aligned to brokers wanting to do the best thing by their customers. We have a very strong focus on doing the best thing by the customer and making sure they have the best solution available to them. And it does allow us to be extremely competitive in terms of what proposition we can put out in the market for brokers.

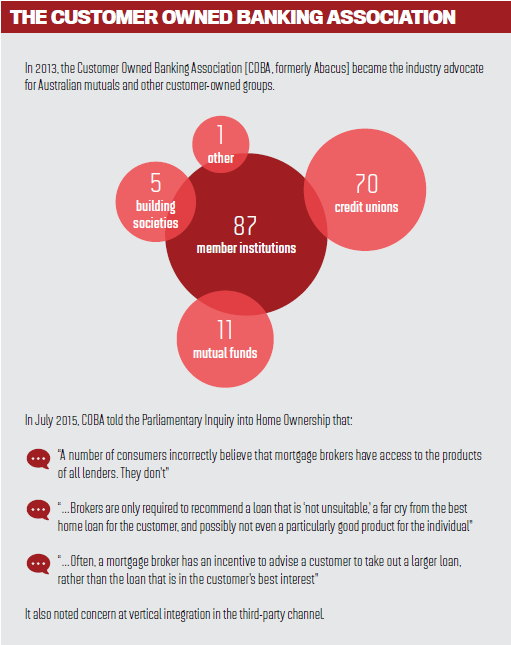

MPA: How can you explain recent comments by the Customer Owned Banking Association [COBA] criticising brokers, given that Bank Australia is a member of COBA that wants to move into the

RI: I guess COBA are in place to form a view from an industry body perspective. Our personal view is that we’re a strong believer in choice; we think customers should have the ability to choose who they do business with, which channels they want to do business through.

We very much see, with 52% of lending and potentially up to 60% of lending coming through the broker channel, over the next few years, that customers are voting with their feet to use the channel. We want to continue to provide choice to the broker market, and we’re seeing customer- owned banks increasingly should be a choice that is available to customers through the broker channel.

MPA: In 12 months, how would you like Bank Australia to be viewed in the broker channel?

RI: Our vision is to be seen by the broker market as providing the best service of all mutual banks. We want to be the bank that brokers look to when considering options for their customers, and if one of those options is a mutual or